Despite ongoing conflict in Europe and the highest inflationary period since the early 1980’s, the US labor market continues to grow briskly. In April, the economy added 428,000 jobs and unemployment remained steady at 3.6%. There was some expectation that heightened inflation could drive the labor force participation rate up, but several key indicators dropped in April.

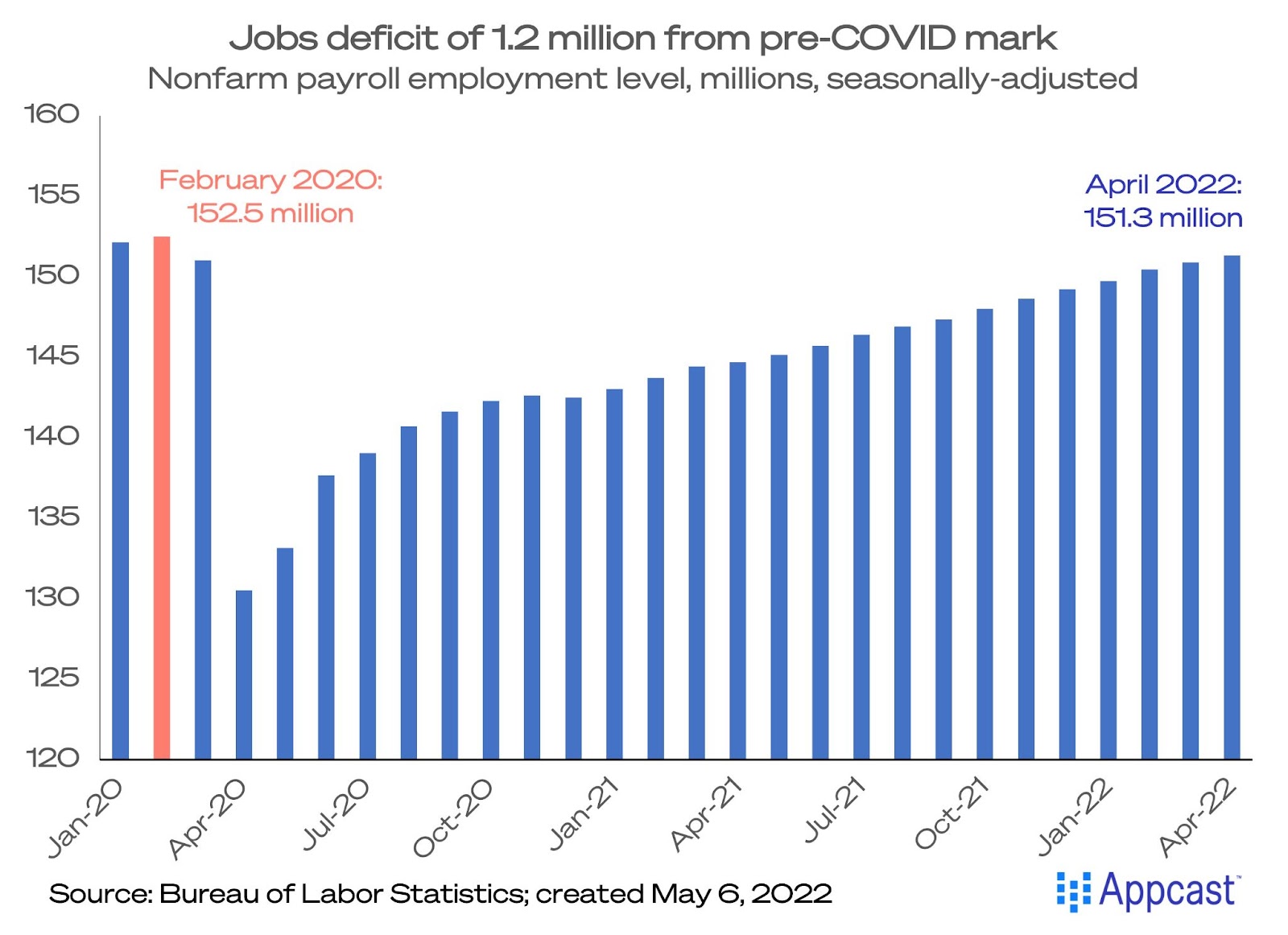

COVID “job deficit” continues to shrink

The three-month moving average of employment gains is 532,000. That’s not far off 562,000 average for all of 2021. These gains occurred despite the Federal Reserve hiking interest rates amid elevated inflation. The “job deficit” shrunk further from its pre-COVID level – and now stands at 1.2 million. The labor market recovery should be complete by the summer.

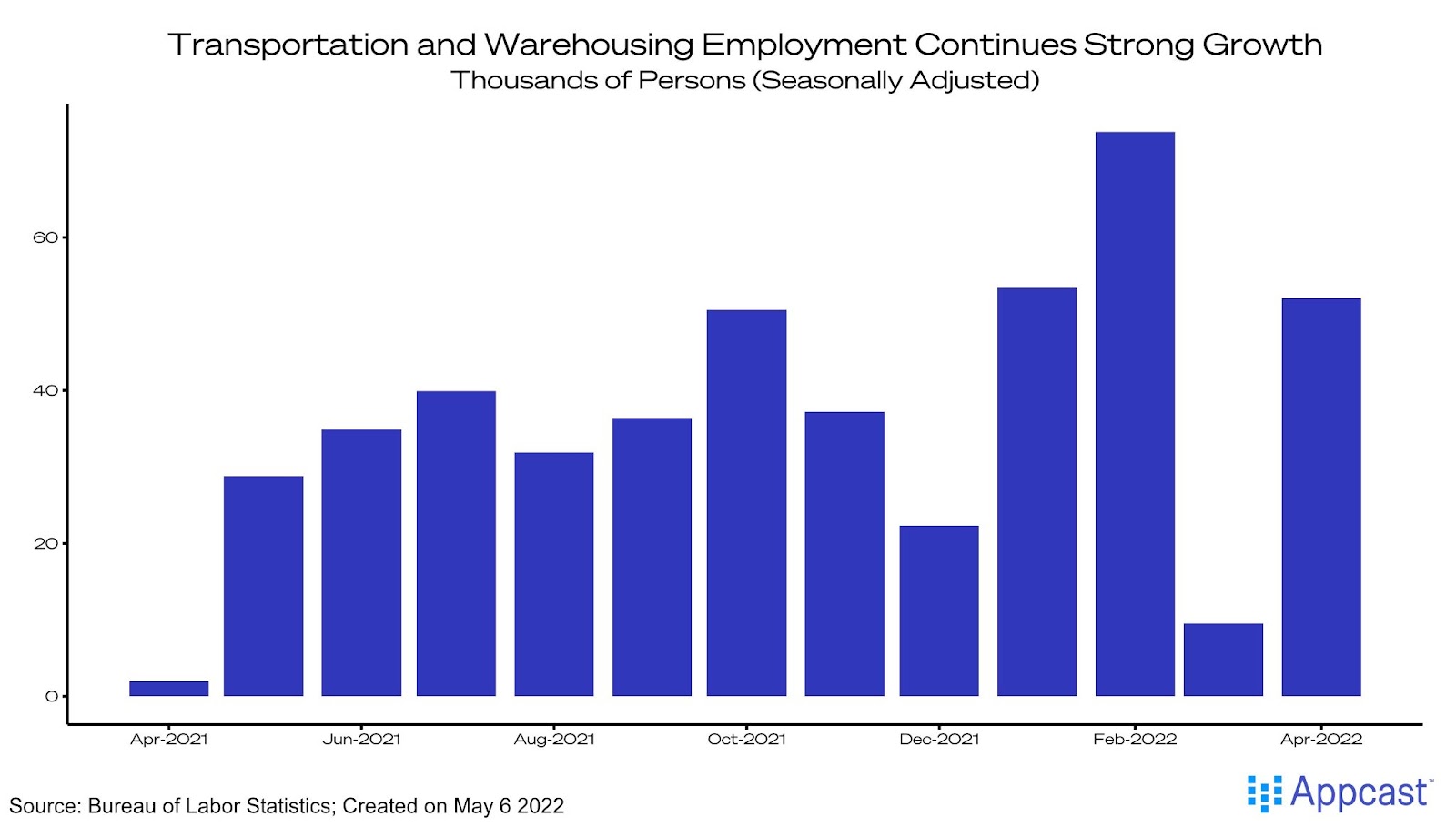

Transportation and warehousing jobs rebound

Transportation and warehousing jobs continue to be a large part of job growth, adding 52,000 new jobs in April. Ecommerce remains a vital part of the economy despite the loosening of COVID restrictions and a return to in-person shopping and activities.

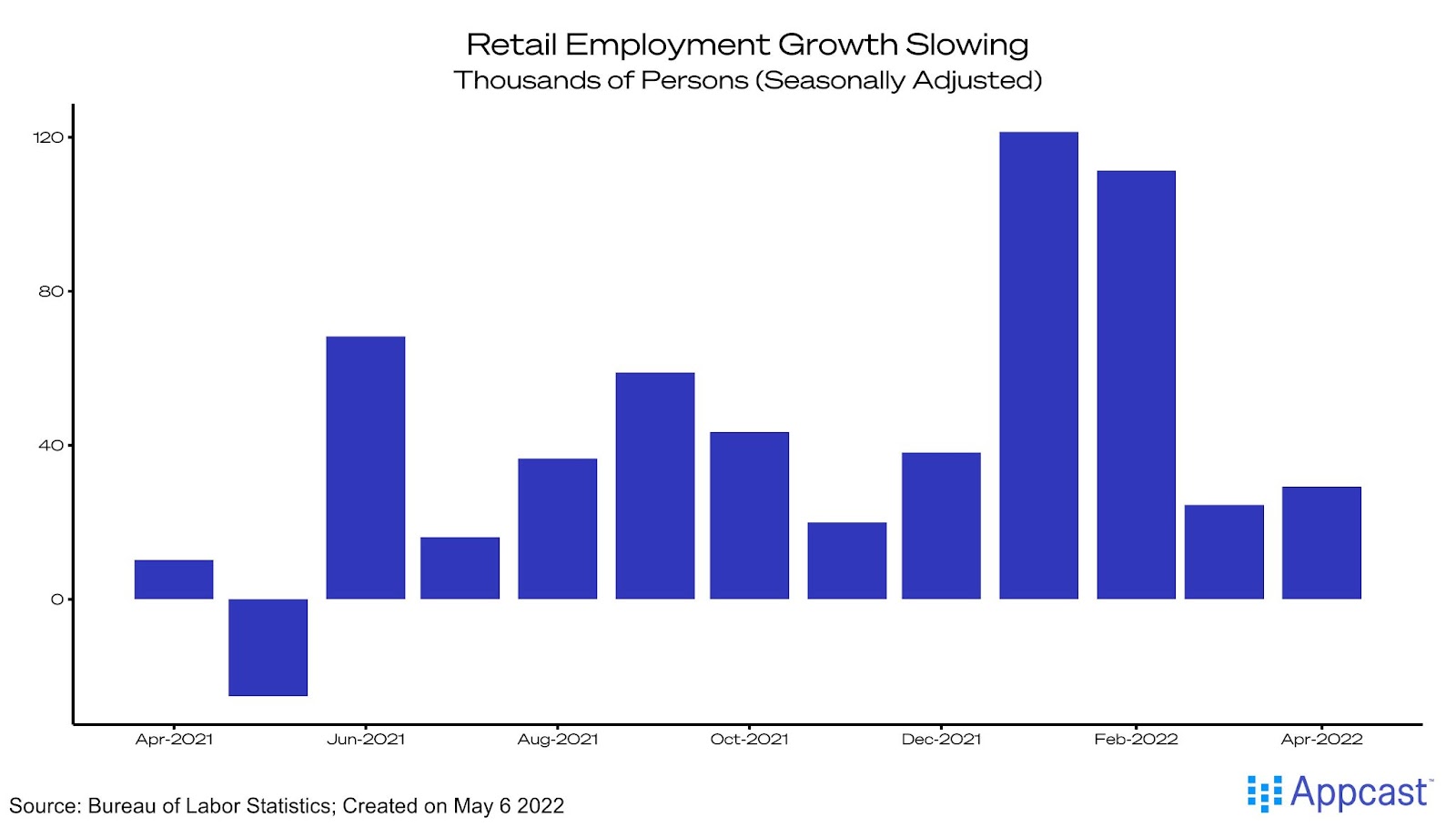

In January and February, retail trade added an average of 116,000 jobs indicating a strong return to in-person shopping. However, in March and April that number fell to an average of just 26,000 jobs. Competition with ecommerce companies could be putting pressure on wages for retail workers.

Would-be job seekers withdrew from the labor force

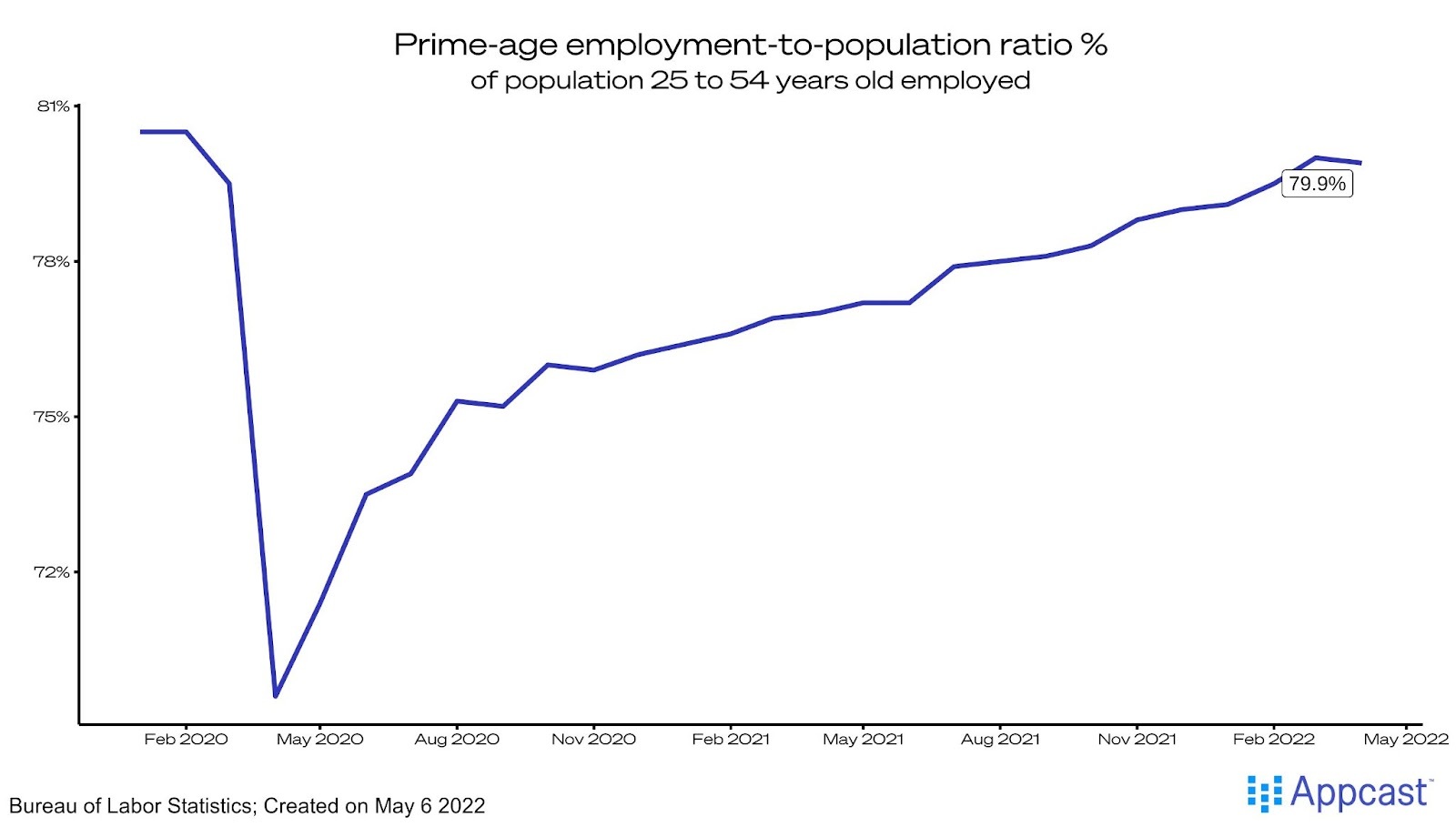

Several measures of labor force participation took a step backward in April. This is a disappointment as economists expected that strong wage growth would drive the labor force participation rate up. The overall labor force participation rate declined to 62.2%, as would-be jobseekers withdrew from the labor force – which shrunk by 363,000. The unemployment rate remained unchanged at 3.6%.

The best metric for the goal of “full employment” – the prime-age employment-to-population ratio – took a step back to 79.9%. That said, it’s still on track for a full recovery to the level of 80.5% seen before the pandemic. But some people remain on the sidelines: the number who say they want a job but aren’t actively looking rose to 5.9 million, and that is up from 5.0 million before the pandemic.

Wage growth cooled, albeit at a high level

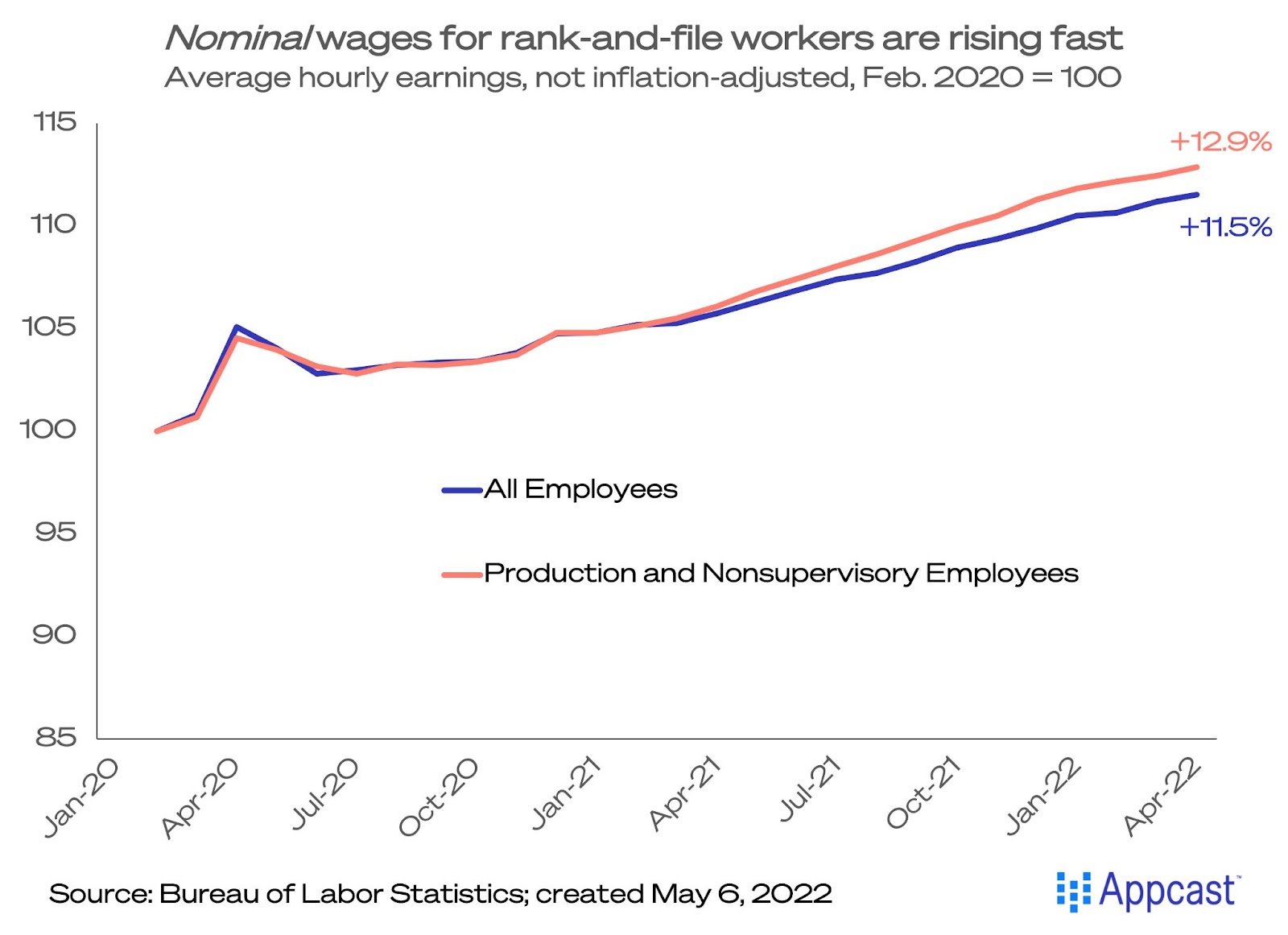

Wage growth moderated in April. Average hourly earnings for all workers were up 5.5% year-over-year (not adjusted for inflation), which is down from 5.6% the previous month. In some ways, this is a good sign because record-high inflation isn’t feeding into a wage-price spiral.

Average hourly earnings for rank-and-file workers – production and nonsupervisory employees – were up 6.4% year-over-year, which is a significant cooling from the prior month. Compared to pre-pandemic levels, nominal wages are 12.9% higher for rank-and-file employees and up 11.5% for all workers. However, these are nominal gains – or not adjusted for inflation – and consumer price inflation is at a 40-year high.

What does this mean for recruiters?

Recruiting continues to be challenging in this ultra-tight labor market, with near record-high job vacancies. Workers have leverage and are exercising it – quit rates are elevated and job switchers are getting strong raises but there are headwinds. With war in Eastern Europe, energy and commodity prices have spiked, exacerbating inflation that is at record levels. At this point,there is no sign of a pull back on hiring plans due to the war and inflation.

Bottom line: People who want a job are getting them, as hiring is happening at a rapid pace with record-high job openings. Wage growth is strong but moderating – perhaps a good sign for inflation dynamics. Employers, however, have to compete for fewer job seekers as the labor force shrinks. This is a solid jobs report, and reflects strong hiring demand in the U.S. during a period when the Russia-Ukraine war was ongoing and the Fed began to aggressively hike interest rates.