Correction (April 18, 2023): An earlier version of this article reported that car production in Germany peaked in 2022. It peaked in 2012. We apologize.

Correction (July 26, 2023): In an earlier version of this article, we reported that cars and car parts represent 16% of total GDP. Actually, cars and car parts make up 16% of total exports. We apologize.

From one of the best to worst-performing Euro area economies

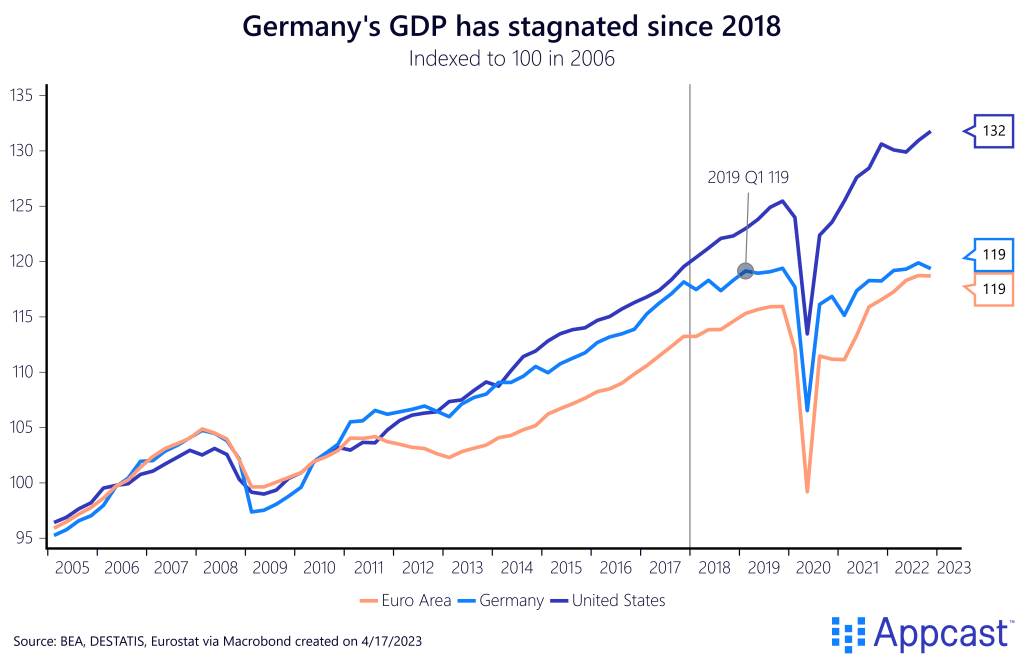

The financial crisis of 2008 and the subsequent Euro area crisis led to a prolonged period of stagnation, especially in Southern Europe. Euro area GDP has performed significantly worse than that of the U.S. in the decade post-2008. While the U.S. is also experiencing faster population growth, even on a per capita basis, Europe has largely underperformed.

Germany’s economy, on the other hand, has been able to keep up with the U.S. in the immediate years after the financial crisis even as the country is facing worse population dynamics: the German society is ageing at much more rapid pace as fertility has been below replacement level for decades.

The German economy did not see a massive asset price boom-and-bust cycle together with the subsequent credit crunch that countries like Spain, Portugal and Greece experienced. Therefore, Germany recovered much quicker in the aftermath of the financial crisis.

Furthermore, Germany is highly reliant on industrial production and its large exporting sector, including car production. As the global economy bounced back in the mid-2010s, the country experienced an export boom that boosted GDP growth.

However, since about 2018, Germany has stagnated and actually underperformed Euro area economic growth.

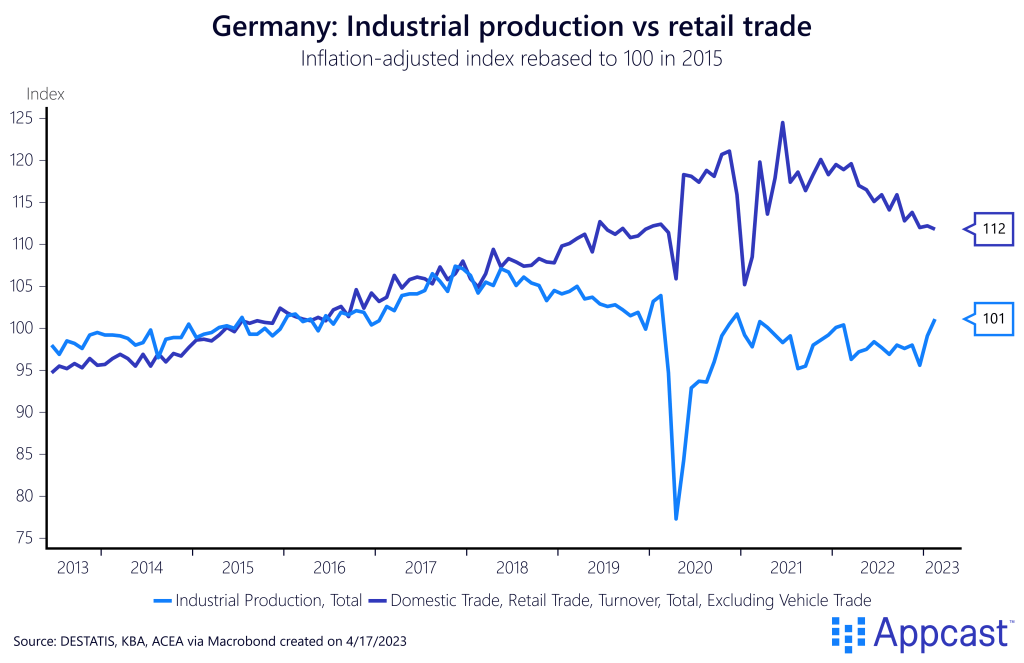

The most obvious culprit is the stagnation of industrial production. Compared to the Anglo-Saxon economies, a larger share of workers in Germany are still employed in manufacturing (12% compared to about 8% in the U.K. and the U.S.) and manufacturing is also still a higher share of German GDP (close to 19% compared to 12% in the U.S. and less than 10% in the U.K.).

As the chart below shows, industrial production in real terms is no higher than in 2016. While there was obviously the massive economic shock from Covid, industrial production had already stagnated in the years preceding the pandemic, which becomes apparent when you compare it with retail trade.

What explains Germany’s industrial decline?

The biggest culprit explaining Germany’s stagnating industries seems to be the car sector. German car makers have so far not been able to make a big push in the electric vehicle space compared to players like Tesla and Asian car manufacturers even as the E.U. is going to ban the sale of combustion engines as early as 2035. If you think that the typical car model has a lifecycle of about 10 years, three to four years development plus five to six years of sale, then the ban of combustion engines is not that far out anymore.

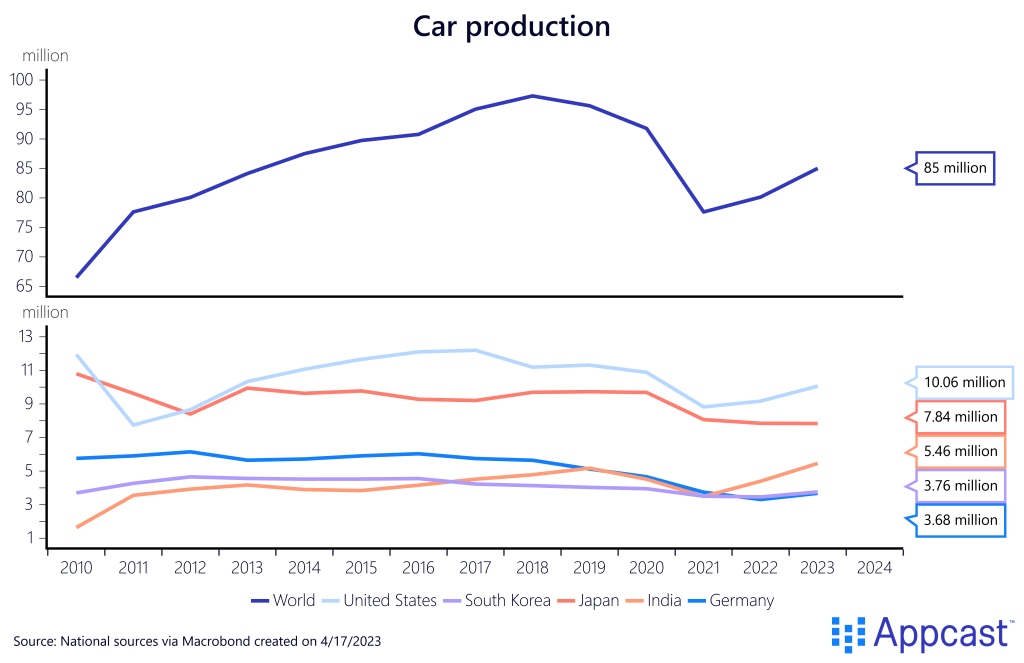

Together with the fact that global car sales peaked a couple of years before the pandemic, German car makers have been feeling the pain for several years now. Global car production peaked in 2018 and is now more than 10% lower than just a few years ago. Sales of new combustion engine vehicles peaked in 2017 and are now down 20%.

Advanced economies are relatively saturated, as the registration and sales of new vehicles has been stagnating for more than decade. This, together with the growth slowdown in emerging markets, has led to lower global demand.

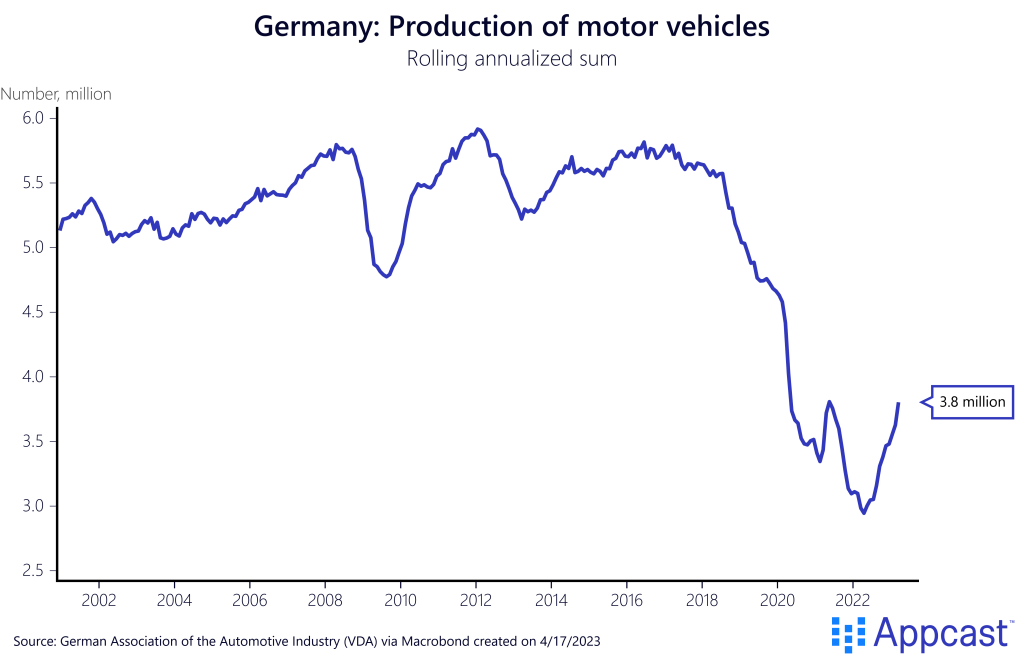

Car production in Germany peaked even earlier – at around six million in 2012 – and has been on a downward trend ever since. It fell to just over four million in 2019 and plunged to just three million in 2021 as the pandemic hit the global car industry hard. Even with the economic recovery over the last two years, German car production is still at its lowest in more than three decades, and more than 1.5 million cars lower than just a few years ago.

There are more than 700,000 people directly employed in the car industry in Germany, down from more than 830,000 a few years ago. Together with all the suppliers and attached industries though, more than three million people in Germany are employed by the automobile industry. This represents some 7% of the total workforce, according to a study from IW Cologne. A bust of the German car industry would have an outsized effect on the German economy.

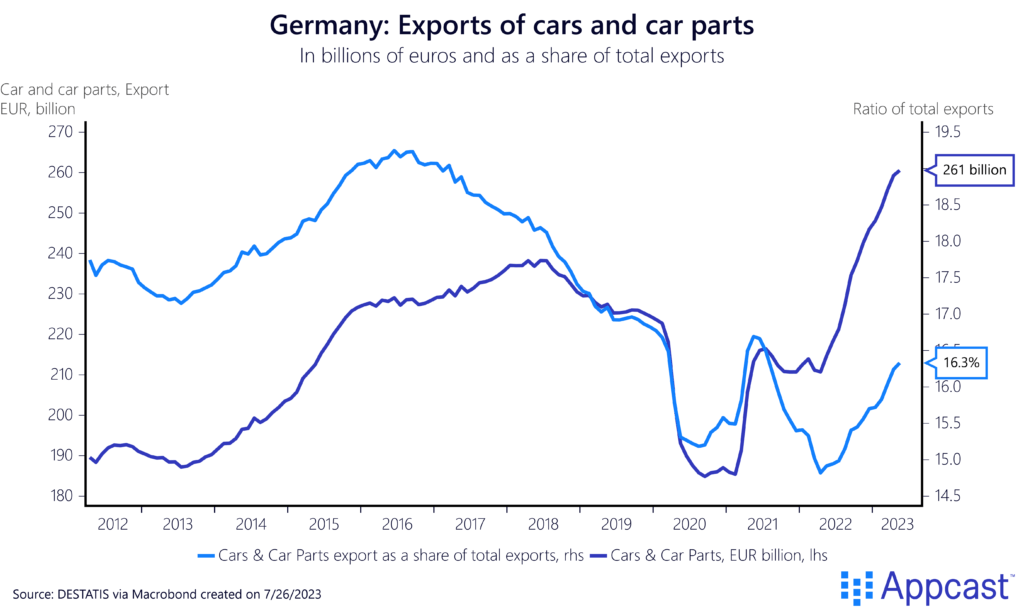

Cars and car parts exports represented more than 19% of total exports in 2016 but declined to less than 16% more recently. While the total value of cars and car parts exports has now recovered, this is mostly a price effect (higher prices) and not a volume effect.

Germany exported only 2.6 million cars in 2022 (the same as in 1990), whereas car exports consistently exceeded four million from 2007 throughout 2017 – apart from 2009 during the Great Recession.

Conclusion

It is well-known that Germany is still an industrial powerhouse and that its economy is quite reliant on manufacturing. Germany has a higher employment share in manufacturing than the U.K. or the U.S., also thanks to its many hidden champions. However, the country’s car sector is stagnating even as it contributes significantly to Germany’s GDP and exports. Global car production peaked more than half a decade ago, and Germany’s domestic vehicle production has been falling for an entire decade. This can explain to some extent why German GDP growth has been completely stalling since about 2018 even as the German labor market has been quite tight. With the electric vehicle revolution and the ban on combustion engines in the decade to come, Germany’s car makers need to reinvent themselves, or face a continued decline that will be a drag on the domestic economy.