Immigration and border policy have emerged as the forefront issues in the upcoming election, with surprising bipartisan agreement: 96% of Trump and 80% of Harris voters support increased border security. Despite this broad consensus on the need for change, Trump and Harris present sharply different visions for how to achieve it.

Under a Harris administration border policy is expected to follow a similar approach to Biden’s current agenda. That agenda has changed over the past year. A bipartisan immigration bill failed in the Senate, prompting the Biden administration to issue a restrictive executive order this year. At the Democratic National Convention, Harris summarized her thoughts on the matter by saying “We can create an earned pathway to citizenship and secure our border.”

Trump’s proposed approach represents a significant departure from current policies. At the Conservative Political Action Conference (CPAC) in March 2023, he suggested large-scale deportations, invoking the Alien Enemies Act of 1798 as a legal mechanism. The scale of this proposed effort hasn’t been seen since the 1950s, when the Eisenhower administration conducted raids across the Southwest, resulting in the deportation of hundreds of thousands of individuals.

This article does not seek to compare the candidates’ proposals in detail. Instead, it aims to use data to project how reduced immigration and large-scale deportation efforts could affect the economy and recruiting landscape in 2025.

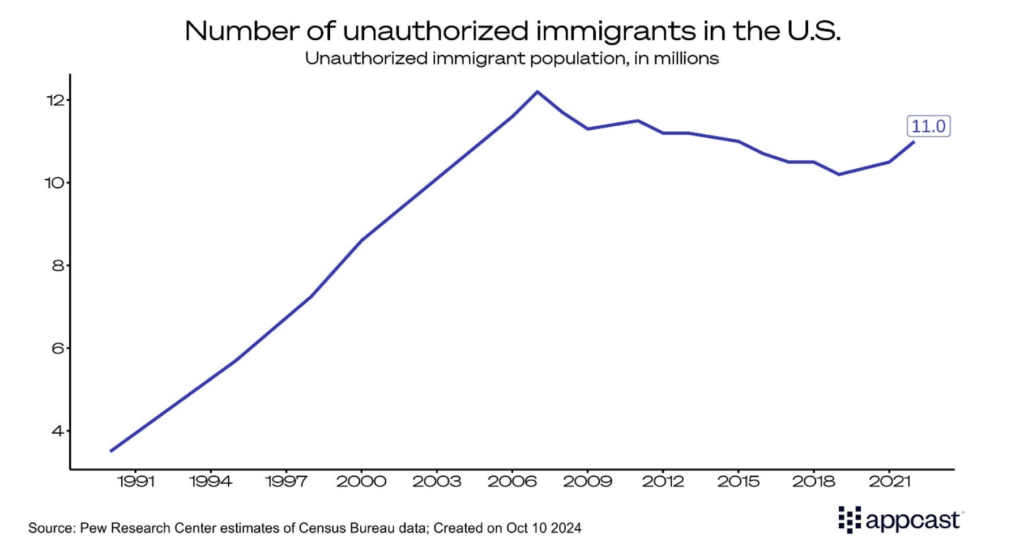

Trend in unauthorized immigration

Despite recent attention on a surge in unauthorized immigration, the total number of unauthorized immigrants is estimated to be 1.2 million below its peak in the late 2000s, though cumulative immigration levels, both legal and nonlegal, are high. While Mexico has historically been the primary source of unauthorized immigration, recent trends show a shift, with growing numbers of people coming from the Caribbean, South America, and Asia.

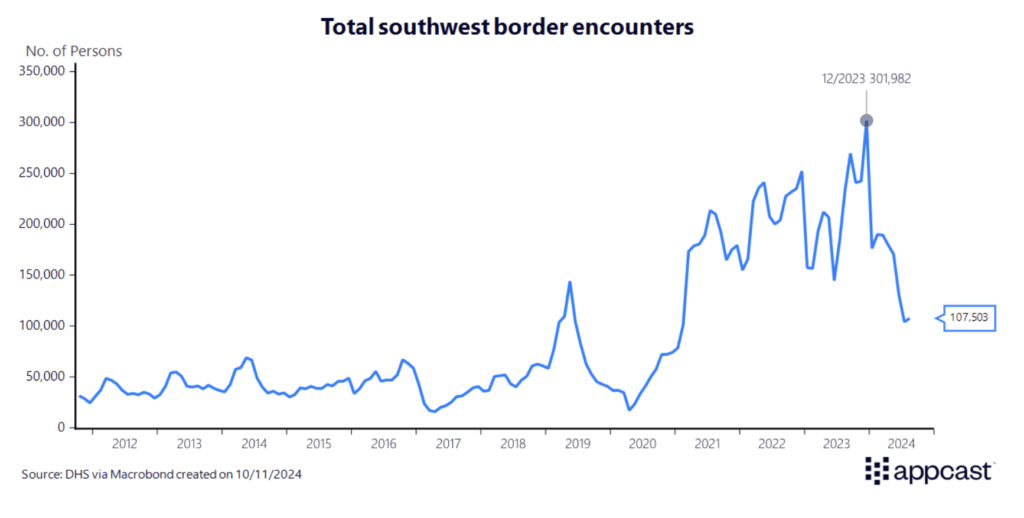

Border encounters reached an all-time high in December of 2023 at nearly 300,000 according to the Department of Homeland Security. This surge in crossings has fueled much of the recent political debate and will ultimately have a large impact on the direction of policy for the rest of the decade.

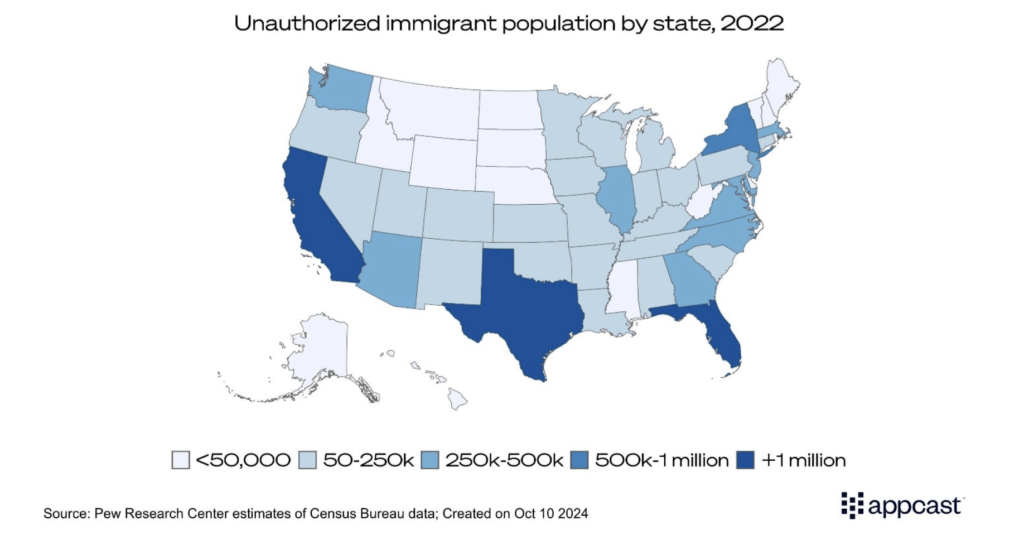

A small number of states have received the largest share of these immigrants, with Florida, Texas, and California alone accounting for more than a third of the total undocumented population. These states, all of which rank among the top four in terms of Gross Domestic Product (GDP), have long relied on both authorized and unauthorized immigrant labor to support key industries such as agriculture, manufacturing, construction and healthcare.

A sudden reduction in this workforce could have significant consequences for their local economies, potentially disrupting the recruiting funnel and causing labor shortages.

Impact on the macroeconomy

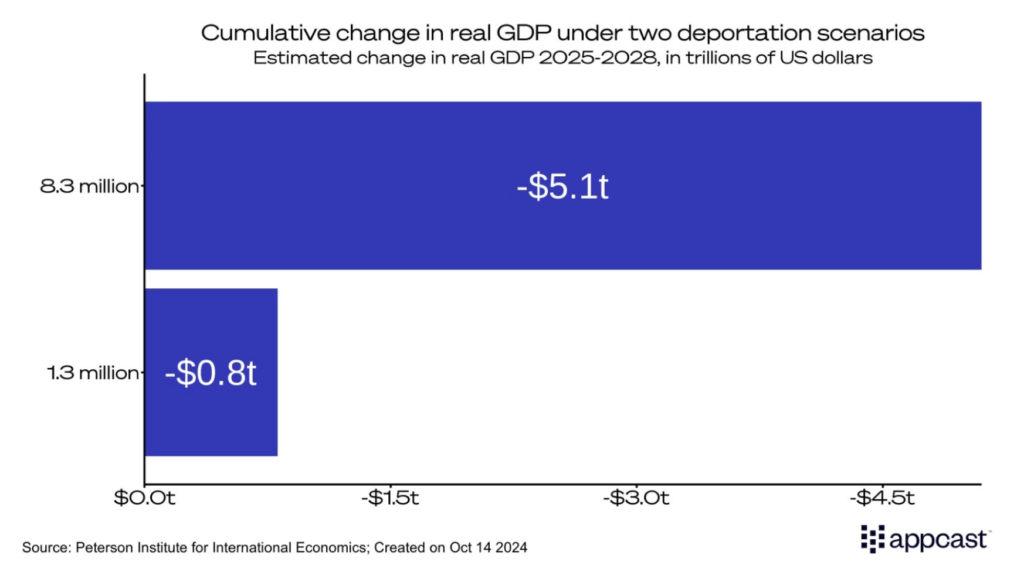

How do economists assess the impact of a policy? They use statistical models to predict outcomes under scenarios, and that’s what the Peterson Institute for International Economics did in a new research paper.

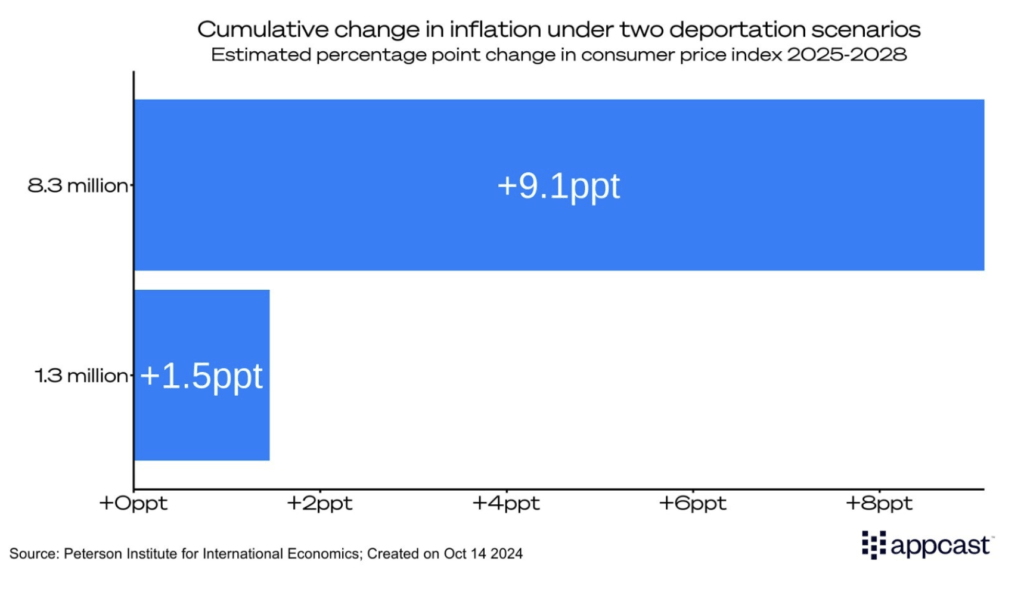

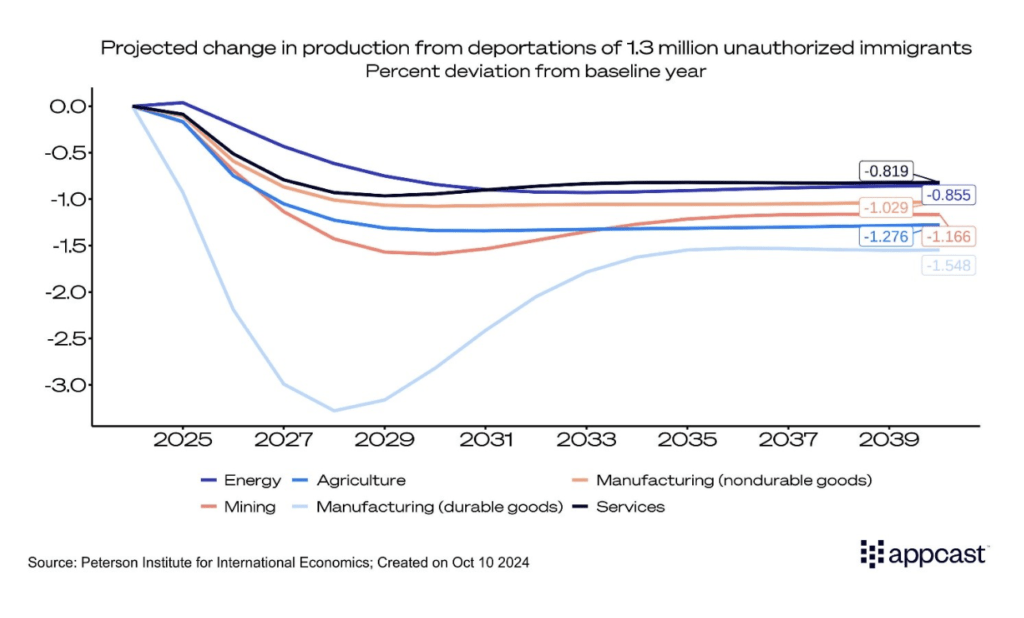

The first scenario uses a low-end baseline of 1.3 million deportations like the Eisenhower administration in the 50s. The second scenario is much more aggressive at 8.3 million—which is the total estimated number of unauthorized immigrants working in the US.

The economic impact in both scenarios is significant. The first model estimates that if 1.3 million workers were removed, the U.S. GDP would shrink by over $800 billion by 2028. In the more extreme scenario, the deportation of 8.3 million workers would lead to a staggering $5 trillion loss in wealth—equivalent to nearly 15% of the total federal debt.

Not only are immigrants’ part of the labor force, but they’re part of the consumer base as well. Removing their dollars from the economy means less money spent on groceries, housing, restaurants, and leisure, stripping demand from those sectors.

Deportations would not only represent a major loss for economic growth but would also drive inflation higher. Under the low-end scenario, the consumer price index (CPI) is projected to increase by 1.5 percentage points (ppt). In the more extreme scenario, inflation could surge by over 9.1ppt. These price hikes would be driven by supply constraints—specifically a shortage of labor—as employers struggle to fill vacancies, which in turn would hurt productivity.

These price shocks wouldn’t affect all sectors equally: agricultural goods would likely see the biggest price increases. This could, in turn, drive up grocery prices, adding further strain on consumers who have already faced rising food costs over the past four years.

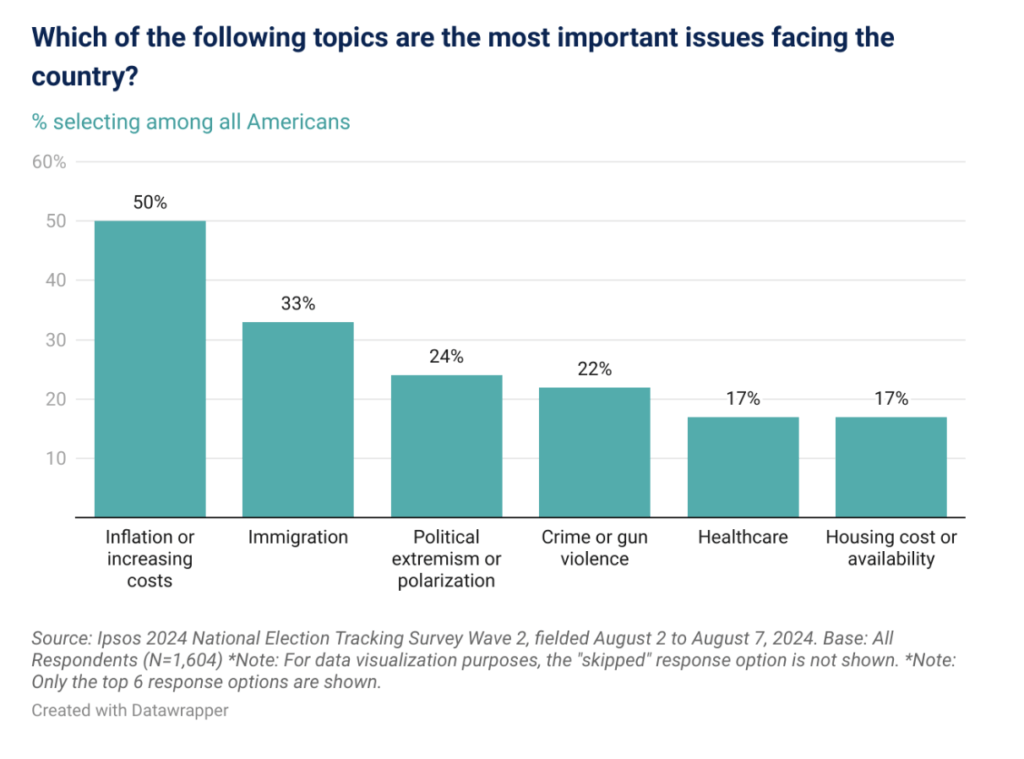

American voters are still grappling with the impacts of pandemic-era inflation, and another bout would surely sour their mood even more. In fact, immigration is not the top issue for this election – it’s the economy. An Ipsos poll from August this year found that 50% of respondents ranked “inflation or increasing costs” as their top priority for the 2024 election.

Impact on labor market

While the economic impact of deportations is significant, certain industries would feel the effects more acutely. In durable goods manufacturing, total production is expected to shrink by nearly $600 billion in the first scenario. Under the more extreme scenario, the loss could reach an astonishing $3.75 trillion.

Manufacturing employment has already been under pressure from global competition and rising interest rates, and removing a significant portion of the workforce would further hinder productivity and growth.

Not only will production-focused industries be impacted, but the entire service sector will also face a severe contraction. Under the most severe scenario, total production will fall by $3.8 trillion in just three years.

The hospitality sector has already dealt with serious attrition the past four years and is still dealing with the hangover effect of the so-called “Great Resignation.” Another fresh wave of worker turnover would disrupt the industry for years to come.

What does this mean for recruiting?

For recruiters, the implications of immigration and border policies are profound. A reduction in the immigrant workforce—whether due to policy changes like deportations or shifts in immigration trends—could lead to renewed labor shortages, particularly in industries heavily dependent on immigrant labor, such as agriculture, construction, and the service sector.

The macroeconomic impact is evident: it would slow the U.S. economy and drive-up prices. Just as the Federal Reserve has begun to lower interest rates in response to easing inflation, a new wave of price shocks would pose serious challenges for both job seekers and businesses. In this environment, recruiters would need to contend with intensified competition for talent and an unpredictable candidate pool.