The U.S. job market has beaten expectations yet again. In April, payroll employment rose by 253,000 and the unemployment rate fell to 3.4% (a more than half-century low). However, gains in February and March were revised downward by 149,000. The unemployment rate for African-Americans hit its lowest level in history. Average hourly earnings over recent months were firmer – a sign that wage growth remains elevated. Overall, the labor market continues to shrug off recession fears and is powering along nicely.

Beyond full employment?

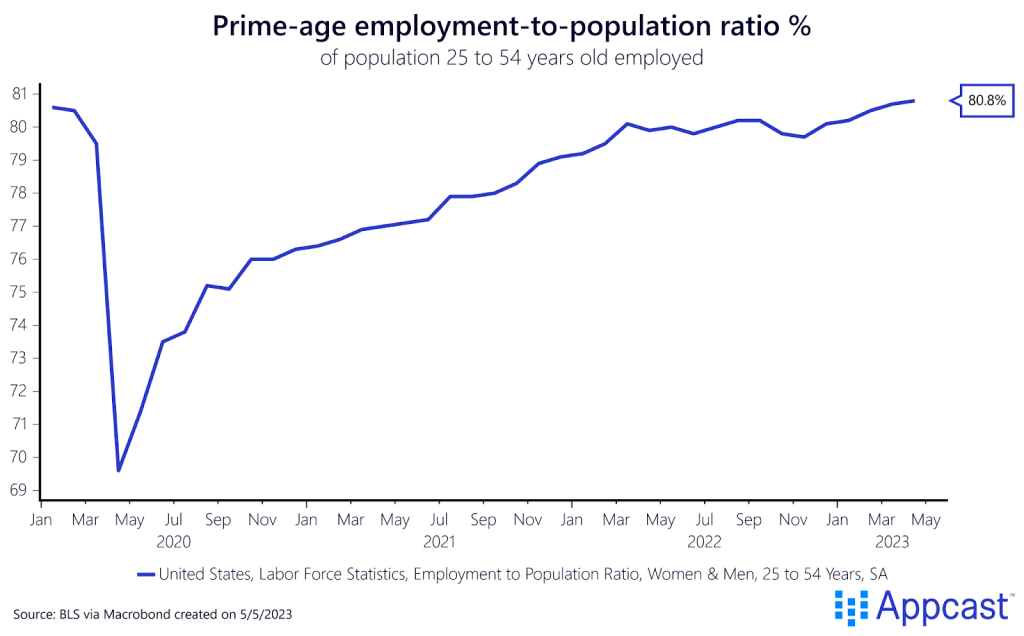

The prime-age employment-to-population (EPOP) ratio rose to 80.8%, above its pre-COVID mark. EPOP is perhaps the best indicator of full employment – a sign that everyone who wants a job can get one.

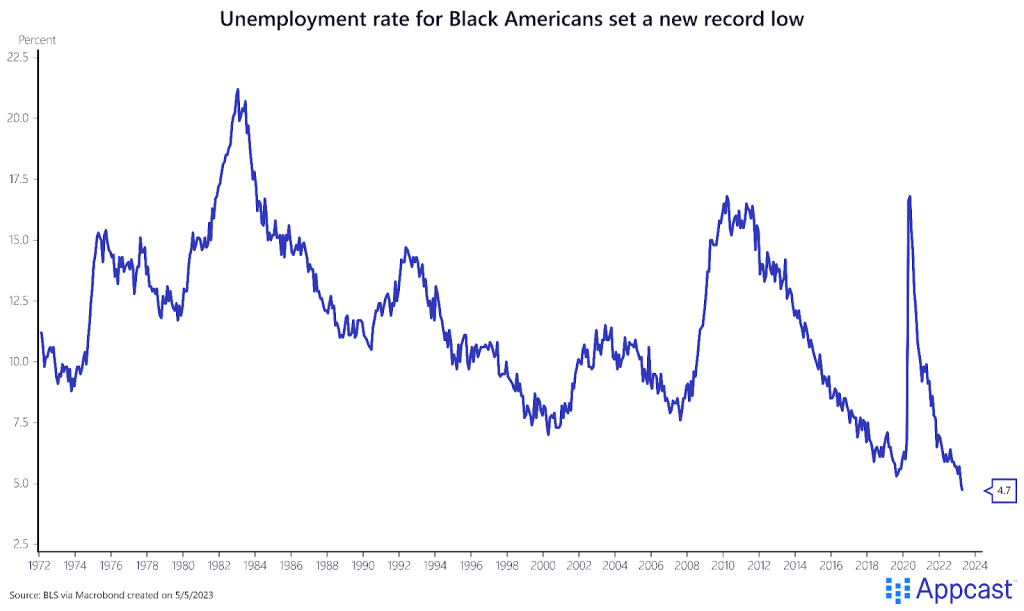

Black unemployment sets a new low

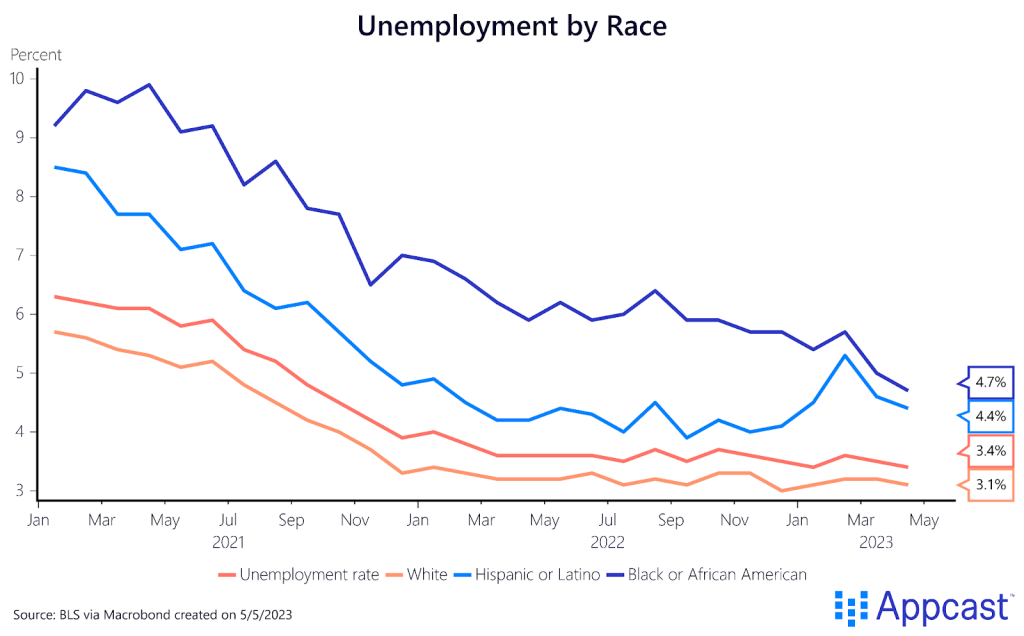

Given this full employment economy, it’s welcome news to see historically disadvantaged groups achieve historic gains. The unemployment rate for Black Americans fell sharply to 4.7%, setting a new low since the beginning of the series in the 1970s. “A rising tide lifts all boats.”

That said, disparities in unemployment by race still persist.

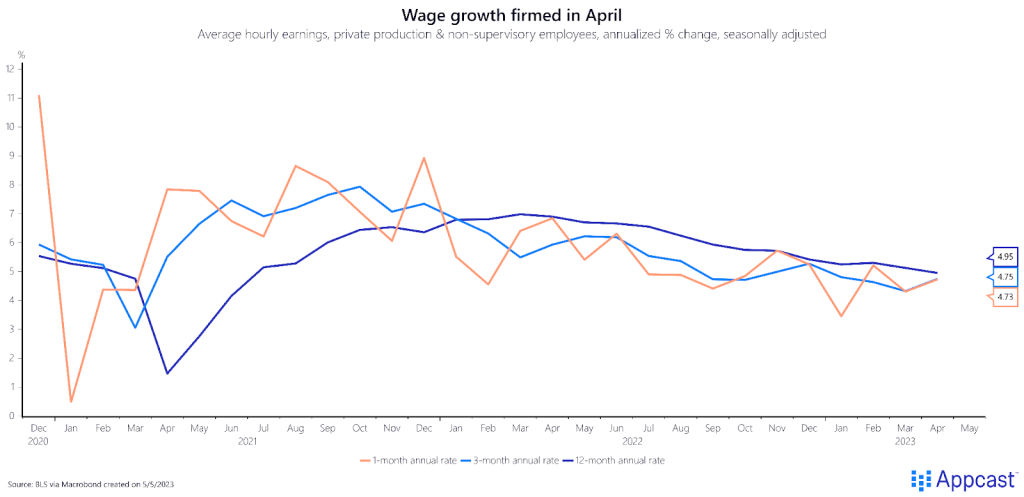

Wage growth firming up

Average hourly earnings, not adjusted for inflation, accelerated slightly in April for private sector non-managers. This is consistent with recent figures from the Employment Cost Index showing wage growth remains elevated. This could be a worrisome sign for the Fed. While earnings growth cooled on a year-over-year basis, the one- and three-month growth rates ticked up to around 4.7% (annual rates). This is clearly inconsistent with 2% inflation.

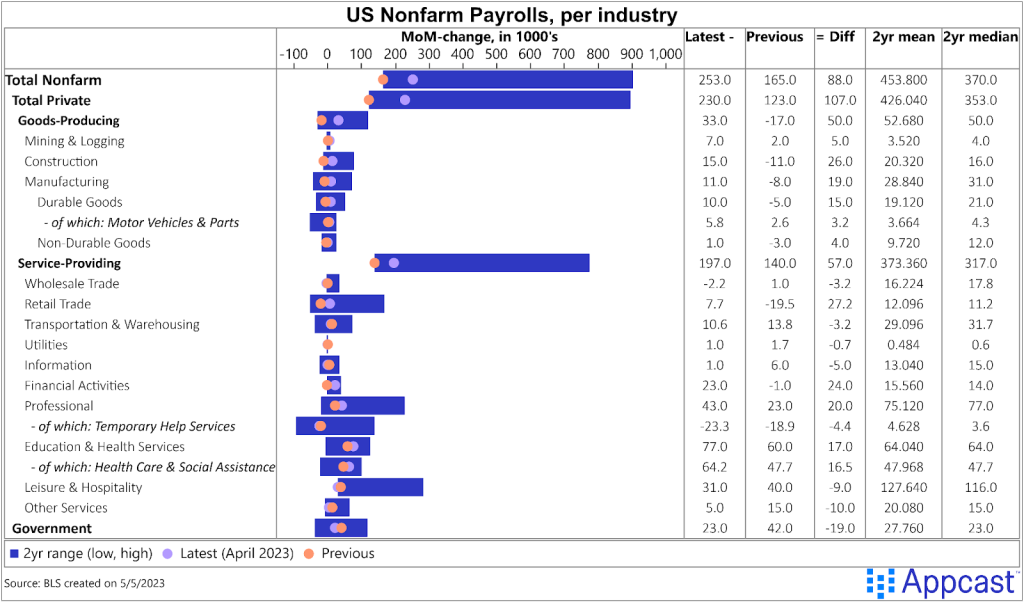

Job growth strong among services industries

Once again, service-providing sectors saw incredible gains, while goods-producing industries are puttering along. Professional and business services led the way with 43,000 new jobs; healthcare was up 40,000; and leisure and hospitality was up 31,000. Goods-adjacent sectors, such as warehousing, just barely rose (up 4,000). One sign of concern: temporary help services employment declined, perhaps a sign of slowing hiring in the future.

Conclusion

For over a year now, the U.S. labor market has exceeded expectations. While job growth is definitely slowing, it’s holding up better than forecasters expected. The rise in labor supply is a welcome sign for recruiters. We’re nowhere near a recession in the present moment. However, two potential warning signs are evident in today’s report: (1) wage growth is not cooling as the Fed had hoped, which could give impetus for driving interest rates higher and holding them there for longer; and (2) temporary help services have declined, and historically that has been the proverbial “canary in the coal mine” of future hiring slowdowns.