As the dust of election uncertainty settles, a new wave of uncertainty arises: policy change. In this article, we examine three core policy shifts promised during Donald Trump’s campaign that are likely to impact recruiting in 2025: immigration, tariffs, and taxes. This week, I explored the current state of the labor market and the potential policy implications in a webinar, offering insights into how these changes may shape recruiting in the coming years.

Deportations: tighter labor market, higher costs

Before the election results, both parties acknowledged the need for immigration reform, but their visions for change could not be more different. Under the new administration, President Trump has proposed executing the “largest deportation” in U.S. history.

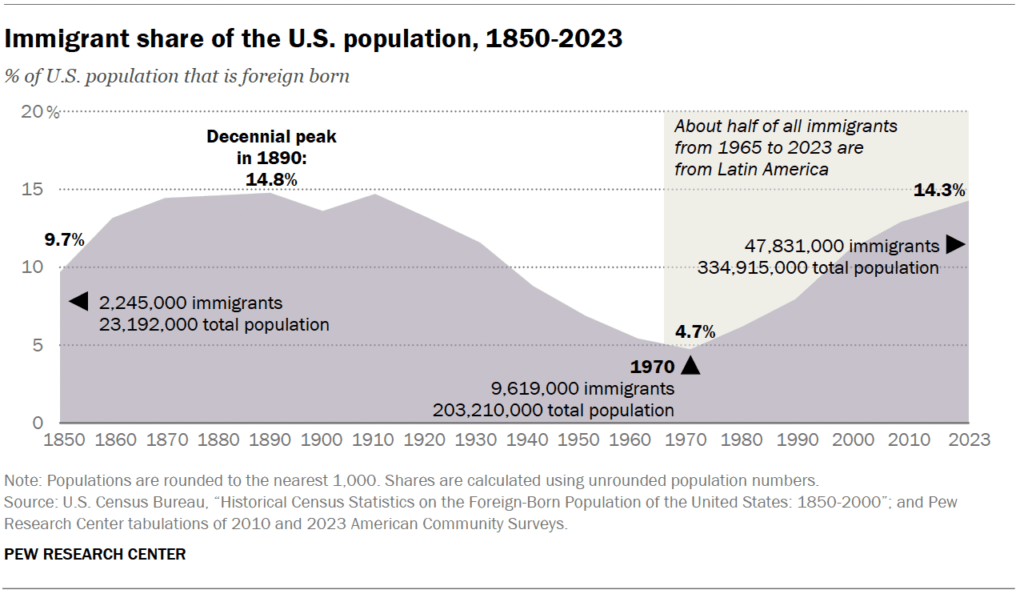

Currently, an estimated 47.8 million immigrants reside in the United States, the highest share of the population since the 1890s. Among them, 23%—around 11 million (which includes the nonworking age population)—are considered unauthorized. This policy direction could have profound implications for the labor market and the supply of talent across industries.

Over the past five years, the growth of the foreign-born labor force has been crucial in driving the post-pandemic recovery of the U.S. labor market. Industries such as agriculture, manufacturing, and construction have leaned heavily on immigrant labor to sustain production amid acute worker shortages. However, a new wave of deportations under the future administration could reignite labor scarcity, potentially fueling another surge in inflation and further straining key sectors of the economy.

Don’t just take our word for it, the Peterson Institute for International Economics released a working paper estimating the impact of deportations on the economy.

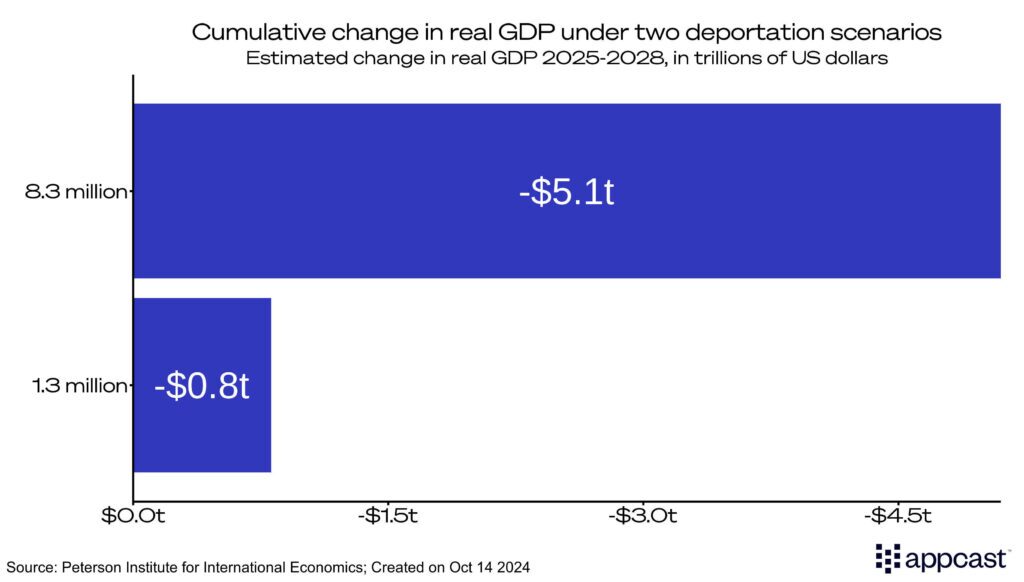

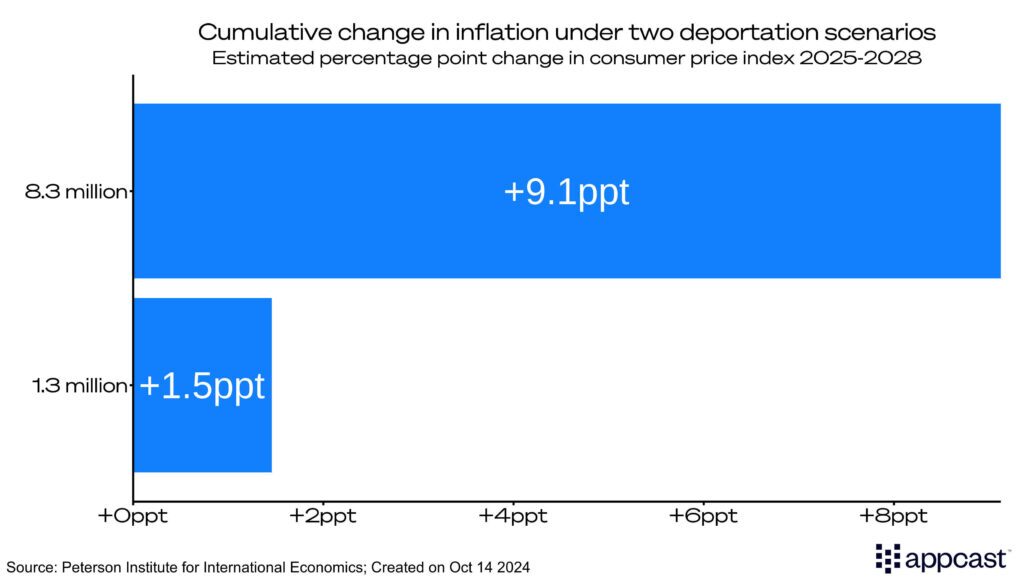

They model two scenarios: deportations of 1.3 million (using a historical example from the Eisenhower administration) and 8.3 million (the estimated number of unauthorized workers in 2028).

Under the first scenario, inflation would rise a modest 1.5 percentage points (relative to the baseline) over the period of three years. Likewise, they estimate the impact on GDP (Gross Domestic Product) as contractionary, reducing output by just under a trillion dollars over the same period.

In the second scenario, prices would skyrocket more than 9 percentage points. Not only would this drive up costs across the board, but it would also result in a $5 trillion hit to GDP in just three years.

Why? The primary driver is supply constraints. As businesses face challenges in filling open vacancies, their ability to produce goods and services diminishes. Reduced production, coupled with sustained demand, creates upward pressure on prices, leading to inflation. Labor shortages, particularly in industries heavily reliant on immigrant workers, exacerbate these constraints, straining the economy further.

Some policy experts have argued that despite the rhetoric on the campaign trail, the cost and logistics of wide scale deportations are too large and complex to be materialized. Deporting 11 million unauthorized immigrants is estimated to cost $150 billion, at $14,000 per person. Even accounting for the costs, the logistics to carry out this directive would require foreign countries to accept the deportees, making the feasibility even more complex.

How does the proposed immigration strategy impact recruiting?

Regardless of whether your company employs unauthorized immigrants, chances are your competitors do. This creates a cascading effect across the economy. Think of the labor market as a game of musical chairs, where each worker represents a player trying to fill an open job (the chairs). Removing a significant number of workers from the game leaves some chairs unfilled, increasing competition for the remaining players. These unfilled chairs heighten recruitment challenges, making it harder for businesses to secure the talent they need.

Tariffs: Slows economic growth and less demand for workers

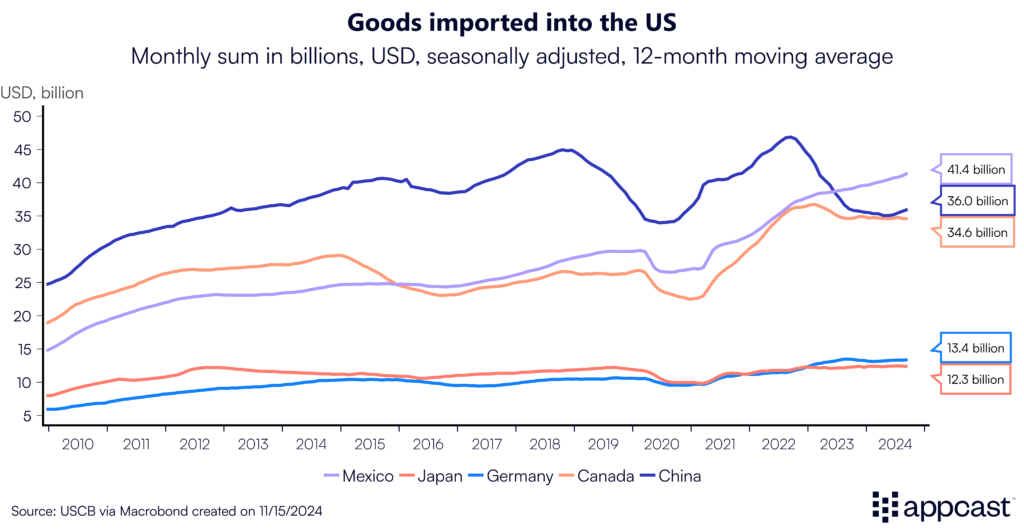

The second policy proposal under the Trump administration are universal tariffs of imported goods from all foreign nations—with a proposed tariff of up to 60% on goods brought in from China. Mexico, which has recently surpassed China as our number one trading partner due to the trend of “nearshoring” – building manufacturing plants closer to our border, is also expected to be hit with a fresh wave of trade restrictions.

Tariffs, to explain simply, are a tax imposed on imported goods. This tax is collected by the government as revenue, typically done so to promote domestic production and consumption of goods and services. Tariffs as a source of government revenue has declined significantly over time, now at just 2%.

During Trump’s first term, a wave of tariffs was imposed on goods like steel, aluminum, solar panels, and washing machines, sparking a trade war with China. This protectionist approach to trade has found surprising bipartisan support, as the Biden administration extended many of these tariffs, generating $145 billion in revenue during his term. The proposed resurgence of tariffs indicates a continued shift toward safeguarding domestic industries, but it also raises questions about the long-term effects on costs, trade relationships, and the labor market.

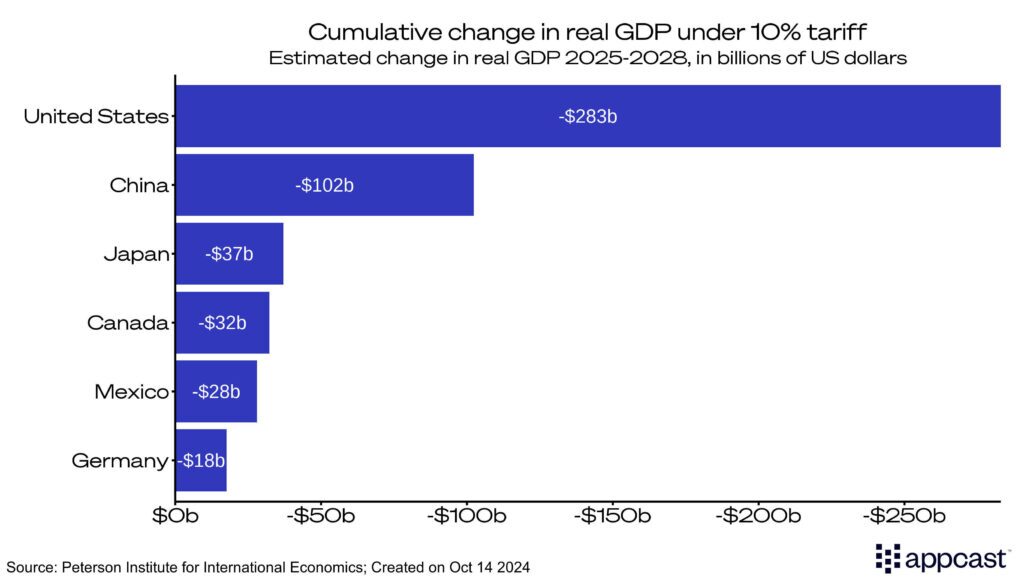

What are those longer-term costs? The Peterson Institute did not just estimate the impact deportations would have on the economy; It reviewed the impact of tariffs as well. In their model, that assumed a universal 10% tax on all imported goods would reduce U.S. GDP by $283 billion by 2028.

The most immediate and pronounced consequence of these tariffs would be a contraction in economic growth, both domestically and globally. For the U.S., reduced trade volumes and higher prices on imported goods would hinder consumer spending and business investment. For trading partners, diminished access to the U.S. market could lead to slower growth and weakened global trade relationships, compounding the economic fallout.

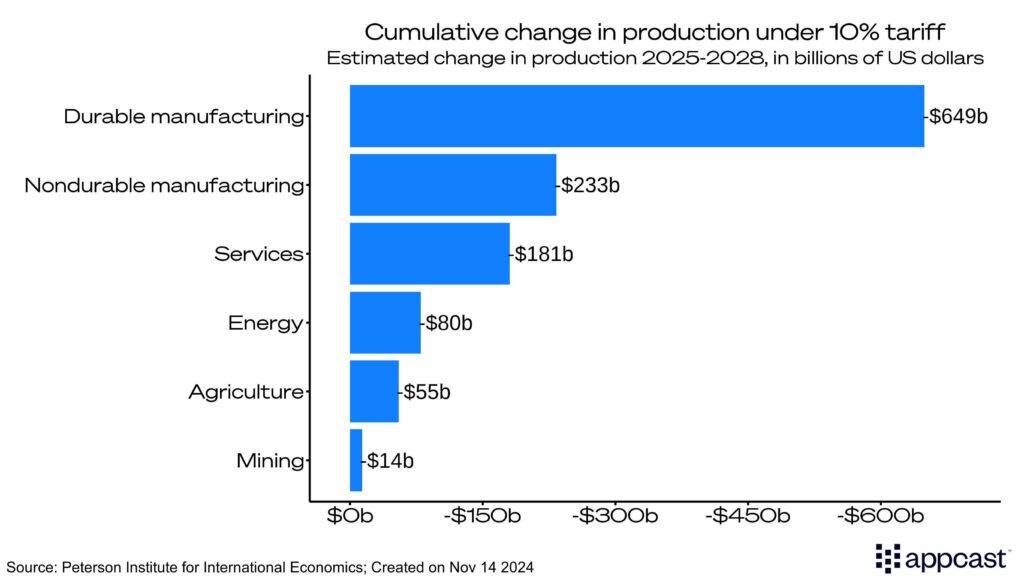

The effects of universal tariffs would not be evenly distributed across the economy, with the manufacturing sector expected to bear the brunt of the impact. Durable goods manufacturing—industries producing items like cars and washing machines—is projected to lose nearly $650 billion in production. Similarly, nondurable goods manufacturing, producing products like clothing and food, could shrink by $233 billion.

This comes at a challenging time for the manufacturing sector, which has struggled with sluggish growth in recent years. While declining interest rates could create potential for upside growth, the introduction of a trade shock of this magnitude would stifle those opportunities, further exacerbating the sector’s vulnerabilities and dampening prospects for recovery.

How do tariffs impact recruiting?

Since tariffs function as an effective tax on imported goods, they drive up costs and slow economic growth. For recruiters in sectors sensitive to these price increases, this could translate to reduced hiring demand as businesses pass higher costs on to consumers, potentially curbing overall demand. Additionally, recruiters may face increased turnover in the roles they manage, as workers, grappling with higher costs at grocery stores and retail outlets, seek out jobs offering better wages to offset the rising cost of living. This creates a challenging environment for both attracting and retaining talent.

Tax cuts: more economic growth, but higher debt

The new administration’s top priority is to extend the expiring 2017 Tax Cuts and Jobs Act (TCJA), a landmark overhaul of the tax code. The changes impact both businesses and consumers. For individuals, an extension would make the increased standard deduction permanent, while for businesses, it would maintain 100% bonus depreciation—allowing immediate deduction of short-term investments—and continue the full deductibility of research and development expenses from taxable income. Furthermore, it reduced the corporate tax rate from 35% to 21%, which some experts have found can increase new business formations, potentially spurring economic growth and increasing wages in local labor markets.

While the campaign trail was filled with ambitious tax proposals, such as eliminating taxes on tips, making overtime tax exempt, and removing income taxes altogether, the most likely outcome is a full extension of the TCJA.

What is the main impact of this extension? The Tax Foundation did the math and produced some topline takeaways under Trump’s tax proposal: it would increase GDP by 0.8%, capital stock (value of assets and equipment used by businesses) by 1.7%, wages by 0.8%, and net employment by 597,000 jobs over the next decade. So overall, it is expected to boost growth in the short term. However, these benefits come at a significant cost as they are projected to add more than three trillion dollars to the deficit over the next decade.

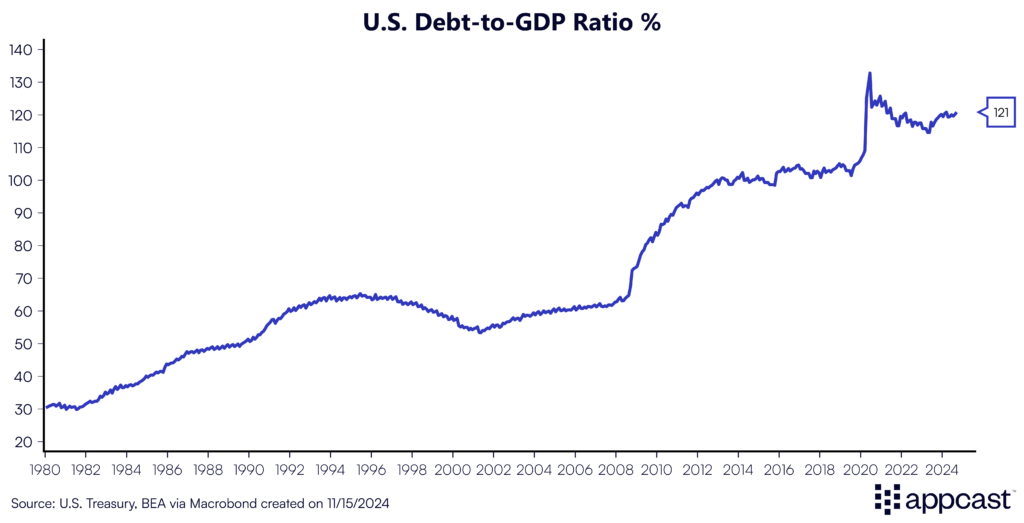

The increase in the long-term debt is what concerns tax experts the most: the gradual rise in the debt-to-GDP ratio is unsustainable and is forecasted to rise to 200% by the late 2040s. This comes at a time when debt-to-GDP is already at a near-record high at 121%. The market reaction was swift: bond yields surged the day after Trump’s election, signaling investor expectations of higher inflation and increased risk in lending to the government.

Investors and businesses value stability in the fiscal management of their governments and on the current path this could weaken long-term economic growth and employment outcomes.

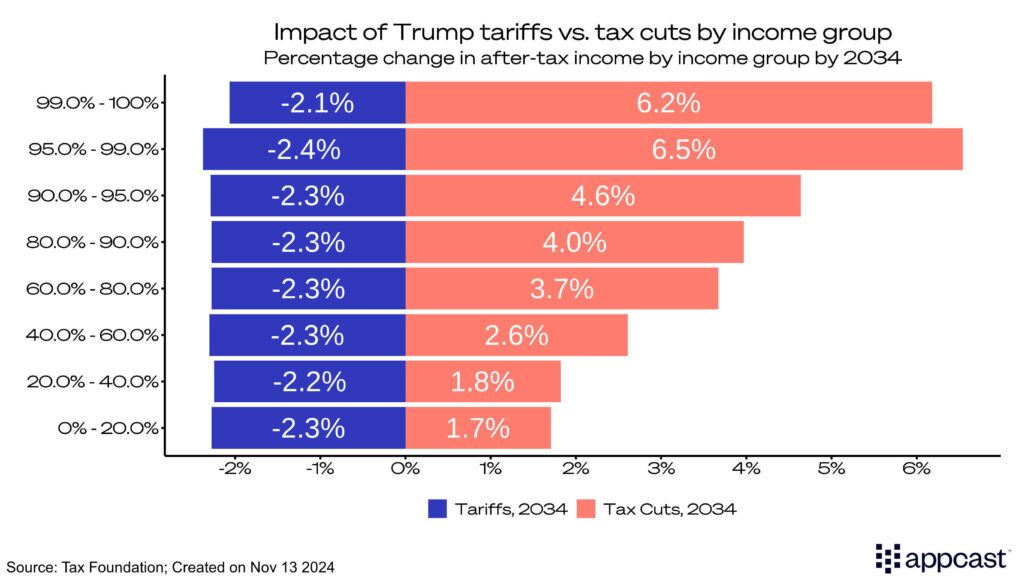

The effects of both tariffs and tax policy will ripple unevenly across the economy. For the highest earners (those in the 90th percentile and above) after-tax incomes are projected to rise significantly under the proposed tax policies. In contrast, the lowest earners, below the 40th percentile, could see their after-tax incomes decline. While lower taxes might offer some relief, the increased cost of goods driven by tariffs would more than offset those savings, disproportionately impacting lower-income households.

Some economists argue that tariffs under the new administration will serve as a negotiating tool rather than being fully implemented, given the political challenges they pose. If this holds true and the impact of tariffs is removed from the equation, the outlook for workers becomes more optimistic.

How does the proposed tax policy impact recruiting?

These impacts are particularly pronounced for those recruiting hourly workers. Those workers would require higher wages to offset income losses from rising costs due to tariffs. The labor market for “standing-up” workers—those in physically demanding, on-site roles—remains tighter than for “sitting-down” workers in office-based or remote roles. These policy shifts could exacerbate challenges in these sectors, potentially triggering another wave of attrition reminiscent of the Great Resignation in 2021.

Conclusion

The uncertainty of the presidential election is behind us, but now we turn to understanding the future of policy under the new administration. In 2025, three key policy shifts will shape the recruiting landscape: immigration, trade, and tax policy.

Immigration policy will shift towards deportations, reducing the talent supply and driving up inflation as labor shortages intensify. Trade policy will expand tariffs on all imported goods, increasing costs for businesses and consumers, ultimately contracting economic growth. Finally, tax policy will focus on extending the current tax code, leading to modest gains in employment and wage growth over the next decade, but adding significantly to the national debt.