The recession was revised away

The Bank of England (BoE) hiked their policy rate to 4.5% on May 11 as the U.K. economy continues to suffer from high inflation, with consumer prices rising by more than 10% (annualized rate).

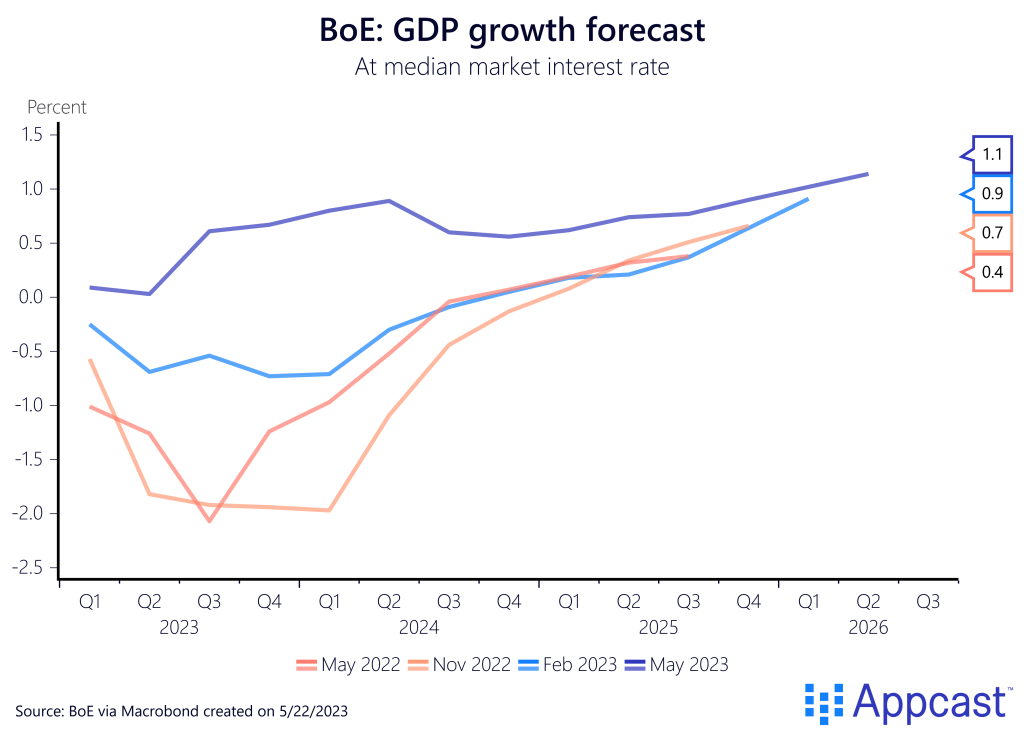

However, there is also some good news concerning the economic outlook. As we wrote a few months ago, the BoE was probably too pessimistic at the end of last year when it forecasted a long and severe economic contraction for 2023 that would last for more than a year.

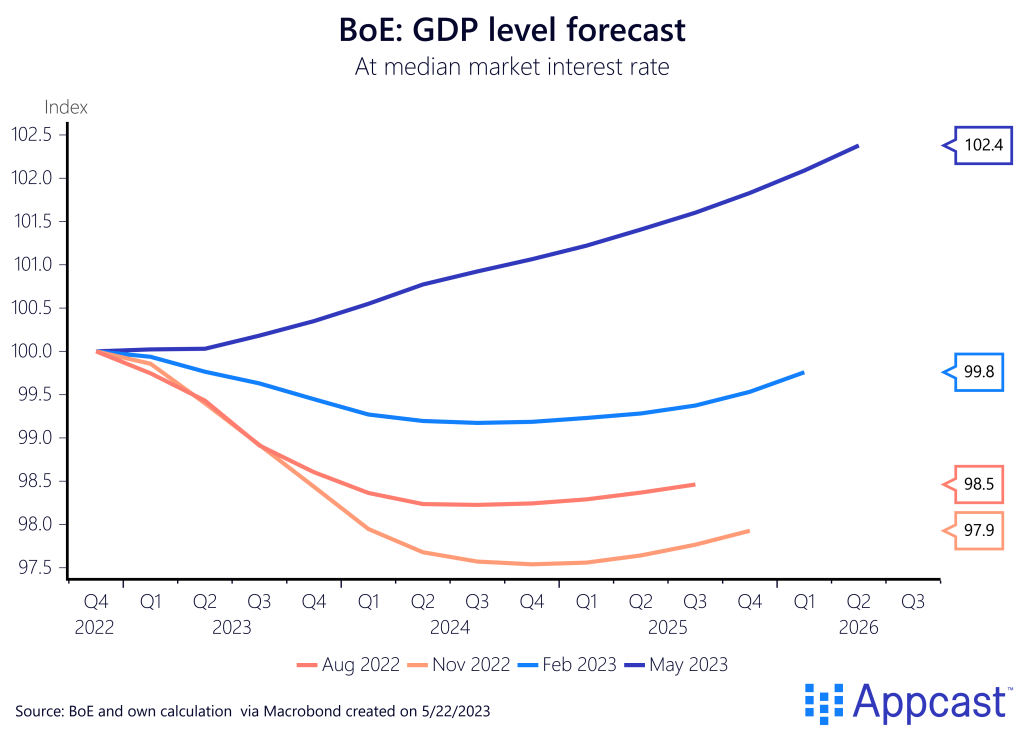

In conjunction with the previous rate hike, economic forecasters at the BoE substantially revised up its short-term and medium-term projections for the U.K. economy. In its latest projection based on future market interest rates, the BoE now expects the economy to grow this year and also has revised up expectations for GDP growth throughout 2024 and into early 2026.

These forecast changes represent the biggest revision to the growth outlook recorded in recent history. The BoE now expects that the U.K. economy will grow by about 2.5% between now and early 2026 compared to the complete stagnation that was expected in February.

However, cumulative growth of 2.5% over a period of more than three years is still quite a horrible performance – it corresponds to an annual growth rate of just a little over 0.6%. This would still make the U.K. one of the worst performing advanced economies in the years to come, even with the significant upward revision to the economic outlook.

The unemployment rate will remain low

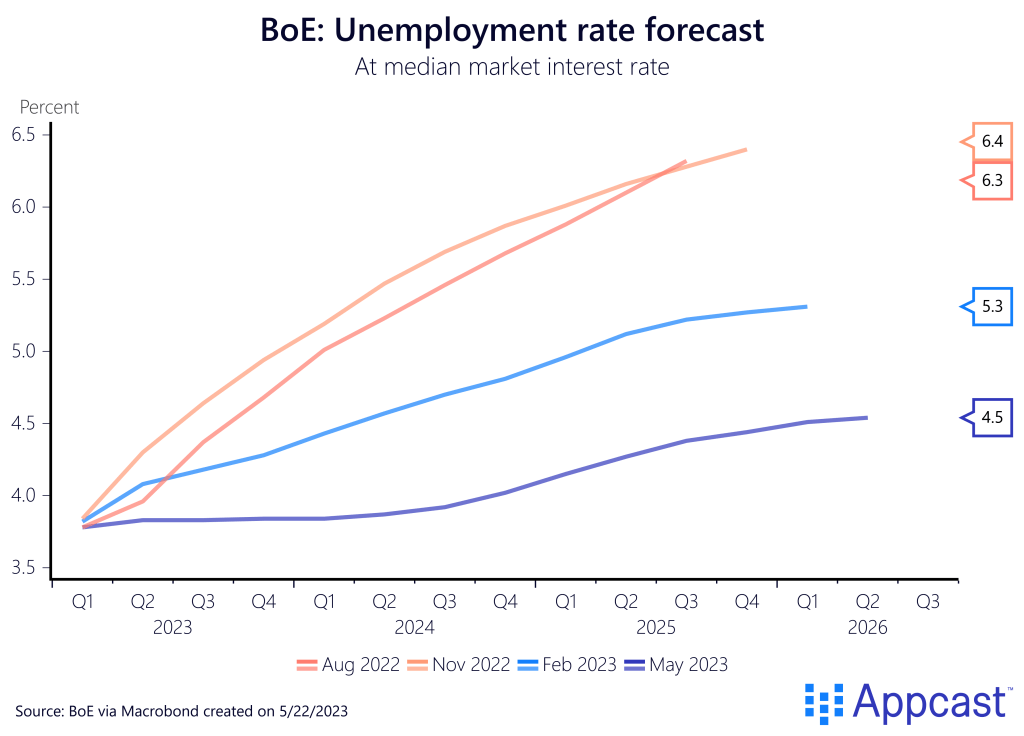

Together with the improved growth outlook, the BoE also revised down its unemployment forecast quite significantly. Last year, the expectation was for the unemployment rate to increase all the way to 6.5% by 2025. Even just a few months ago, the projection was for more than 5% unemployment in 2025. The new projection now assumes only a modest increase to about 4.5% from the current rate of 3.9%.

However, the U.K. has been suffering from labor shortages since the beginning of the pandemic, which will not go away any time soon. Brexit has aggravated recruiting problems, especially in some blue-collar sectors like retail and hospitality. Additionally, the demographic outlook means that the U.K. economy will see a large number of people approaching retirement age in the years to come. If demand holds up and the economy continues to grow, there is no reason for the unemployment rate to increase all the way to 4.5% in the coming year unless rate hikes plunge the economy into a downturn.

Inflation continues to be a main problem and rates will remain higher for longer

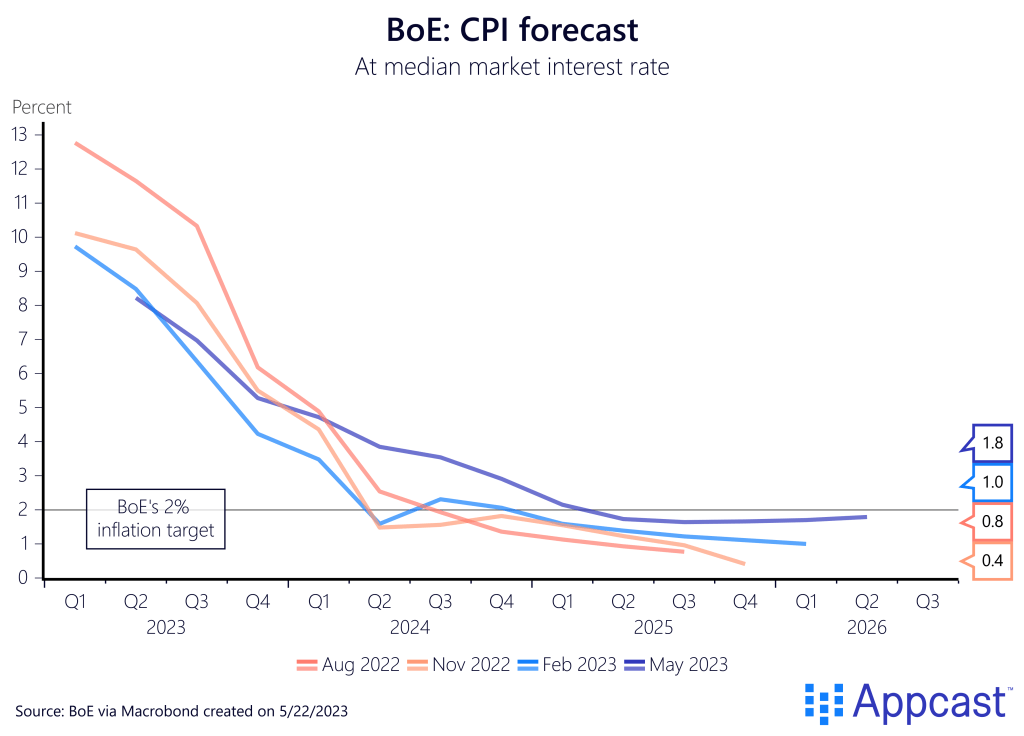

The inflation outlook is currently the main concern for the BoE. The central bank now expects inflation – according to the Consumer Price Index (CPI) – to remain above target for longer than previously thought. Inflation is now assumed to be stickier in the coming years. BoE economists expect the CPI to remain above target throughout 2024 and only fall below 2% by 2025.

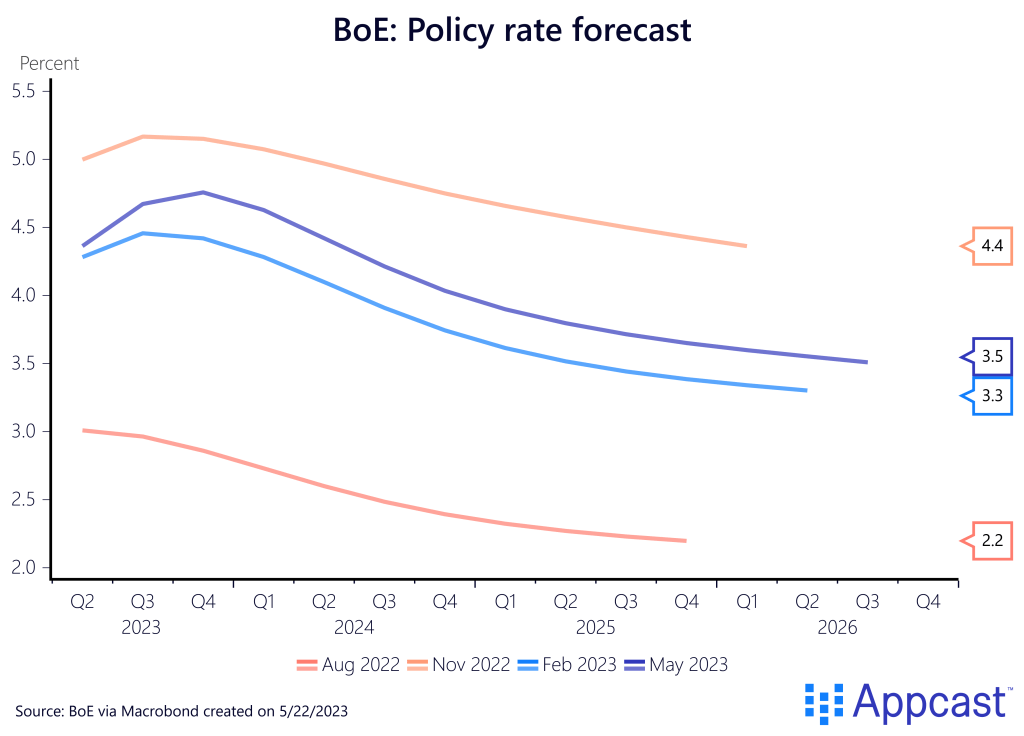

Consequently, the BoE will also keep its policy rate higher for longer, given that inflationary pressures will not fade anytime soon. And as we recently observed, the U.K. economy is the one country where fears of a wage-price spiral – a situation where high wage growth feeds into higher prices and vice-versa – are warranted.

The BoE thus expects that it will keep its policy rate above 4% until the end of 2024. And even beyond, interest rates will stay elevated at more than 3.5% until mid-2026. Assuming that inflation is back at target, central bankers are projecting a positive real interest rate of 1.5% for the U.K. economy in the coming years, which is certainly quite different to the period following the financial crisis when real interest rates were negative in most advanced economies. In other words, borrowing costs adjusted for inflation are expected to remain at a much higher level than before the pandemic for the foreseeable future.

Conclusion

The BoE has completely revised its forecast for the U.K. economic outlook again. The changes represent the biggest revision to the growth outlook ever recorded in recent history. While growth is now expected to come in stronger, inflation is also expected to be stickier and remain above target until 2025. This also means that interest rates must remain high, which could potentially be a big risk to the economy later this year as high mortgage rates will weigh on the housing market.