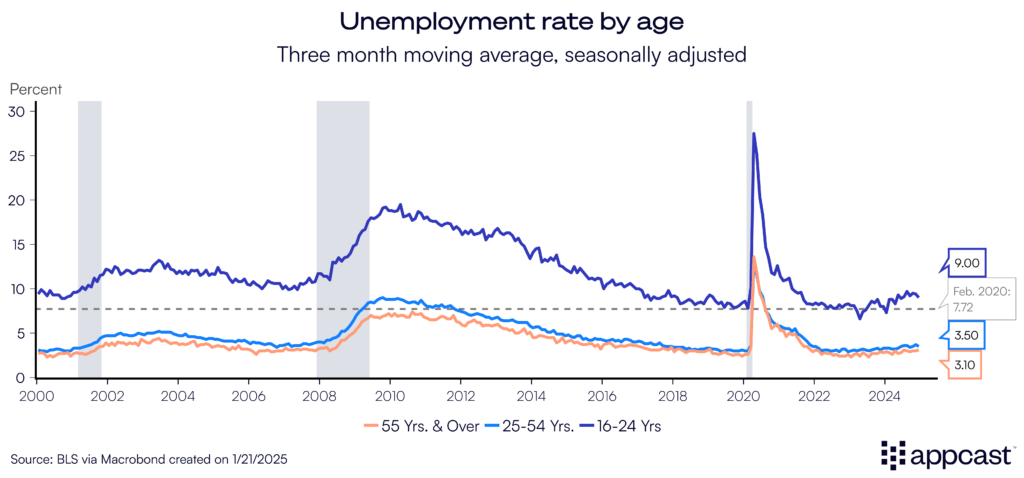

Think of today’s labor market as a ladder. Prime-aged workers are climbing steadily, but our youth are finding the lower rungs a bit shaky. Workers in the prime of their career are enjoying historically low unemployment rates, consistent wage growth, and a (mostly) healthy flow of job opportunities. The same can’t be said for Gen Z workers earlier in their careers.

Since the start of 2024, the unemployment rate for younger workers has climbed by more than two percentage points, leaving many struggling to gain stable footing in an otherwise resilient labor market.

What’s driving this change? Rising interest rates, which began to climb in 2022, fundamentally shifted the dynamics of the labor market. As the “cost of money” increased, so did the cost of hiring, prompting employers to become more selective. Faced with tighter budgets, companies are prioritizing workers with proven track records—those who can contribute immediately—over younger candidates still building their experience.

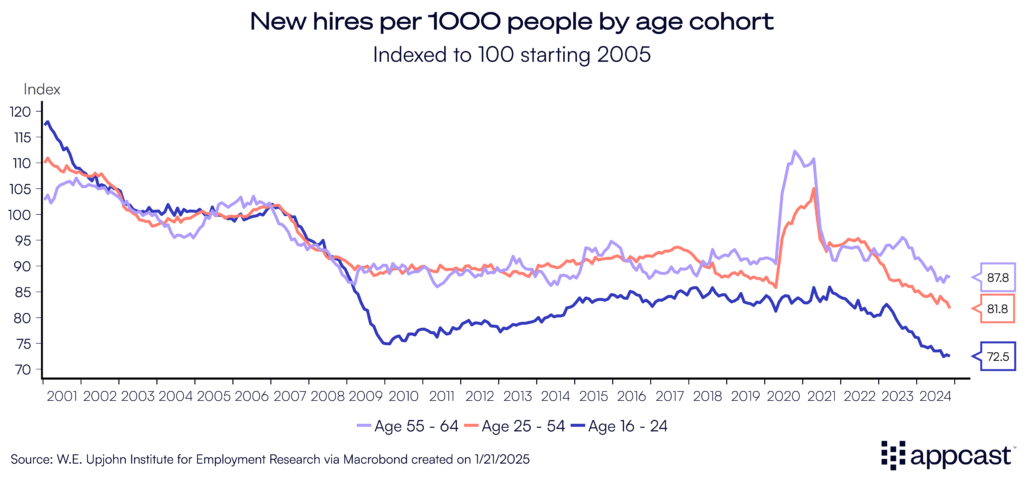

Nothing reflects this more starkly than data from the W.E. Upjohn Institute for Employment Research that tracks the volume of new hires by age cohort. Among workers aged 16-24, per-capita new hires have declined by 14% since before the pandemic. While hiring has cooled across all age groups, the decline has been especially acute for Gen Z.

During periods of depressed hiring activity, it typically hits the least experienced of the workforce first. Look back at the start of the Great Recession: hiring for the core of the workforce (25-64) fell slightly, but it fell dramatically for those under 24.

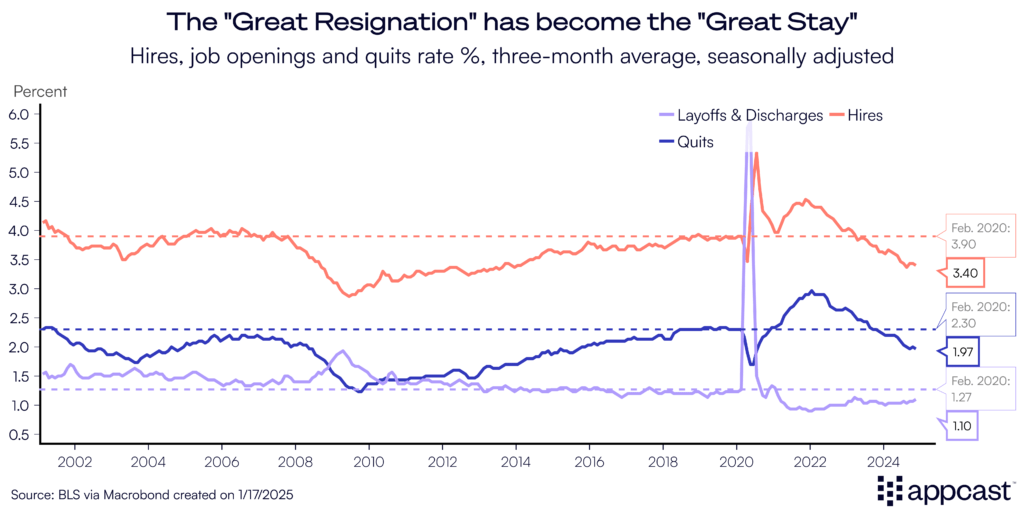

Not only has diminished hiring appetite made competition for jobs fiercer, but the drop in quits rates translates to fewer openings to backfill. This is especially true in industries like professional and business services, where quits rates have fallen more than a percentage point from their 2021 peak. Historically, this sector has been a key landing spot for new college graduates, providing a critical on-ramp to the broader workforce.

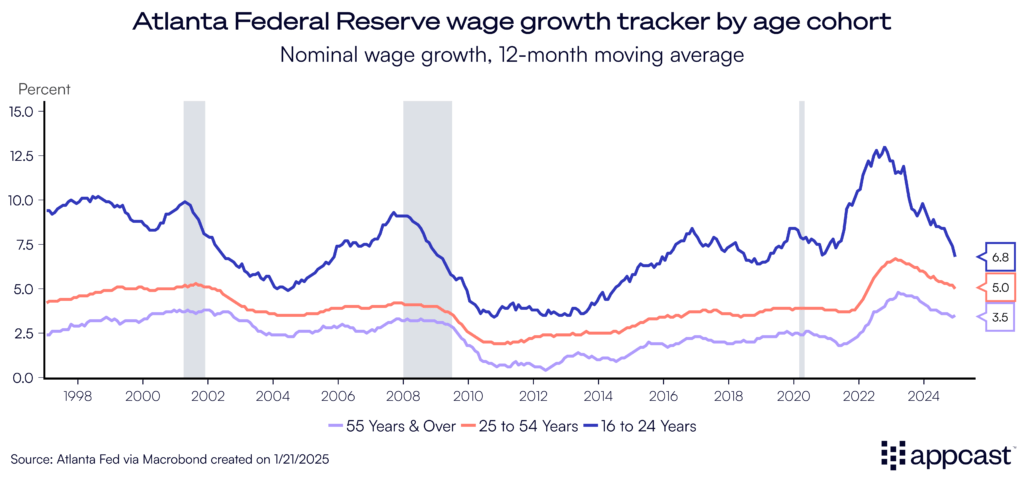

Young adult wage boom and bust

Combining these forces—diminished hiring demand and fewer quits—has also put downward pressure on wage growth for younger workers. After peaking at an all-time high of 13% in late 2022 during the height of the Great Resignation, wage growth for young adults has slowed considerably.

Nowhere was the wage boom more evident than on Wall Street. Big banks, desperate to secure young talent, shelled out record-high raises and bonuses to investment banking analysts—bright-eyed twenty-two-year-olds stepping into the high-stakes world of finance. Some banks raised base pay to nearly $110,000 as they fought tooth and nail for new recruits. But as financial conditions tightened and demand cooled, the need for extravagant pay bumps dissipated.

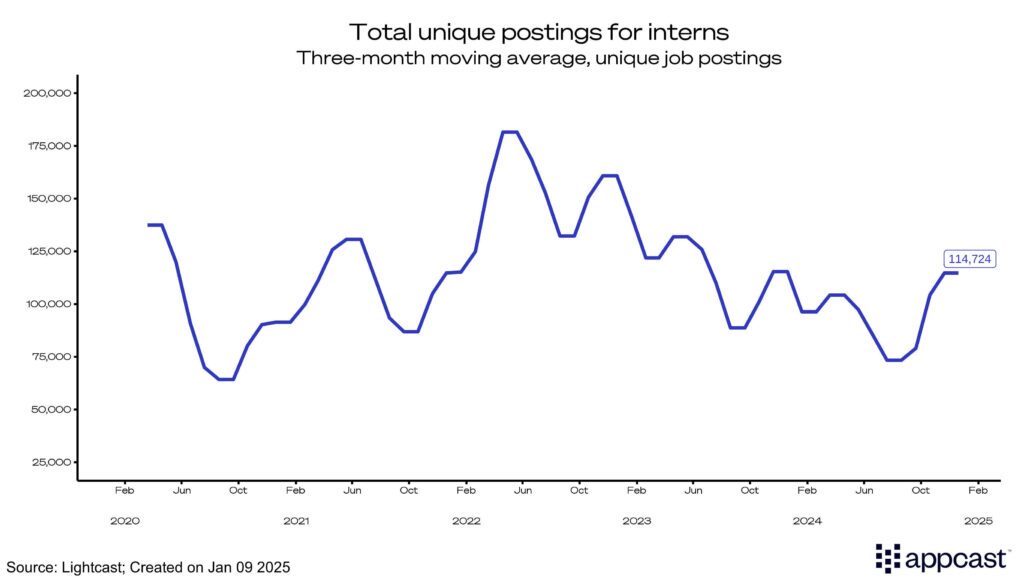

Another major source of employment for college students has been internships, which have recently dried up. Data from Lightcast, tracking job postings across the internet, reveals a clear trend: employers are increasingly reluctant to take a gamble on new intern classes.

In the spring of 2022, total postings for internships peaked at north of 180,000 per month. By the following spring, that number had dropped by more than 40,000. By 2024, postings had fallen back to the depressed levels seen in the spring of 2020, when uncertainty around the COVID-19 pandemic forced companies to scale back internship programs.

Internships have long been a crucial bridge from the classroom to the workplace. As these opportunities vanish, closing off vital pathways to gaining experience and launching their careers, many students find the transition into the workforce even more challenging.

What does 2025 look like?

There is good news on the horizon. Interest rates have begun to come down as the Federal Reserve shifts its focus from combating high prices to maintaining a stable labor market. While the edges of the labor market frayed in 2024—particularly for younger workers—2025 brings cautious optimism.

Although it’s unlikely that hiring demand will return to the boom levels of the early 2020s, there is potential for the labor market to even out. As new opportunities emerge, workers may feel more confident leaving their current roles, creating openings for younger candidates. This type of job churn is essential for a healthy labor market, allowing younger workers to gain the experience they need to establish their careers.