The U.S. labor market is clearly cooling and has been for some time. Does this cooling reflect a successful effort to bring down inflation (aka, a “soft landing”) or does it mean we’re on the verge of more dramatic weakening, perhaps a looming recession? It’s not so clear!

The August jobs report was a tweener: neither so weak to indicate a collapse in hiring and a rise in layoffs is on the horizon, nor steady enough to give comfort that a “soft landing” has been safely accomplished. The Fed has a difficult decision to make later this month – whether to cut interest rates by 25 or 50 basis points – and this jobs report just made that decision even harder.

Payroll job growth rebounds, albeit with downward revisions

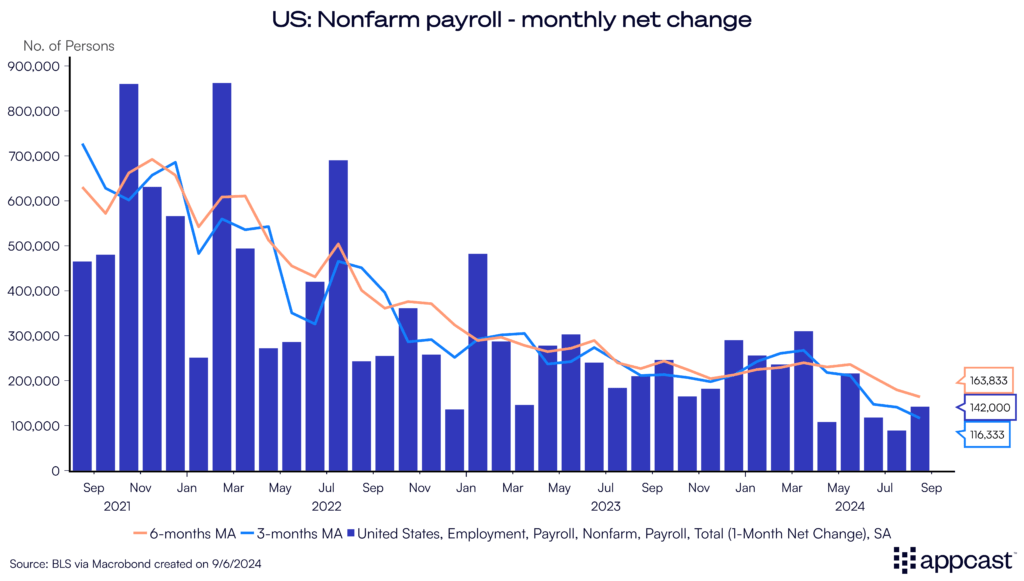

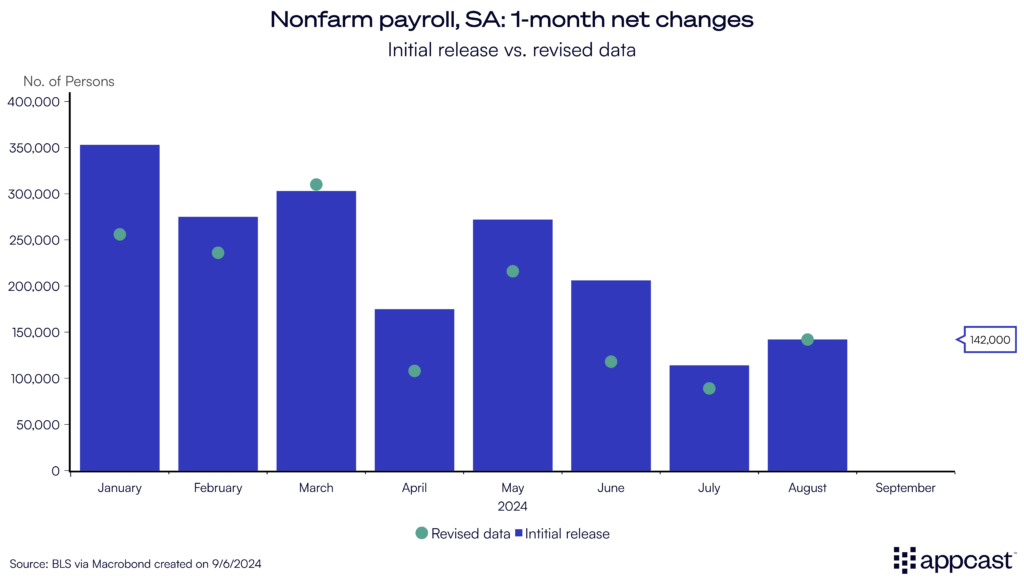

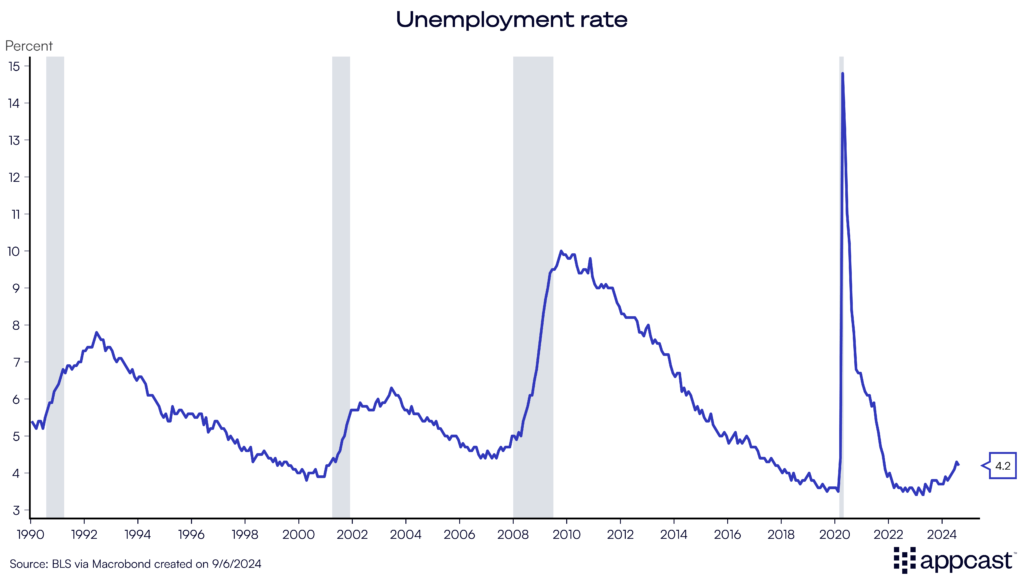

The U.S. economy added a modest 142,000 new jobs in August, with a net negative revision of 86,000 combined for June and July’s data. Although the headline number was below market expectations (+165,000) this jobs report can still be considered a sigh of relief, as it wasn’t nearly as low as July’s (just 89k after revisions) and the unemployment rate declined slightly to 4.2%. The trend in the labor market is now clearer – it seems to be returning to a 2019 level and not a 2010 level.

The downward revisions for June and July are noteworthy and follow primary benchmark revisions that showed over 800,000 fewer jobs were added in the 12 months from April 2023 to March 2024.

Let’s not sugarcoat it: This is the third month in a row that the labor market has underwhelmed expectations, as businesses have rapidly scaled back their willingness to hire. While hiring activity has cooled, we’ve yet to see wide-scale layoffs as the unemployment rate slightly declined after steadily rising the past year. Yes, unemployment has drifted up over the past year, but from nearly 50-year lows.

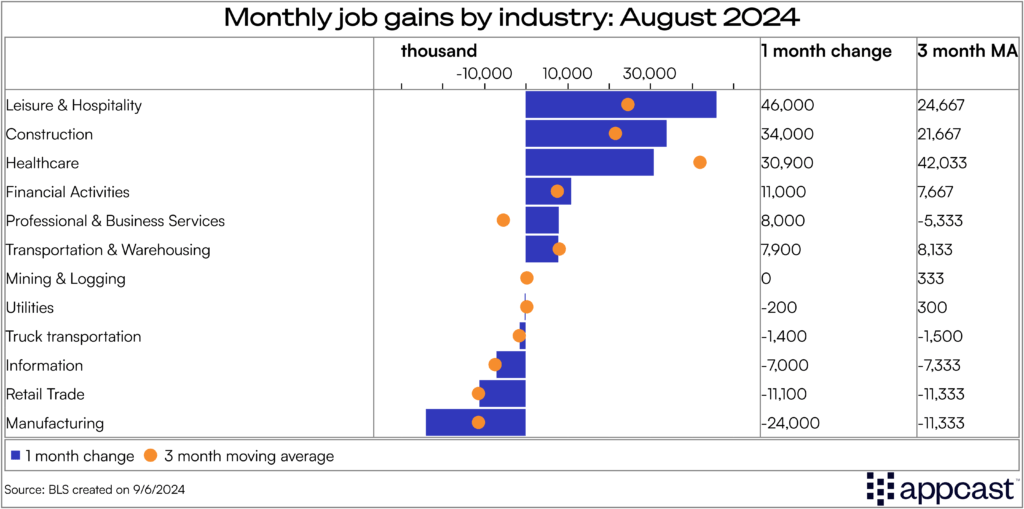

Industry insights: Healthcare downshift, construction resilience, manufacturing falls

The more subdued gains were seen across private industries, even those previously unimpacted by interest rate increases. Healthcare, for example, added just 31,000 net new jobs in August, the lowest monthly gains in the sector since the beginning of 2022. Among industries, construction was a leader, adding 34,000 net new jobs last month – surprisingly strong considering the high interest rates. Manufacturing, however, which has held up in the past two years of elevated pressure, seems to be cracking, shedding 24,000 jobs in August. White collar jobs, or “standing up” industries, were nearly flat last month, with Professional and Business Services adding just 8,000 and information losing 7,000 jobs.

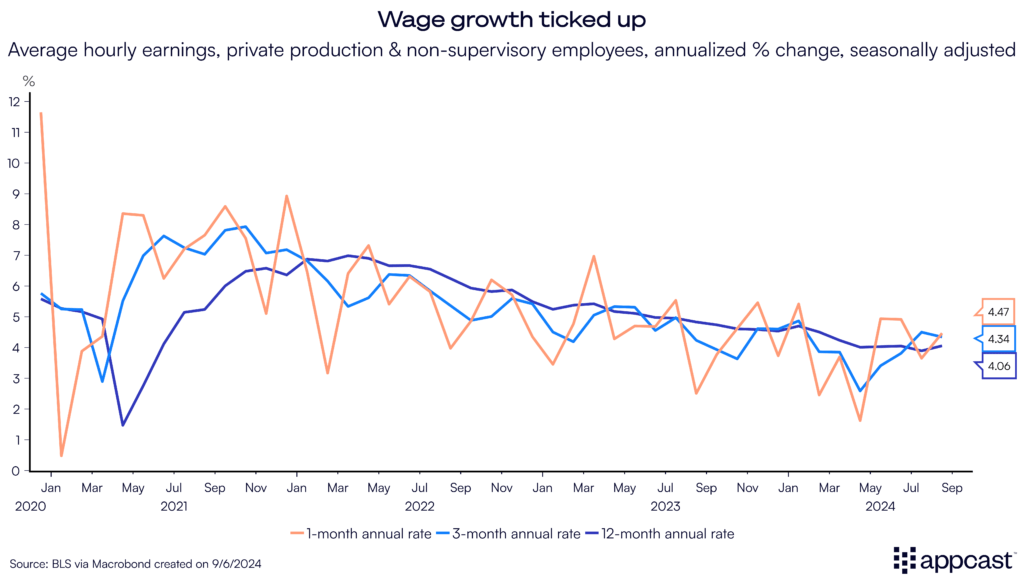

Wage growth firms, but on glide path downward

Average hourly earnings had a slight uptick this month to 4.5% for all frontline workers (non-managers) but the underlying trend is still clear – overall quitting and attrition has declined significantly since 2022 which is putting downward pressure on wage growth

Big picture: What does this mean for recruiters?

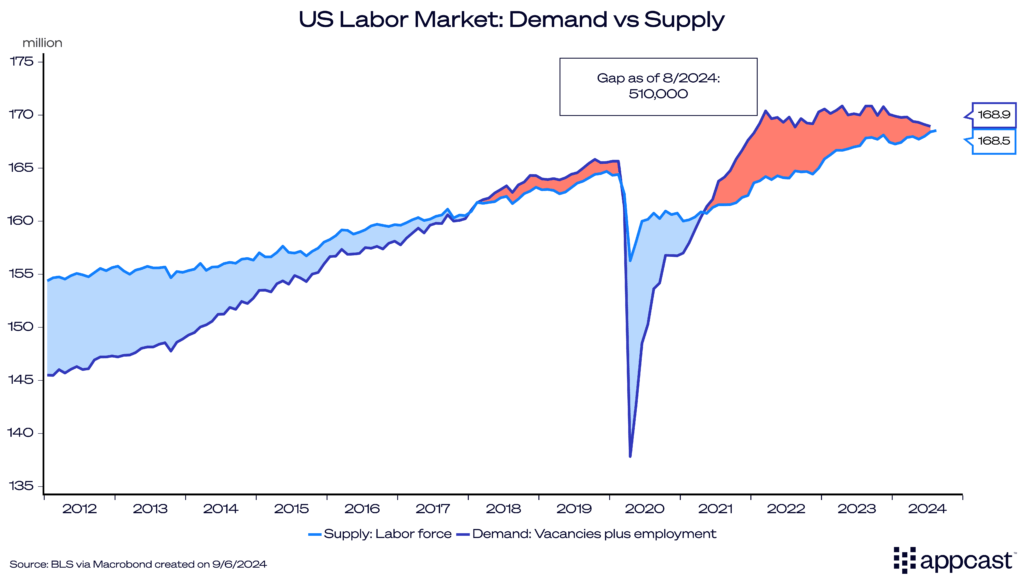

At a high level, the U.S. labor market is nearly at equilibrium – where supply matches demand. History may look back on August 2024 as the month this happened. Demand in the chart below is approximated by employment plus job openings. And it has been gradually declining for some time. Supply, which in this case means the labor force, has been on the rise – thanks to immigration, primarily. The two lines are about to intersect.

Now back to the Fed, which is in a pickle. When the Fed’s interest rate setting group, the Federal Open Market Committee (FOMC), decides to cut rates on September 18 – and makes no mistake, they will cut rates – I suspect there will be dissent within the committee. Why? Because this report was a tweener. If job growth had fallen below 100,000 and/or the unemployment rate continued to rise, it would be easy for the FOMC to justify a larger-than-normal 50 basis point cut in interest rates. On the other hand, if job growth solidly rebounded above expectations, and showed that the weakness in recent months was more an anomaly, then the Fed could more prudently cut by just 25 basis points, taking a “wait and see” approach. This report had neither and therefore leaves the Fed stuck with a difficult decision, perhaps to be helped by next week’s inflation report.