Today’s jobs report, for January 2025, was not your typical jobs report. Beyond the monthly job gains and unemployment numbers, historical revisions were released that transformed our view of the recent past of the U.S. labor market, while providing insight on the present and future trends.

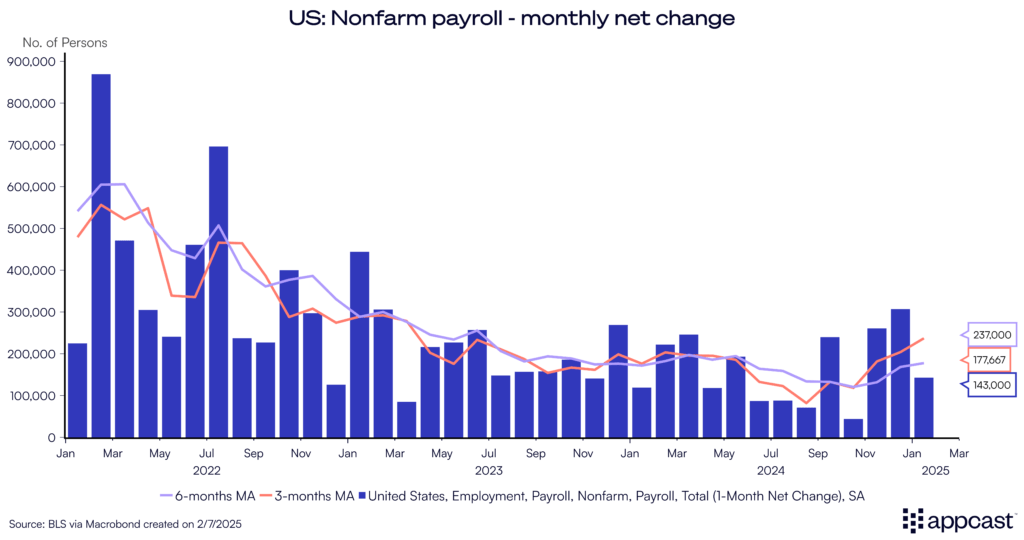

Overall, employment rose by 143,000 in January and the unemployment rate ticked down slightly to 4.0%. So overall the labor market remains in solid shape going into 2025, although the recent past (2023 to 2024) shows a slightly weaker trajectory than before.

Watch my colleague Sam Kuhn’s main takeaways, and read my thoughts below:

Past: Jobs-to-workers gap smaller

The key takeaway from the historical revisions is that 2023-2024 U.S. labor market was less tight than we thought. In other words, the gap between labor demand (jobs) and labor supply (workers) was smaller. Let’s unpack each of these revisions: job growth was marked down and the labor force revised up.

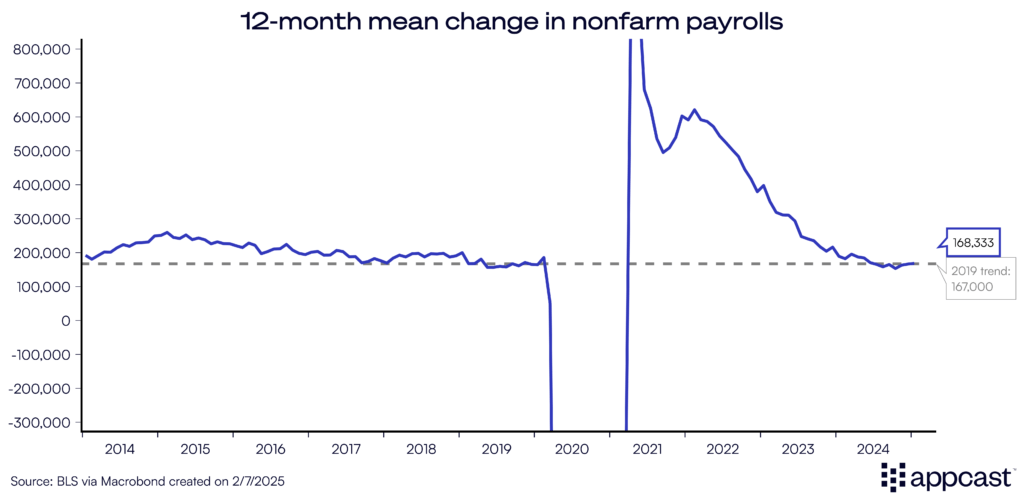

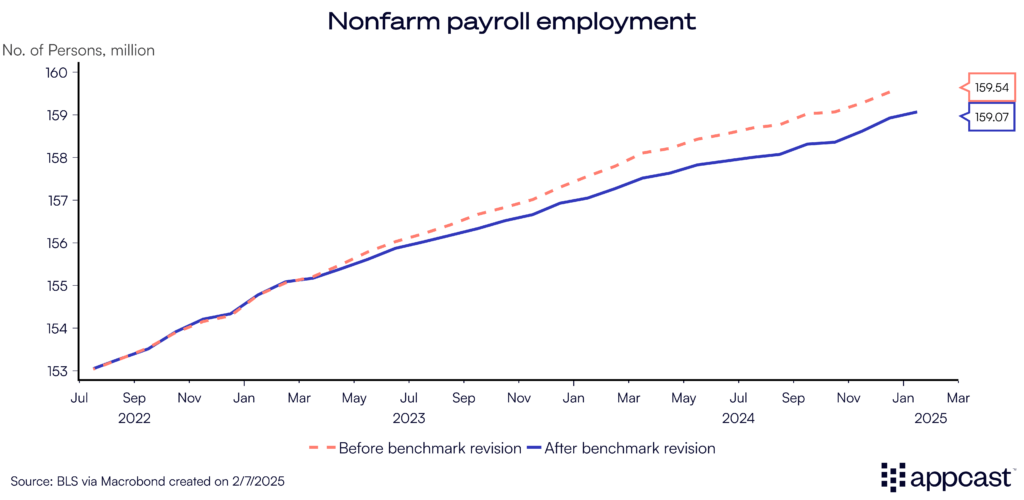

First, employment growth was marked down. Job growth in the 12 months through March 2024 was revised down by 589,000, so monthly job gains were actually about 50,000 lower per month than initially reported.

Wonky details: Every year nonfarm payroll employment undergoes a “benchmark revision” where the numbers from the Current Employment Statistics (a survey of employers) is revised to account for more accurate but delayed data from state unemployment insurance agencies. Last August’s preliminary revision was substantial—over 800,000 jobs. The full benchmark revisions today were less dramatic, but still negative.

Second, labor force numbers were revised up dramatically. This was principally a reflection of that the influx of immigrants was far greater in recent years than initially reported.

Wonky details: The Current Population Survey (which produces indicators like the total labor force and the unemployment rate) adjusted its population counts with the latest Census population figures. This boosted the reported level of employment by more than two million; however, this jump isn’t driven by a sudden surge in employment. Instead, it reflects an updated estimate of immigration that was previously undercounted.

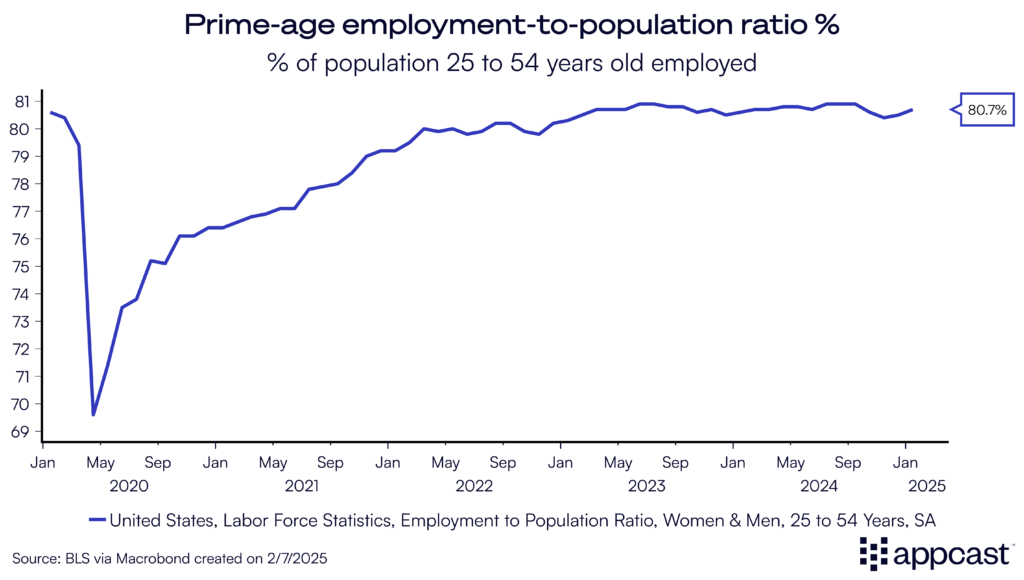

That said, the upward revisions to the labor force did not change the basic indicators we track, such as the prime-age employment-to-population ratio. At nearly 81%, the share of 25-to-54-year-olds who are employed remains high historically, even if the level of our population has been revised up dramatically.

Present: A strong, but moderating labor market

Looking forward, the 2025 labor market is moderating, with a near-perfect balance of job gains and labor force growth. Average monthly job growth over the last three months through January 2025 stands at 237,000, an acceleration from last year’s trend.

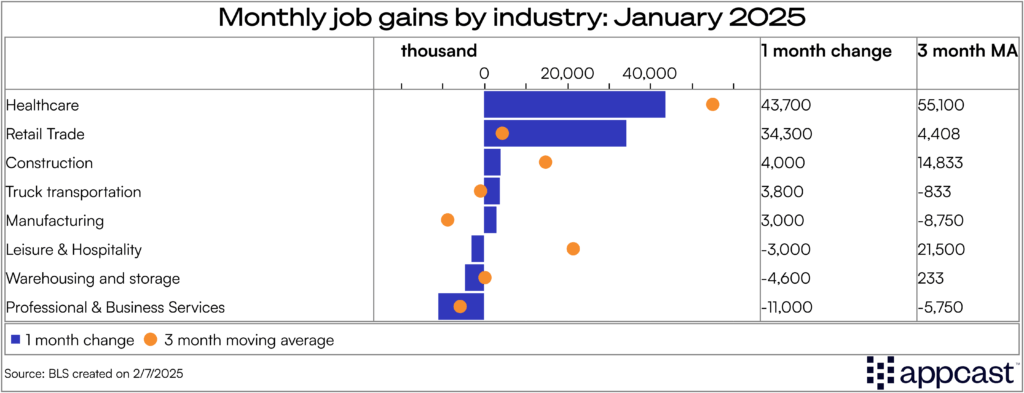

Industry breakdown: The composition of job growth continues to be healthcare heavy. Retail has had a strong few months recently. Job growth was slightly more broad-based in January than it had been in recent months. While that’s a good sign, because labor market growth concentrated in a few industries is perhaps more precarious, the bigger picture is that most industries outside of healthcare are seeing a tapering off in hiring.

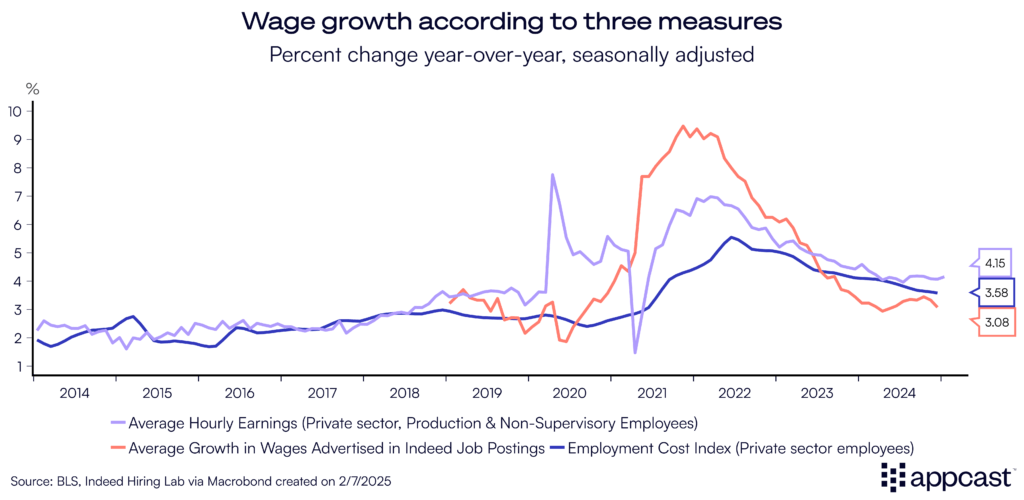

Wages: Wage growth seems hot, but the Federal Reserve and other inflation watchers shouldn’t fret. Average hourly earnings have ticked up to around 4% year-over-year – a level that would normally trigger concerns about overheating. However, severe weather in January limited hours worked in some key industries (like utilities), and that composition change explains some of the strong earnings growth. Moreover, recent productivity reports have been strong, suggesting that strong nominal wage growth can be sustained without raising inflation.

Future: Risks on the horizon

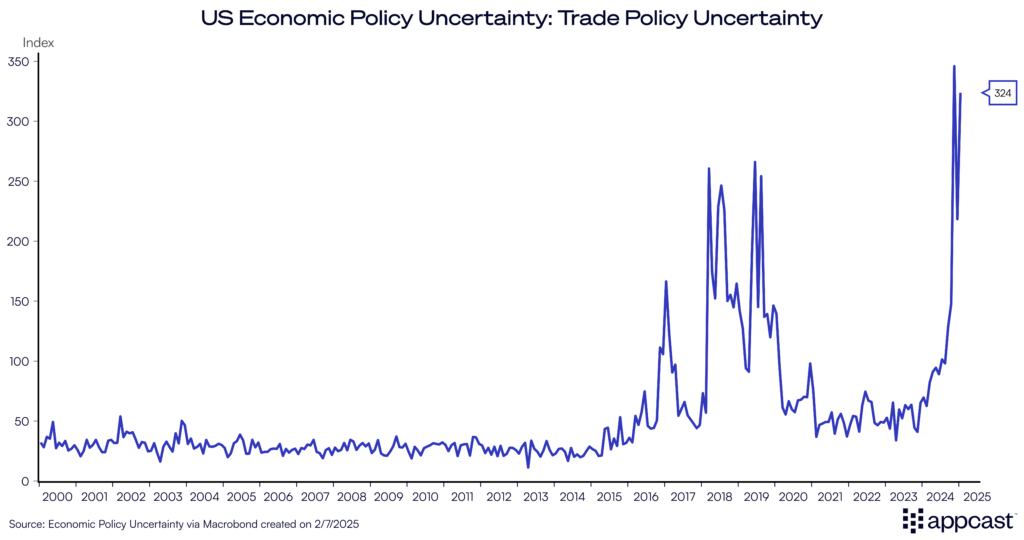

The future is always uncertain, but its particularly hazy for the U.S. labor market at this juncture. President Donald Trump threatened Mexico and Canada with punitive tariffs, before issuing a 30-day delay this week. Additional tariffs on China went into effect, and China retaliated this week. Indicators of trade policy uncertainty have spiked. The lack of clarity on tariffs can itself cause businesses to pull back on investment plans. That would cause job growth throughout this year to suffer, even if the tariffs implemented are rather modest. The theater of negotiating tactics that threaten tariffs is an impediment to job growth.

Policy uncertainty aside, the labor market is in near-perfect balance, with a healthy supply of new workers and job gains. The 12-month change in employment exactly matches the 2019 trend.