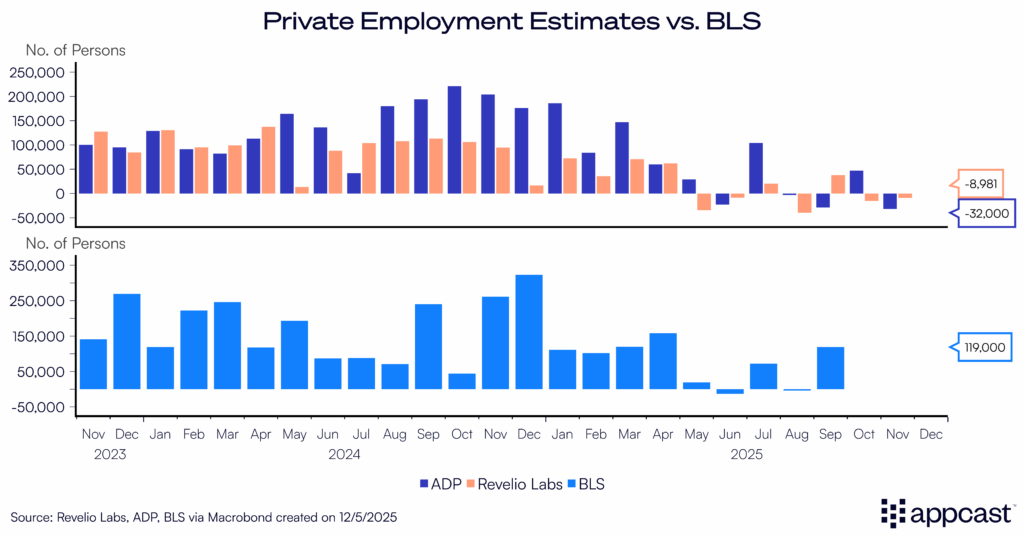

Jerome Powell and the Federal Reserve face a high-stakes decision on interest rates next week without their most trusted source of labor market data: the Bureau of Labor Statistics. With the October and November employment reports delayed until December 16th, the Fed may need to lean more heavily than usual on private-sector indicators from ADP and Revelio Labs.

ADP’s November report shows a meaningful slowdown, with the economy shedding 32,000 jobs. The pullback was concentrated among small businesses with fewer than 50 employees.

Weakness remains most pronounced in “sitting down” jobs: the Professional and Business Services and Information sectors together lost 46,000 positions. Meanwhile, demand for in-person “standing-up” roles continues to be the labor market’s strongest pillar, with healthcare and hospitality posting steady gains.

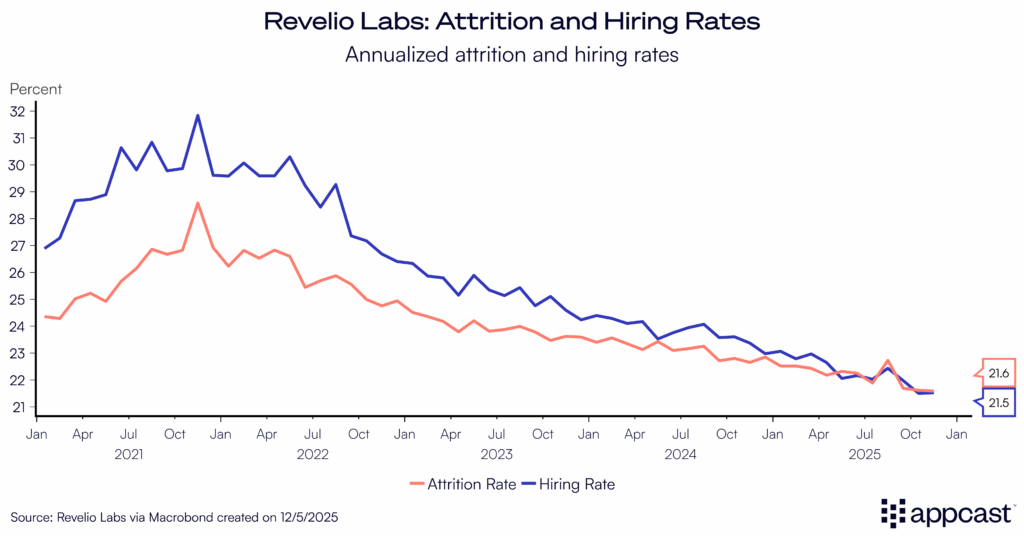

Revelio Labs data also suggests a similar trend as their estimate of employment growth showed a decline of 9,000 jobs for November. Perhaps the most concerning component of the data release is the trend on hiring and attrition rates, which slipped further this month to 21.5% annualized. Workers are increasingly hesitant to find new opportunities due to broad economic uncertainty, pushing down hiring across the board.

Two forces appear to be driving the hiring slowdown: persistently high interest rates and heightened economic uncertainty, both amplified by the 43-day federal government shutdown that ended November 13th. It’s possible that November represents a temporary disruption rather than the start of a deeper downturn, and that the labor market is settling into a slower (but still positive) trajectory compared to 2024.

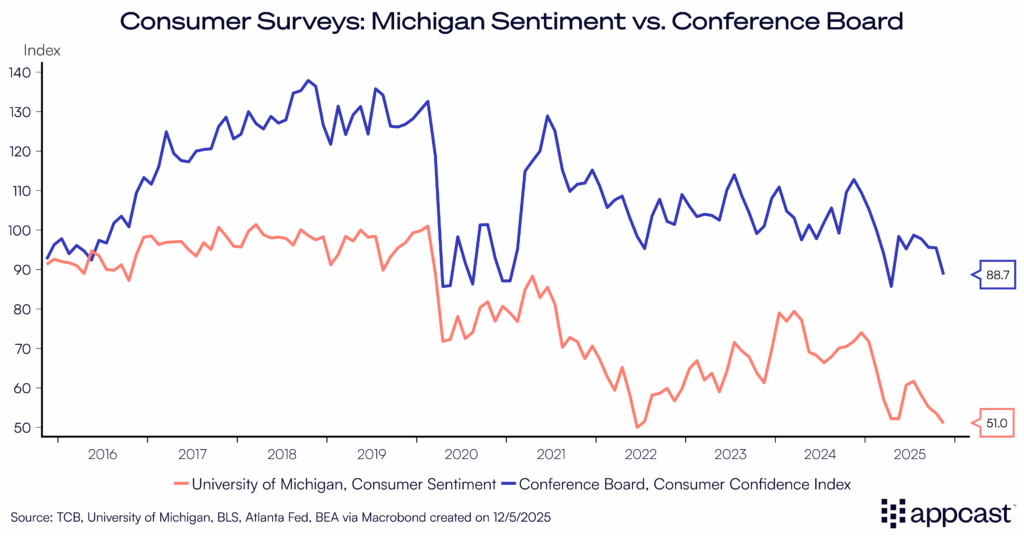

Broader economic signals remain mixed. GDP growth is tracking at a strong 3.8%, suggesting no imminent recession. Yet consumer confidence, according to both the Conference Board and the University of Michigan, has deteriorated sharply. Michigan’s index fell to its lowest level since 2022, with many consumers citing unexpected costs related to new tariffs. The lapse of the de minimis exemption on imports under $800 has increased household exposure to duties, particularly during the holiday shopping.

Before the Fed’s decision next week, we will get one more important data release from the BLS: the Job Openings and Turnover Survey (JOLTS). This data will show changes in job postings and hiring for September and October, but more importantly: layoffs. Challenger & Grey’s Announced Job Cuts data indicated a significant spike in layoffs in October, and the JOLTS report will be the first official measure to compare against.

If the October JOLTS data reveal a meaningful rise in layoffs, it may raise alarms inside the Fed and nudge more policymakers toward additional rate cuts. If the data instead shows a low hiring but low firing labor market, the Fed may choose to discount private-sector data volatility and wait. Markets currently expect a cut, with CME futures pricing in an 87% probability.

The Fed enters next week’s meeting with an unusually incomplete picture of the labor market. Whether November was a temporary pause or the start of broader weakness will shape the path of rate cuts. All eyes now turn to the JOLTS report, one of the few remaining signals the Fed will have before making its call.