The labor market in Canada continues to surprise markets and analysts. The economy added 64,000 new jobs in September, more than three times expectations. Wage growth remains elevated, feeding into still-high inflation. Strong economic growth with high consumer prices puts the Bank of Canada in a tough spot. Do they raise interest rates again and risk tipping the labor market into negative territory or stay pat and hope inflation cools naturally?

Inflationary challenge: wage growth

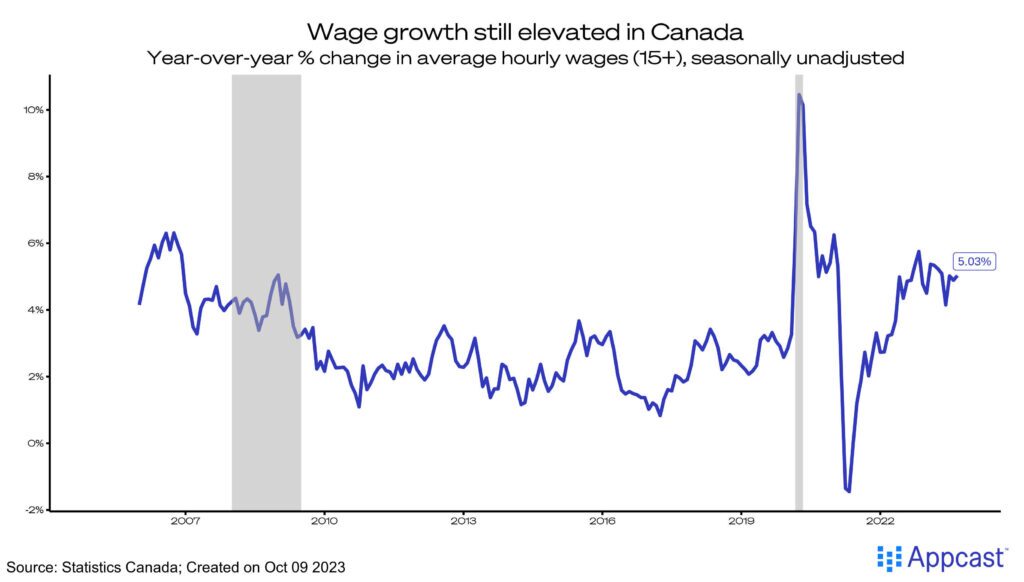

While wage growth in the U.S. has naturally ebbed recently, earnings in Canada remain above-trend. Last month, earnings increased 5% from the year prior.

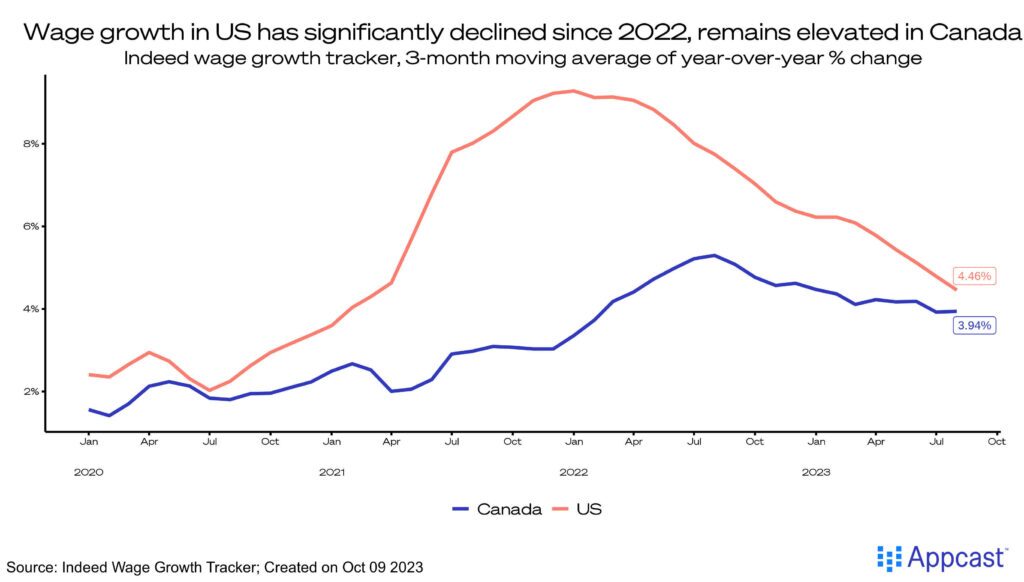

Indeed’s Wage Growth Tracker mirrors a similar trend from government data – the U.S. has seen a significant cooling in earnings while Canada’s drop has been much less dramatic.

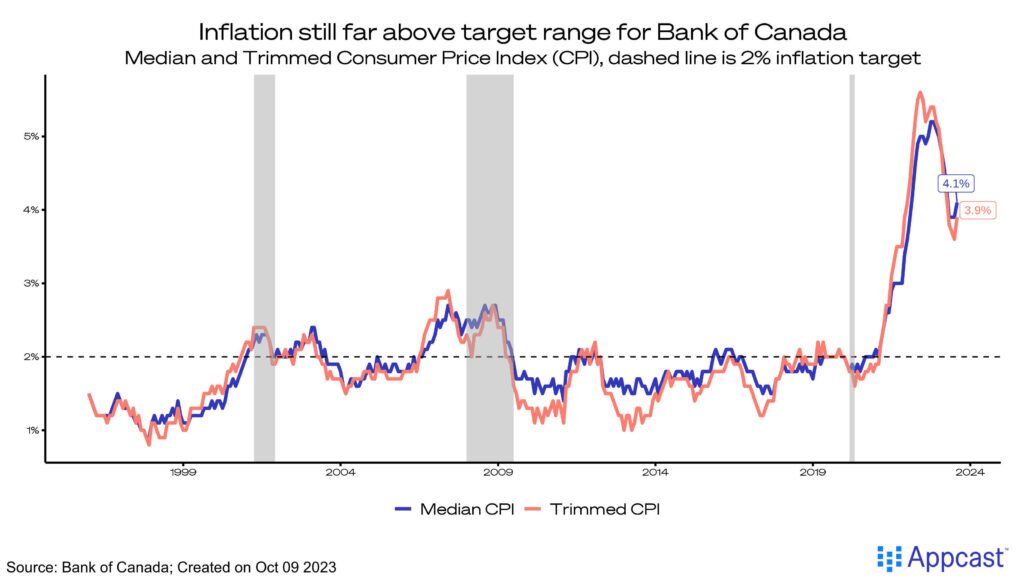

A hot labor market with even hotter prices puts the Bank of Canada in quite a quandary. Inflation reached a peak in June of 2022. From there, prices slowly fell. However, this summer prices picked back up again, bringing the median consumer price index up to 4.1% year-over year. Policy makers decided to not raise interest rates last month based on fears of weaker growth. When the option comes again to raise rates, decision makers will have to decide between balancing the stronger-than-expected labor market with inflationary pressures.

Industry trends

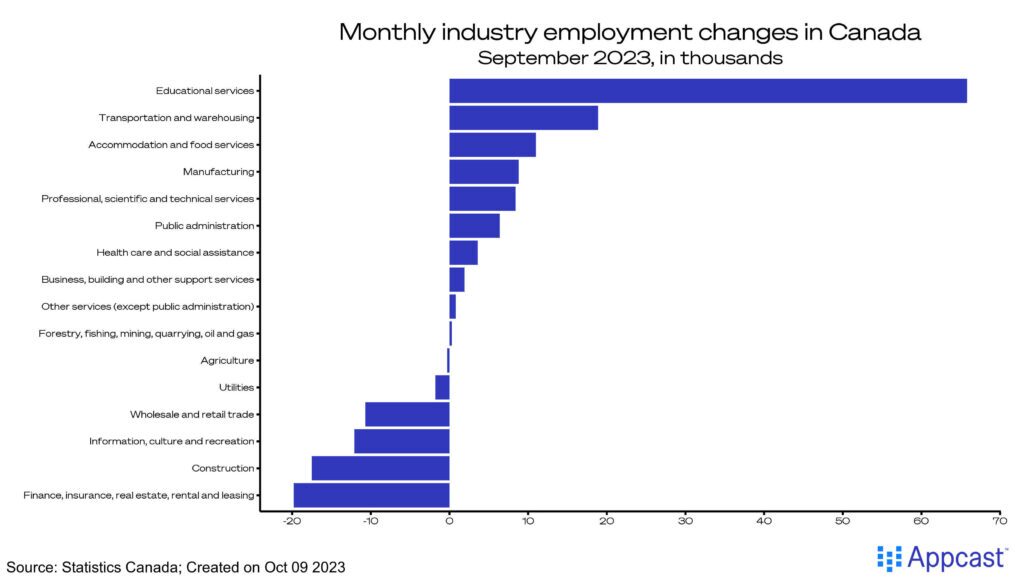

Job gains were highly concentrated in the education sector this month, which added 66,000 new jobs. This is possibly due to statistical noise – how and when school schedules end and start is factored into the seasonal adjustment methods. However, there was broad-based growth in the services sectors, with accommodation and food services leading the way with 11,000 new jobs.

Both construction and wholesale retail had noticeable drops in employment (-17,500 and –10,700 respectively). This is particularly concerning for retail as we approach the seasonal hiring period, which typically bolsters employment.

Labor force trends

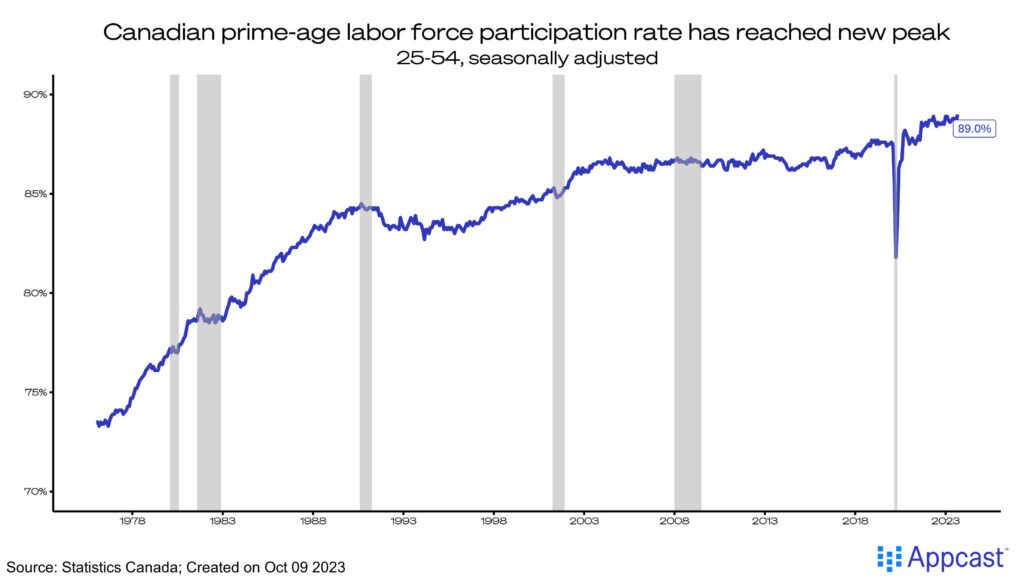

The prime-age labor force grew substantially last month, increasing to 89.0%. This is now a tenth of a percent higher than the previous highs earlier this year in January and February. In fact, if we zoom out, this is the highest recorded in more than 40 years! This demonstrates the resilience the labor market has shown, recovering all the workers from the COVID-19 pandemic and many more.

A trend we’ve spotted over the past few months is the gap between full-time vs. part-time hiring, which edged towards closing last month. Of the latest job gains, 48,000 were in part-time hiring, which are split into two distinct types: voluntary and involuntary. The involuntary group of part-time workers want more than 30 hours a week, but currently can’t get it, and this group increased by a percentage point from the year prior. The switch from full- to part-time work is used as a leading recession indicator – something to continue to watch out for.

For the third month in a row, the unemployment rate remains unchanged at 5.5%, a data point sure to soothe policymakers concerned that heightened interest rates could spark a recession.

What does this mean for recruiters?

The Canadian economy teeters between curbing inflation and avoiding a significant cooldown in their labor market. The past two data releases suggest the job market is hotter than realized, making the situation for the Bank of Canada more uncertain. For recruiters, filling open roles should continue to be competitive.