Photo from FrugalFlyer

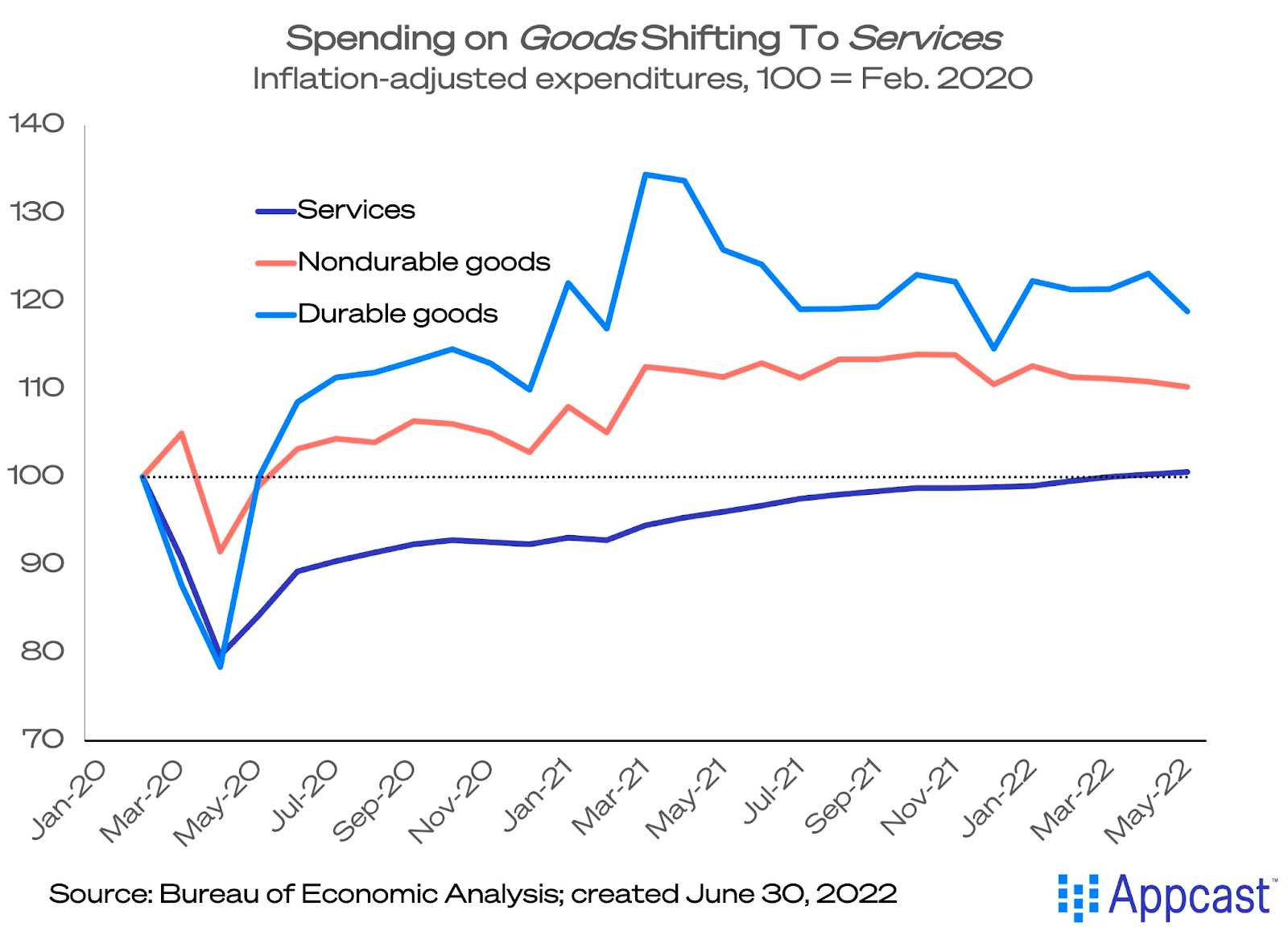

Consumers continued to spend in May, with an increase of 2.1% from one year ago. The shift from goods spending to services spending, a trend we’ve been following, continued as well. There was a large decrease in consumer spending on durable goods (goods that last more than three years) in May, driven by a large decline in spending on motor vehicles and parts.

Spending on goods has been particularly elevated in the two years following the pandemic. Stuck at home, people bought cars, furniture, exercise equipment, and the like. It’s no surprise that goods spending is trending downward from its COVID-era spike. But pullbacks in spending on big-ticket items, like durable goods, also tend to occur during periods of economic uncertainty, as consumers feel less confident in their personal finances and the general trajectory of the economy.

After a long hiatus from services spending, consumers have recently reached pre-pandemic levels of spending on services, and in May, this trend continued. At the very beginning of the COVID-19 pandemic, consumer spending on services dropped dramatically and though it has been gaining since, each variant flare led to modest drops. This May increase was driven by spending on housing and international travel. Consumers are still making up for a pandemic-driven lack of services and May did not disrupt this trend.

Other takeaways from the Personal Income and Outlays release:

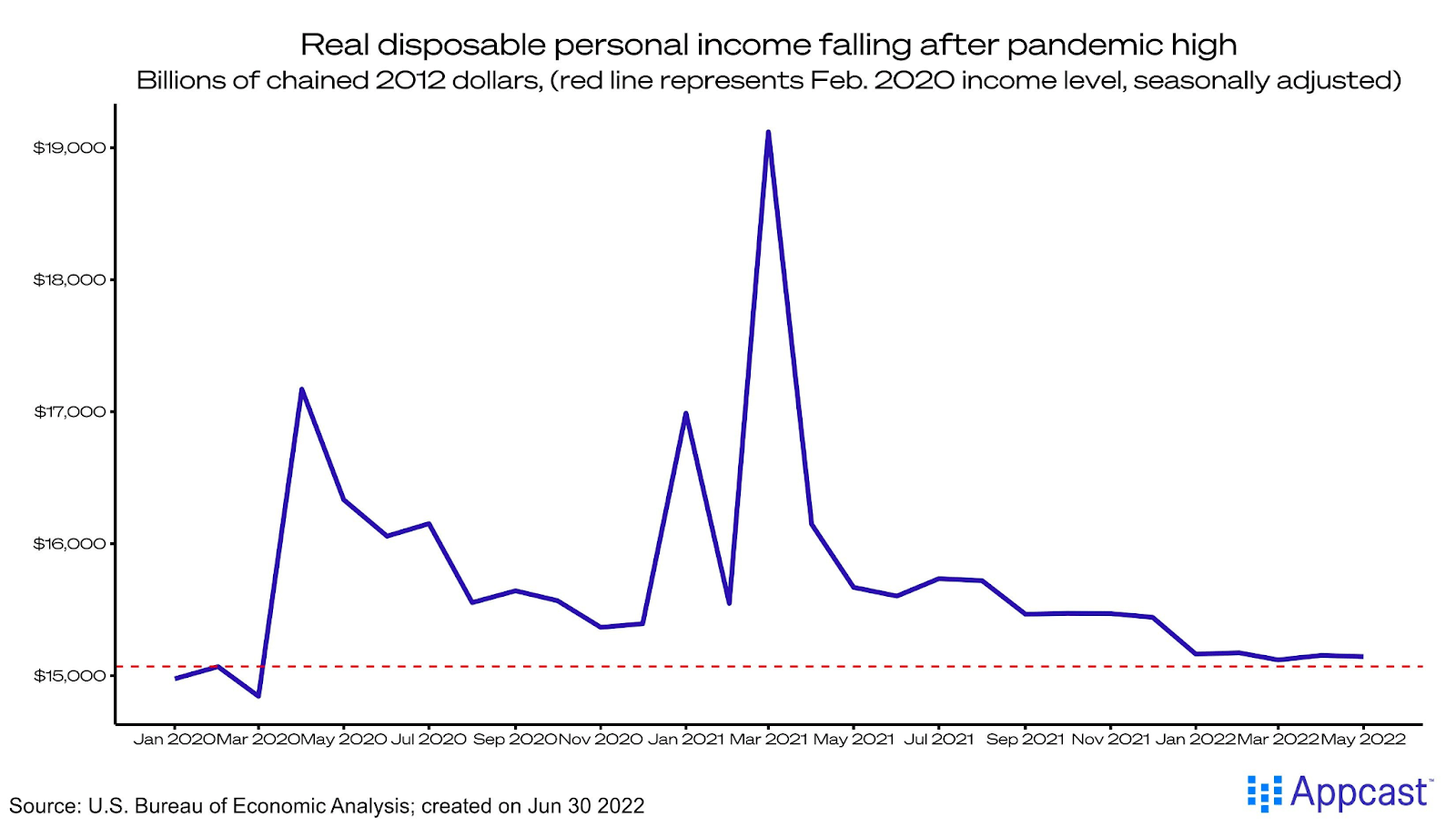

- In May, while spending rose, income fell. Real disposable personal income fell 3.3% in May from a year ago, the 8th monthly drop in the last year and barely above February 2020 levels.

- The Fed’s favorite inflation measure – personal consumption expenditures – was up 6.3% in May from a year ago. In March, this measure jumped to 6.6% and decreased slightly in April to 6.3%. A leveling out in May should be encouraging for the Fed.

- The savings rate as a percentage of disposable income rose to 5.5% in May.