What can we expect from the U.S. labor market going into 2024? Beige. Yes, beige, the boring color.

Since COVID-19 hit in 2020, the economy went from an ominous red to a neon green, a whipsaw that is only now starting to normalize. Yes, the “soft landing” that most economists didn’t expect – though we did! – has begun to look more and more likely: Inflation has trended down, while layoffs have remained low.

This morning’s jobs report for December 2023 showed a resilient strength in hiring and a still-low unemployment rate. Expect a more boring set of indicators in 2024 – expect more beige.

Reviewing 2023

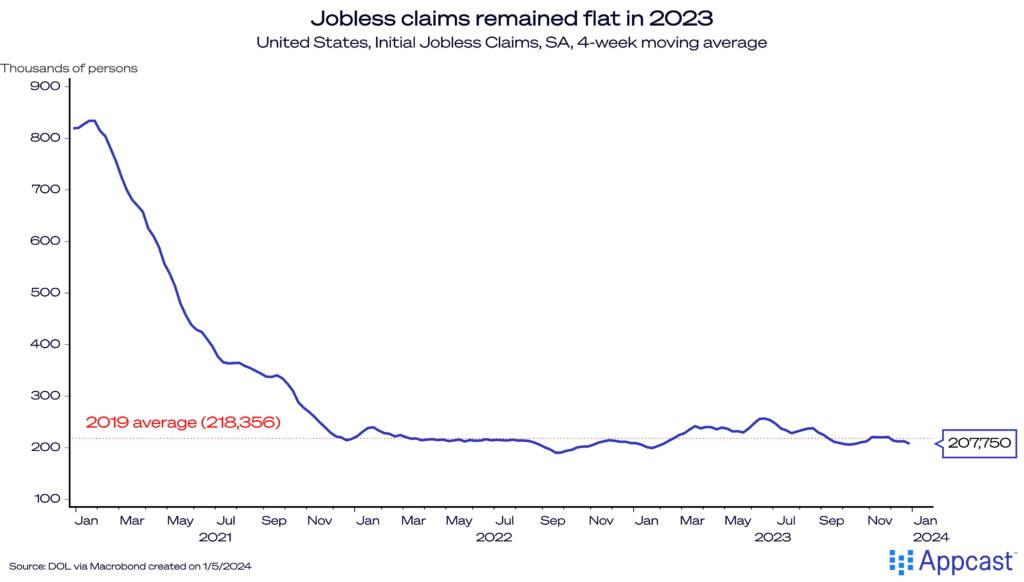

Before we dive into the latest jobs report, let’s take a moment to reflect on last year. About a year ago, I mentioned two charts on the U.S. labor market that I was going to keep a close eye on in 2023. The first was to monitor layoffs: initial jobless claims. Throughout the year, claims remained subdued at a low level. There was no broad spike in unemployment, despite the headlines of tech-related layoffs.

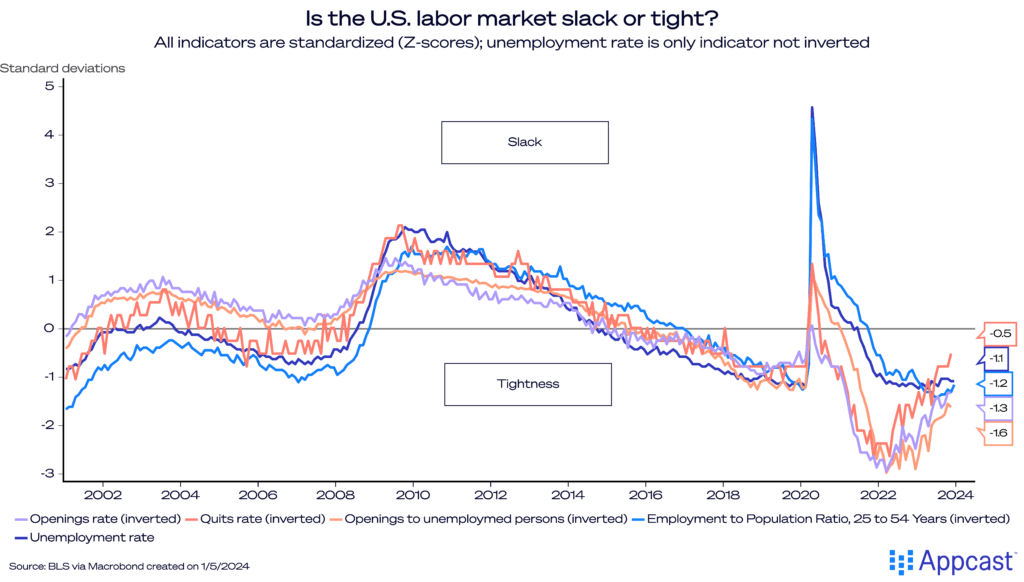

The second chart was a bit more complicated. Inspired by the work of Jason Furman and Wilson Powell III, the graph below plots five indicators of labor market tightness – from the unemployment rate to the prime-age employment-to-population ratio. These indicators are standardized (using Z-scores) to allow for an apples-to-apples comparison. Four of the five indicators normalized throughout the year, moving closer to a “slack” labor market, while still remaining “tight” (just less so than a year ago). Taken together, these two charts confirm that the U.S. labor market softened in 2023 without a rise in layoffs. Impressive and very much consistent with a “soft landing.”

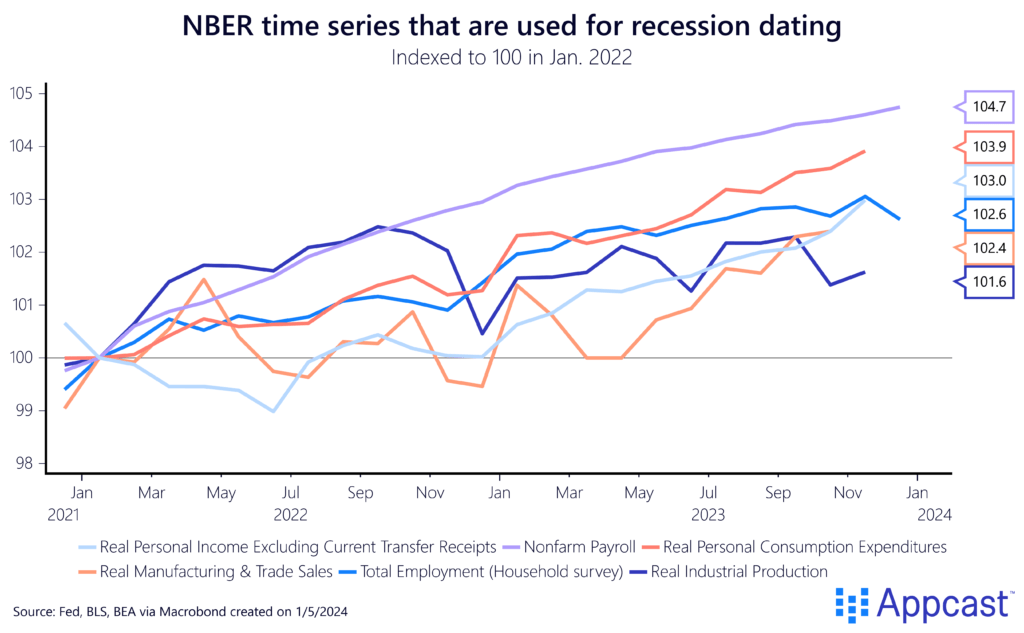

Beyond just the labor market, look at other economic indicators throughout 2023. In early 2023, talk of an imminent recession dominated the economic discourse. I wrote in March 2023 how I did not think a recession was coming. My proof? Just look at the six indicators tracked by the Business Cycle Dating Committe at the National Bureau of Economic Research (NBER), which dates the start and end of recessions in the U.S. These indicators include some measures of the labor market’s health, but also personal income and spending, manufacturing, etc. Across-the-board, there was no sign in 2023 of broad-based weakness in the economy. Clearly the U.S. has avoided a recession (so far).

December 2023 jobs report recap and what to expect in 2024

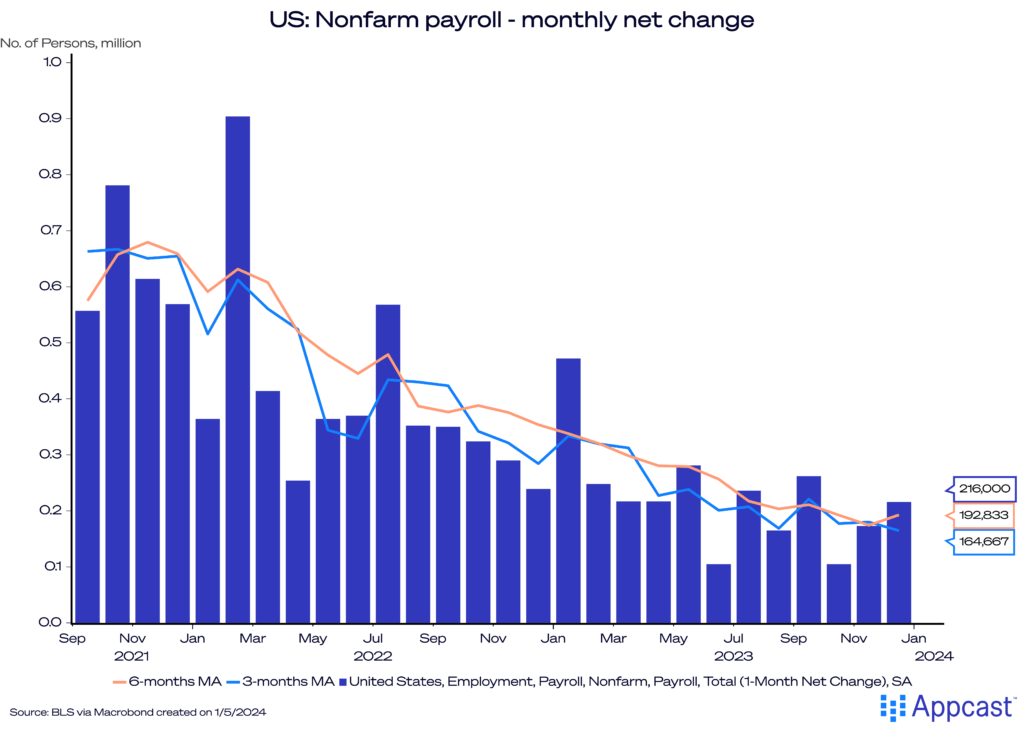

Expect hiring to slow, but with no dramatic reversal toward job losses. Nonfarm payroll gains slowed throughout the year, but in December 2023 the U.S. labor market added 216,000 net new jobs and the unemployment rate remained unchanged at 3.7%. This is strong momentum as we move into a new year. The definition of spike has shifted in the past two years, though: In 2022, that meant several hundred thousand more jobs were added than the month before. Now, as we move into beige territory, that just means a couple tens of thousands more.

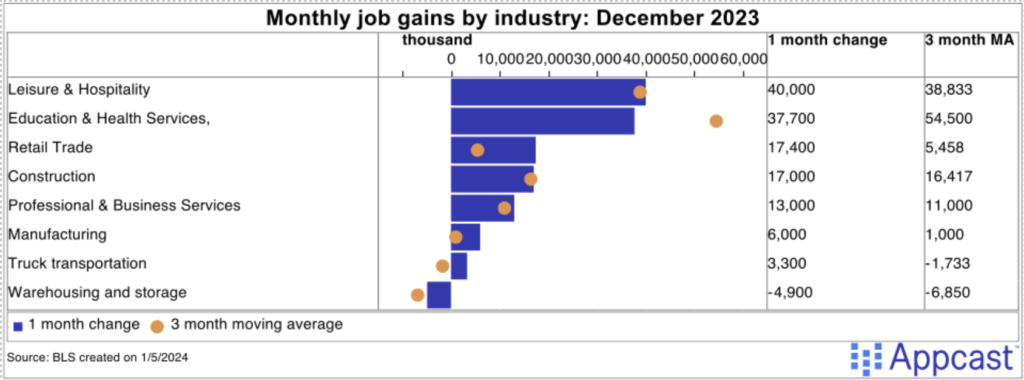

Healthcare and government continue to be the main powerhouses of the labor market, but other sectors have also held up comfortably. Construction, for example, was set to struggle from rising interest rates but has instead made solid gains in recent months. The “tech-cession” has ended, as the information sector added 1,400 jobs in December.

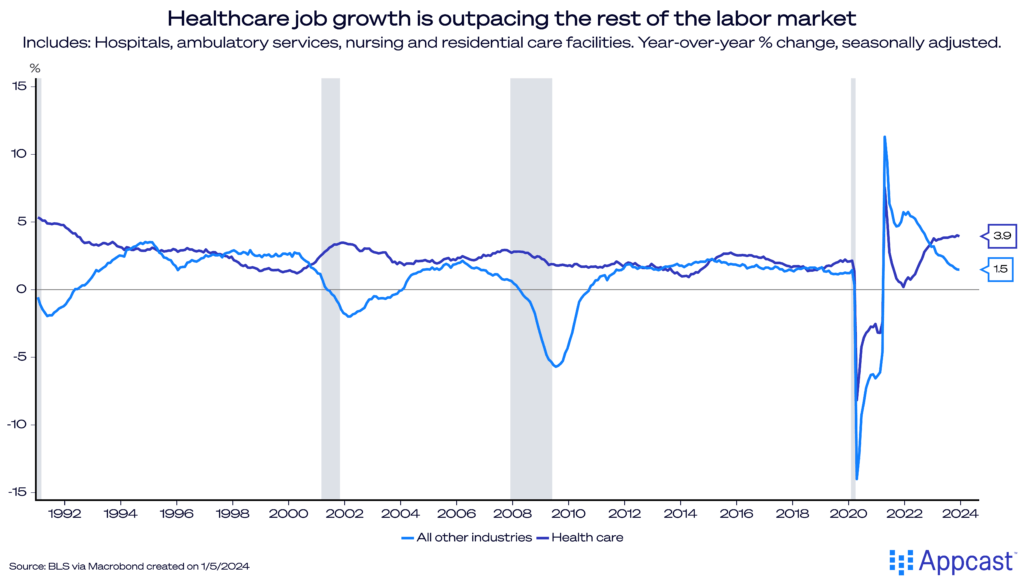

It’s particularly noteworthy how healthcare job growth has accelerated even as non-healthcare job growth has weakened. Year-over-year, healthcare jobs grew by nearly 4%, while the rest of the job market rose by just 1.5%.

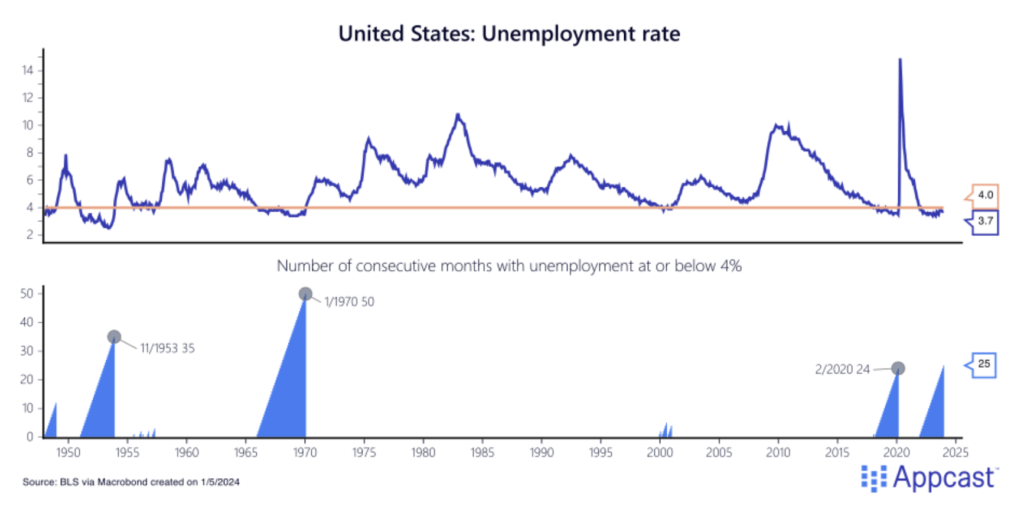

The unemployment rate remained steady at 3.7% in December, adding to a long streak of 4%-or-below unemployment. This is now a 54-year record!

Conclusion: What does this mean for recruiting in 2024?

In conclusion, our prediction for 2024 at Recruitonomics is a “soft landing” (no recession) but more boring labor market indicators: Hiring will continue to slow, turnover will continue to decline (“The Great Resignation” fully fades), and wage growth will continue to moderate.

For recruiters, and talent acquisition and HR leaders more broadly, what does this mean? Probably less competition and reduced recruiting costs to boot. The supply of job seekers is hard to predict, but the strong rebound in 2023 was an encouraging sign.

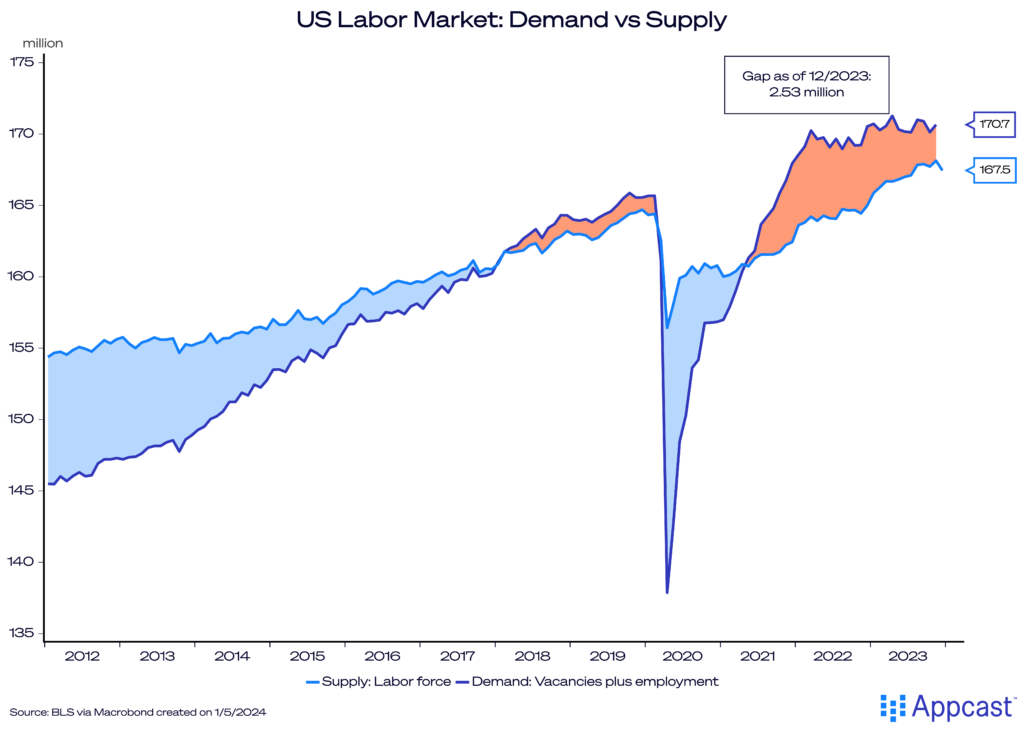

Let’s go back to Economics 101: Supply and Demand. Labor demand continues to exceed supply by about 2.5 million in December. But this gap is narrowing. Despite the growth in labor force participation over the year, the labor market remains unbalanced, with fewer people looking for jobs than there are jobs available. As the population continues to age, this trend is likely to continue, barring an increase in productivity. Expect the orange area here to shrink as 2024 progresses.

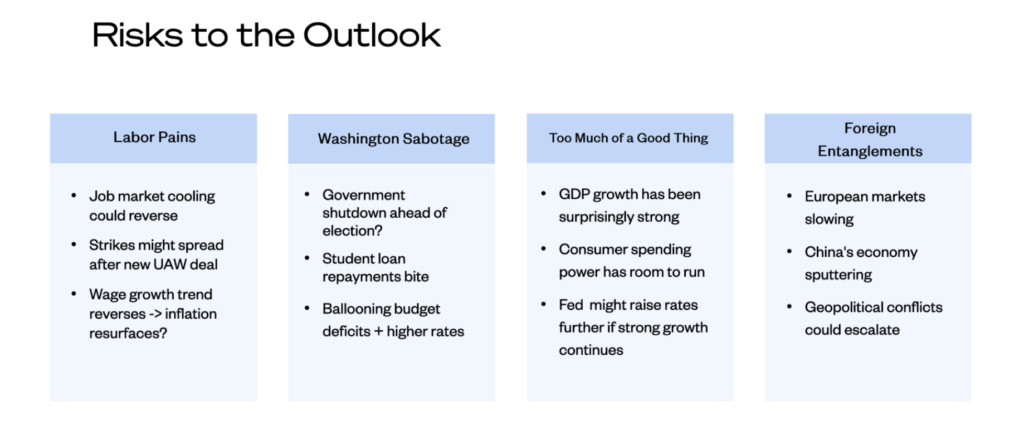

However, there are risks to the outlook. Below we detail four of them. Barring a severe government shutdown or geopolitical escalation, the greatest risk is the economy re-heats – the “Too Much of a Good Thing” scenario. Above-trend GDP growth, should it continue alongside surprisingly robust job gains, could tip the Fed’s hand into forestalling rate cuts (or perhaps even resuming hikes).