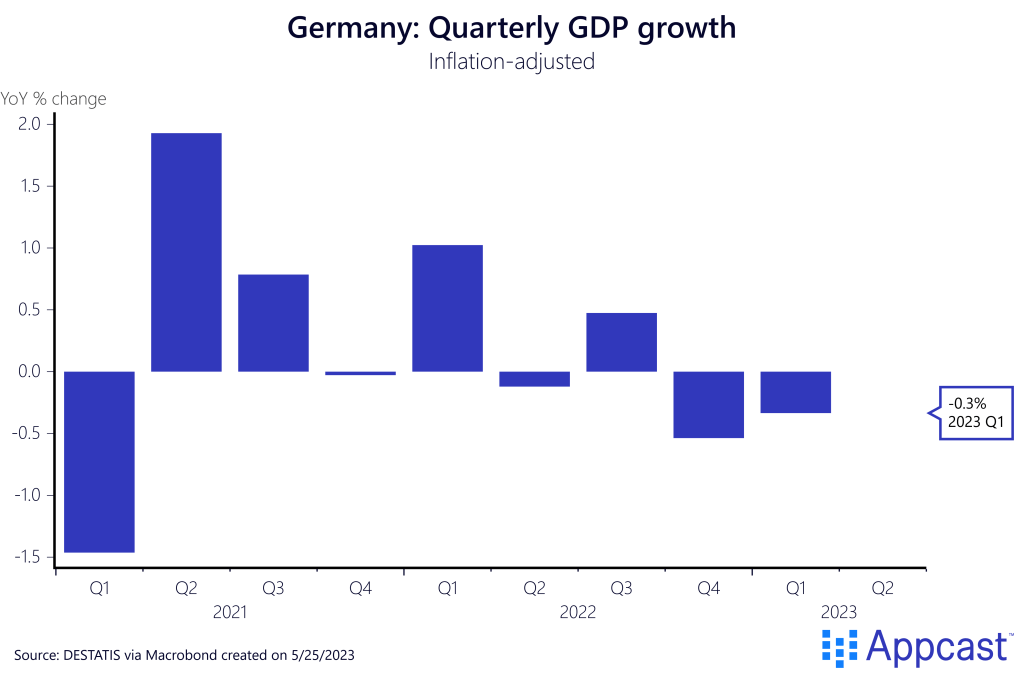

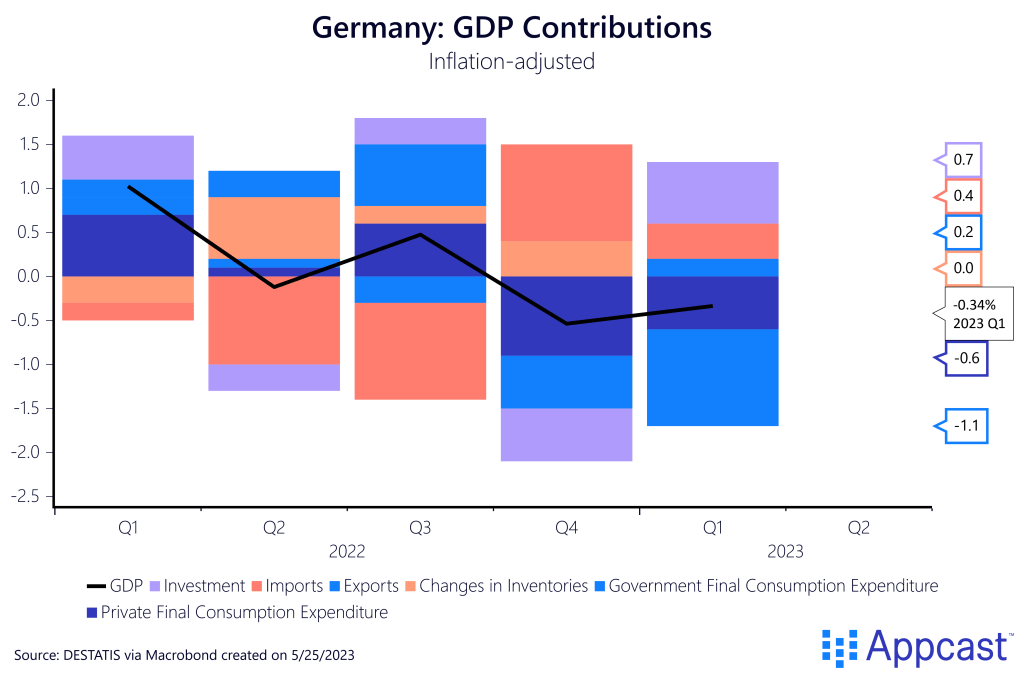

In the U.S., the recession dating committee from the NBER is responsible for determining whether the economy is in a contraction or not; in Europe, the rule-of-thumb of two consecutive quarters of negative GDP growth is widely used. By that measure, Germany is now in a technical recession: The economy contracted by about 0.5% in Q4 of 2022 and 0.3% in Q1 of 2023 and is now down by about 0.5% from last year.

It is fair to say that Germany’s economic model was reliant on cheap energy imports from Russia and exporting industrial goods to the rest of the world while keeping domestic wages in check. Both the reliance on Russian energy imports as well as the model of domestic wage compression to boost its competitiveness vis-à-vis other Eurozone economies have been criticized in the past.

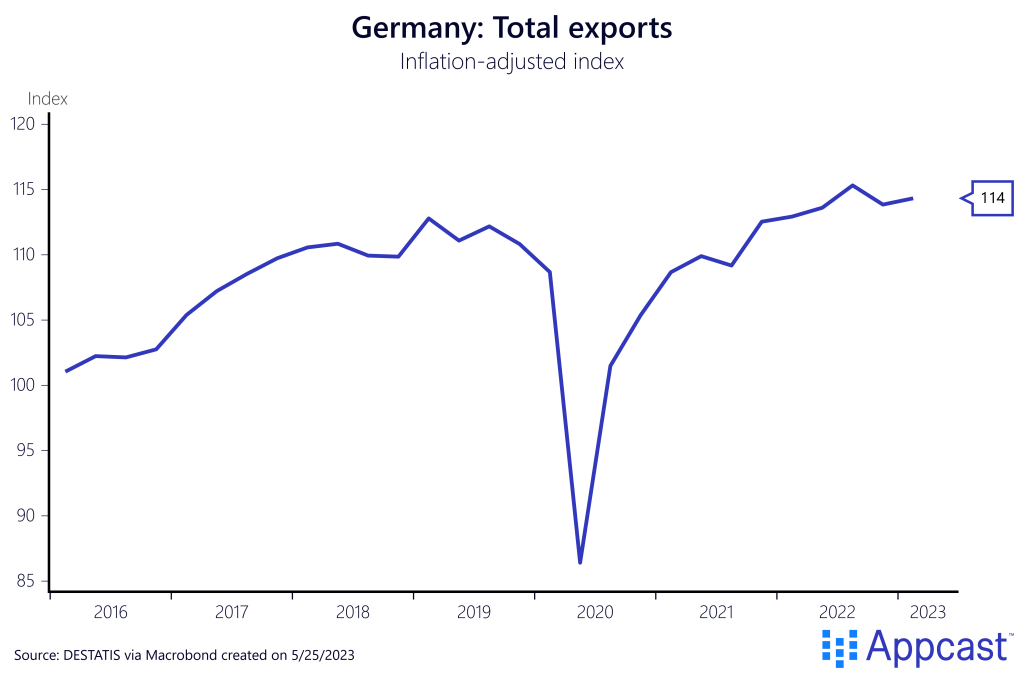

It is that wage model that has led to economic stagnation in recent years. As we have previously noted, the German car sector is a large share of the German economy but began stagnating in the mid-2010s. The pandemic and the war in Ukraine then led to two consecutive global shocks that affected the German economy more than others. As a result, German exports have stagnated when adjusting for inflation. Plus, supply chain problems, combined with the massive commodity price shock that followed the war in Ukraine, have contributed to the decline in industrial production that is weighing on the German economy right now.

While German exports to the rest of the world recently reached a new record high of more than 500 billion euros in Q4 of 2022, almost all of the increase is due to a price effect and not a volume effect: On an inflation-adjusted basis, German exports are not much higher than at the end of 2019.

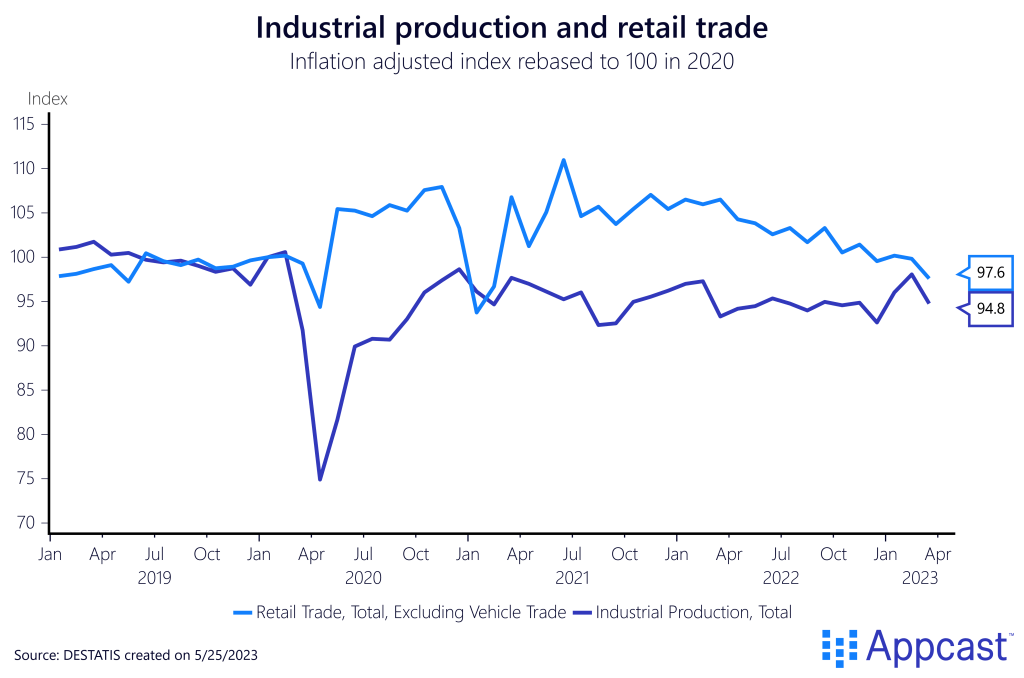

German industrial production is now down by more than 5% on an inflation-adjusted basis compared to the end of 2019. As production stagnates, domestic demand in Germany suffers too. German retail trade is down by more than 10% since mid-2021 and has also fallen below 2019 levels.

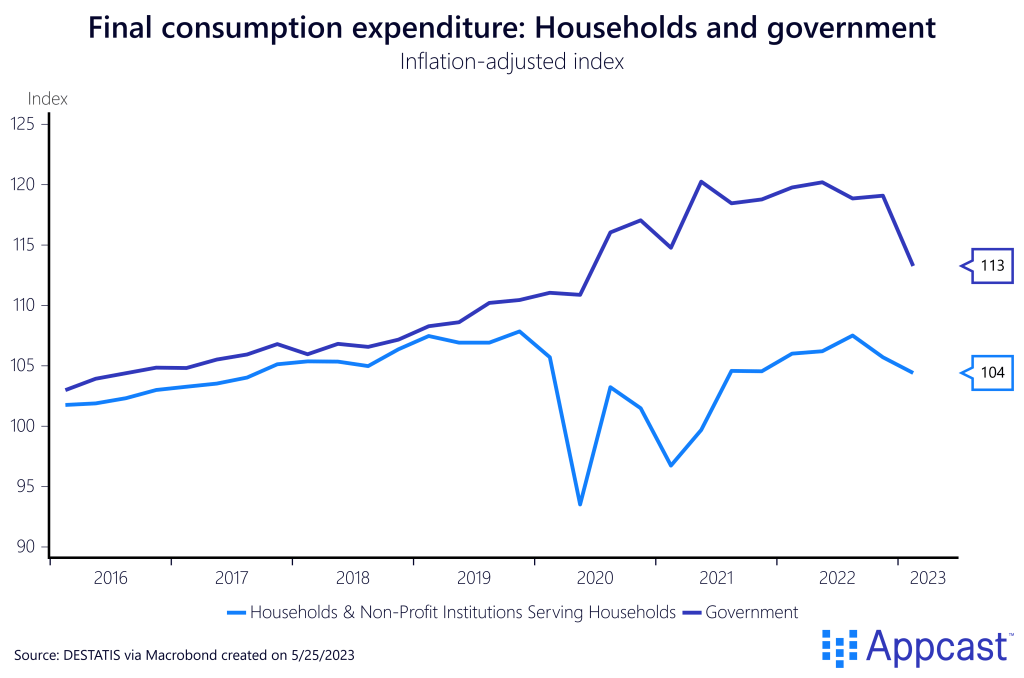

With weakening domestic demand, it is no wonder that household final consumption expenditures are declining. Germany’s inflation rate reached a record high of 9% last year, with food inflation up by about 20% year-over-year at the beginning of 2023.

These price surges have weighed on consumer confidence and depressed domestic spending. Household expenditures in real terms have completely stagnated in recent years and are slightly down compared to the end of 2019.

In the U.S., household spending surged thanks to income support measures from the U.S. government (stimulus checks and increased unemployment benefits). The German government, on the other hand, provided less generous income support to its citizens, and therefore, domestic spending didn’t pick up to such an extent in 2021.

More interesting though is that the German government is now reducing its expenditures by a significant amount. Government consumption expenditures are down by more than 5% year-over-year, with most of the decline happening in Q1 2023.

This significant contraction in government spending has depressed German GDP by more than one percentage point in the first quarter. With household expenditures contributing another -0.6 percentage points, it is absolutely no wonder that this was enough to pull the German economy into a recession.

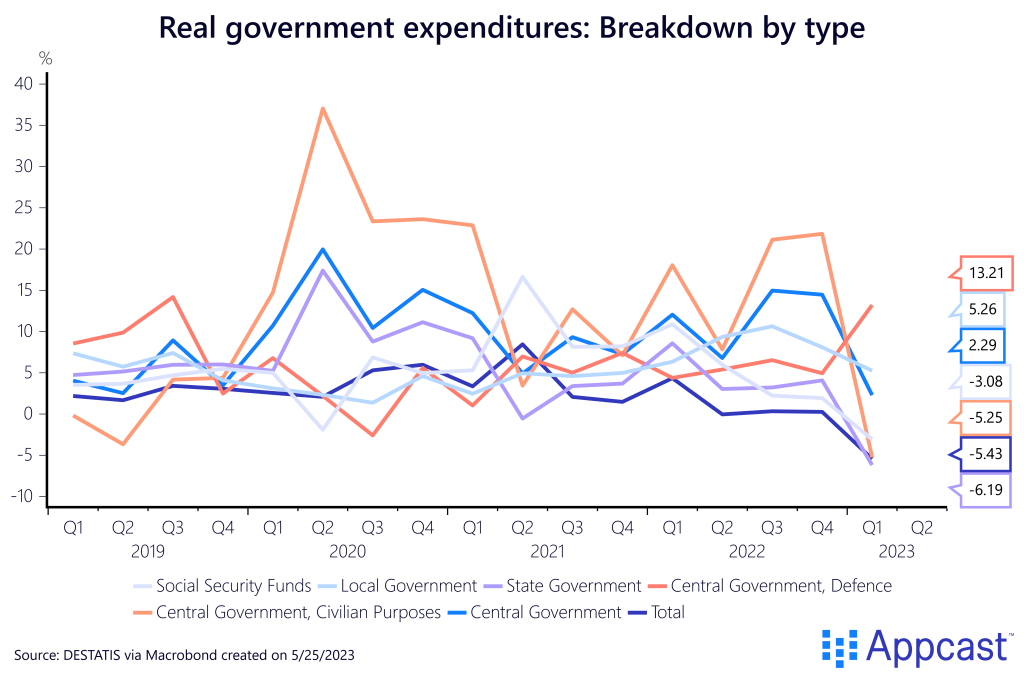

Some of the decline can be attributed to the end of the pandemic. Coronavirus vaccinations and testing during the Omicron wave contributed massively to government spending in early 2022. And these expenditures have now fallen away.

However, this is not the entire story. The German government has also announced a fiscal contraction. Spending peaked at about 560€ billion in 2021 due to emergency measures that were supporting the economy during the pandemic. in 2022, spending had already declined to 480€ billion even as the economy was suffering from the commodity price shock.

While the budget for 2023 is only set slightly below 2022-levels, with inflation still running at more than 7% right now, this represents a significant fiscal contraction in real terms.

Looking more closely at the decline in government expenditure by type, one can see that the negative fiscal impulse is coming from both the central and state governments – and, to a lesser extent, local governments (communes).

The central government’s spending on civilian purposes is declining by more than 5% in real terms right now. The spending contraction from state government is at -6%, while local governments are only recording a decline of -3%.

Overall, the fiscal contraction is broad-based and coming from all levels of German government. While some of it seems to be a result of reversing the spending increase of 2021 and 2022, the amount and pace of this fiscal contraction seems to be a rather bad idea right now, given that the German economy has been facing various other headwinds.

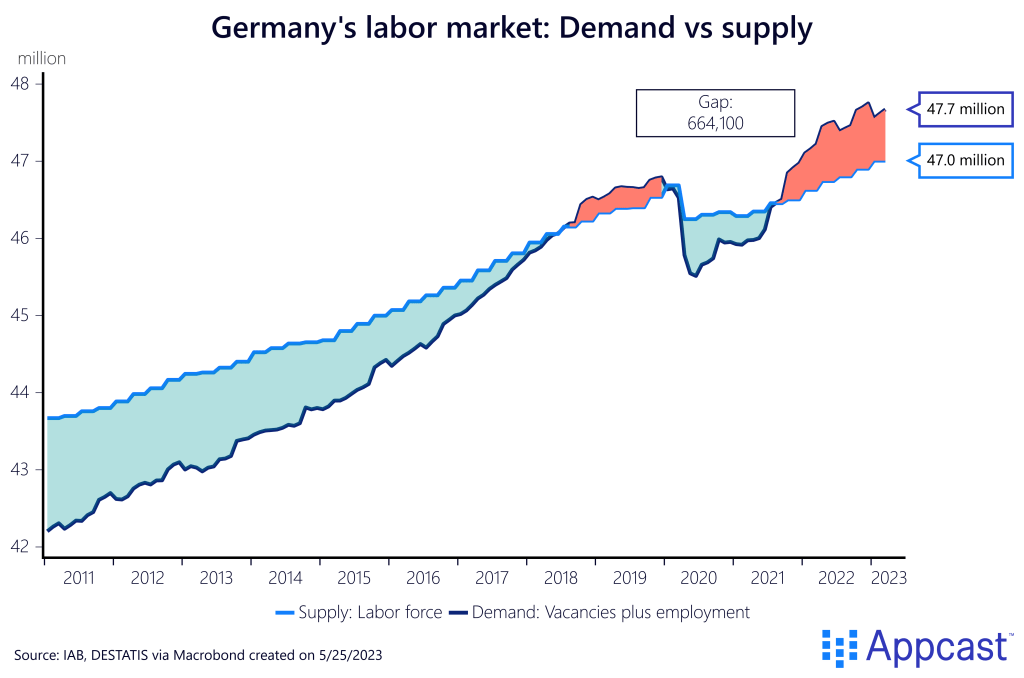

Despite the weakening economy though, Germany’s labor market is still suffering from a massive worker shortage as adverse demographics are starting to take their toll. According to our estimates, the demand for workers is still exceeding the available supply by more than 600,000 and many companies are still reporting a skilled-worker shortage that will not disappear any time soon, even with a mild downturn.

Conclusion

The German economic engine has been stuttering for several years. Germany is a manufacturing powerhouse but has seen its industrial production stagnate for half a decade now. The cost-of-living crisis have also depressed domestic demand and household consumption.

Surprisingly, the most significant negative impulse in early 2023 is coming from the government, with expenditures down by more than 5% in real terms. The pace and amount of fiscal contraction have pulled the German into a recession and seem to be a rather bad idea, given that the economy is facing various other headwinds.