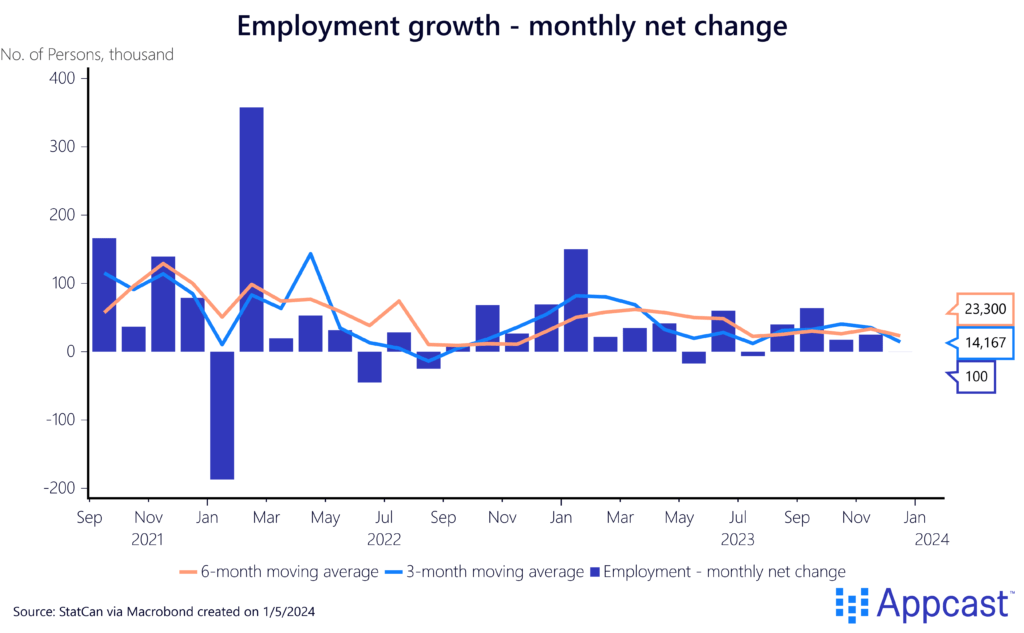

Usually, the new year brings in a renewed sense of optimism and excitement. For those watching Canada’s economy at the start of 2024, that might not be the case. The labor market was effectively changed by a rounding error last month, adding just 100 jobs! The slipping demand for workers over the past three months is a signal of stormy clouds ahead, dampening the positivity for 2024.

Labor Force Trends

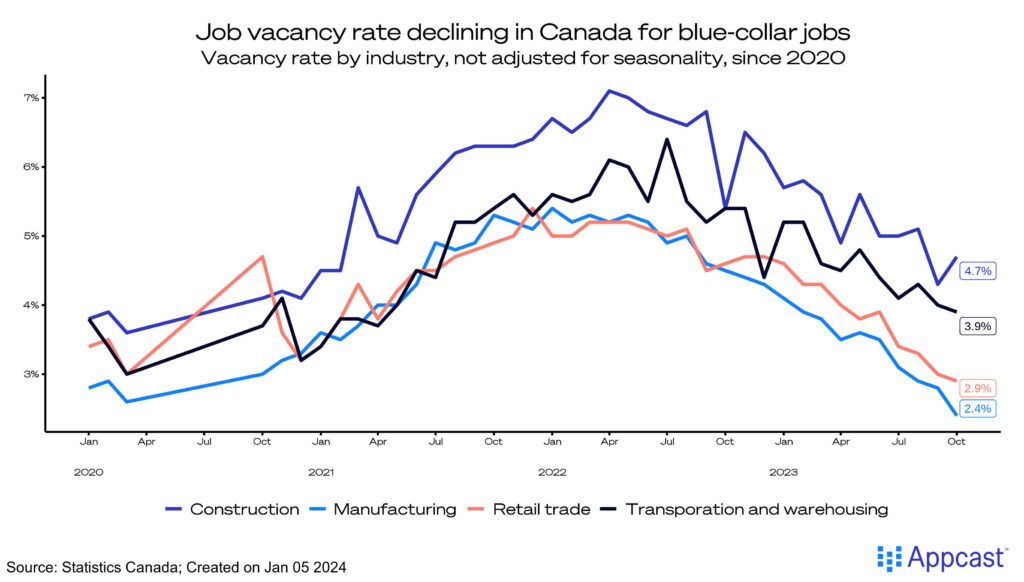

What could be driving this slumping job market? Looking at the job vacancy rate (ratio of openings compared to total employment), demand has cooled for most major sectors. Manufacturing, which peaked just above 5% in 2022, has more than halved – down to 2.4% last quarter. Retail trade, transportation and warehousing declined similarly. Employers are simply looking to hire less, which reduces new opportunities for both the employed and unemployed.

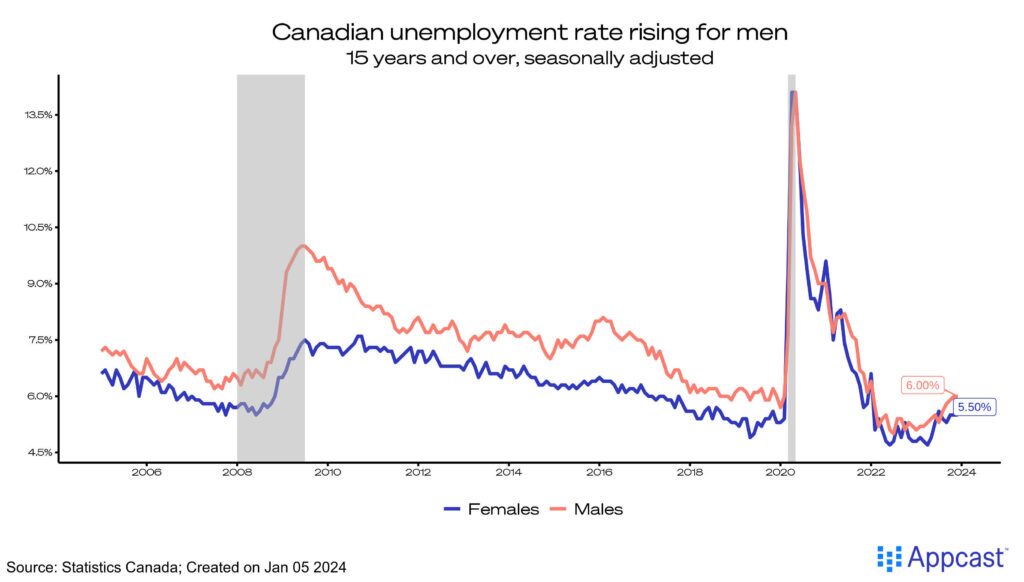

The unemployment rate remained flat at 5.8% last month, a relief after it increased for five of the past seven months. However, a worrisome trend is the split between genders: the unemployment rate for men has continued to eclipse that of women, now by a margin of half a percent.

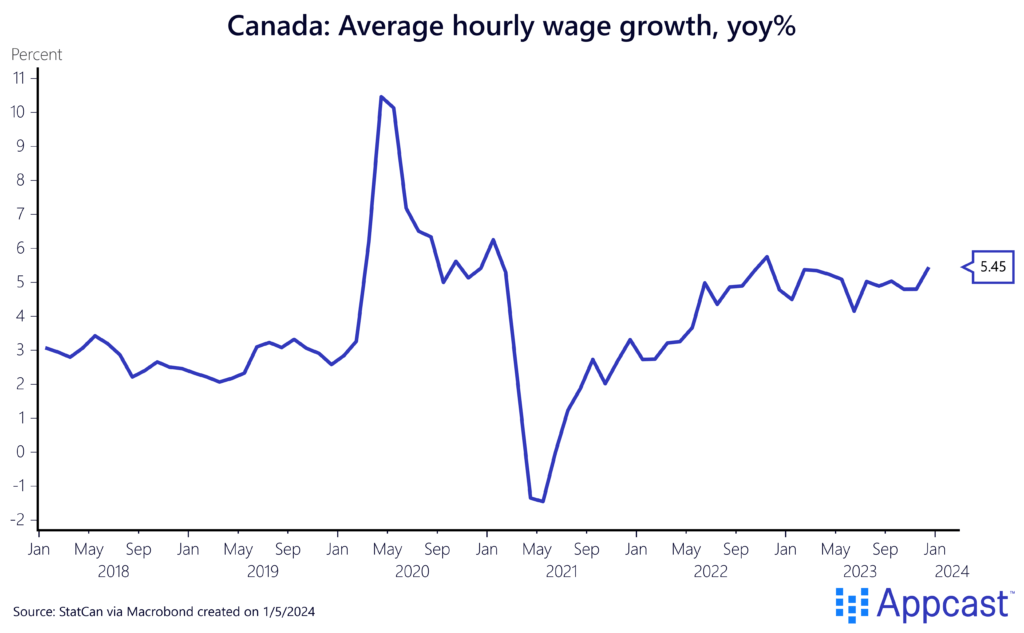

Despite a softening in the labor market, wages continue to grow. Average hourly earnings increased nearly two dollars (up $1.78!) from the month before and are up by 5.4% year-over-year. Total hours worked also showed positive signs, growing 1.7% for the year 2023.

Luckily for the Bank of Canada, higher wage growth hasn’t been reflected in the recent inflation data; the median Consumer Price Index (CPI) fell by 0.6 percentage points since August. Forecasters now predict rate cuts by the Bank of Canada as early as the spring.

Sector Trends

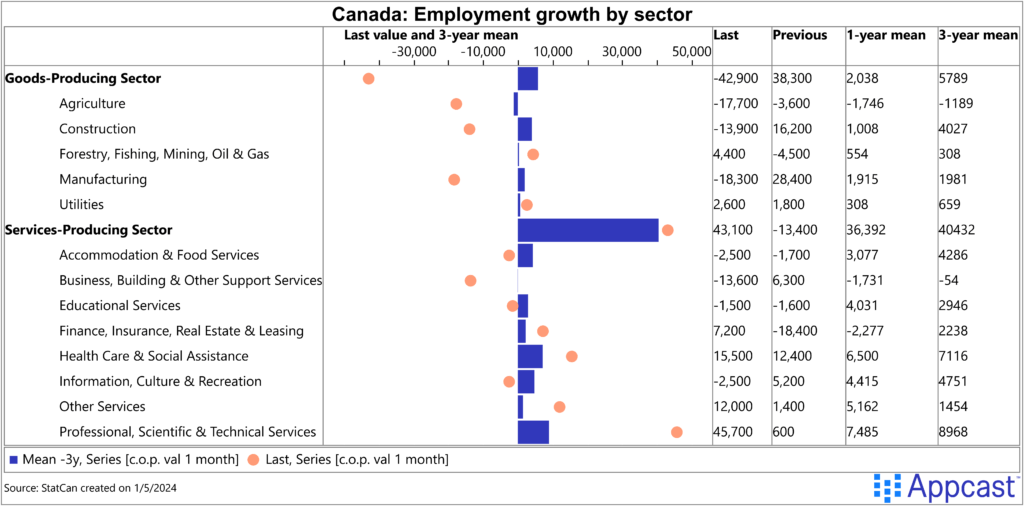

The employment gap between the goods-producing industries and service-producing is massive – the former lost 42,900 jobs last month while the latter gained 43,100. For goods industries, construction and manufacturing drove most of the losses, combining 32,200.

Healthcare and professional business services made up most of the job gains, the latter leading with an impressive increase of 45,700 new jobs. This is particularly good news, since the sector’s 1-year mean of employment growth is just 7,400.

For the construction industry, much of the blame could be the poorly performing housing market. Existing home sales fell 0.9% month-over-month in November, and new listings fell as well. Lower housing demand is cooling housing construction, obviously bleeding into employment growth.

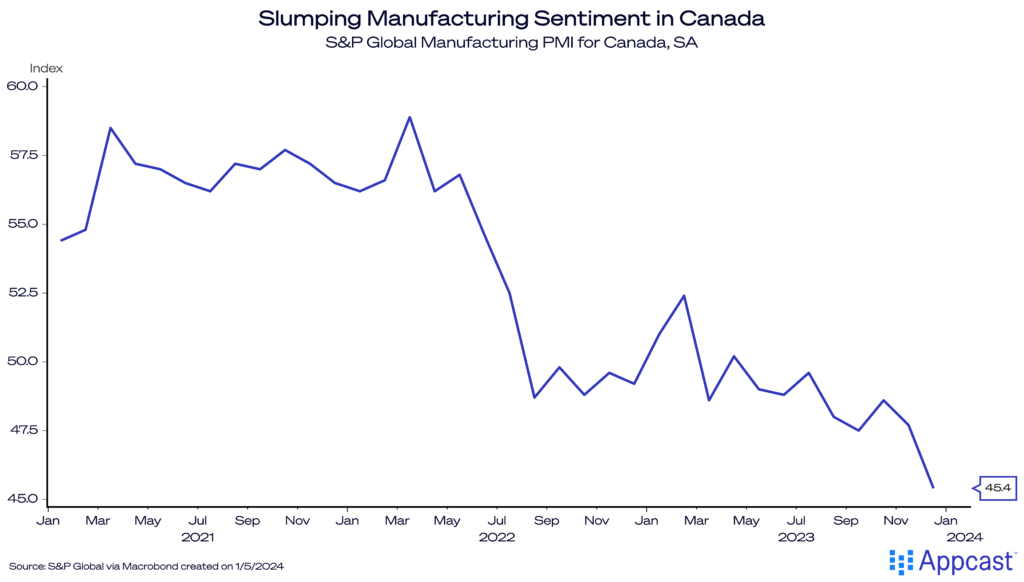

The decline in manufacturing employment can be explained by plummeting new orders and purchasing activity. The Canadian Manufacturing PMI (a survey of manufacturing sentiment) has fallen quite substantially this year, down from the mid 60s in 2021 to just 45.4 last month. Manufacturers feel less and less confident about the prospects for 2024 resulting in lower hiring demand.

What does this mean for recruiters?

The Canadian economy’s labor market is experiencing a significant slowdown, presenting a challenging landscape for recruiters in 2024. Meager job growth and a cooling job vacancy rate across major sectors indicate reduced hiring needs.

Despite a steady unemployment rate and rising wages, the gender disparity in unemployment, and sector-specific downturns (particularly in goods-producing industries) all suggest that recruiters will need to navigate a more competitive and selective environment in 2024. The cooling economy and forecasts of rate cuts further complicate the hiring outlook, emphasizing the need for strategic and targeted recruitment approaches.