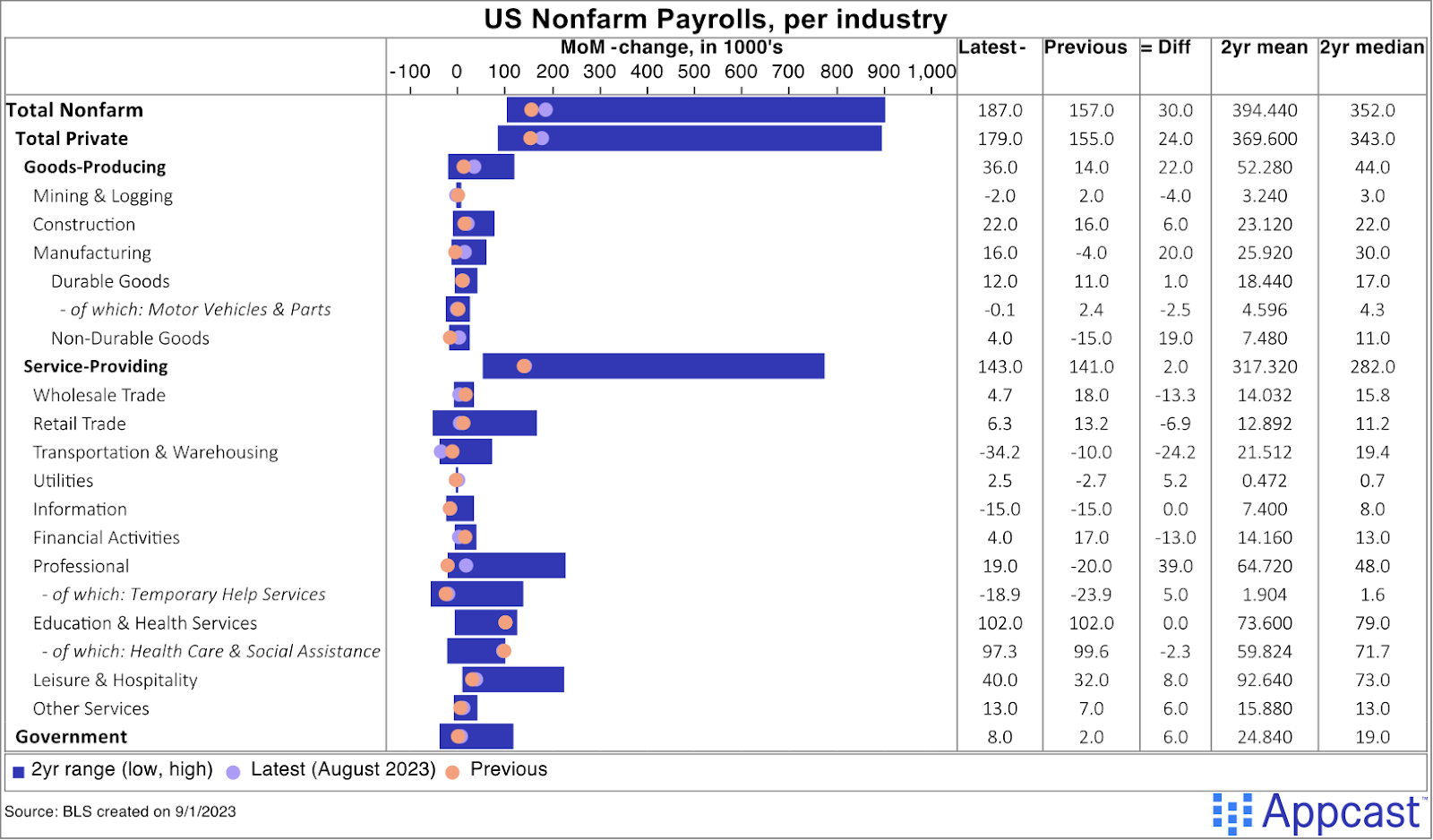

In August, the U.S. economy added 187,000 net new jobs and the unemployment rate increased to 3.8%, but for “good” reasons. There were downward revisions to employment gains in June and July, totaling 110,000. Wage growth cooled substantially and the reason unemployment rose was because the pool of available workers (the labor force) expanded noticeably. The prime-age labor force participation rate is up to 83.5%, the highest level in over 20 years.

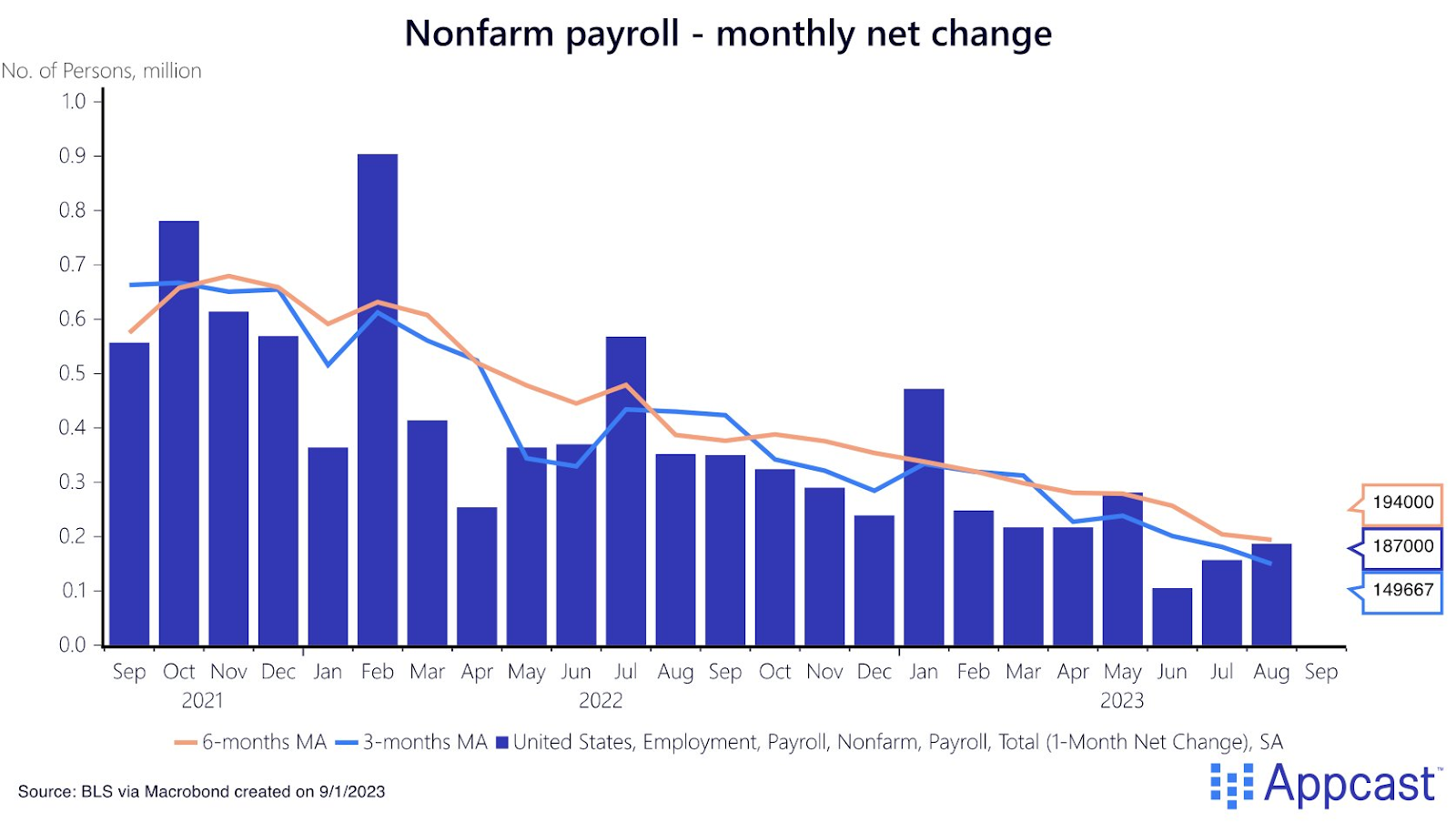

Employment growth is easing

The U.S. labor market is cooling, clearly. With the downward revisions to June and July, the 3-month average is about 150,000, just above the “break-even” rate needed for population growth (which is about 70,000 to 100,000).

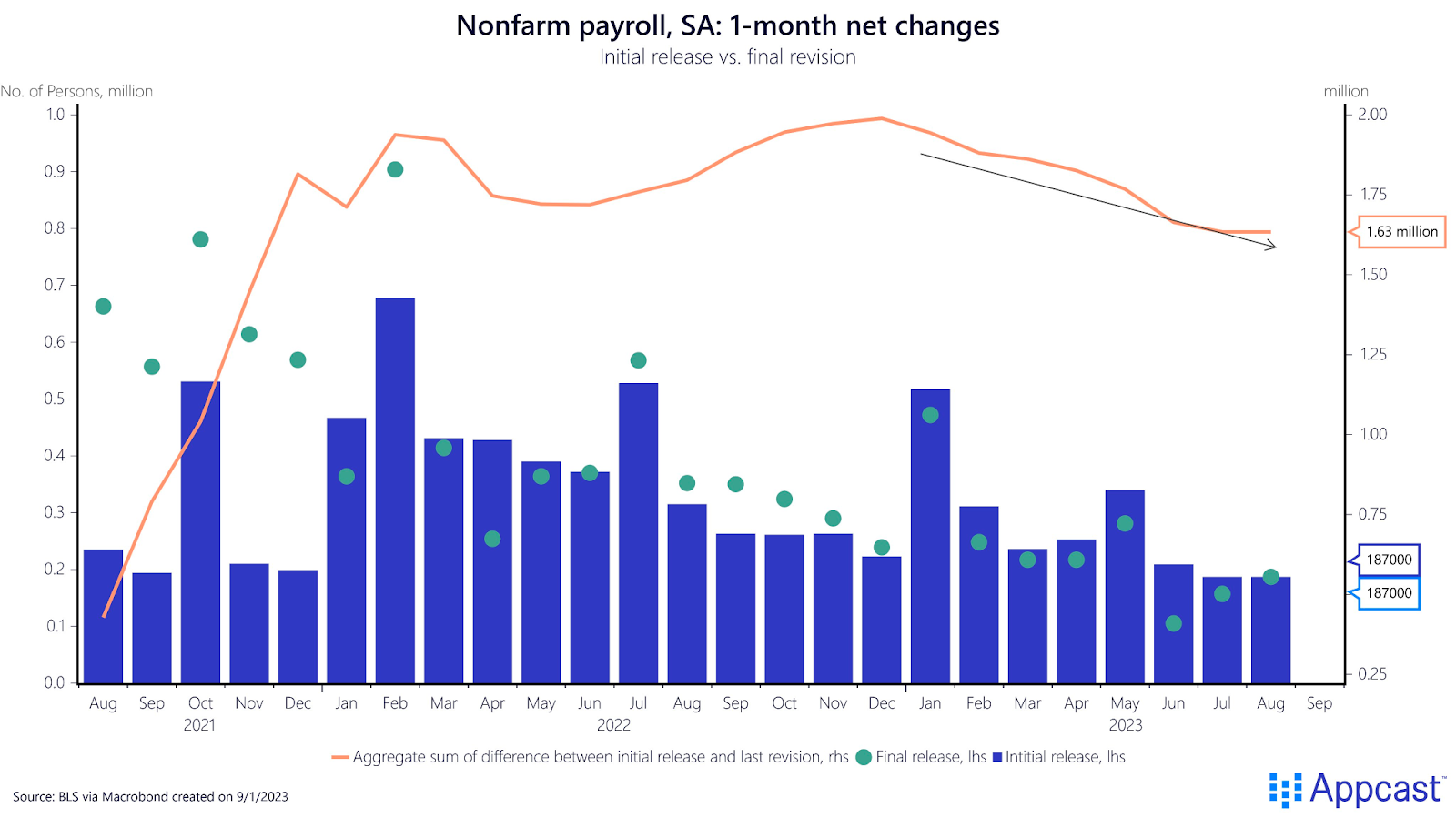

Downward revisions are the story of the jobs reports this year. In 2023, we’ve seen every month get revised lower, but the revisions to June were especially notable. Visually, you can see this phenomenon in 2023 by how the green dots (the initial jobs numbers) are below the blue columns (the revised numbers). Last year it was the reverse: green dots above the blue columns.

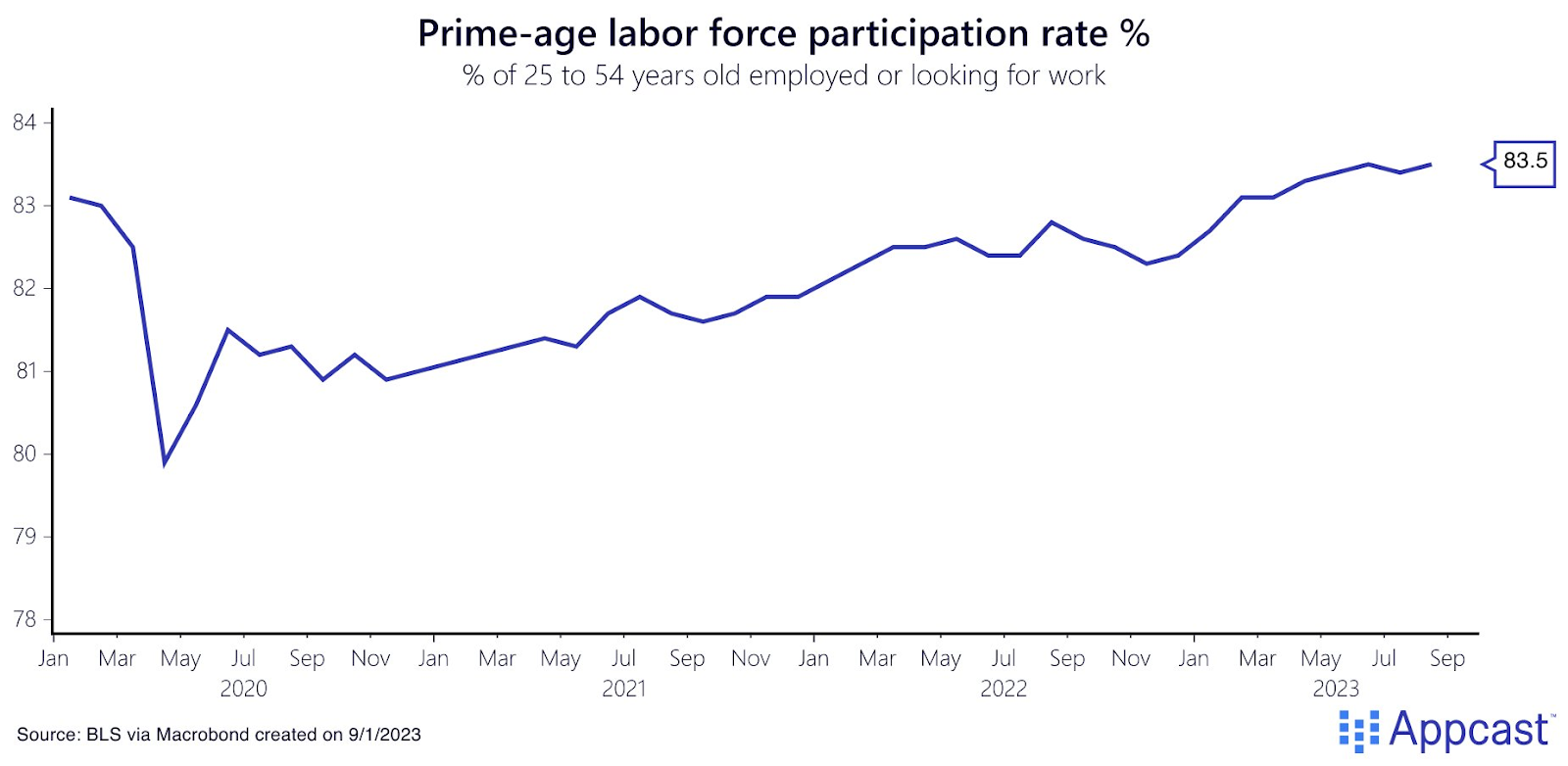

Labor force expansion continues

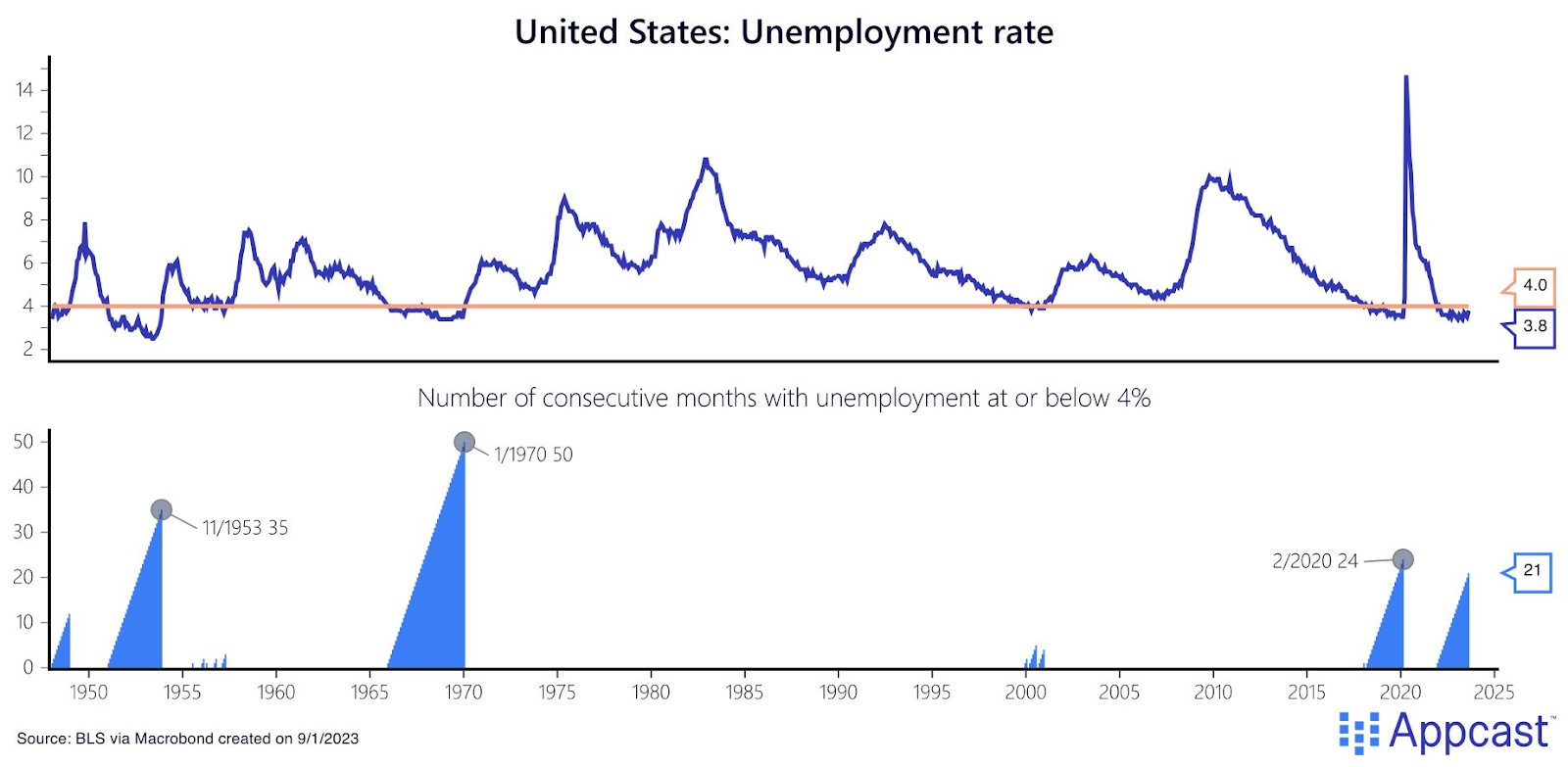

The unemployment rate ticked up, to 3.8%, but for “good” reasons. Why is it “good?” Because the labor force expanded strongly. The streak of 21 months of below 4% unemployment rates continues.

An expanding labor force is a good thing! How much did the labor force grow? By 736,000. The prime-age labor force participation rate moved up to 83.5%.

Wage growth signals a soft landing

Wage growth – at least by the imperfect average hourly earnings series – cooled substantially. The 1-month annual rate dropped to 2.5%; over the last three months, it’s fallen below 4%. For the Fed, this cooling in job growth and wage gains is on target for a “soft landing.”

Two notable tidbits: Historic healthcare growth and Hollywood strikes

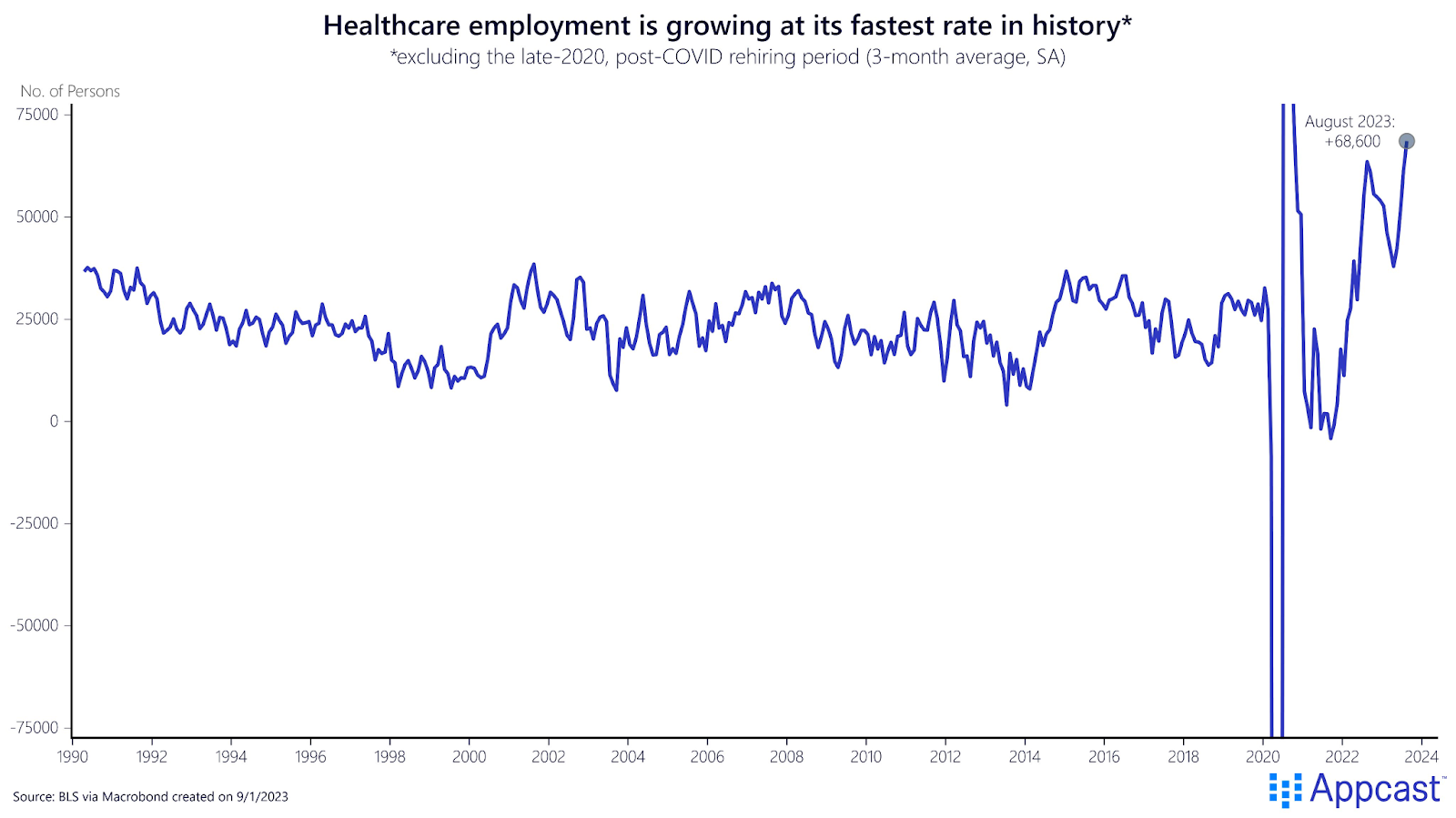

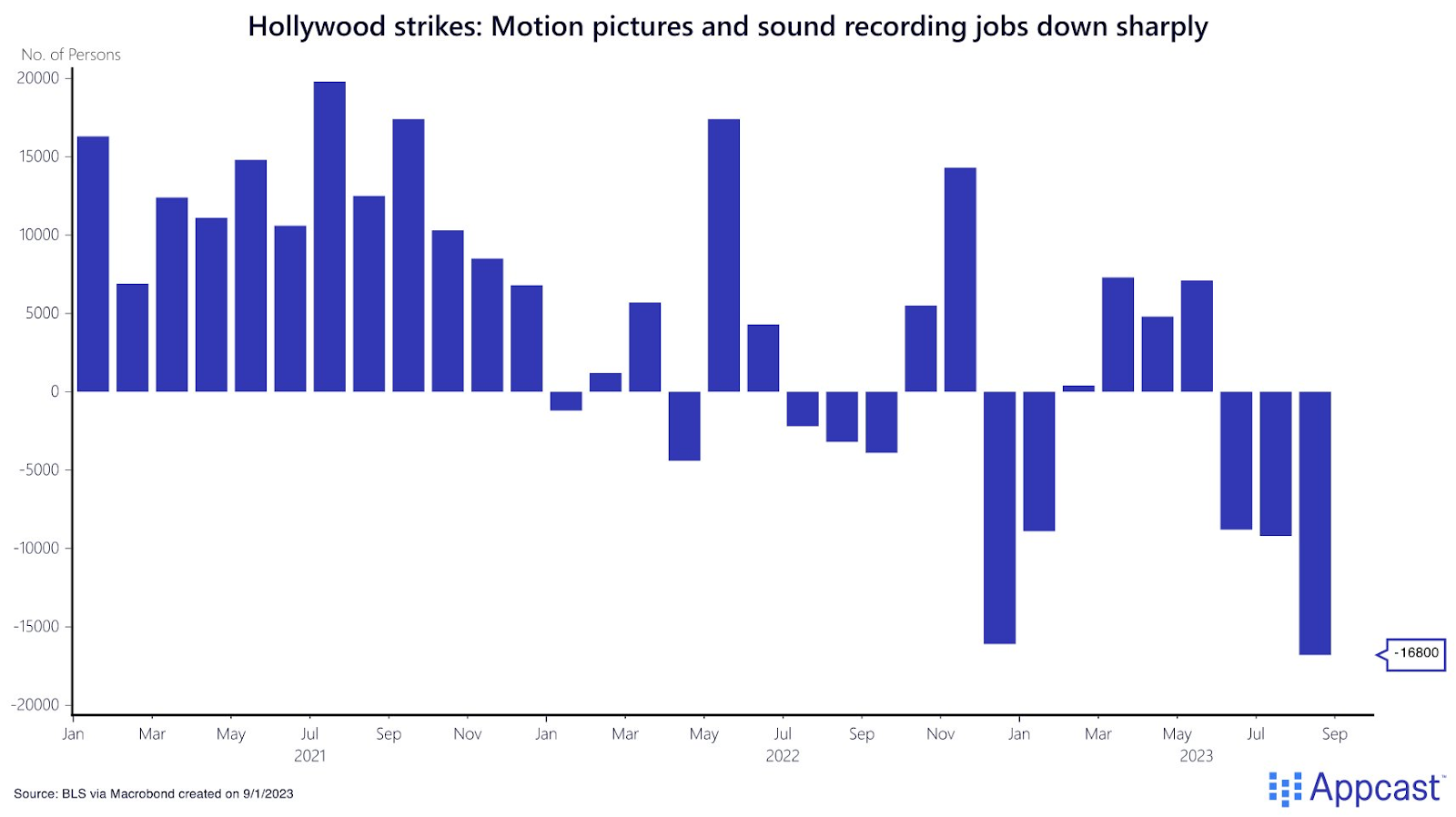

Industry job gains were largely unsurprising. Healthcare is booming, adding 97,300 jobs in August. Leisure and hospitality saw decent growth of 40,000 last month, though gains were softer compared to those in the immediate post-pandemic period. Information (most technology, but also media and film jobs too) and warehousing are both in decline.

Notably, the healthcare sector is growing at its fastest rate in history (excluding the boom immediately after COVID began). Recruiting in the healthcare industry has been challenging for the past year, but it seems recruiters are up for it. As the population ages, demand in the healthcare industry will continue to grow.

The screen actor and writer’s strikes has wreaked havoc on Hollywood. Throughout this summer, the workers behind Hollywood productions have taken to the picket line, panicking studios as they scramble to rework schedules and release dates. Unsurprisingly, this shutdown has hurt employment in the motion pictures and sound recording industry, down 16,800 in August. The Hollywood ecosystem is fragile: Production cannot go on without writers and actors. But, as recent communications between the guilds and studios suggest, these strikes aren’t ending anytime soon.

What does this mean for recruiters?

The Federal Reserve wants to see a cooling labor market. And with job gains still above the “break-even” rate given population growth, the labor market is cooling gracefully. Moreover, an expanding labor force is good for recruiters and for the Fed’s intention to ease wage pressures. So, in all likelihood, the Fed is done (or almost done) raising interest rates. The “soft landing” is still on, with no recession on the near term horizon.