Eurozone inflation remains high even as supply chains are easing

There is no doubt that the eurozone suffered disproportionally from the war in Ukraine. Until a little more than a year ago, Europe’s dependence on Russian gas was extremely high. This was especially true for Germany and Eastern Europe. The commodity price shock from the war led to a significant increase in energy prices, which contributed to inflation rising to 10% across eurozone economies at the end of last year. This is significantly higher than the 2% inflation target held by the European Central Bank (ECB).

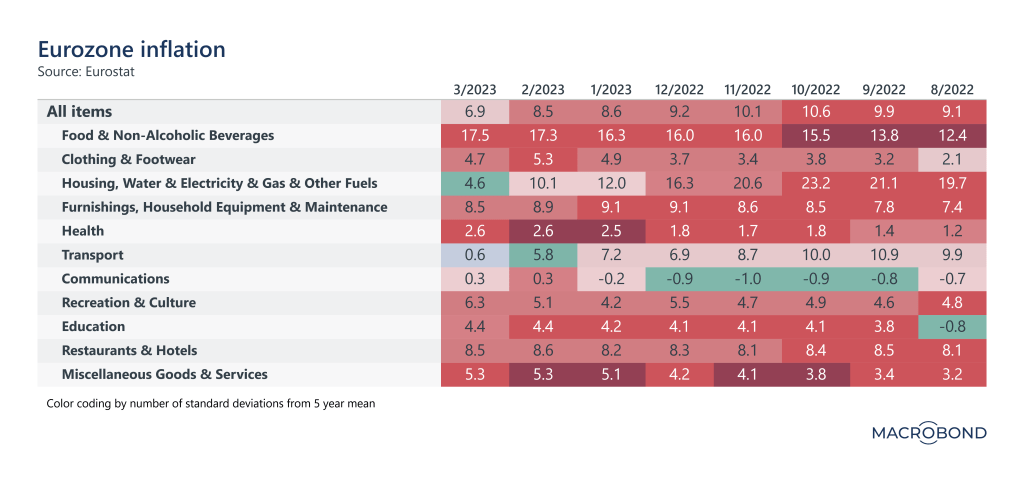

While it is especially housing, electricity and gas prices, and food prices that have contributed to the rise in prices across the eurozone last year, inflation is a broad-based phenomenon now affecting all subcomponents.

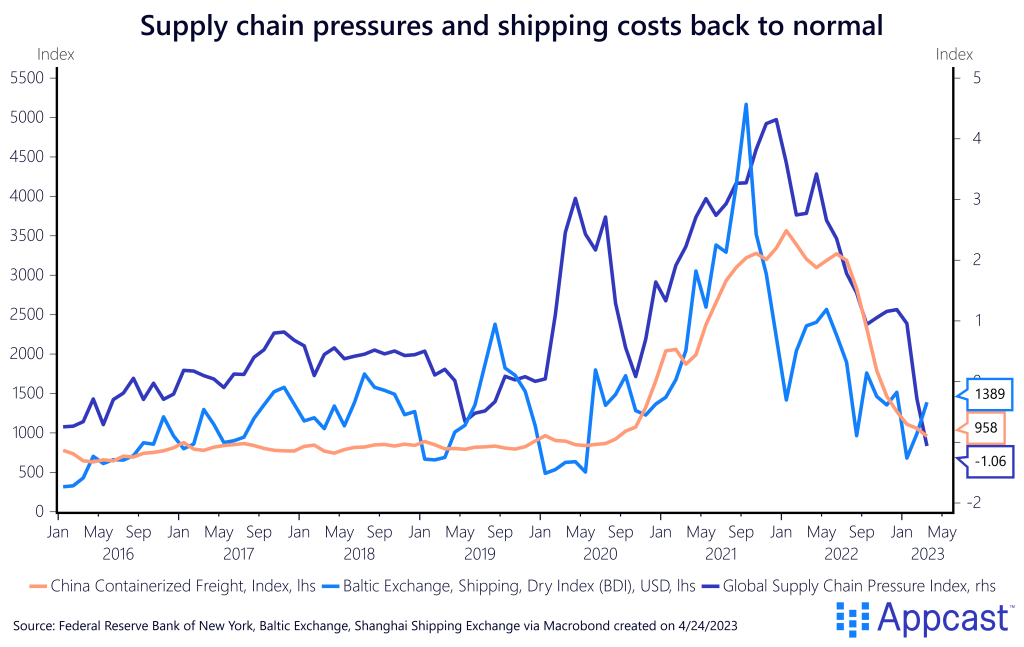

As such, it is wrong to contribute the rise in prices to commodities only, especially since global commodity prices have been falling for several months now and global supply chains have eased as well. The global supply chain pressure index from the New York Fed is back below pre-pandemic levels and global shipping prices have declined substantially.

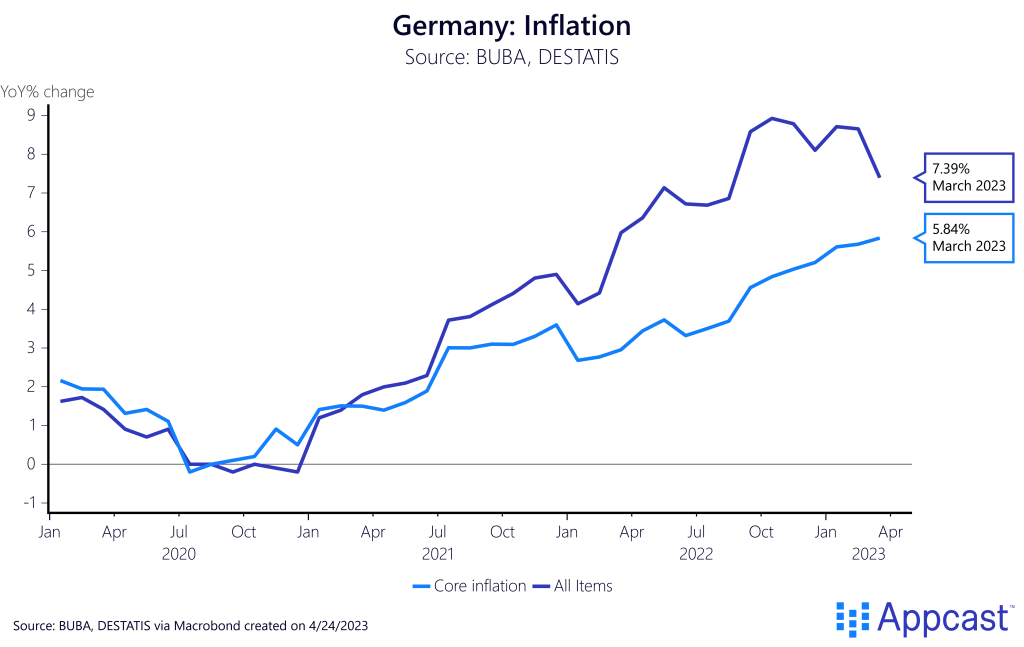

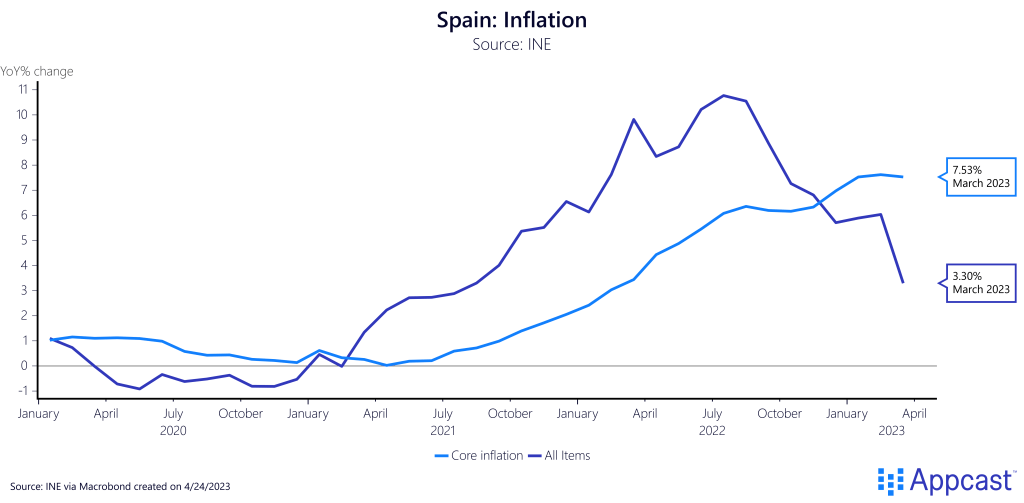

Core inflation is now higher than headline in some eurozone economies

The most recent inflation data emphasizes this point. While headline inflation is now finally declining in Germany, core inflation (stripped of energy and food prices) continues to rise. It is abundantly clear that inflation is currently driven by other factors other than commodity prices and supply chains – in fact, these two factors have been rather disinflationary since the end of last year.

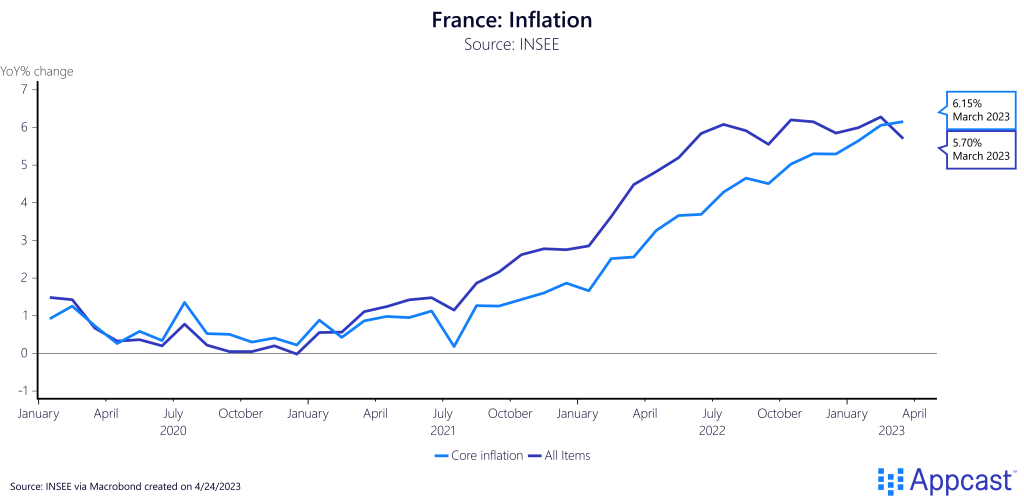

The rise in core inflation is also not just a story about Germany, even though the country has one of the tightest labor markets in Europe. Other economies in the eurozone have also seen a substantial rise in core inflation. French core inflation is now above 6% and exceeding headline inflation.

Similarly, Spanish headline inflation has been plunging for months and is now at about 3%, down from 10% just last summer, while core inflation continues to rise and is now exceeding 7.5%.

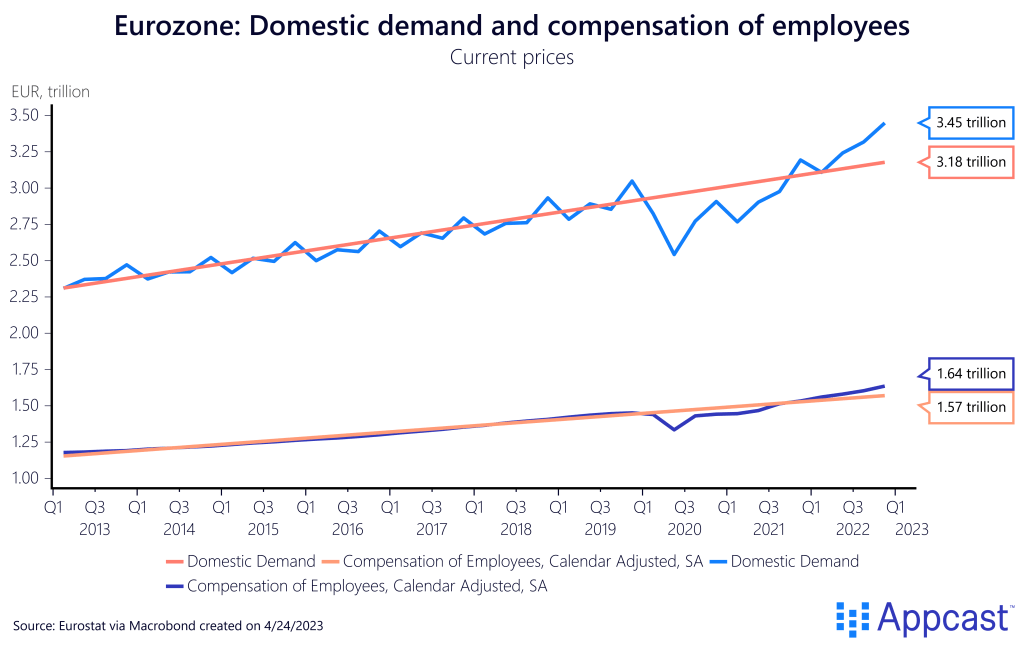

Demand is now above trend

This broad-based increase in inflationary pressures across all major eurozone economies is freaking out monetary policy makers at the ECB, and rightly so. It indicates that recent inflationary pressures are more of a demand story. And that, of course, also means that the ECB underestimated the strength of the recovery post-COVID and now needs to tighten up to fulfill its price stability mandate.

Compensation of employees is now slightly above trend for the eurozone as a whole. And nominal domestic demand is probably the best measure to capture the demand-side of the economy and was about 5% above trend at the end of 2022.

While the eurozone suffered insufficient demand for several years post-2008, it isn’t necessarily a great idea to create a positive demand shock during a time when inflation has been extremely elevated because of a global commodity price shock.

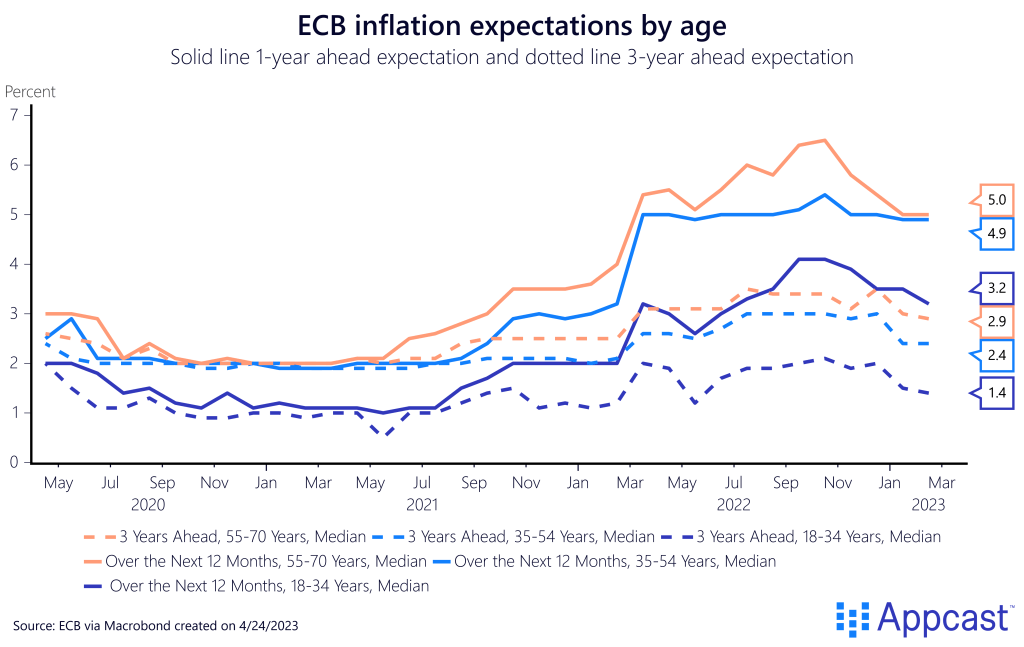

One-year-ahead inflation expectations for all age groups are still extremely elevated and way above target. Even three-year ahead inflation expectations are still above 3% for the age group 55 to 70, i.e., the generation that has already experienced inflationary episodes earlier in their lives. This should make the ECB feel uneasy, because those elevated inflation expectations feed into higher wage demands and higher prices.

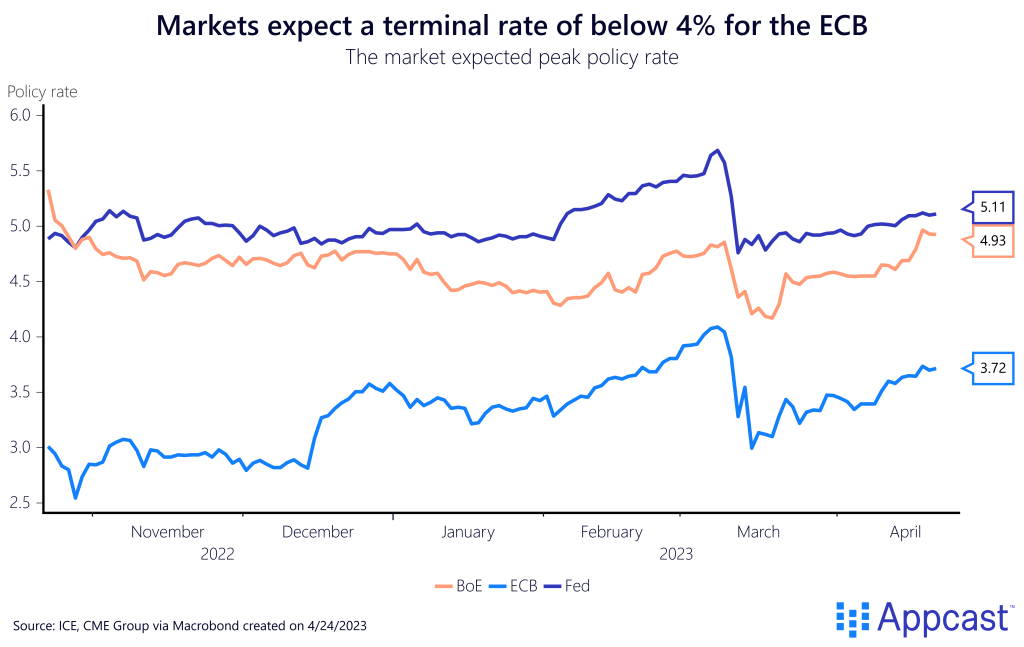

The latest macroeconomic projections show that the ECB believes it is almost done, with only two or, at most, three rate hikes to go in this tightening cycle. The current policy rate is already at 3%, and the March projection assumes a peak of 3.75%. More amazingly, financial markets are currently pricing in a peak policy rate of less than 3.6%, requiring just two more rate hikes.

While this is certainly possible, I want to issue a note of caution. More than a year ago, both policy makers and financial markets completely underestimated the demand-side pressures that would materialize during this economic recovery and, by extension, the number of interest rate hikes that would be needed from Central Banks.

While the U.S. economy is already experiencing a good amount of disinflation, the synchronized increase in the core inflation rate across eurozone economies show that inflationary pressures have not yet subsided on this side of the pond. Just as the U.S. was leading Europe by more than half a year in this inflationary cycle when prices were rising, it now looks like the same will be true on the way downward. This could open the possibility for more rate hikes from the ECB later this year, even as the Fed will already have reached its peak policy rate.

Conclusion

Core inflation across eurozone economies continue to rise even as headline inflation has now started to fall. This shows that commodity prices and supply chain pressures are not the only culprits keeping inflation high. Excessive aggregate demand is contributing to rising inflation in the eurozone right now, which is also aggravating labor shortages. Most macroeconomic projections, as well as financial markets, currently assume that the ECB only has two rate hikes to go before reaching the peak policy rate. This will not be true, however, if core inflation across the eurozone remains elevated throughout the summer.