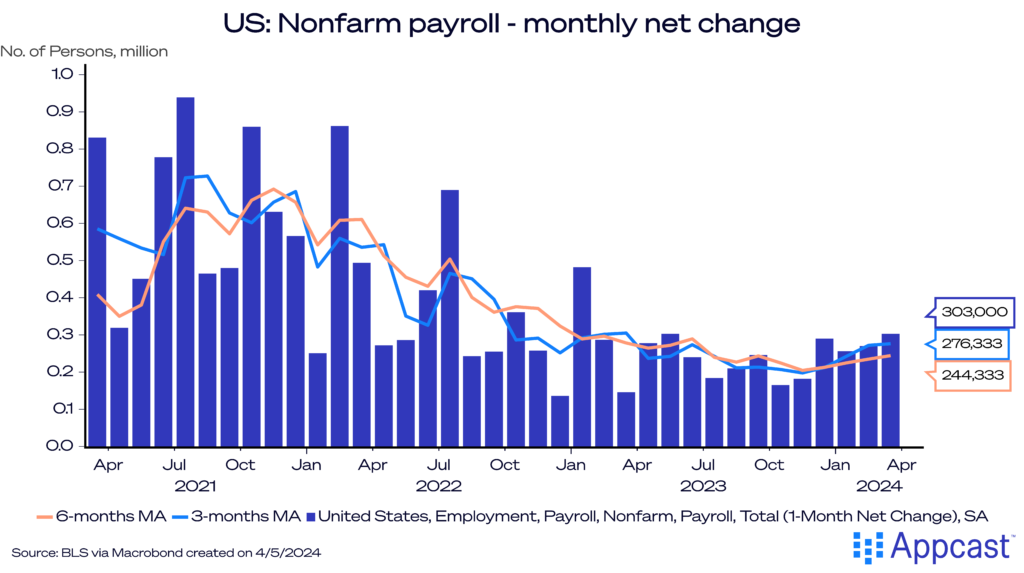

The U.S. labor market added an impressively strong 303,000 net new jobs in March. The unemployment rate fell slightly to 3.8% and overall labor force participation moved up, now at 62.7%.

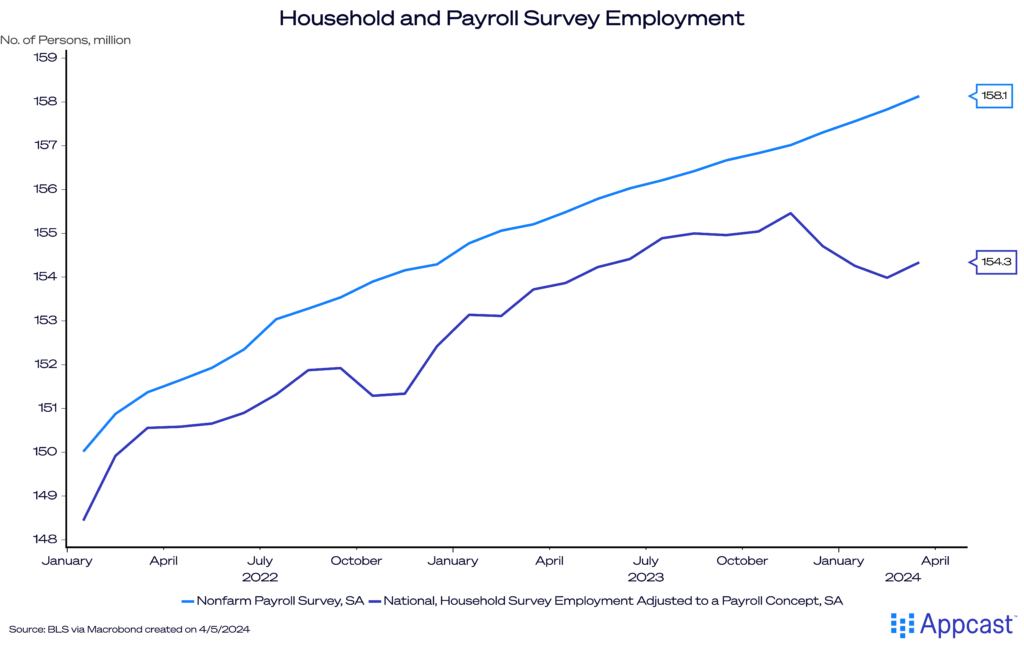

Even the few areas where it may have been acceptable to criticize this labor market are vanishing. Doubters of this strong labor market had pointed to two things in recent months: a pattern of downward revisions to prior months’ figures and weakness in the household survey’s measure of employment. Well, January and February’s numbers were revised upward by a net 22,000. And the household survey showed an increase in employment.

Making a habit of breaking expectations

The headline employment gain of 303,000 in March (once again) blew past expectations. Bloomberg, for example, surveyed 74 economists and this top-line figure was higher than every single economist’s forecast. The 3- and 6-month trends have started to reaccelerate. So, this is more “no landing” than “soft landing.”

A source of weakness in recent months has been the household survey’s adjusted measure of employment, but that rose in March. Revisions to January (+27,000) and February (-5,000) were positive on the net. If anything, financial markets are expecting this is too much of a good thing – with 2-year Treasury yield spiking, as traders anticipate the economy is strong enough to delay Fed rate hikes.

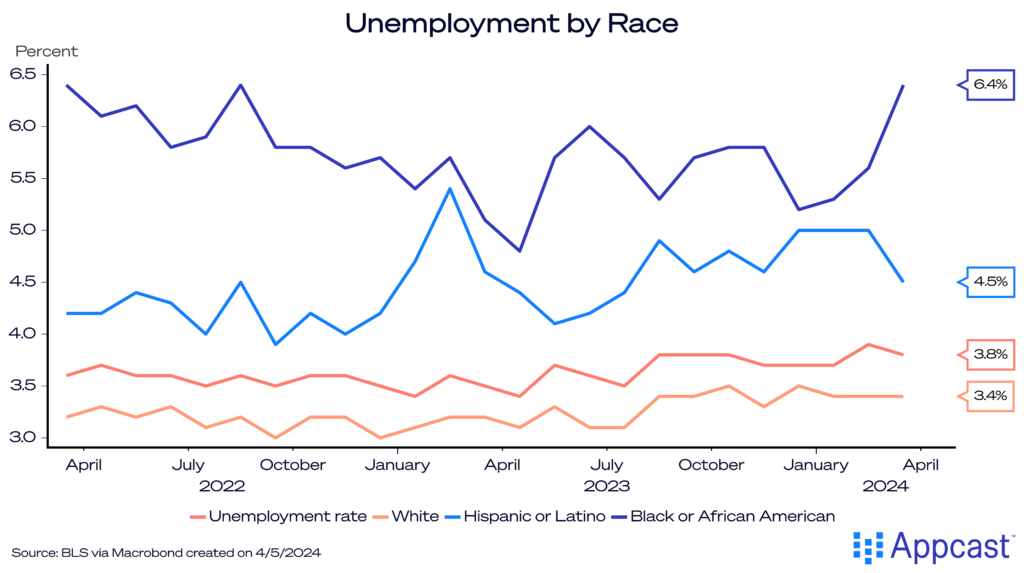

Unemployment rate wins and losses:

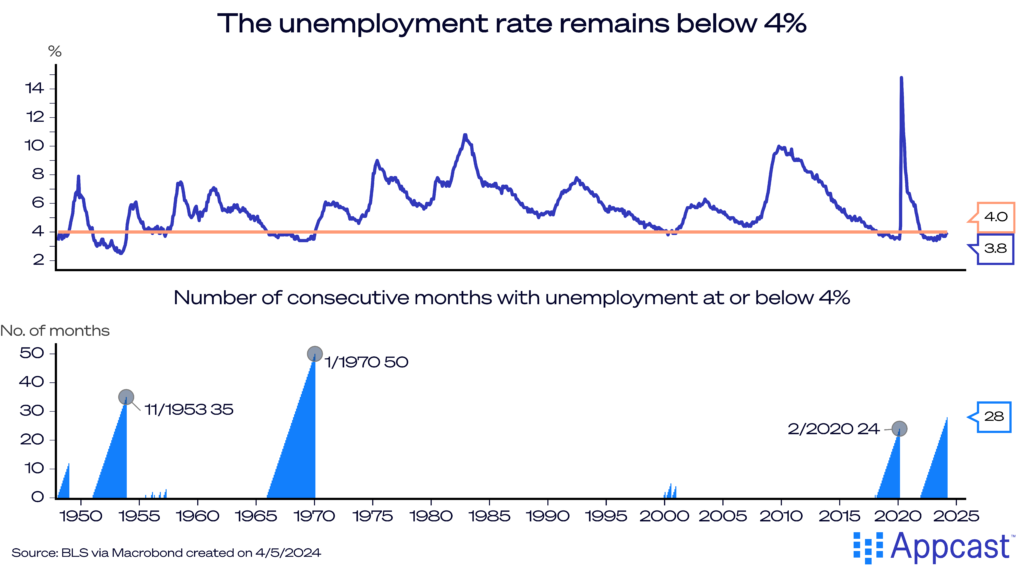

The unemployment rate decreased slightly to 3.8% in March, adding to one of the longest streaks of 4%-or-below unemployment. Of course, this represents the enduring tight nature of the labor market.

However, there have been jumps in unemployment among demographic groups, including for Black Americans, for whom the unemployment rate rose to 6.4% in March. These demographic changes are often volatile, so hopefully this is not an enduring trend.

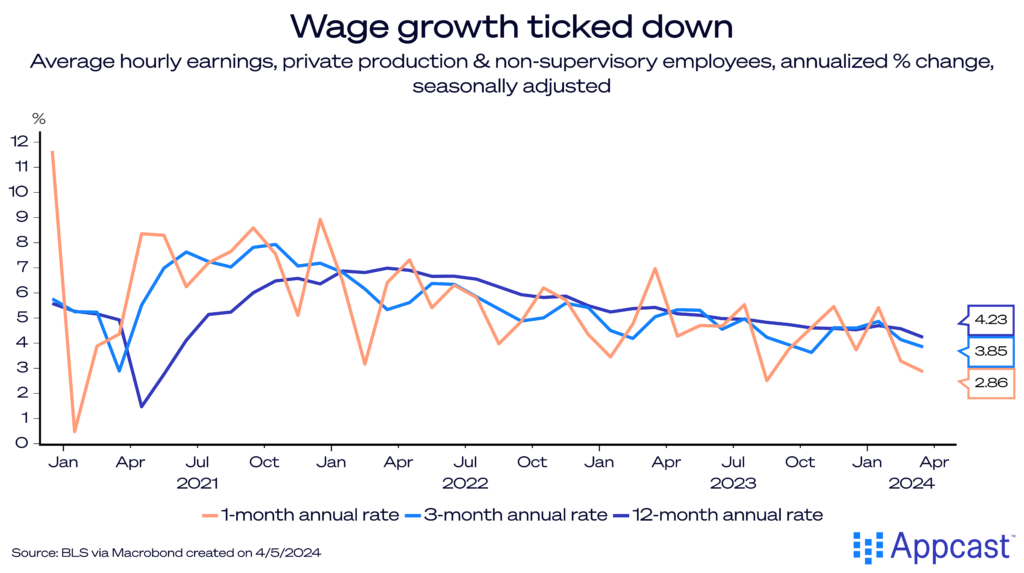

A bright side for the Fed: cooling wage growth

Average hourly earnings for non-supervisory workers came in at a refreshingly cool 2.9% annualized rate in March. The 3- and 12-month rates ticked down to 3.9% and 4.2%. So, the red-hot job growth figures have not led to an upward turn in wage growth – reassuring the Fed’s inflation outlook.

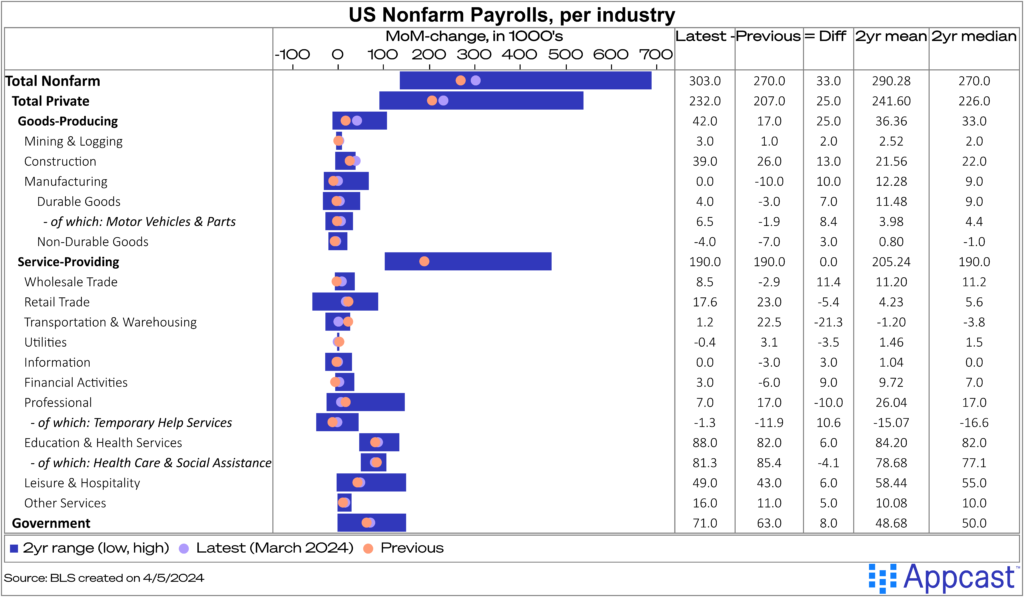

A sitting-down slowdown

The usual suspects added jobs: healthcare by nearly 72,000; leisure and hospitality grew by a respectable 49,000; and construction continues to surprise by adding 39,000. On the flip side, manufacturing and information added exactly 0 jobs each. Professional and business services added just 7,000 jobs, while financial activities added 3,000.

This is increasingly a labor market driven by demand for “standing-up jobs,” rather than “sitting-down jobs,” and perhaps beginning to look like a bifurcated labor market.

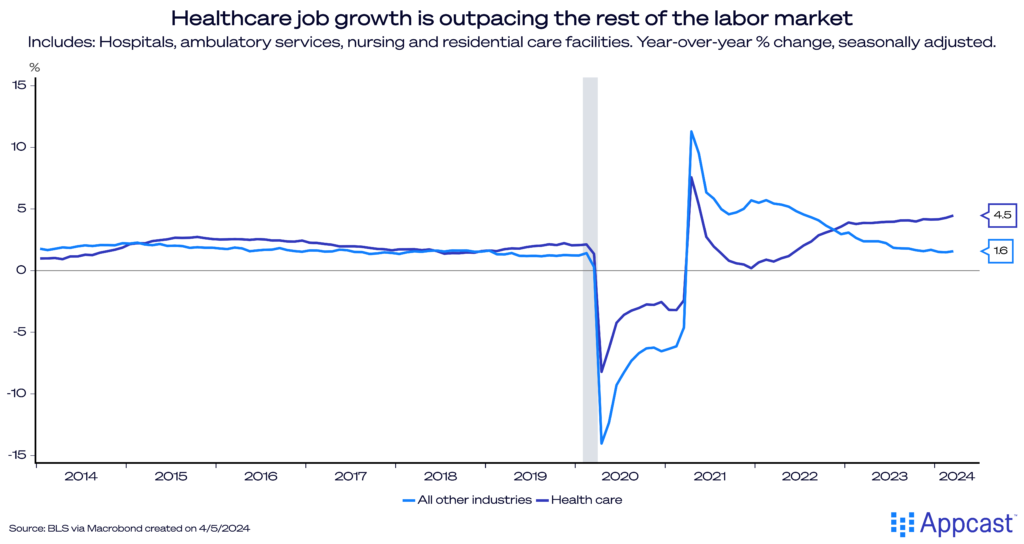

What does this mean for recruiters?

Recruiters may be feeling the heat at varying temperatures these days, depending on which sector they are recruiting in. If one is recruiting in healthcare, they are likely feeling far more pressure than someone recruiting in the tech space. For the healthcare recruiters, this is likely not a temporary phenomenon – with an aging population, demand for these jobs will hold up. Additionally, the depressed demand in “sitting-down jobs” will not last forever – the Federal Reserve will eventually lower interest rates, which will reinvigorate investment.