The holiday cheer has just begun to set in, but a chill just swept through the United Kingdom economy — and it’s not the winter frost. The U.K. jobs report released on Tuesday confirmed what many feared: the Labour Budget’s impact on hiring is beginning to bite, long before the policies even kick in next April.

The warning signs began flashing earlier this week when dismal employment data from the Purchasing Managers Index (PMI) signaled a contraction in private sector employment. Now, with falling vacancies, a decline in payroll jobs, and wage growth that remains stubbornly high, it’s clear the labor market is feeling the squeeze. For policymakers and jobseekers alike, it’s shaping up to be anything but a festive season.

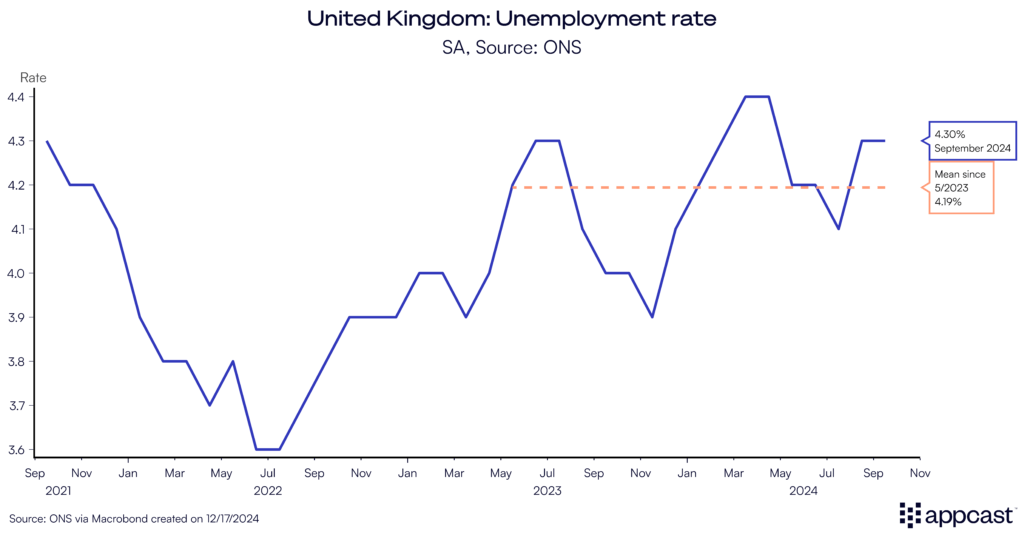

Unemployment remains low, but the data quality is questionable

The unemployment rate was unchanged at 4.3% from the previous month. The inactivity rate is slightly down on the quarter (it fell by -0.2 percentage points to 21.7%), while the employment rate is basically stable at around 74.9%.

However, each of these data points are based on the currently flawed Labour Force Survey, which is a household survey (meaning it surveys workers, rather than companies). The Office for National Statistics (ONS) has seen historically low response rates in recent years with this report. Unfortunately, a fix is delayed, as the ONS recently announced that the new and improved Labour Force Survey might not be available until 2027!

The accuracy of the data is questionable and policy makers in the government and at the Bank of England (BoE) dismiss it. Labor market watchers have to rely on alternative indicators instead to gauge the strength of the labor market until the problems are fixed.

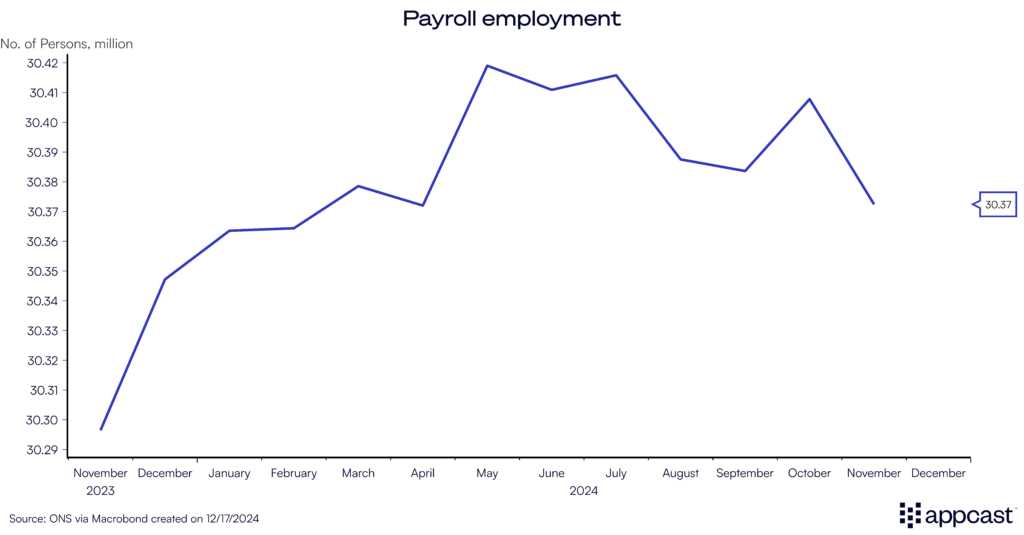

Payroll employment is contracting

One of these indicators is payroll employment based on data collected by tax authorities (HMRC), likely providing a more accurate picture. Unfortunately, this month’s data release is bad news. While the October number was revised up, November shows a decline of 35,000 payroll jobs. There basically has not been any meaningful payroll job creation in the U.K. since March of this year, a completely stagnant labor market since the Labour government has been in office.

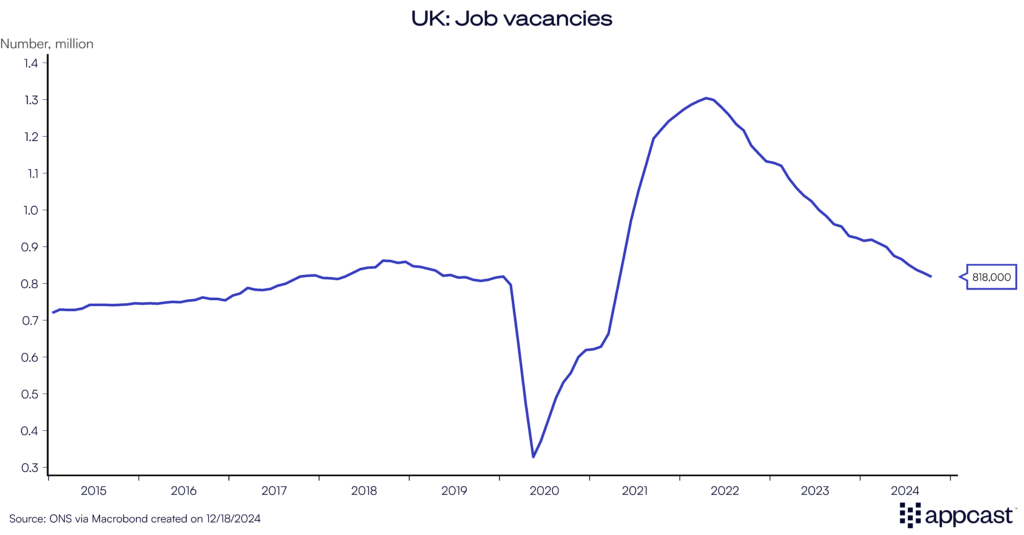

Vacancies continue to fall

Paired with the job losses, vacancies continue to decline as well. The U.K. is now heading towards its third consecutive year of declining job openings ever since they reached a record-high of more than 1.3 million in early 2022.

As we have discussed previously, white-collar roles (think marketing, project management, consulting, tech and finance) are more affected by this slowdown than blue-collar roles. The latter continue to be affected by Brexit-induced supply shortages, while demand remains relatively stable.

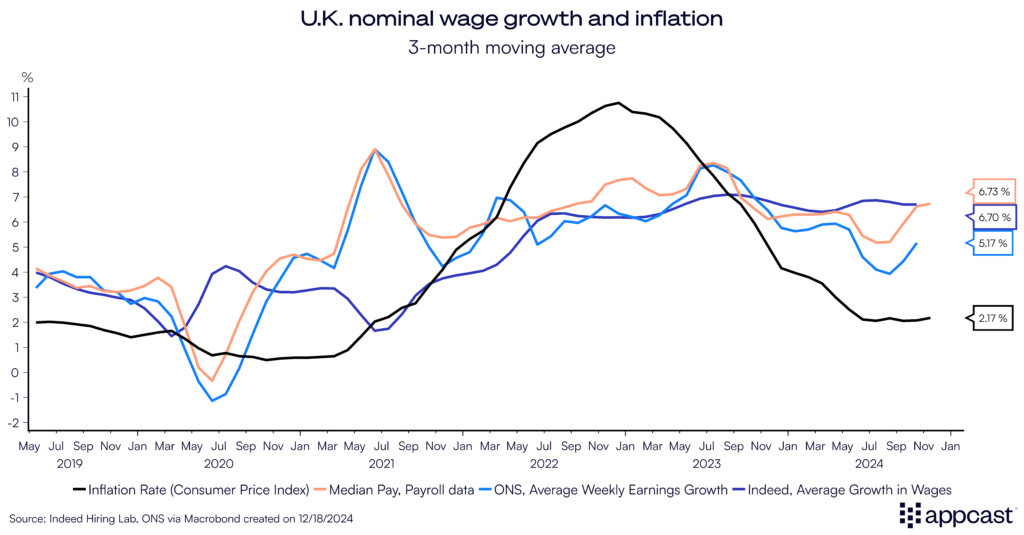

Wage growth remains uber-sticky

But even as the labor market has cooled from lukewarm to outright chilly, wage growth has actually accelerated in recent months. In fact, wages are advancing at such an elevated pace that it is inconsistent with the BoE’s inflation target in the long run. Average weekly earnings growth is at 5.2%. Median pay based on payroll data is even worse, running closer to 7%. The Indeed wage growth tracker based for job postings is equally bad, also around 7%. No matter how you slice the data, the U.K. is now an outlier amongst advanced economies in terms of wage growth. Wage growth continues to run super-hot, despite stagnant employment growth. For officials at the BoE, this means an elevated risk of continued inflation.

No Christmas gift from Lombard Street

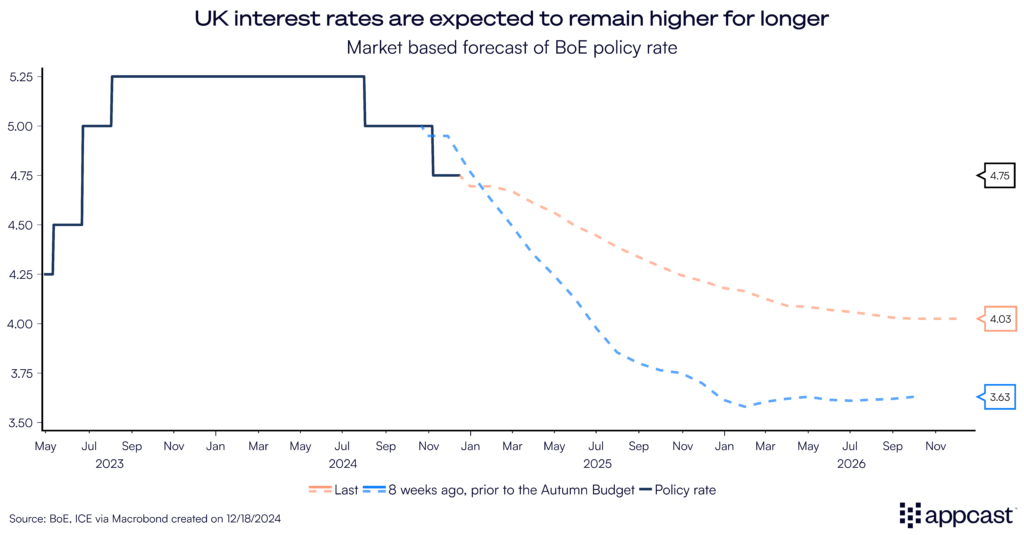

The combination of job losses and sticky wage growth means that monetary policy makers on Lombard Street (where the BoE is seated) are stuck between a rock and a hard place. The bad employment data screams for easier monetary policy to support the labor market. On the other hand, high and sticky wage growth means elevated interest rates for longer since monetary policy makers need to nip salary growth and inflation in the bud.

As expected, BoE policy makers chose today to keep interest rates at 4.75% to contain inflationary pressures. The future path of interest rates is now substantially higher compared to a couple of months ago before the Labour Budget was announced. While tighter monetary policy is needed to bring inflation and wage growth back to normal, it will heavily weigh on economic activity in the months ahead.

What does that mean for recruiters?

Economic activity in the U.K. has been weakening in the second half of 2024. The Labour Budget has led to a substantial increase in employer costs, which is now negatively affecting recruitment. Many employers, especially in low-margin sectors like retail, hospitality, and the care sector, are reducing or even freezing their hiring activity.

Consequently, labor demand continues to fall. Vacancies and online job postings are declining months after months and are now barely higher than pre-pandemic levels. Recruitment difficulties have eased substantially compared to two years ago. But this does not necessarily mean that recruitment is easy! There are some big sectoral differences. Worker shortages remain prevalent in some industries that are predominantly blue-collar as Brexit has led to a substantial reduction in labor supply.

Moreover, wage growth continues to be elevated, especially for posted jobs. If you are losing employees to competitors, you will have to hire new workers at substantially much higher wages. This means that worker retention must be a crucial part of your workforce strategy.