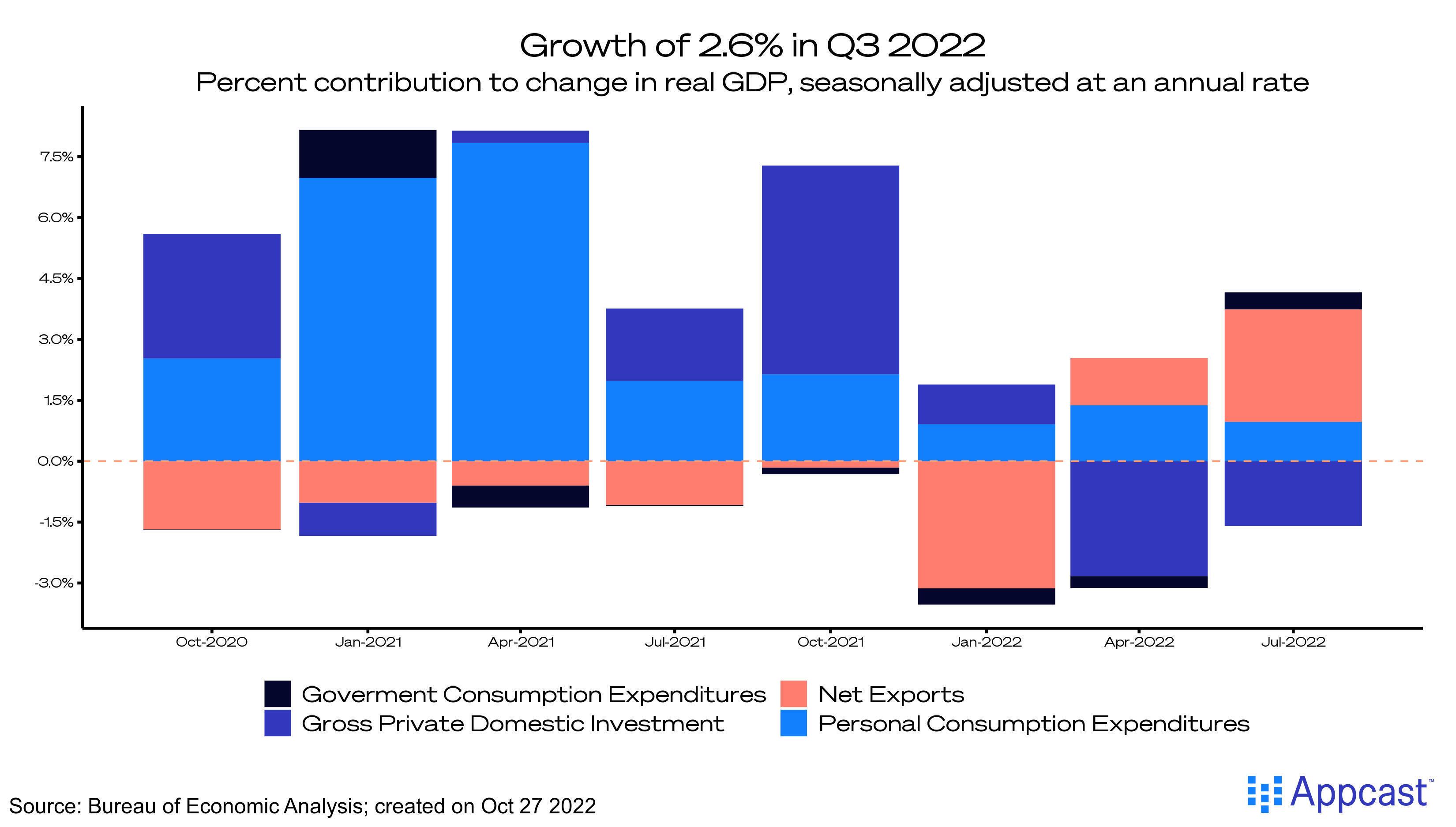

The economy grew by 2.6% annual rate in the months of July through September (Q3) 2022. This early estimate – which is often revised as incoming data comes in – beat market expectations, but was slightly below some Fed forecasting models. Earlier this year, inflation-adjusted output growth was negative for two consecutive quarters, so this quarter’s rebound was a welcomed reversal.

So, is the threat of a recession behind us? Not quite. Just like two consecutive quarters of declining Gross Domestic Product (GDP) doesn’t necessarily make a recession, one quarter of decent growth does not eliminate the odds of a recession. According to the Wall Street Journal panel of business economists, the odds of a recession sometime in the next 12 months was 63% earlier this month.

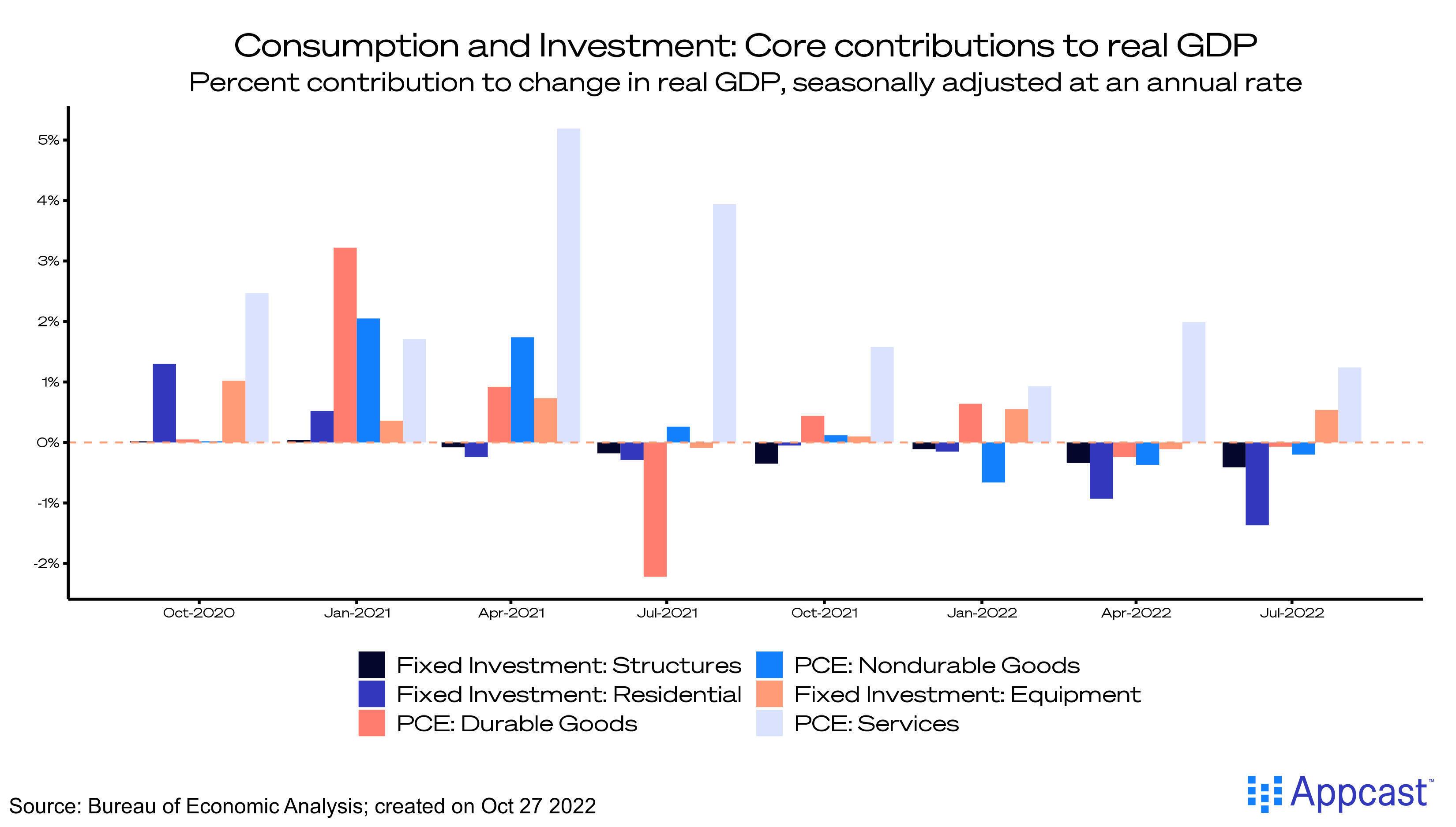

Additionally, narrowing in on the components of GDP tell us that the Federal Reserve’s efforts to slow the economy are already beginning to make their mark. Fixed investment dropped at a -4.9% seasonally adjusted annual rate (saar); a dramatic decrease in residential investment was not quite offset by a rise in nonresidential investment.

Personal consumption expenditures in the third quarter confirm the ongoing consumer demand shift between goods and services. Consumer spending on both durable and nondurable goods faltered, while services spending increased by 2.8% (saar).

Consumers, however, pulled from their savings to fund continued strong consumption: the savings rate was just 3.3%, and personal savings fell by $2.9 billion from the second quarter.

The largest contributor to growth last quarter was net exports – but the notoriously volatile measure cannot be relied on to bolster GDP growth while investment slows.

The report was positive overall. The stark decline in residential investment shows the Fed’s goal of slowing the economy is most definitely underway. But inflation is still too hot to handle – in the Fed’s eyes, it is still too early to forgo tightening policy. Solid evidence on slowing rates of inflation will be a more convincing turning point on interest rate hikes, but this report may convince the Fed of a slower rate of increase moving forward.