Trade shocks can hurt – they create many winners but a few big losers

There is no doubt that many economists underestimated the shock that resulted from trade liberalization in the 1990s, especially with China. In most economic models, more trade is good. When countries specialize in the production of goods and services for which they have a competitive advantage and then trade with each other, everybody wins. And while this is obviously true, the actual picture is a little bit more nuanced.

On the one hand, increased trade with Southeast Asia (and China specifically) drove down the price of manufactured goods substantially over time. The American and Western class highly benefitted from cheaper stuff, ranging from clothing to consumer electronics like TVs and phones to kitchen accessories like dishwashers and microwaves to cars.

The price of many of those goods had fallen considerably between the late 1990s and the pandemic, providing a massive real income boost to the entire American middle class (and the same goes for Europe).

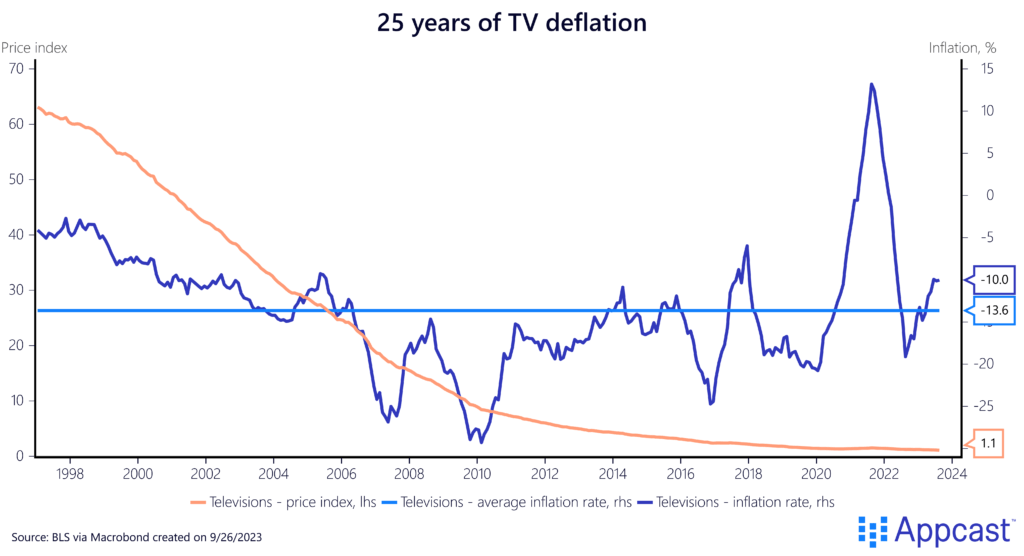

Annual TV deflation, for example, has averaged more than 13% on a yearly basis since the late 1990s. This does not quite mean that TVs have gotten cheaper by that amount every year – it adjusts for the massive increase in quality and technological improvement that has taken place since then. Today’s flat screen TVs are a very different creature than those box-shaped things from the 1990s.

But in general, on a quality-adjusted basis, consumer electronics and many other manufactured goods have massively fallen in price, meaning that hundreds of millions of middle-class families in the Western world have been able to afford more of these products thanks to cheap manufacturing and trade with Southeast Asia. And this has led to a massive boost in real incomes for American middle class.

Who are the losers?

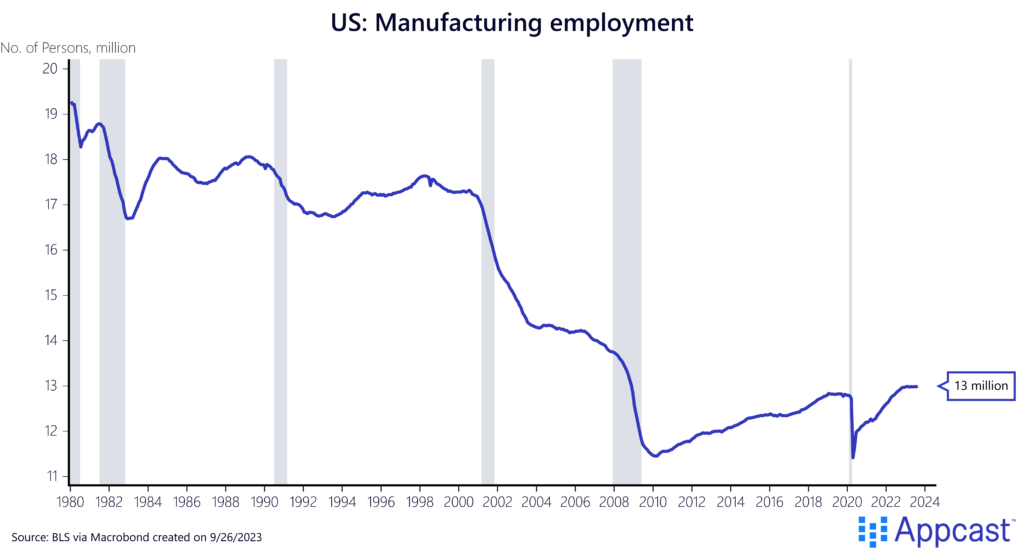

But there were some Americans who were less fortunate. And this is not just true for workers but even entire cities that had previously been highly industrialized but then lost out in the competition with Southeast Asia. Manufacturing employment almost halved between 1980 and 2010 as it fell from a little under 20 million to a little over 11 million within just three decades.

While a big share of these job losses can be attributed to automation, the loss of manufacturing jobs in the U.S. clearly accelerated once China joined the World Trade Organization (WTO) in 2001. The U.S. lost more than five million manufacturing jobs alone in the decade thereafter.

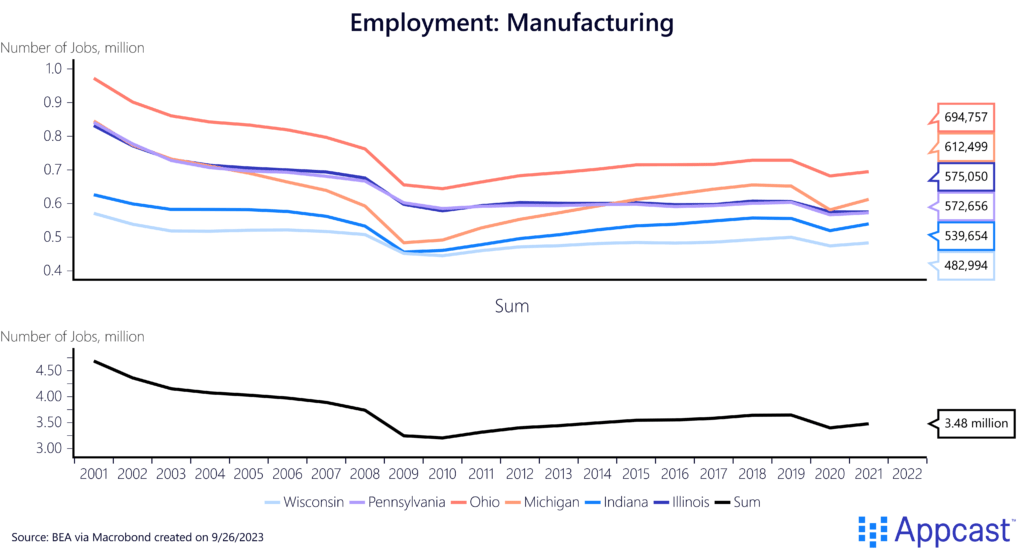

And more importantly, a large share of the job losses occurred in just few states – the Rust Belt. And within those states, job losses were concentrated in certain industrial cities.

Between 2001 and 2010, the six big Rust Belt states lost about 1.5 million manufacturing jobs.

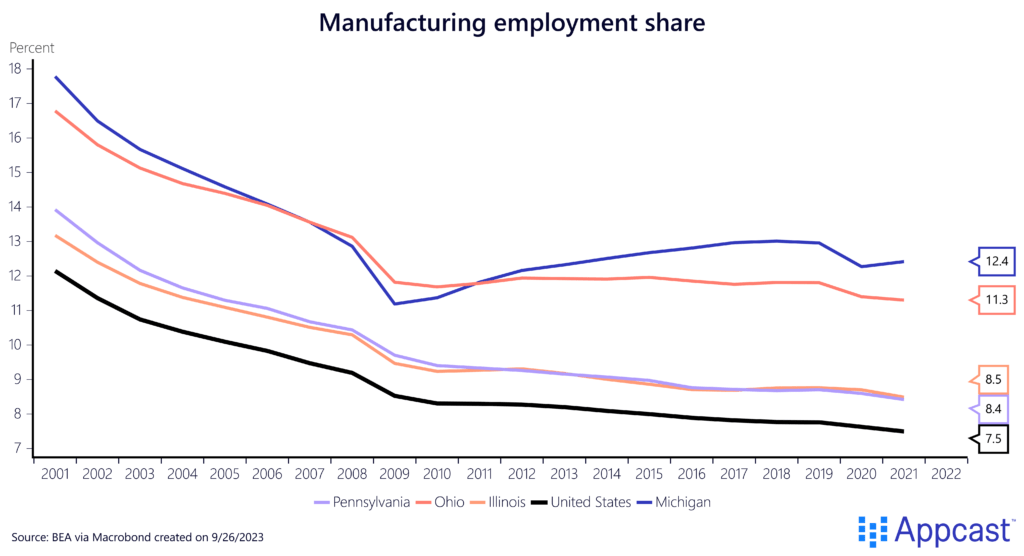

As one can see, the manufacturing employment share in those states was still significantly higher than the national average in 2001 – 18% in Michigan compared to 12% nation-wide – and subsequently declined at a much more rapid pace.

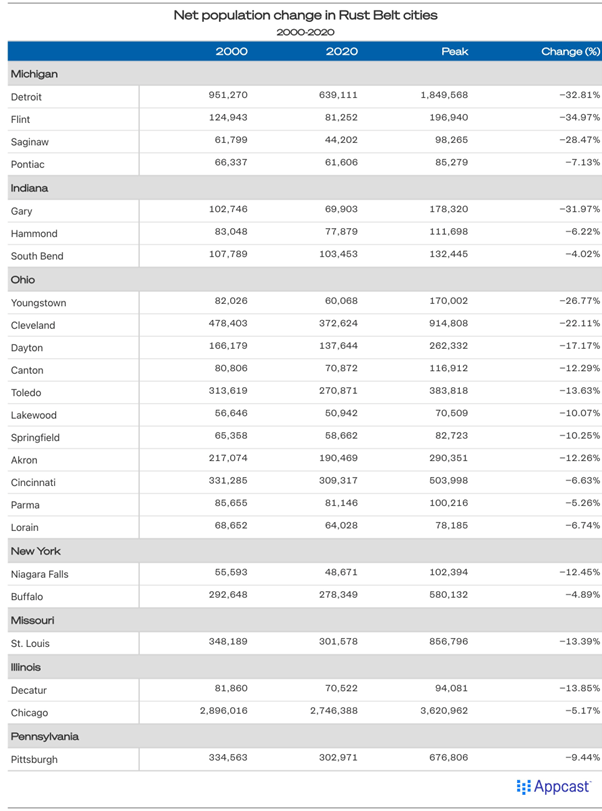

Cities in the Rust Belt suffered a lot, losing some 15% or even more of their population within just two decades. This includes larger cities like St. Louis, Toledo, Cleveland, and Detroit. And some have lost about 50% of their population since the 1950s.

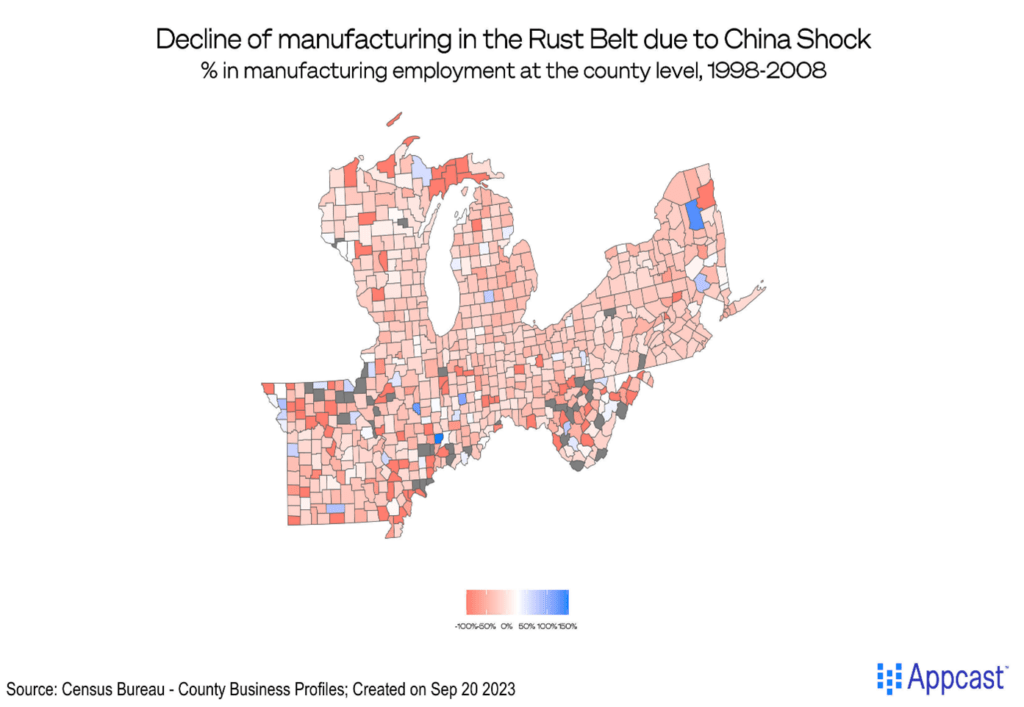

Within the Rust Belt, manufacturing job losses have been highly concentrated in some areas. Many counties that were previous manufacturing clusters went into a steep decline due to the competition with China.

The famous research paper about the China shock by the economists Autor, Dorn, and Hanson shows that labor mobility in the U.S. is not as high as most assumed – this is true both for regional mobility as well as for sectoral reallocation.

The counties that saw job losses in manufacturing recorded saw their unemployment rates surge and employment go down. And these regional shocks have been highly persistent and lasted for more than a decade.

The opioid epidemic can partially be explained by economic misery in the Rust Belt. There is a reason why Hillbilly elegy – the memoir by now-Senator J.D. Vance about his Appalachian upbringing and the socio-economic problems that many inhabitants in that region face – received so much attention. Appalachia has been the epicenter of job destruction in manufacturing and the opioid crisis.

Reversal of fortunes: The Rust Belt comeback?

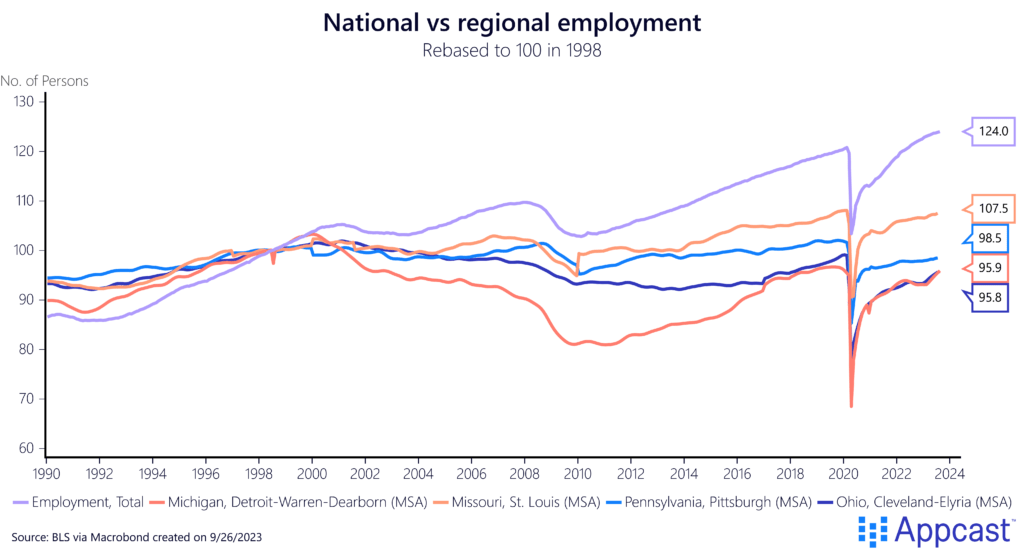

The relative decline of many Rust Belt cities was a process that lasted for decades. Many communities suffered for the better part of two decades, much longer than what economists would have initially predicted. It turns out that these regional shocks were highly persistent because of limited labor mobility.

But some former industrial cities are now seeing an economic revival as they have started to attract many white-collar jobs: Baltimore has one of the largest clusters in healthcare jobs in the U.S. Both Baltimore and Pittsburgh also have started to lure businesses and talent in tech and even finance.

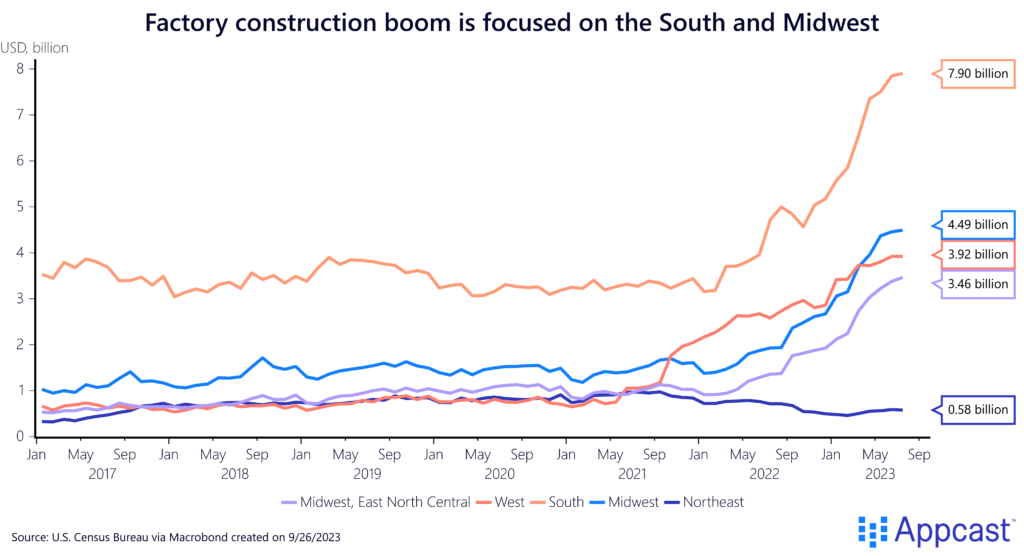

Moreover, the U.S. economy is currently seeing a manufacturing revival, sparked by rising tensions with China. The pandemic-era global supply chain crisis revealed how vulnerable production chains can be if key inputs become unavailable for longer periods. Consequently, companies have started to onshore some production domestically, also to become less reliant on China.

The Rust Belt is one of the few regions in the U.S. where middle-class families can more easily afford to buy a home as real estate prices are considerably lower than elsewhere. Moreover, many large cities in the region, including Pittsburgh, Detroit, St. Louis, Cleveland and Cincinnati, have large research universities and therefore a large pool of available skilled workers that companies can tap into.

This, together, with the more recent federal initiatives coming from the Biden administration to foster regional development mean that some of the former Rust Belt cities are due for a spectacular comeback. President Biden’s “Build Back Better Regional Challenge”, funded by the pandemic stimulus package, is supporting various regional projects in the Midwest.

As we wrote earlier this year, the manufacturing sector in the U.S. is currently getting a massive boost from the large surge in manufacturing construction spending, which is running twice as high as before the pandemic. And a significant share is happening in the in the Rust Belt states. Manufacturing construction in the eastern Midwest states has more than tripled over the last couple of years.

This large investment boom that is taking place right now will support the sector for years and potentially lead to large positive regional shocks for the local economies being affected.

Conclusion

Regional economic shocks matter more than you think. The “China shock” led to a local labor market depression in parts of the Rust Belt. The decline of local manufacturing caused regional employment rates and wages to fall. The shock also turned out to be somewhat persistent as the Rust Belt suffered for more than a decade.

But just as negative shocks can turn out to be persistent for regional economies, so can positive shocks. The former Rust Belt currently stands out as one of the few regions in the U.S. with decent housing affordability. Large cities like Baltimore, Chicago, and Pittsburgh also can tap into a large pool of high-skilled workers thanks to the large research universities that are located there.

Finally, the current investment in tech and manufacturing construction in those states will give those areas an economic boom that might last for years. But