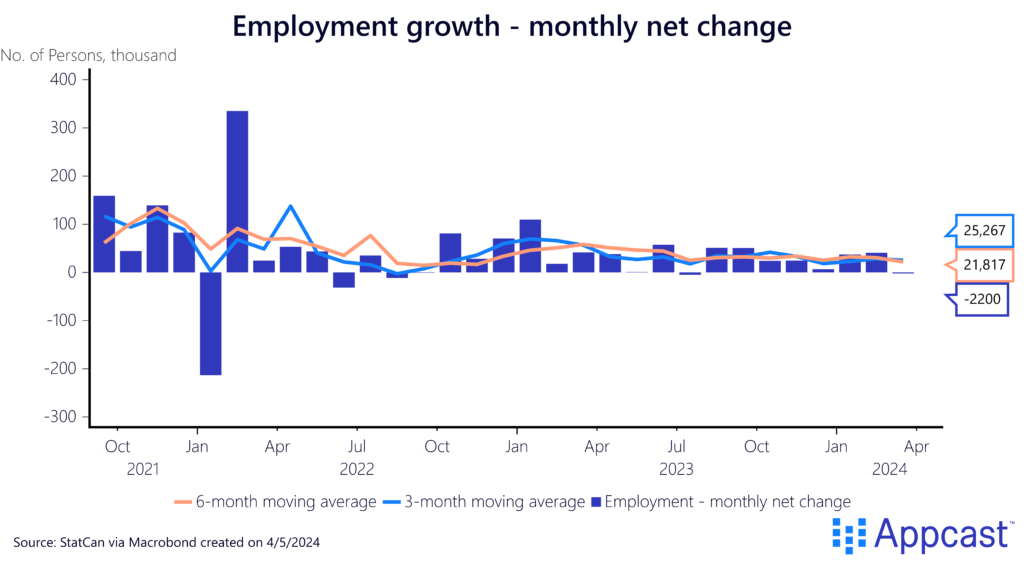

In a shift from the recent trend of a steadying labor market, Canada’s job market experienced a setback in March, shedding 2,220 positions. This decline follows two months of robust employment gains. Despite the setback, the longer-term outlook remains positive, with an average of 21,000 jobs added each month over the past six months.

While this is an unfortunate step back, economists caution against placing too much emphasis on a single month’s data, and instead emphasizing the importance of considering longer-term trends to better understand the underlying growth of the job market.

Sector Trends

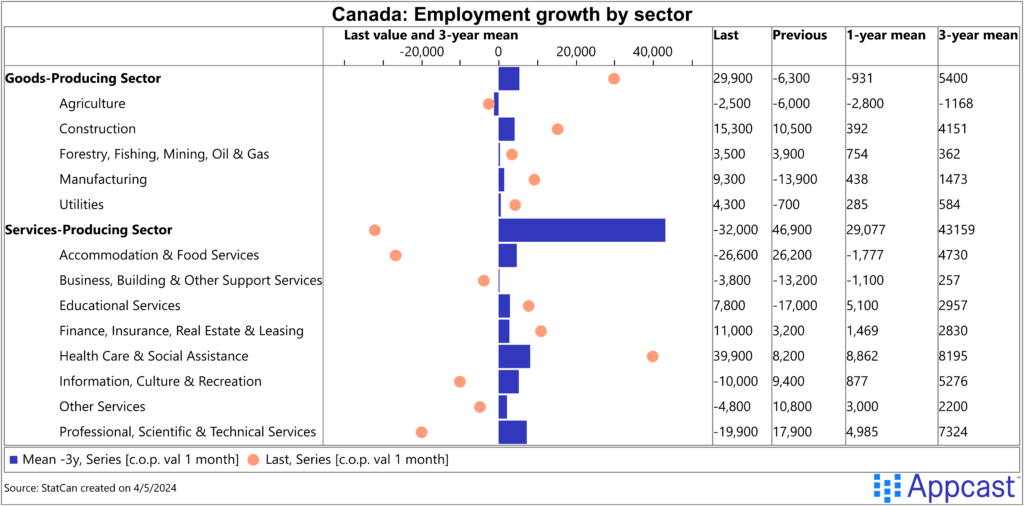

In an unexpected turn of events, the goods-producing sector added 29,900 new jobs after many months of negative growth. On the other hand, the service-producing sector (think hotels, restaurants and healthcare) experienced a significant contraction of 32,000 jobs, concentrated in the accommodation and food services industry.

In fact, nearly all job losses were concentrated in the accommodation and food services industry, which saw a decline of 26,600 positions. This downturn effectively erased the previous gain of 26,200 jobs. It has been a turbulent period for workers in hotels, bars, and restaurants, as the overall industry has contracted by nearly 2,000 jobs over the past year.

A weakening exchange rate for the Canadian dollar against the U.S. dollar may be impacting the vital tourism industry, which relies heavily on tourists visiting Canada’s scenic state parks.

One industry worth celebrating over the past year has been healthcare & social assistance, and last month it continued that tradition by adding nearly 40,000 new jobs! Educational services jobs also had a nice rebound from the prior month, adding 7,800 new jobs.

Labor Force Trends

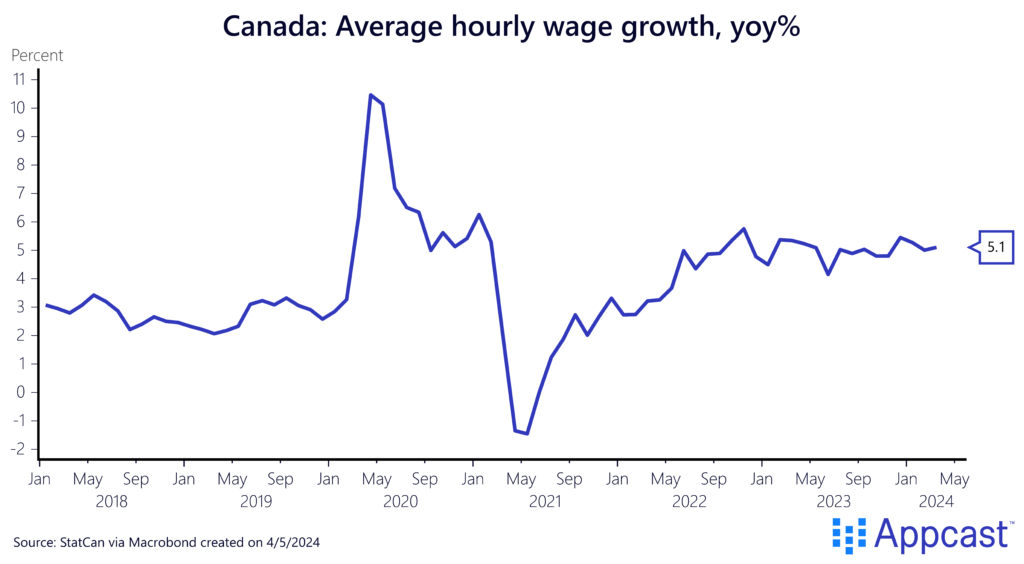

Despite a softening labor market, wage growth in Canada just won’t quit. Average hourly earnings were up 5.1% year-over-year, which has remained consistently high since 2022. The average number of hours worked was unchanged last month, but has increased by 0.7% over the past year, a welcome sign that part-time workers are getting the hours they need.

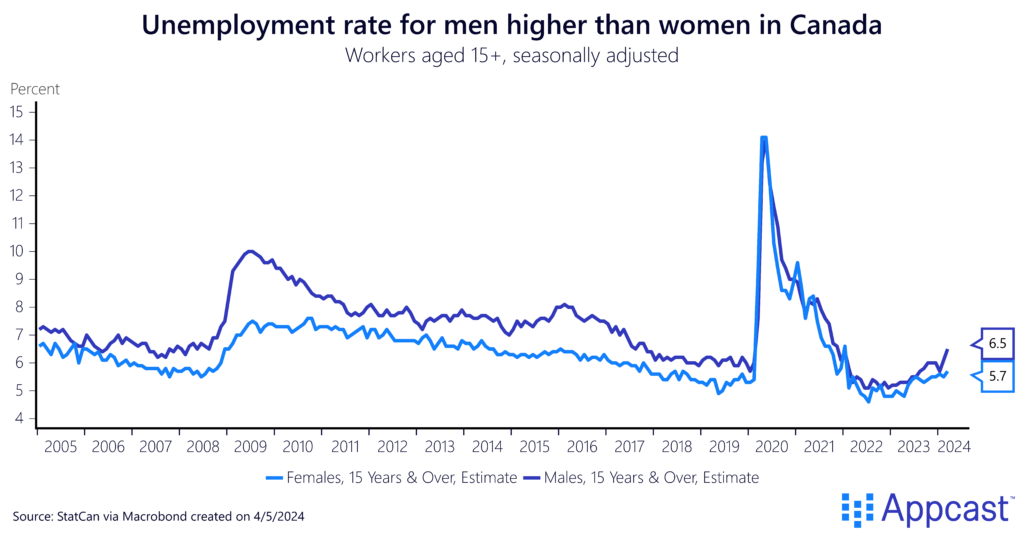

A notable trend observed in recent months is the gradual increase in the unemployment rate for men compared to women. Last month, this gender gap widened to a recent high of 0.8 percentage points, primarily due to a 0.4 percentage point increase in the unemployment rate for men.

A potential cause for this increase is the poor performance of typically male-dominated industries like manufacturing and construction over the past year, while traditionally female industries like healthcare and education have performed quite strongly.

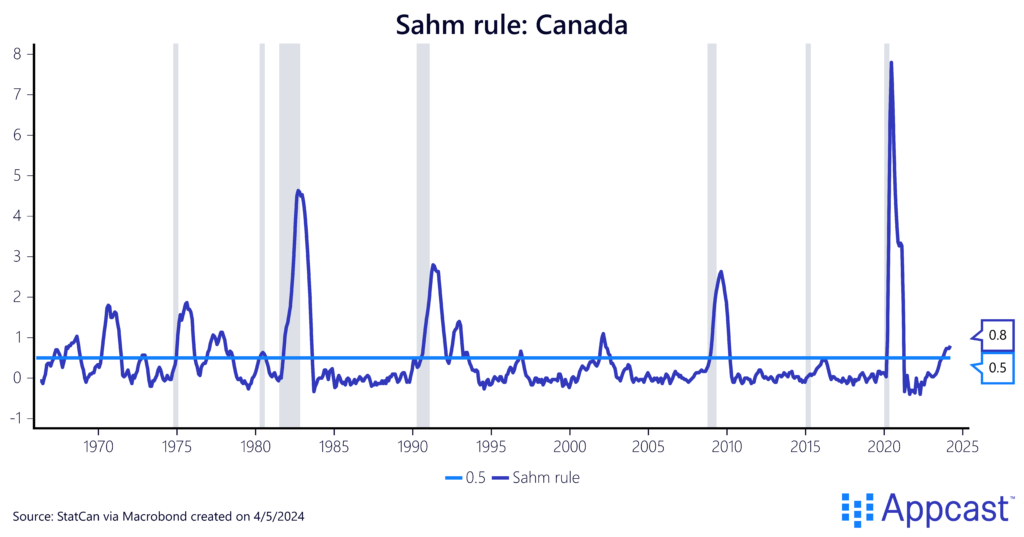

Another potential warning sign is a recent triggering of the “Sahm Rule” coined by economist Claudia Sahm, which tracks if the three-month moving average of the unemployment rate rises 0.5 percentage points above its 12-month historical low.

Since this measure has been triggered in every major (U.S.) recession since 1949, many have taken it to be a definite recession indicator. But even Claudia reminds us that rules are made to be broken – and the current economic situation is far from normal.

Regardless, Canada’s job growth is modest at best and is showing signs of consistent cooling. We will be watching the state of Canada’s labor market closely in the coming months.

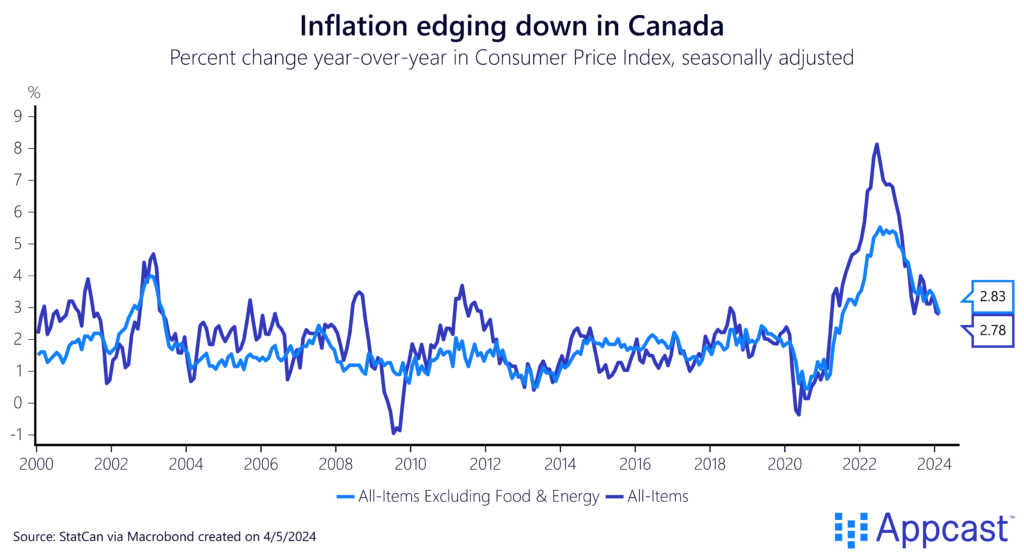

You might be asking, “Where’s the good news, Sam?” Well – inflation data is cooling much faster than expected! Core inflation (which strips out food & energy) fell to 2.8% year-over-year, beating market forecasts and boosting the chance of a rate cut in June.

What does this mean for the Canadian consumer? Hopefully, imminent relief for those looking to purchase a new home with lower mortgage rates.

What does this mean for recruiters?

Using a brake light analogy, the Canadian labor market is currently flashing yellow, signaling caution but not an immediate stop. While the latest job report indicates some weakness, previous reports have been more positive. If this trend of weakness continues in the coming months, the signal could turn red, indicating a potential halt in the labor market’s momentum. Recruiters looking to hire in healthcare and education are facing tighter competition – while those in the goods or accommodation sector are not.