The 110-billion-pound gap

The short-run outlook for the U.K. economy is now looking brighter than last year. Business and consumer sentiment improved in the beginning of 2023 and so did the Bank of England (BoE)’s forecast for the economy. Instead of a shallow recession, the BoE now expects GDP to remain flat in the first half of 2023. Monetary policy makers also see an improved employment outlook and no longer expect U.K. living standards to fall this year.

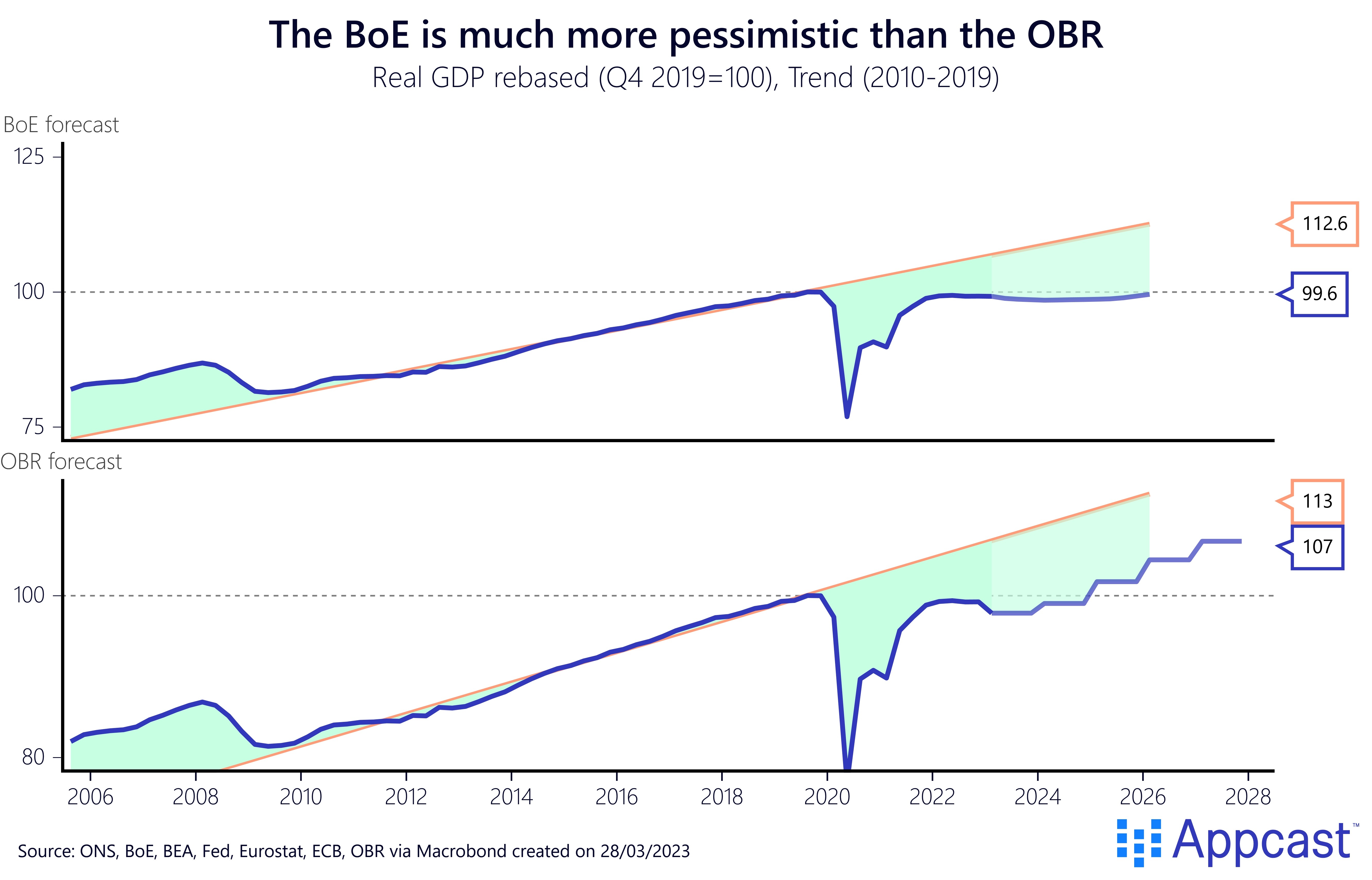

However, there is a massive disagreement between U.K. policy makers. On the one hand, you have the BoE in control of monetary policy. And on the other hand, you have the Office for Budget Responsibility (OBR), the independent economic forecasters of the UK Treasury, representing fiscal policy. The monetary and fiscal policy makers do not see eye-to-eye about the U.K. economy’s long-run economic growth potential, with the BoE being much more pessimistic. In fact, the gap between the BoE and OBR forecast amounts to a striking 110 billion pounds in 2025, or about 5% of GDP.

The OBR assumes that the U.K. economy will be some 5% larger in inflation-adjusted terms at the end of 2025 while the BoE basically assumes complete stagnation for the years to come.

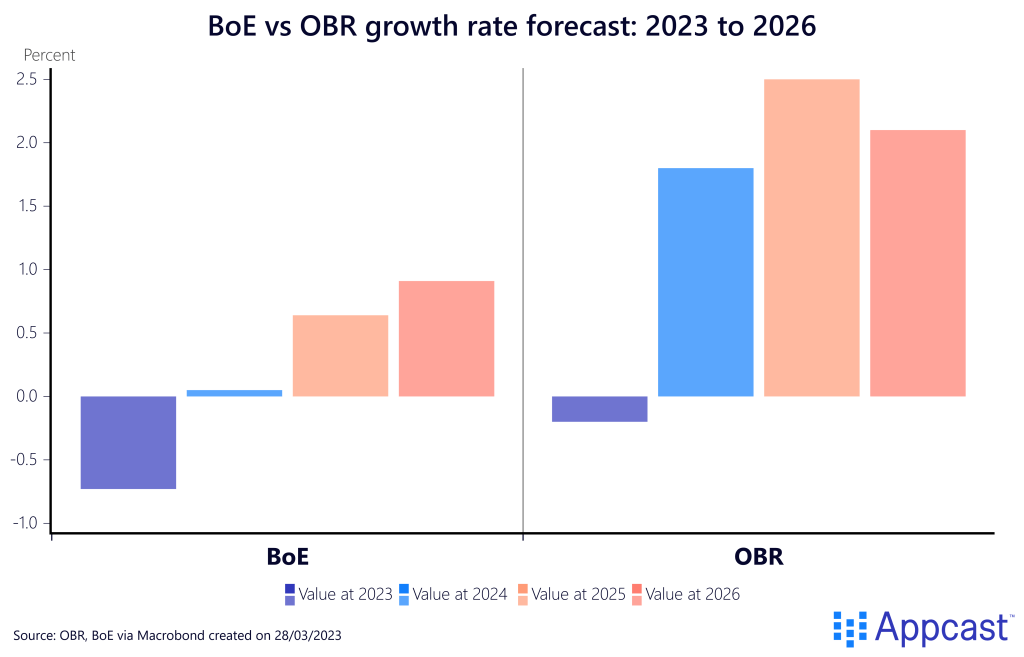

In the slightly outdated February forecast, the BoE expects a modest 0.6% contraction. With last week’s rate hike, BoE policy makers announced that they now expect growth to be flat this year with an extremely sluggish recovery in the years thereafter, with middling growth of 0.5% or below.

The OBR, on the other hand, is projecting both a shallower recession this year as well as a faster return to more normal growth, with the economy expending by more than 1.5% from 2024 to 2026.

Business investment, employment, and labor productivity

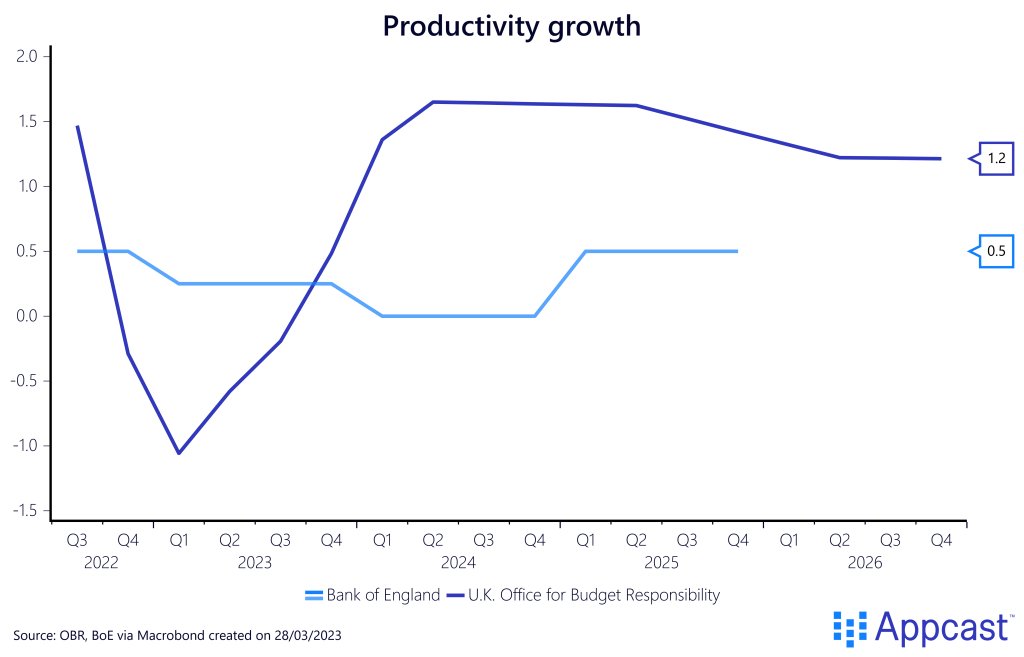

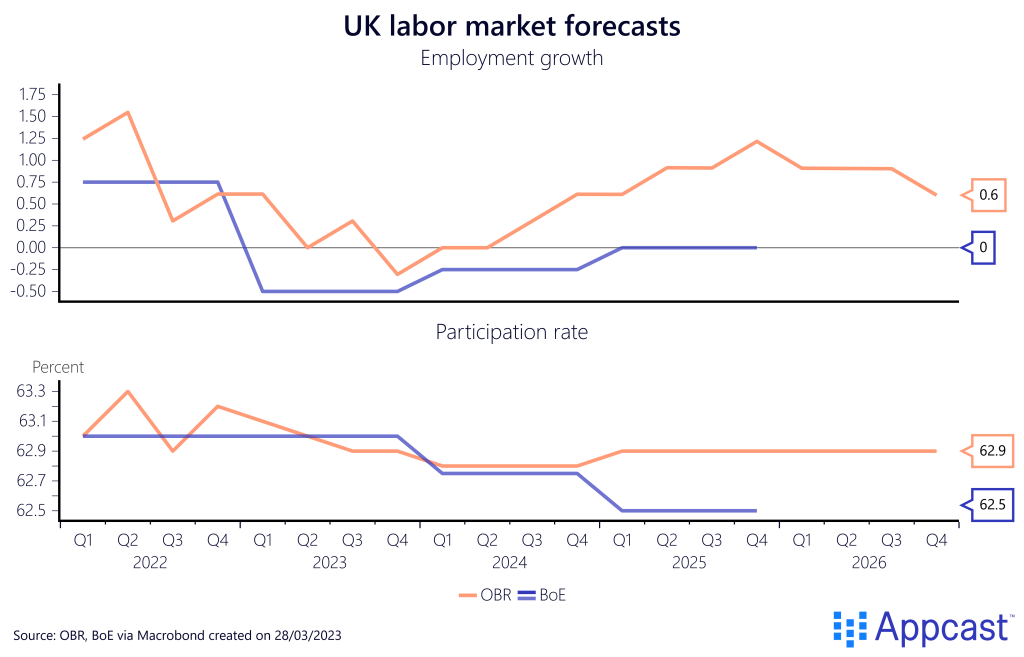

The massive divergence between the two forecasts can be explained by different assumptions about the employment outlook, labor productivity, and business investment in the economy.

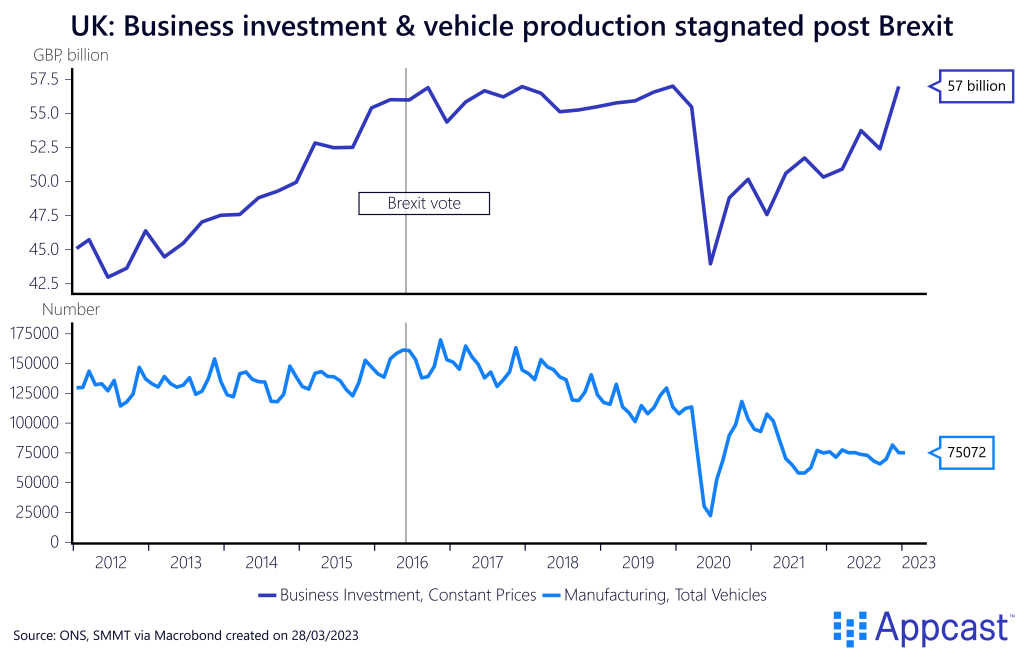

In general, U.K. business investment has been performing very poorly since the Brexit vote in 2016 with international companies reducing capital spending or leaving the country outright. Car production in the U.K., for example, has fallen off a cliff in recent years.

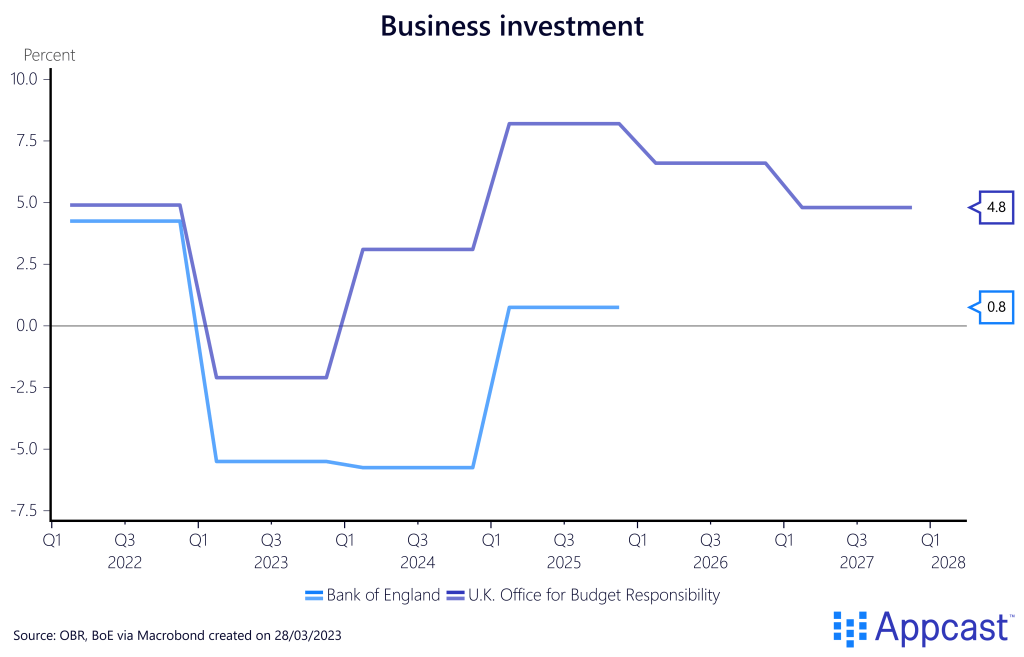

The BoE is assuming that adverse developments will drag on and that business investment is not picking up any time soon. They actually project a severe slump in business investment in 2023 with only a very modest recovery thereafter. The OBR, on the other hand, is more optimistic on that front, with a forecast of relatively high growth rates from next year onwards.

Such a severe slump in business investment reduces the amount of capital investment per worker. This would be one of the main sources of lower productivity growth and a therefore drag on wages and living standards.

The decline in capital spending and low labor productivity are the biggest challenges to the medium-run growth outlook for the U.K. economy. Another growth obstacle could be a weak labor market.

As we discussed before, the BoE is also more pessimistic in terms of the labor market outlook, even though their unemployment forecast has improved substantially earlier on this year.

In general, the BoE is expecting higher unemployment rates and lower employment levels. Monetary policy makers assume negative employment growth throughout 2023 and 2024 with a declining participation rate. Meanwhile, the OBR assumes positive employment growth in the coming years with the participation rate remaining relatively unchanged.

Summing up the difference between the two forecasts. What does it all mean?

The BoE is significantly more pessimistic about the U.K.’s economy to grow in the coming years. Compared to the OBR, the BoE is expecting a worse labor market with lower employment and more idle workers.

In terms of growth, the BoE is also more pessimistic about future business investment and productivity growth. Monetary policy makers think that the U.K. economy will be roughly the same size at the end of 2025 as it is right now, a terrifying outlook, while the OBR thinks the economy will be some 5% larger in real terms.

The U.K. outlook is bad but not as bad as the BoE expects. While Brexit has indeed been a disaster for the economy – recent estimates suggesting that it trimmed about 4% from UK GDP – there is no fundamental reason to believe that U.K. growth should be close to zero over a time frame of several years.

And in fact, such pessimistic growth forecasts could, to some extent, become a self-fulfilling prophecy if policy makers buy into the stagnation narrative. Luckily, this does not seem to be the case right now.

As I recently outlined, missing workers are one of the biggest challenges for the U.K. economy. It is thus good to see that chancellor Jeremy Hunt addressed the issue in the U.K. spring budget and announced a number of measures that will hopefully pull workers back into the labor force.

Tackling high childcare costs and allowing more mothers to get back to work are of crucial importance to boost U.K. labor supply. Another option is to allow for more migration even as this is politically more challenging.

The main reason to worry for the U.K. economy is the drag on business investment resulting from Brexit, which is directly feeding into lower productivity and lower living standards. Only time will tell whether the current slump is temporary or more long-lasting. Let’s hope for the best!