The British growth malaise

One of the bigger puzzles in macroeconomics is the productivity stagnation that has taken a hold on advanced economies. Despite all the technological improvements, productivity growth has been extremely slow since the early 2000s. The U.K. has been particularly severely affected by this malaise with productivity advancing at a snail’s pace since the Financial Crisis.

Productivity in the U.K. is now more than 15% below pre-crisis trend, which matters tremendously because productivity growth is by far most important factor affecting living standards. Inflation-adjusted incomes have been extremely stagnant in recent history precisely because U.K. workers have not become meaningfully more productive over time.

Some researchers have suggested that bad productivity numbers are simply a measurement problem. Modern economies have become more service-centered and productivity improvements in services are hard to capture—and the same is probably true for the internet economy. However, this begs the question: why have living standards and wages failed to increase as well?

Another possibility is that innovation is declining because humanity has already created so much knowledge that it becomes incrementally harder to come up with pathbreaking inventions. However, recent medical advances and the emergence of AI seem to be contrary examples.

In what follows, I will suggest an alternative barrier that has constrained economic growth: the screwed-up housing market and its negative impact on the labor market.

The Great British Housing Shortage

House prices in the U.K. have far outpaced incomes for several decades, the last three years being the notable exception. As a result, residential real estate has increasingly become unaffordable—especially for younger people. The price-to-income ratio for houses in England has more than doubled from less than 4 in the late 1990s to over 8 in 2024.

Housing unaffordability has been most severe in the capital, with parts of London boasting house price-to-income ratios of 15 above. The average house price increased from less than £300,000 in 2008 to more than £532,000 more recently.

The London premium

One of the main drivers behind unaffordability in housing is that the phenomenon of superstar cities has become even more pronounced in recent decades. A few metropolitan areas have been able to attract the best workers in tech, finance, real estate, marketing and media. While the incomes of these high-skilled white-collar workers have soared in places like London, boosting local house and service prices, other regions have increasingly been left behind. As a result, London now commands a substantial house price premium. The region generates more than 22% of U.K. GDP,while its population share is only 13%.

The importance of access to the London labor market also shows up in national house price data. A very simple analysis of the largest 100 cities in England (plus some 20 London commuter towns) shows that 60% of the house price variation can be explained by one single variable: commute time to London. While the average house price for London commuter towns with a travel time of 30 minutes stands at £415k, each additional 30 minutes reduces local house prices by roughly £50k.

The Elizabeth line: A rare infrastructure success story

One of the most successful U.K. infrastructure projects by a mile (or 118, to be more precise) was the construction of the Elizabeth line, which runs across Greater London. It allows for a much faster commute into the city center and connects several London boroughs and commuter towns like Slough and Reading in the West, and Shenfield and Stratford in the East of London. With more than 600,000 daily passengers and 220 million annual passengers, capacity is much higher than anticipated.

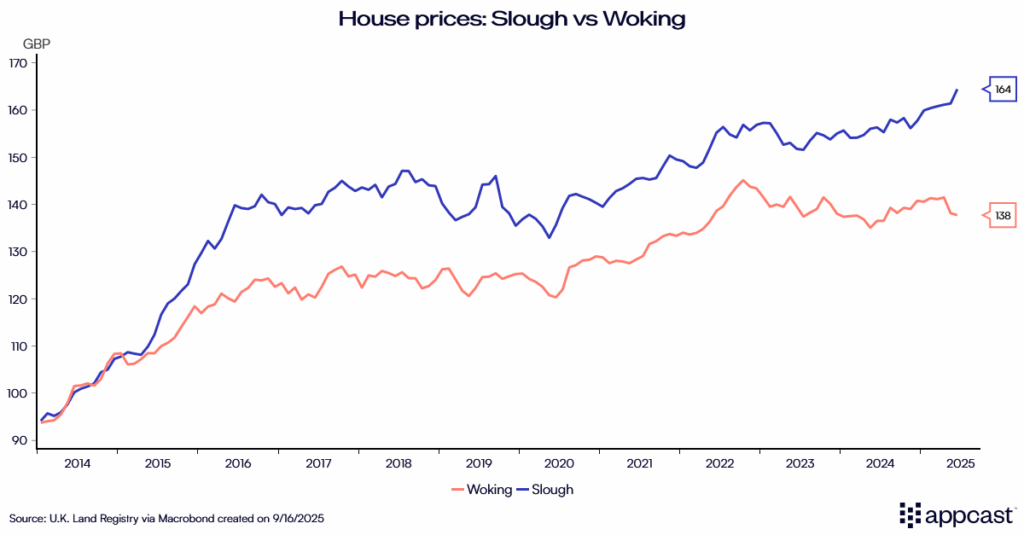

House prices in areas around Elizabeth line stations were already appreciating several years before completion in anticipation of better connectivity. Comparing Woking with Slough is informative here. The former already enjoyed a decent train connection into the City. With the Elizabeth line, travel time from Slough to the center was cut in half, leading to a substantial surge in local house prices (and rents).

The case for HS2?

Building HS2—the high-speed train connecting Birmingham to London—is a good idea, in theory.

Full disclaimer: The author has some vested interest. My wife and I recently bought a property in Solihull, a 12-minute car ride to Birmingham International Train Station. Based on the simple graph above, the reduction in commute time from currently 70 minutes to Euston down to 45 minutes could easily boost house prices in Solihull by more than 15% in the long run. East Birmingham/Solihull would effectively become commuter towns.

Improved connectivity with London improves local living standards by giving more workers access to the London labor market. And just like me, some Londoners might opt out of the ridiculous housing market in the capital and decide to relocate to cheaper pastures in the Midlands. All of this means that house prices around future HS2 stations are bound to increase.

While Birmingham’s economy could grow by billions of pounds, economic costs obviously must be considered, too. As it stands, the 100-mile stretch of high-speed rail will cost potentially more than 80 billion pounds. And with the extension to other large English metropolitan areas (Manchester / Leeds) being scrapped, the nationwide benefits will remain extremely limited. All in all, a rather disastrous outcome.

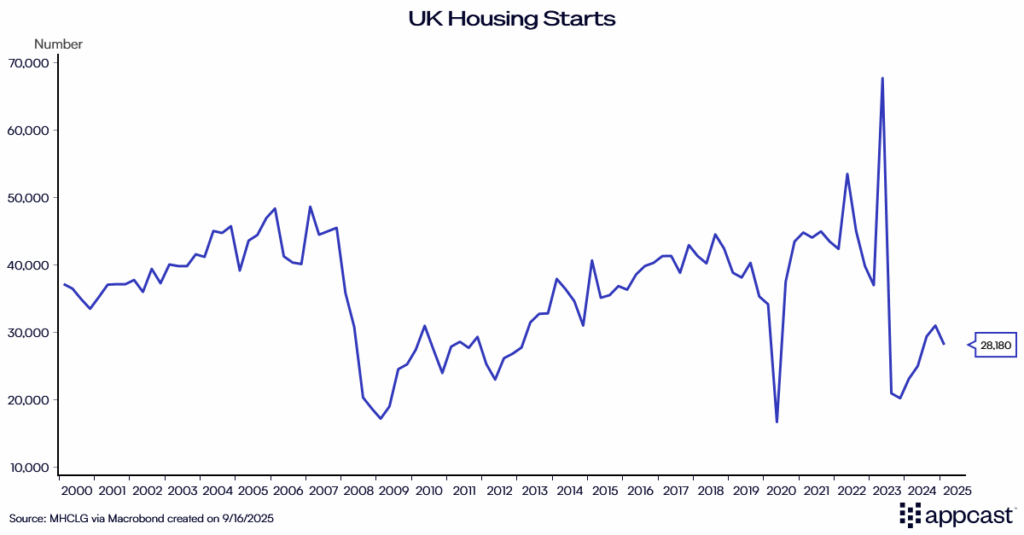

Infrastructure needs to be complemented by a national housing strategy

While the potential economic benefits of expanding the London labor market with improved connectivity to Birmingham are considerable, it needs to be complemented by a national housing strategy. London’s housing shortage cannot just be solved by shifting demand to other areas without addressing the lack of supply. For context, the U.K. is missing several million housing units relative to its population size. Despite record levels of net immigration, national housing starts have cratered in recent years (especially in London). While Labour’s attempt to tackle planning reform might be a good start, current proposals are short of what’s needed to solve the national crisis.

The case for flexible work and what it means for recruiters

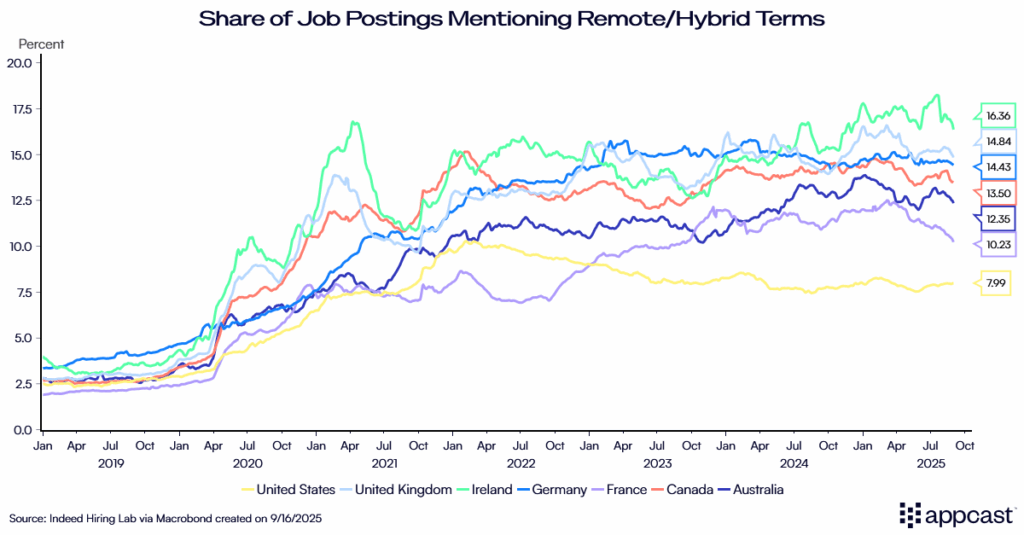

Realistically, extending the London labor market to other parts of the country can only work if remote/hybrid work continues to thrive. Speaking for myself, I wouldn’t have moved out to the Midlands if I had to be in office more than twice a week because frankly speaking the exhaustion and cost of the lengthy commute would be too high. While there certainly has been some pushback from large corporations, the truth of the matter is that hybrid work won’t go anywhere. In the U.K., a solid 15% of job postings mention remote/hybrid right now with no downward trend in sight.

Research shows that several working days from home might be equivalent to up to 25% of the workers’ salary. What that means is that companies ordering a full-blown return to office mandate should expect higher churn—a worker exodus if you will—if they are not careful.

It also means that smaller employers who are unable to match the compensation package larger competitors afford can stand out by offering a more flexible workforce strategy since employees highly value working from home and are willing to accept large salary discounts to obtain this benefit.