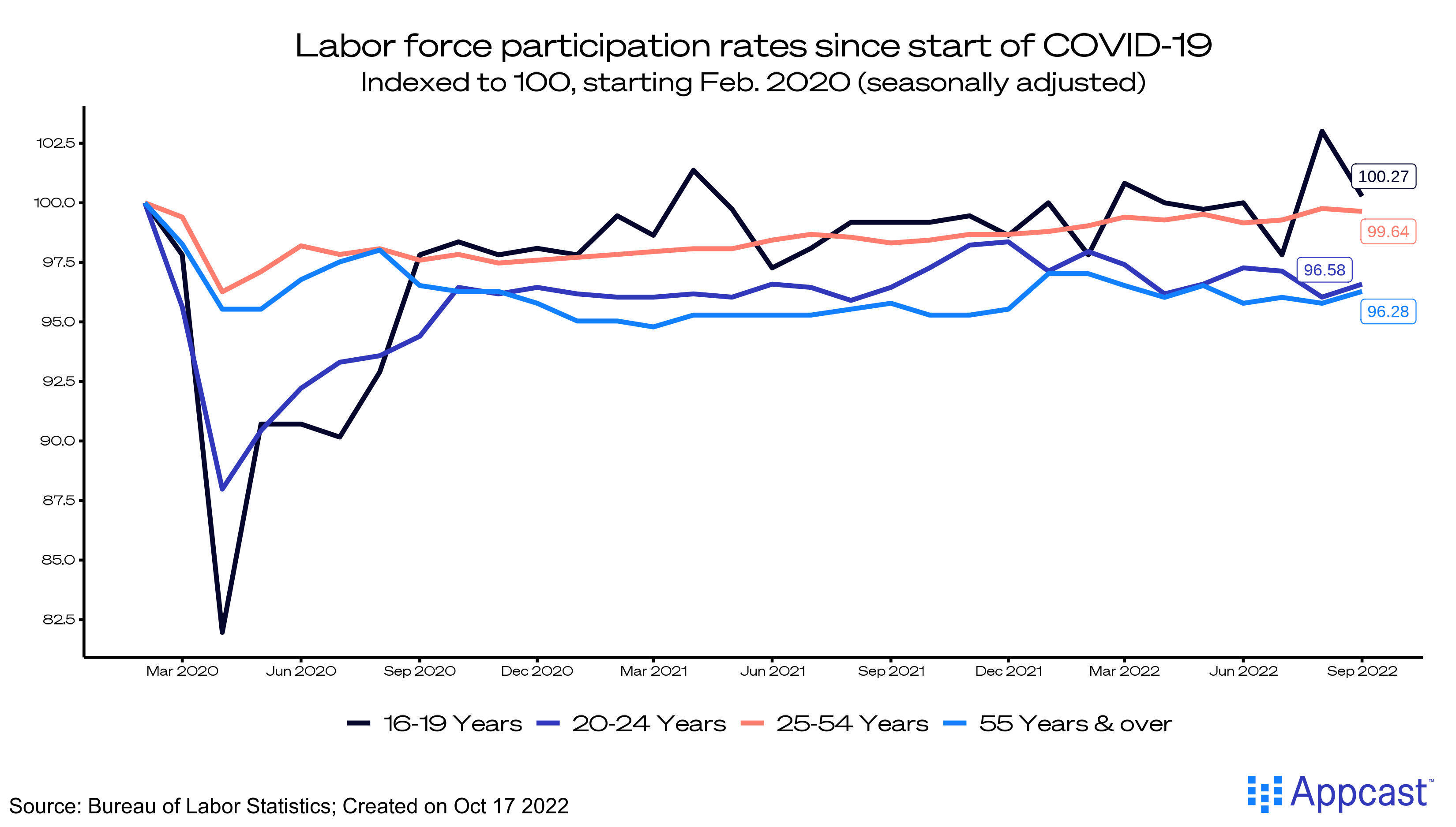

Labor force participation still lags behind its pre-pandemic level, but some age groups are faring far better than others. Breaking down the numbers by age gives a better idea of where workers are lagging – and can perhaps give clues for where recruiters can more easily find candidates.

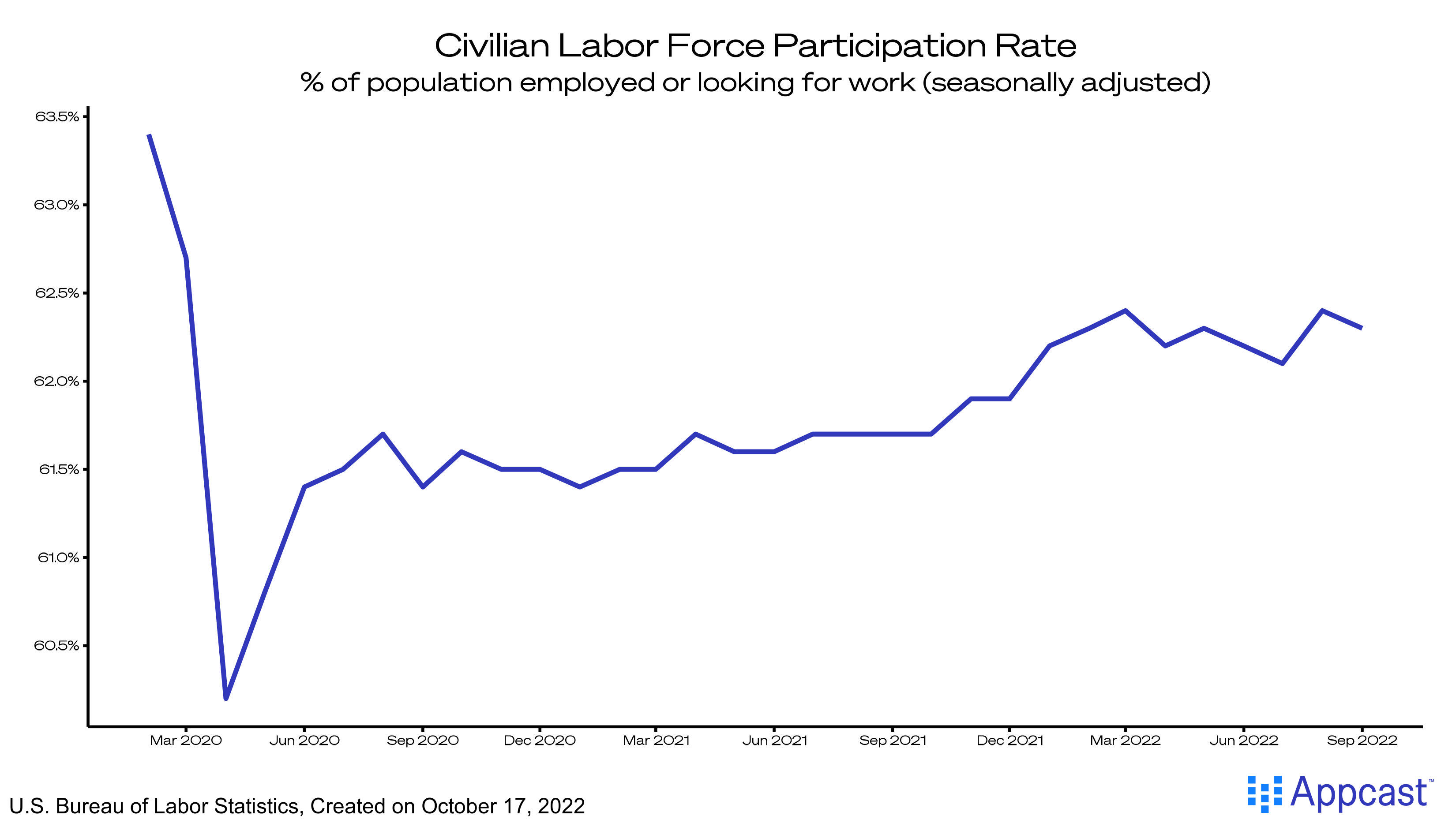

Overall, labor force participation rates are slightly behind February 2020 levels. In September, 62.3% of Americans were in the labor force compared to 63.4% pre-pandemic.

Age Demographics

Across four age groups, labor force participation has rebounded unevenly. The youngest cohort, ages 16-19, had a 36.7% participation rate in September – 0.1 percentage points above the pre-pandemic baseline. This age group mostly consists of students that work part time in low-wage positions. These workers are a valuable resource for leisure and hospitality employers – so a full recovery of teenagers engaged in the labor force is great news for that sector.

The participation gap for workers aged 20-24 is perhaps the most confounding lag in the group. College enrollment has dropped since the pandemic began; in theory, that would drive more of this age group into the labor force. But, participation sat at 70.7% in September compared to 73.2% pre-pandemic.

It’s possible the pre-pandemic baseline used here was elevated above the normal level: the average rate for this age group was 71.2% between the end of the 2008 recession and February 2020. If this is used as the baseline, the difference between today and pre-pandemic levels is 0.5, rather than 2.5.

Participation in the prime-aged population (ages 25-54) is floating near a full recovery. These workers and job seekers make up the majority of the entire civilian labor force, so their return determines the strength of the overall labor market. Two years of labor market tightness cannot be completely blamed on the slow recovery of this age group, but it certainly hasn’t helped.

Finally, fewer adults aged 55 and above are working or seeking jobs than before the pandemic. The pandemic drove a modest amount of older workers towards an earlier retirement – but retirement does not have to be permanent, and high inflation has pushed some retirees back into the labor force.

How Recruiters Can Respond:

This demographic data should demonstrate to recruiters how important it is to distribute job ads widely. Fewer people are participating in the labor market overall – especially those aged 20-24 and 55 and up. Expanding a job ad’s reach is necessary to reach more job seekers during this period of scarcity.