The German economy has been underperforming

We recently discussed in a blog post how the German economy has become the “sick man of Europe” again. Growth has been stalling since about early 2018, the recovery from the COVID-19 pandemic has been anemic, and in late 2022 Germany fell into a technical recession.

The reasons for Germany’s struggles are multifaceted. A skilled labor shortage, the massive energy price shock following the start of the war in Ukraine, the falling demand or German exports, declining household consumption, and a lack of government spending to make up for falling demand all contribute to Germany’s current economic stagnation.

While the recession technically ended in Q2 of this year – GDP growth was at exactly zero – there is good reason to believe that the German economy might contract again in the latter half of 2023.

High frequency indicators point towards further contraction

GDP figures are released with a substantial lag. The Q3 GDP numbers for Germany are published end of October. For that reason, economists have increasingly consulted high frequency economic indicators that can help get a better understanding of where the economy is heading in real-time.

These data points were particularly important during the pandemic when the economy was in a stop-and-go mode due to the intermittent lockdowns that governments imposed that were supposed to keep the virus from spreading.

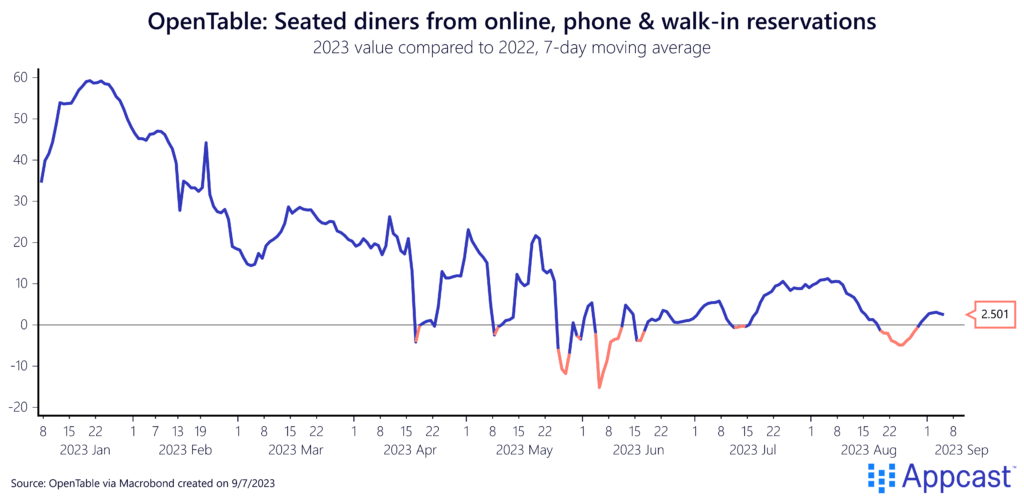

OpenTable has data on the restaurant industry for several advanced economies. Their graph below shows the number of seated diners from online, phone, and walk-in reservations for current OpenTable restaurants in Germany. It measures the weekly change in seated diners in 2023 compared to 2022. A negative value thus indicated fewer restaurant visitors compared to last year.

As one can see, the index dipped below zero back in May and June and now again in August. While a three percent reduction is not the end of the world, it shows that there is less demand for eating out in Germany than last year. Certainly, high inflation and the cost-of-living crisis are playing a role here. German real wage growth was negative for two years until very recently.

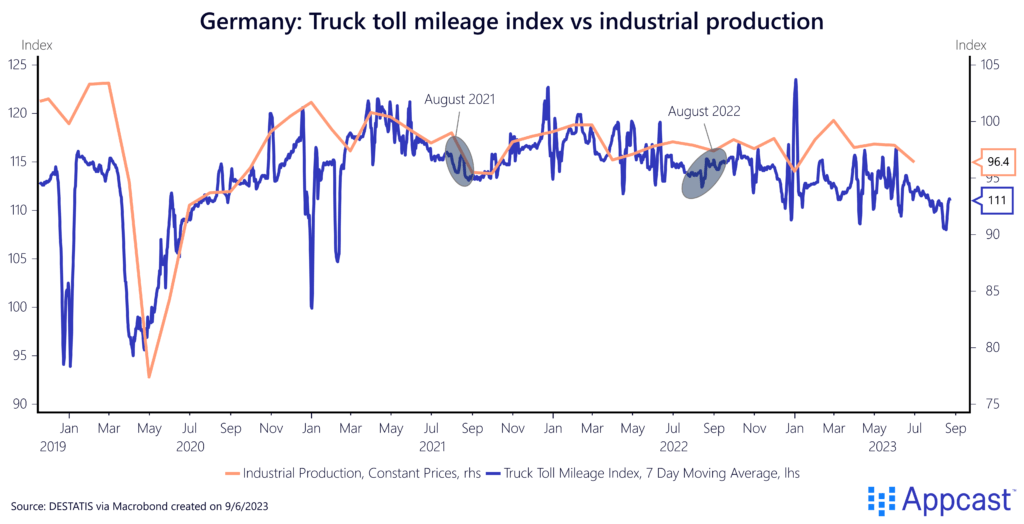

Even more concerning is the decline in the truck toll mileage index measured by Destatis (the German statistics office). The index shows how the mileage of large trucks on German highways develops over time. The daily series is highly correlated with output produced by the industrial sector. It is therefore a very good leading indicator for the German industrial production series.

The truck toll mileage series recently plunged and is now more than six percent lower than in August 2022 and August 2021. We should therefore expect continued weakness and even a further decline in German industrial output in the months ahead.

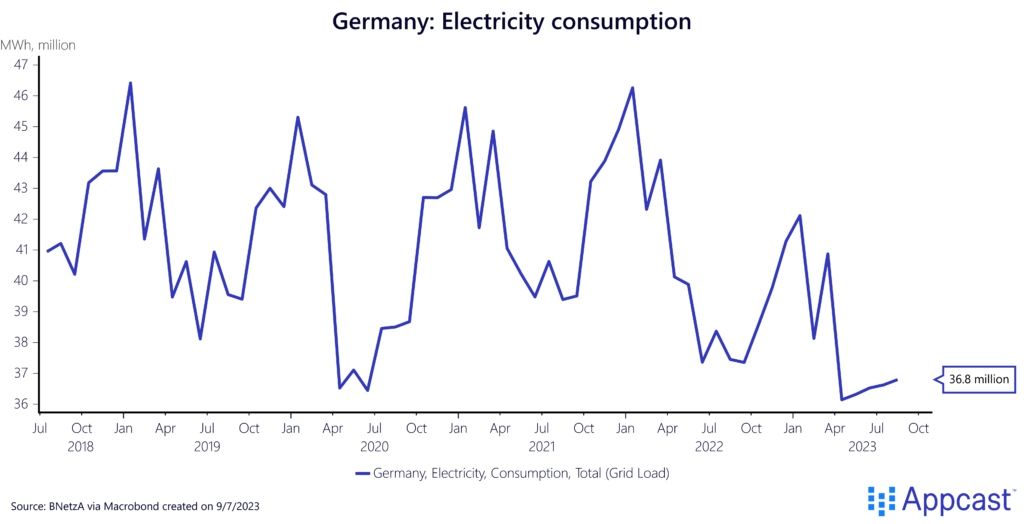

Current electricity consumption in Germany is also painting a bleak picture. While part of the decline can be attributed to energy savings following the Russian gas price shock, current consumption is just as weak as during the spring of 2020 when the economy had been entering the first COVID lockdown.

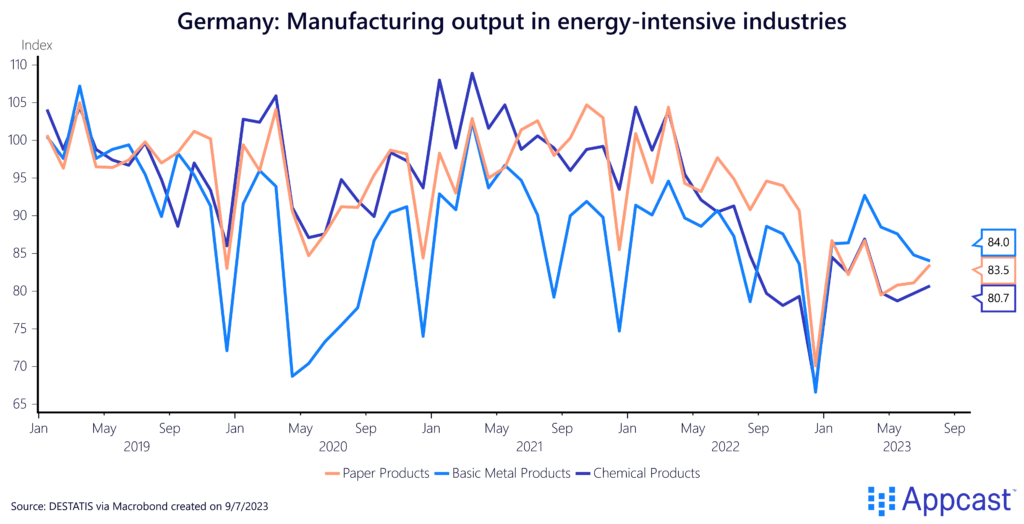

The current decline in energy consumption is a result of some of Germany’s most energy-intensive sectors producing much less output than just a year ago. Manufacturing output of paper products, basic metals, and chemical products have plummeted since early 2022 as Germany’s energy prices soared more than in other European countries.

The decline in competitiveness that Germany experienced is going to hurt these sectors for a while. While energy prices have come down from last year, they are still significantly higher in Germany than in Southern Europe, for example, thus giving German producers a big cost disadvantage.

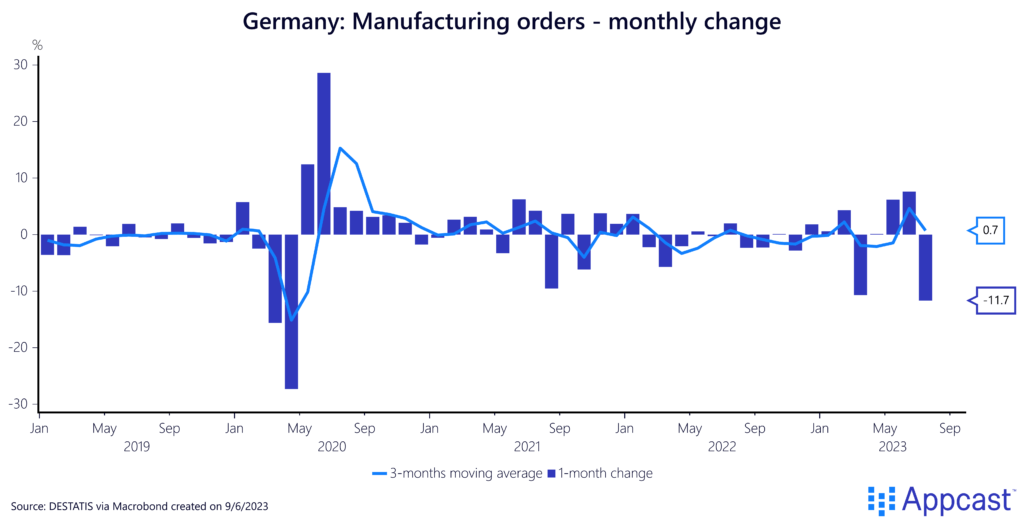

German manufacturing orders slumped by more than 11% last month, a much steeper decline than expected by most economists, according to Bloomberg. This is yet another sign of how much the German economy is dependent on external (foreign) demand, which is now turning out to be a major weakness.

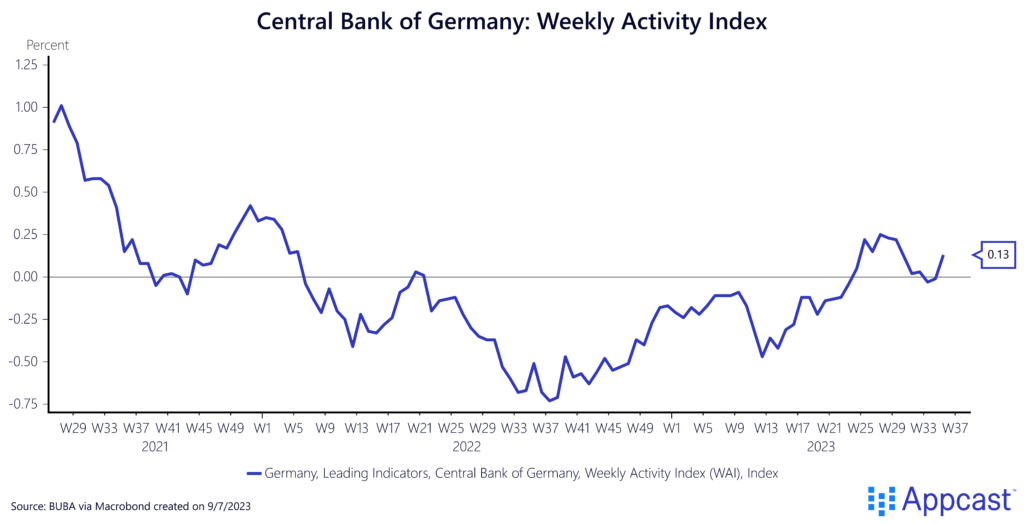

The German Central Bank is publishing a weekly activity index (WAI) that is based on nine different high frequency indicators, including truck toll mileage and electricity consumption mentioned above. The current positive value of about 0.13 indicates above-average growth for the last 13 weeks compared to the previous 13 weeks. However, keep in mind that growth in the second quarter was zero and that Germany’s trend growth is very low. The current value for the WAI is thus hardly mind-blowing and rather indicates continued stagnation than anything else.

Economic surveys suggest doom and gloom

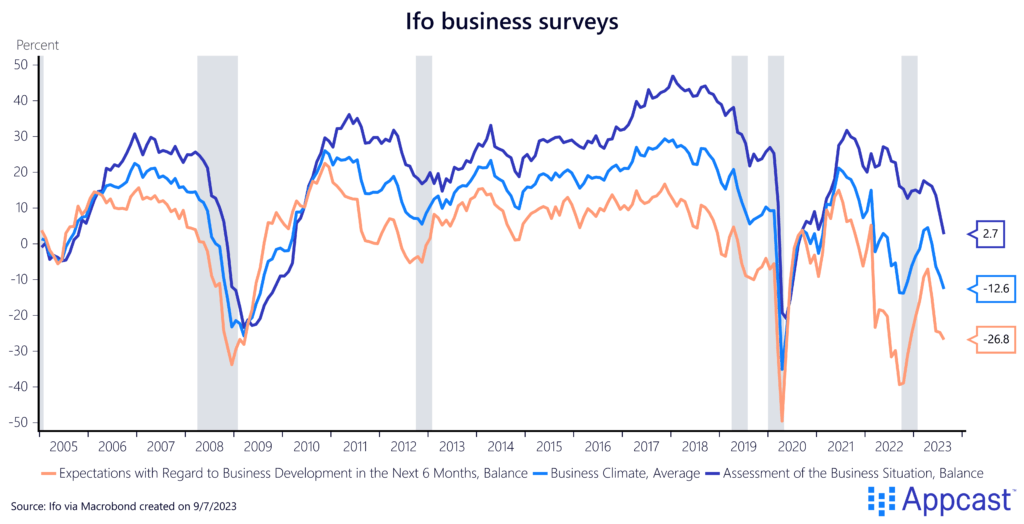

Economic surveys are currently foreshadowing that the German economy will shrink again in the second half of the year. The Ifo indicators – Germany’s most renowned business survey – have declined for the third month in a row. Current values show that the business climate is severely depressed and consistent with an economic contraction.

Equally concerning, expectations for the business development for the next six months has also fallen recently and is approaching the low of the 2008 recession.

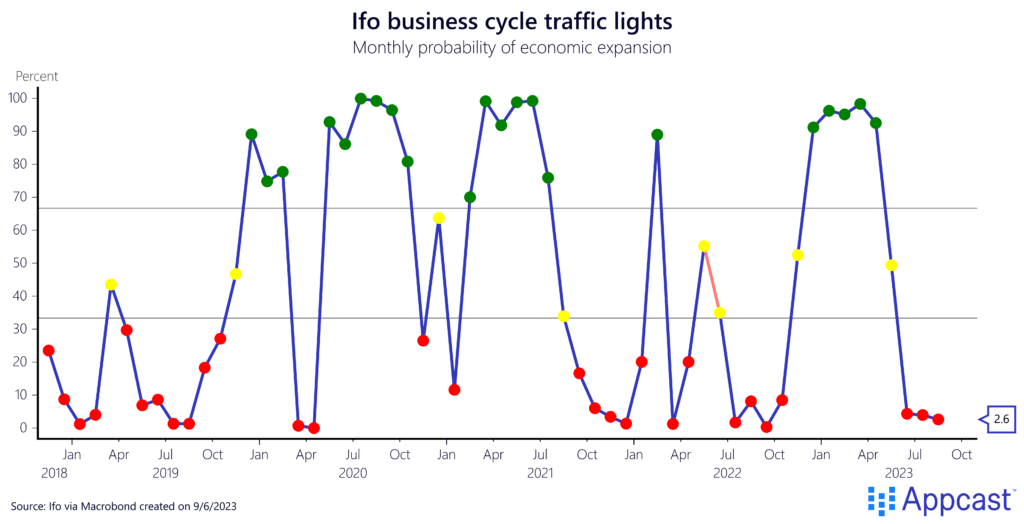

The Ifo institute has also designed a traffic light system that estimates whether the German economy is currently in an upswing or downswing phase. The traffic light signal provides the monthly probability estimate for being in an economic expansion regime.

As one can see, the indicator recently plunged. While it was still green in the beginning of the year, it is now visibly red and stands at only 2.6%. According to this model, the German economy is now in contraction territory.

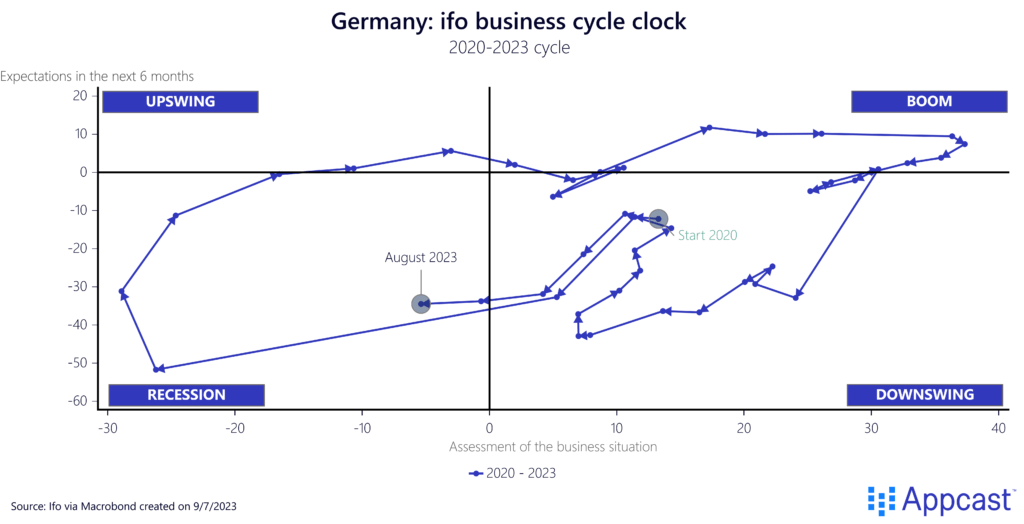

This is also confirmed by the famous Ifo business cycle clock, which plots the current assessment of the business situation vs. near-term expectations. The four quadrants show in which economic phase the economy is right now. And as of July 2023, Germany’s economy entered recession territory again.

What does that mean for the labor market?

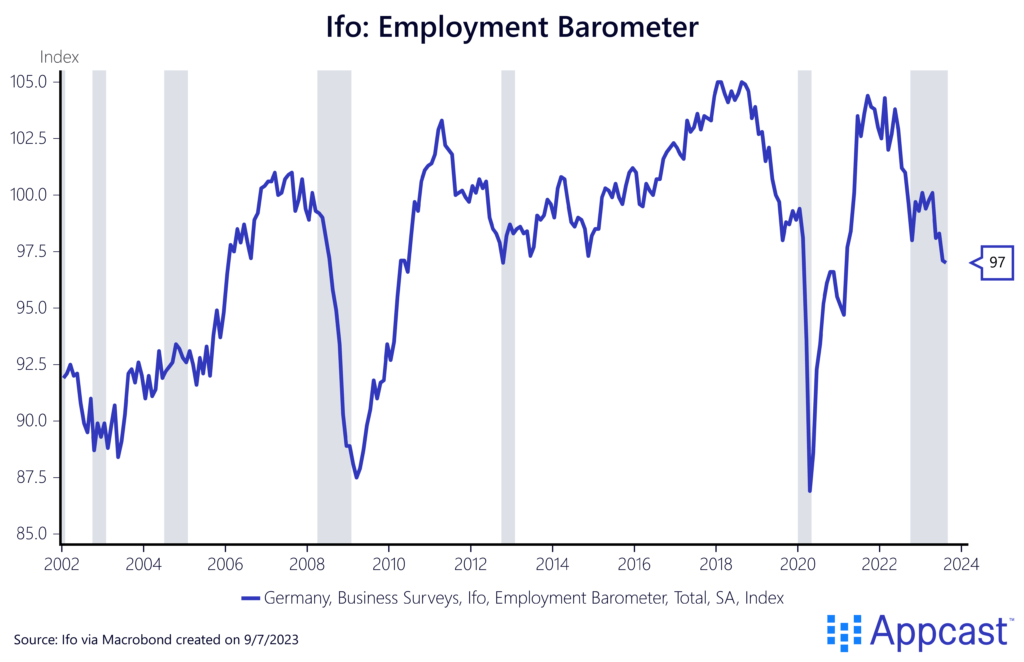

A contracting economy is obviously bad for workers and will likely mean a weaker labor market in the quarters to come. The Ifo employment barometer has been falling since the end of last year and indicates weaker demand for labor. That being said, German unemployment is currently at historic lows and did not substantially increase during the last economic contractions. Due to adverse demographics, Germany has a structurally tight labor market and is missing more than half a million workers. While vacancies might fall a lot in the months to come, employment will probably hold up well and the unemployment rate will most likely remain below 4%.

Many companies were scarred by the hiring difficulties in 2022 and will therefore rather engage in labor hoarding – holding on to workers instead of letting them go right away when demand weakens. We therefore think that the structural problem of missing workers will outweigh cyclical fluctuations.

Conclusion

Since the COVID pandemic, economists have increasingly focused on high frequency indicators to get an idea of where the economy is heading in real-time since GDP series are only published with a substantial lag.

The German economy entered a technical recession in Q4 of last year. While growth in the second quarter of 2023 was exactly zero, a large number of high-frequency indicators are currently signaling another economic downturn in the months ahead. While the labor market will likely weaken as a result, we think that the structural problems of missing workers will outweigh the cyclical factors. Weak demand will first translate into a significant decline in vacancies before affecting employment. Unemployment will most likely remain low as companies will hoard labor.