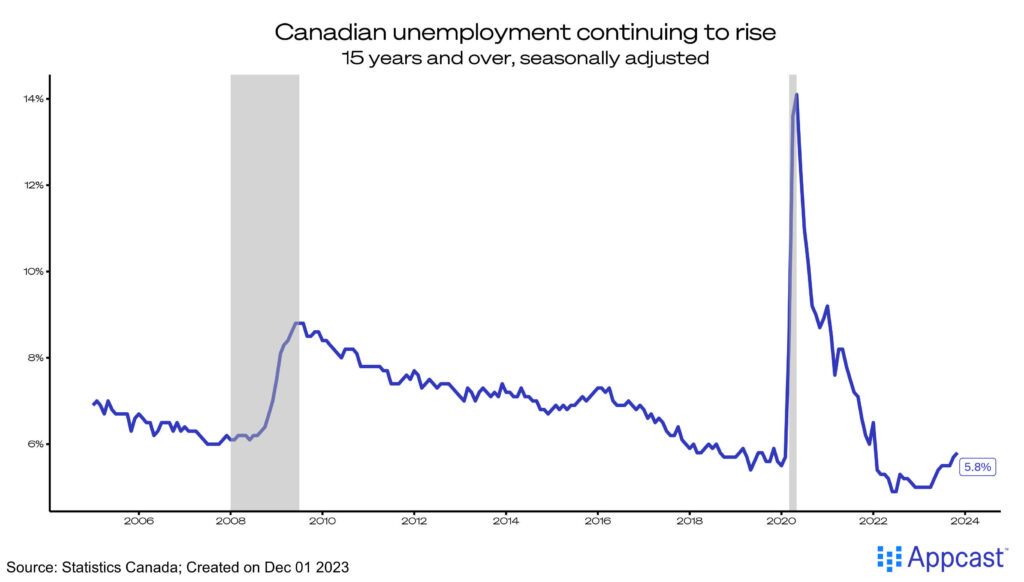

The outlook for Canada’s labor market and broader macroeconomy is worsening: unemployment continues to rise, inflation remains above what the Bank of Canada can stomach, and employment prospects dwindle for both native-born Canadians and immigrants.

Canada’s labor market added 25,000 new jobs last month, while the unemployment rate increased for a second month in a row to 5.8%. This is now 0.8 percentage points above the historical low in April this year, indicating prospects for job seekers are getting more competitive. The total size of the population (age 15+) also grew by 78,000, more than triple employment growth.

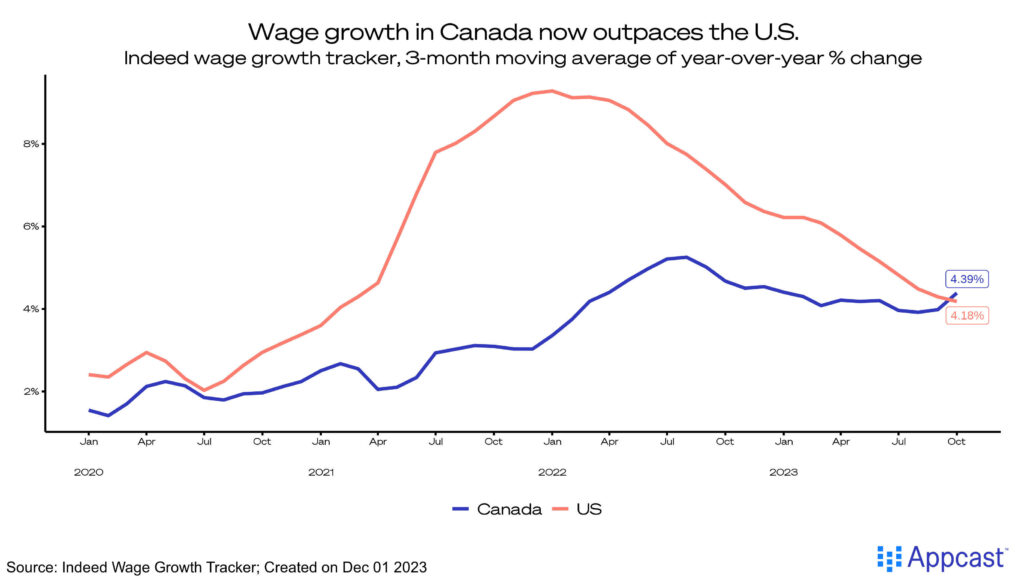

For the first time in over three years, wage growth in Canada is now outpacing the same metric in the U.S., according to Indeed’s data on advertised wages in job postings. Relatively stable over the past six months, wages ticked up to 4.4% (year-over-year) in November contrasted against the smooth decline in the U.S., down to 4.1%.

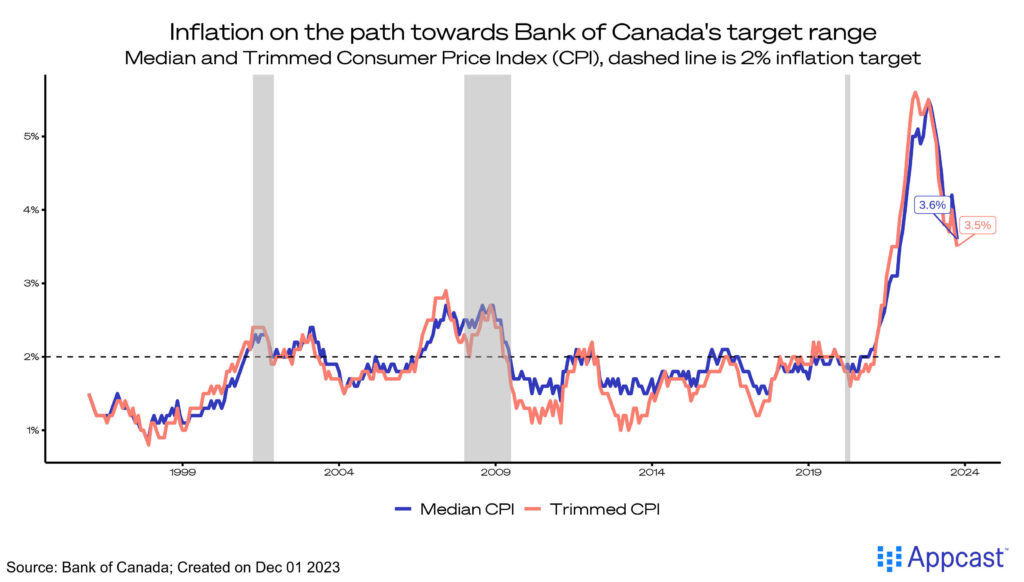

For inflation, the trend is heading in the right direction after the Consumer Price Index (CPI) fell for the second month in a row, down to 3.6% (median CPI). While the trend might be encouraging, it is still far above the Bank of Canada’s target goal of 2%. The process of reaching this goal will continue into 2024, where the decision to maintain or cut interest rates will be a delicate balancing act between a fragile labor market and too-high inflation.

Sector Trends

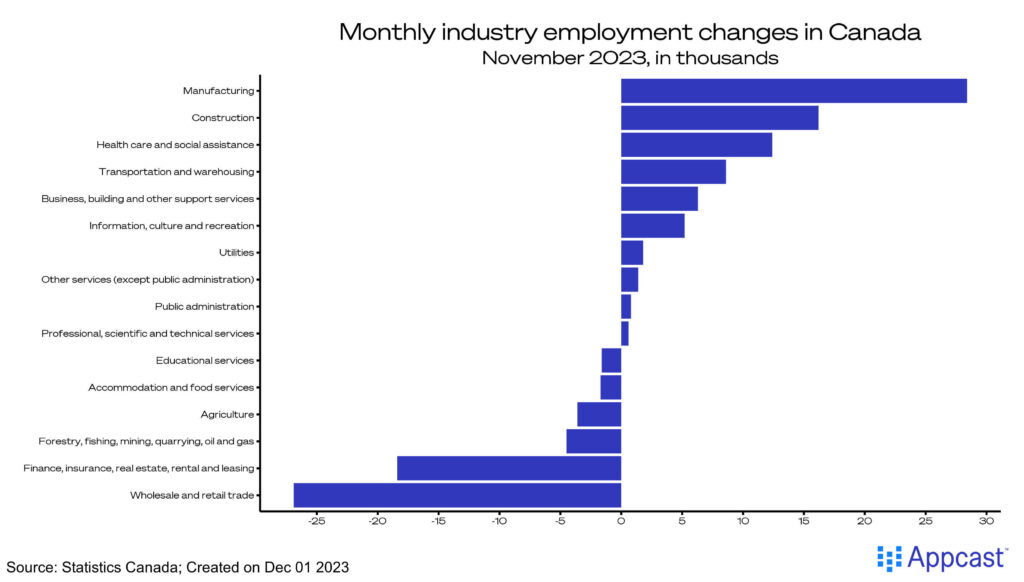

The gap in employment growth between the “standing up” versus “sitting down” economy has continued to diverge, as construction (+16,000) and manufacturing (+19,000) lead the pack, while white-collar professional occupations like finance and insurance bleed jobs (-18,000).

The warehousing and retail trade sector is in a particularly bad state – after losing 22,000 jobs last month, it saw an even more significant drop of 26,900 jobs this month. This comes weeks before the holiday period where consumers typically pick up their spending. Not this year – core retail sales fell by 0.3% in September.

Retail shoppers tightened their belts for Black Friday this year, forgoing new TV purchases as the cost of staple goods has been eating away at household budgets.

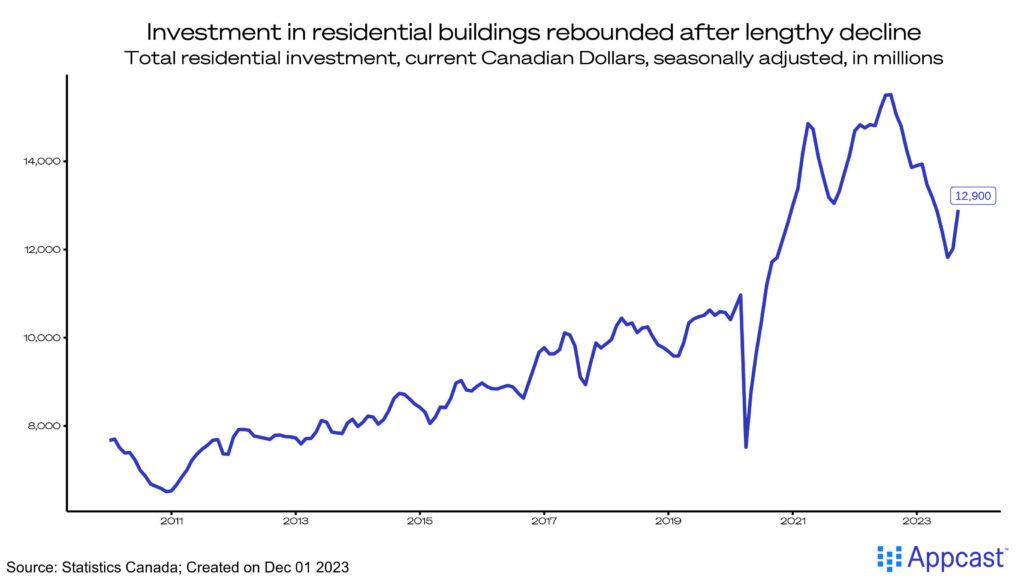

A potential sign of relief for the beleaguered housing market in Canada is a return in residential investment. After many months of declines, investors are starting to feel more confident with a rebound in spending over the past two months. A recent Reuters poll of Canadian economists forecasts potential rate cuts in the second half of the year due to the weakness in the labor market.

Labor Force Trends

The prime-age employment rate continues to fall after reaching a historical high this year, a troubling sign of the health of the core labor market. Down 0.8 percentage points from January this year, a slumping job market puts the BoC in a pickle as it must decide the path forward between reducing inflation or maintaining the labor market.

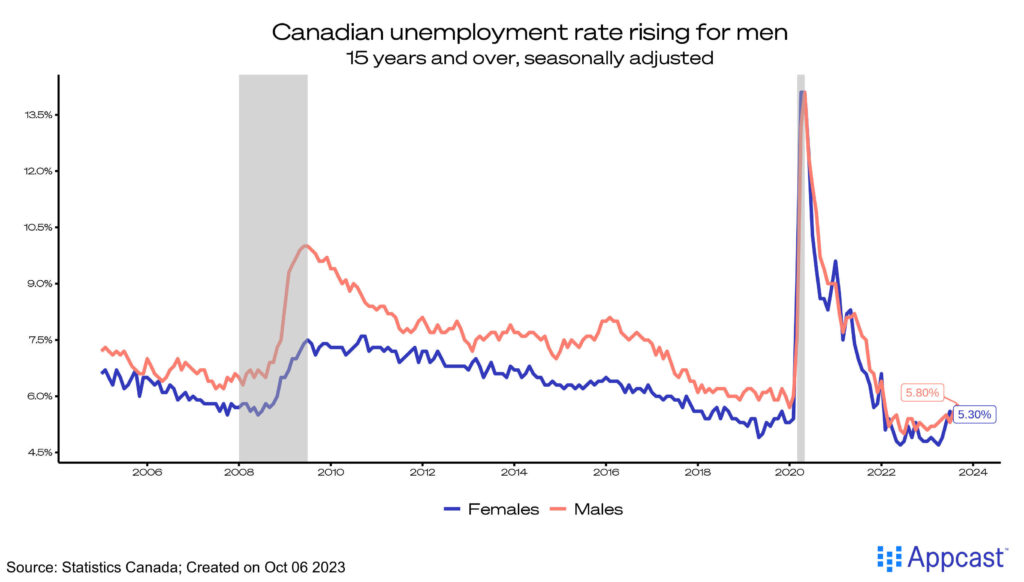

Employment for core-aged men slips as well, down 0.2 percentage points this month. Unemployment for men has creeped up to 5.8%, widening the gap with women to 0.5 percentage points.

What does this mean for recruiters?

The labor market in Canada is in a delicate state. Job growth has been weak for several months now, not being able to keep up with the pace of population growth. Unemployment steadily creeps up from record lows. Wage growth is now higher than in the U.S., with still-elevated prices for consumer goods and services. The standout industries of construction and manufacturing do bring positive news for recruiters in those industries, but the situation for industries dependent on consumer spending is bleaker.

The Bank of Canada will have to make some tough decisions in 2024. Economists are now forecasting rate cuts in Q2 of next year, hopefully indicating that inflation will fall accordingly to the desired target and the labor market will not head into recession territory.