Today, the Federal Reserve announced a fourth consecutive 75 basis point interest rate hike, continuing the central bank’s battle against inflation. These hikes have yet to reverse the course of inflation: prices remain far too high for comfort. But it takes some time for the impact of tightening policy to seep through the economy. The true effects of higher interest rates are yet to be felt.

Housing Hurt

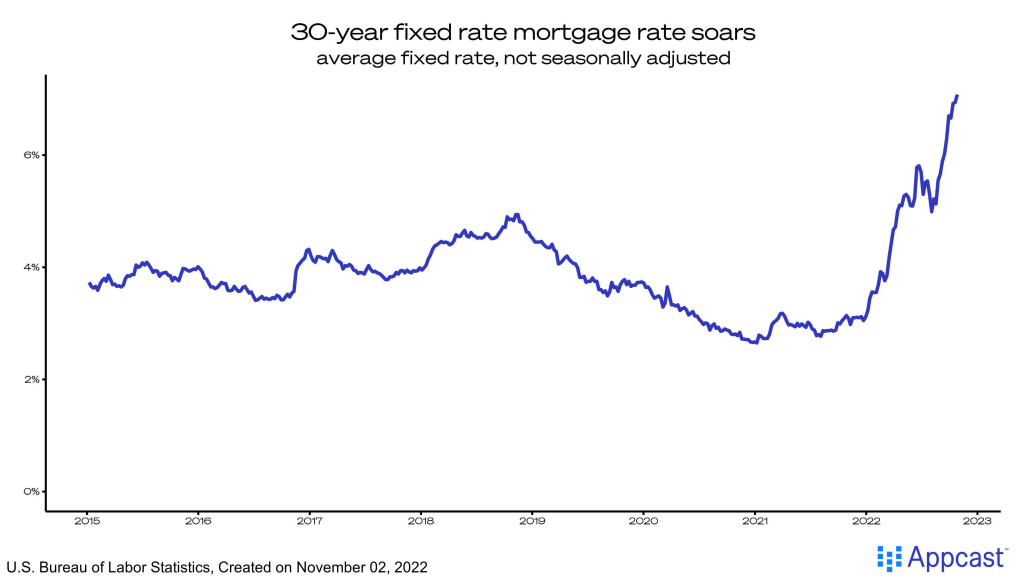

So far, these interest rate hikes have slowed the housing market: mortgage rates have increased, pushing home sales and construction of new homes down. The housing market was running too hot just months ago; this decline in housing demand is precisely the outcome the Federal Reserve was hoping for.

Labor and Demand Lags

Higher borrowing costs have yet to noticeably impact the labor market. Demand remains strong and most sectors continued to add workers in September – even sectors related to the slowing housing market, like construction and real estate. Additionally, labor demand is increasing in both sectors: in September, real estate job openings jumped by 27,000 and construction by 36,000.

The labor market is still very strong, even in the industries where higher interest rates have already made a mark.

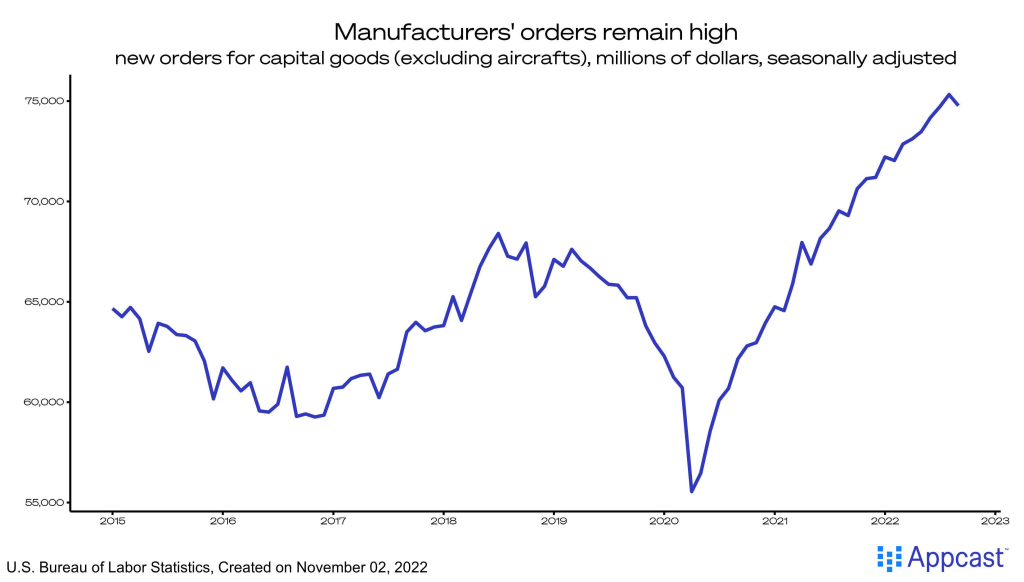

Manufacturing demand is also still very high – manufacturers have reported unease, but new orders on capital goods are strong. Durable goods orders should eventually tick down as higher borrowing costs move prices into unjustifiable territory.

A final problem for the Federal Reserve: consumer demand remains very strong. Neither inflation nor higher borrowing costs have been able to curb consumption, in part because households came into this inflationary period with very strong balance sheets. Excess savings have bolstered consumption as prices rise.

Striking a Balance

The lagged impact of interest rates make it difficult for the Fed to measure when they have gone far enough to curb inflation, but not so far as to cause a recession. In the 1980s, the Fed’s extraordinary interest rate hikes caused a recession, prompting a period of rate slashing. But the economy emerged from the downturn still struggling with high prices. If the current Fed reverses course too soon, the economy could end up in that same lose-lose situation.

Fed Chairman Jerome Powell understands the daunting nature of this balancing act, but knows the importance of not backing down: “It is very premature to think about pausing. We have a ways to go.”