Canada is approaching a pivotal moment. The Conservative Party, led by Pierre Poilievre, has been the popular polling option of late. But the political winds have shifted. Following Prime Minister Justin Trudeau’s decision to step down and the inauguration of President Trump in the U.S., momentum has swung back toward the Liberal Party, now led by former Bank of Canada and Bank of England Governor Mark Carney.

What does this reversal mean for the Canadian economy and for recruiters grappling with an uncertain labor market?

A Liberal victory could mean continuity in fiscal and labor market policy, along with a potential emphasis on international cooperation to ease trade tensions. Meanwhile, the business community may look to Carney’s central banking credentials (he helped guide the economy through the 2008 recession) as a sign of policy stability in uncertain times.

For the recruiting landscape, key questions remain: Will tariffs persist? How will the labor market react?

A Stumbling Labor Market

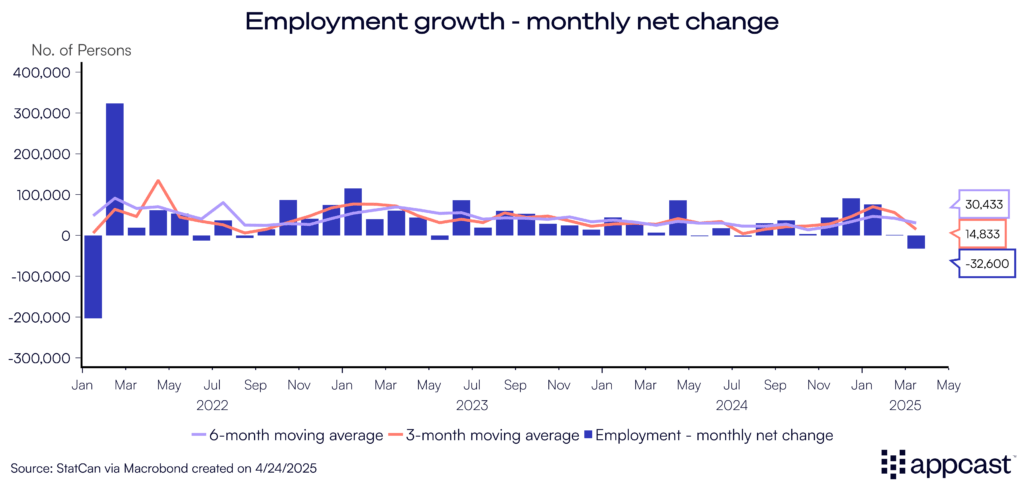

After a strong start to the year, Canada’s labor market is showing signs of strain. Through early 2025, employment growth averaged a healthy 46,000 jobs over a three-month span —well within historical norms. But momentum has sharply reversed. In March, the economy shed 33,000 jobs, bringing the monthly average down to under 15,000. This marks the first net job loss since January 2022.

The decline was led by wholesale and retail trade, two sectors especially sensitive to weakening consumer sentiment and fewer exports. With tariffs climbing, employers in these industries may be scaling back hiring plans in response to tighter margins.

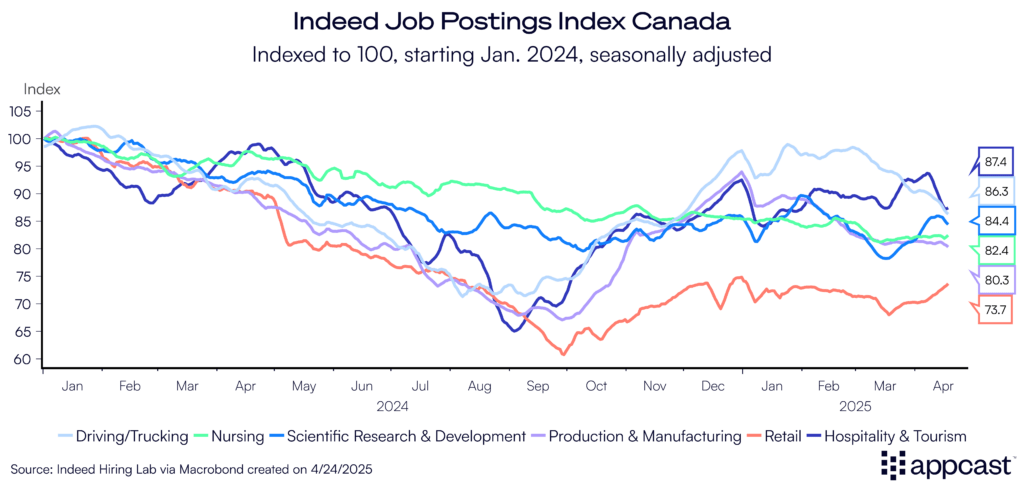

The slowdown isn’t limited to retail and wholesale trade, though, it’s broad-based. According to Indeed’s Job Posting Index, demand has weakened across a wide range of occupations. Postings for nurses have dropped 16% since the start of 2024, signaling softening demand even in traditionally resilient sectors like healthcare. Manufacturing job ads are down 19%, tourism roles have declined 9%, and trucking is off by 10%. There are two potential, non-mutually exclusive factors at play: employers may have temporarily paused their hiring plans to see how the election and trade war turns out. Plus, dampened consumer and business demand may be impacting hiring.

This widespread cooling suggests employers across industries are tapping the brakes, possibly in response to cost pressures and declining consumer demand. Notably, much of the deceleration in hiring occurred before the most recent tariff announcements, suggesting further headwinds may lie ahead.

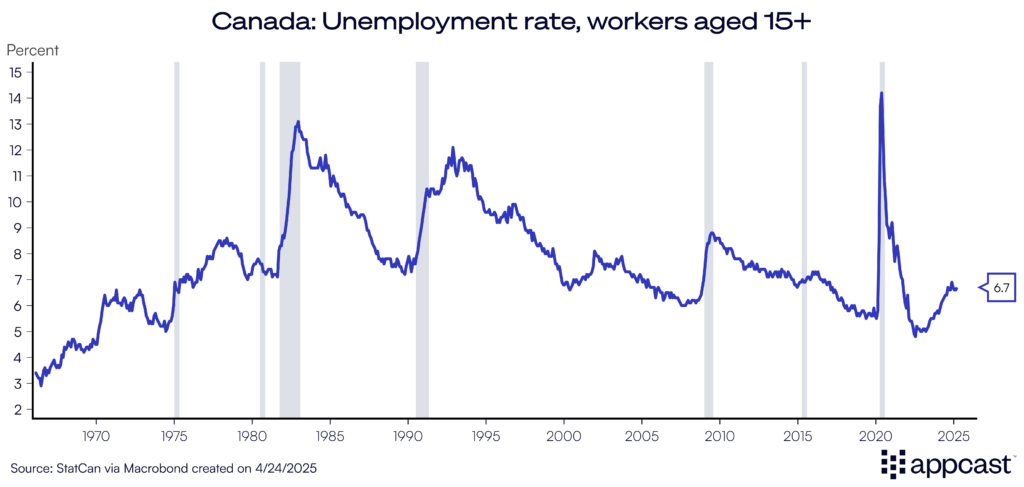

Cooling hiring demand has put upward pressure on the unemployment rate. The standard unemployment rate for workers aged 15+ is at its highest in more than 10 years, a major warning sign about the underlying health of the labor market.

This impact is not felt evenly across all workers. For core-aged workers (25 to 54) their unemployment rate has risen modestly to 5.7%. For the youngest workers (15 to 24) their unemployment rate has spiked to nearly 14% as employers have shifted their hiring towards more established workers.

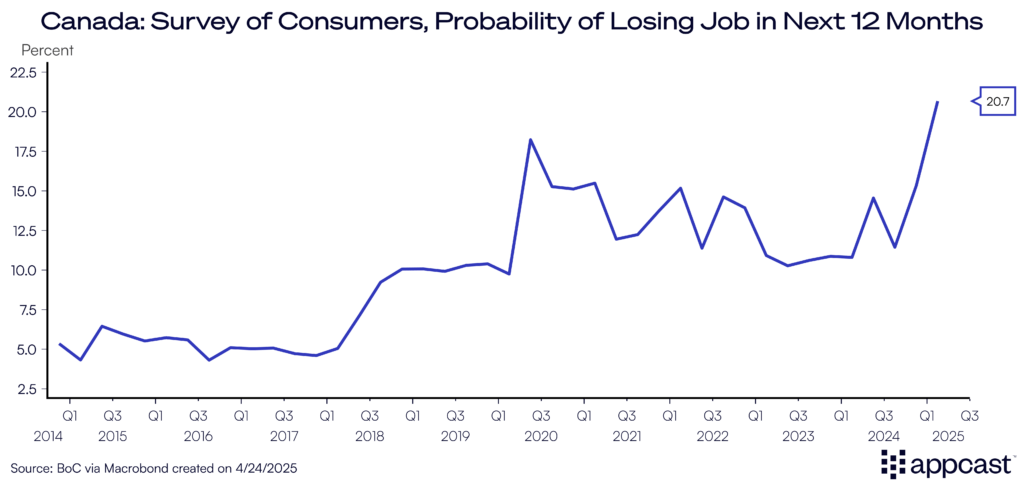

Perhaps the most concerning signal yet: a recent survey of Canadian workers found that one in five expect to lose their job within the next 12 months. The anxiety is even more acute in trade-exposed industries. Among workers in sectors tied to international trade, 60% reported concerns about job security, nearly double the 34% seen in less exposed industries.

Rising uncertainty, compounded by tariff-related disruption, is not only cooling employer demand but also weighing heavily on household sentiment, a combination that could further dampen labor market momentum in the months ahead as workers are more reluctant to look for new jobs.

Looking Ahead: A Crossroads for Canada’s Labor Market

Taking stock of it all—slowing hiring demand, rising unemployment, and weakening consumer confidence—it’s clear that Canada’s labor market has entered a pre-recessionary territory. The outlook hinges on one critical unknown: are the U.S. tariffs on Canadian imports a temporary bargaining chip or a lasting shift in trade policy?

If they’re here to stay, the drag on employment in trade-exposed sectors could persist and potentially spill into broader segments of the economy. But if they prove transitory, there’s still room for stabilization and recovery. For now, uncertainty reigns and both workers and employers are responding with caution.

Tariffs: A Passing Storm or Permanent Change?

The Governor of the Bank of Canada put it bluntly: “This is an unprecedented shock in more than 100 years.” The shift in trade policy, marked by rising tariffs from the United States on Canadian exports, represents a sharp break from decades of stable trade between the countries. He warned that the economy could slip into recession, facing the rare dual challenge of higher inflation alongside rising unemployment.

Although the policy shock originates outside Canada, lawmakers have taken steps to soften the impact. Recent measures include financial support for businesses most affected by the trade environment, aiming to preserve jobs and maintain investment during this tumultuous period.

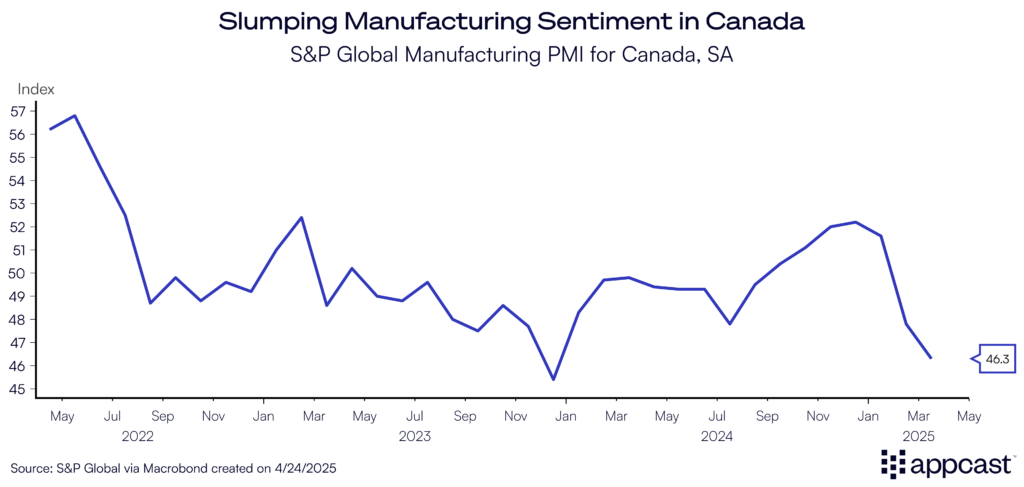

Just as Canadian households are reacting to rising uncertainty, businesses are responding too. The S&P Global Manufacturing PMI, which tracks sales and new orders, recorded a sharp decline in both February and March. This drop signals that manufacturers are already feeling the effects of weakened demand and growing trade friction.

Energy exporters stand at the front line of trade barriers. In 2024, Canada shipped nearly $172 billion in energy products to the United States, making it the country’s largest export category. Any disruption to that flow, whether through tariffs or regulatory barriers, would have outsized consequences for both GDP and employment in the sector, plus ripple effects on other areas of employment.

Motor vehicles and auto parts rank close behind. Canadian automakers and suppliers exported almost $79 billion worth of cars, auto parts, and tires last year. These goods now face a 25% tariff at the U.S. border, posing a direct threat to one of the country’s most important manufacturing supply chains. With both sectors deeply tied to U.S. demand, the stakes for Canada’s trade-dependent industries have rarely been higher.

Canada’s outlook: Bleak

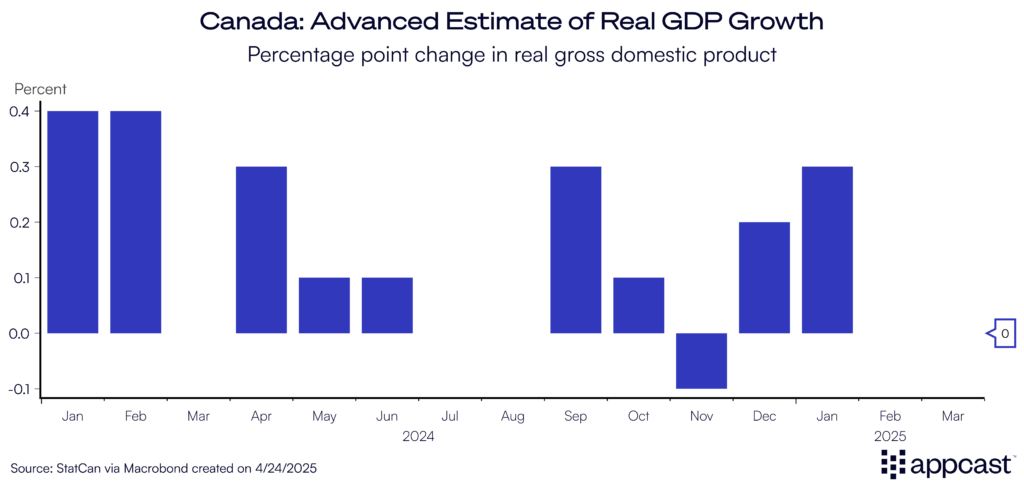

Canada’s economic momentum is fading fast. Advanced estimates show real GDP growth was flat in February, with no inflation-adjusted growth. December and January offered modest gains, each around 0.25 percentage points, but that early strength appears to have dissipated.

With labor market conditions deteriorating and trade barriers tightening, the outlook has weakened. What was once a soft patch now looks increasingly like the early signs of contraction.

There is still room for optimism. A bilateral trade agreement could ease restrictions and restore confidence, offering much-needed breathing room for businesses and consumers alike. For households already feeling financial strain, even a modest de-escalation in trade tensions would be a welcome relief.

But it’s important to remember: the labor market was softening well before tariffs entered the picture. Structural weaknesses such as slowing hiring, rising unemployment, and cooling business sentiment were already taking hold.

Whoever forms Canada’s next government after the April 28th election will inherit more than a trade dispute. They’ll face a fragile labor market, subdued growth, and a population growing increasingly anxious about what comes next.

What does this mean for Canadian recruiters?

The months ahead carry real uncertainty for Canadian recruiters. If the trade war continues throughout the year, the risk of a recession increases. This could lead to fewer job openings, a higher unemployment rate, and more cautious hiring, especially in sectors tied to international trade.

There is still a path forward. A negotiated trade agreement could ease tensions and restore cross-border activity. In that scenario, hiring could bounce back, particularly in industries like manufacturing, transportation, and energy. Trade within Canada’s provinces has room for improvements as well: policy makers are looking to reduce trade barriers within provinces to offset potential losses from cross-border trade.

For now, recruiters should prepare for short-term volatility. With the federal election approaching, many employers may delay hiring decisions until there is more clarity on trade policy. The party’s platforms have recently been released, which describe in detail each policy position. On the matter of cost of living, both the Conservative and Liberal parties promise some form of tax cuts. On trade, both also agree to initiate retaliatory tariffs on the U.S. and temporary relief funds for those sectors affected the most.

The direction of Canada’s labor market in the second half of the year will depend heavily on what unfolds at the ballot box and at the negotiating table.