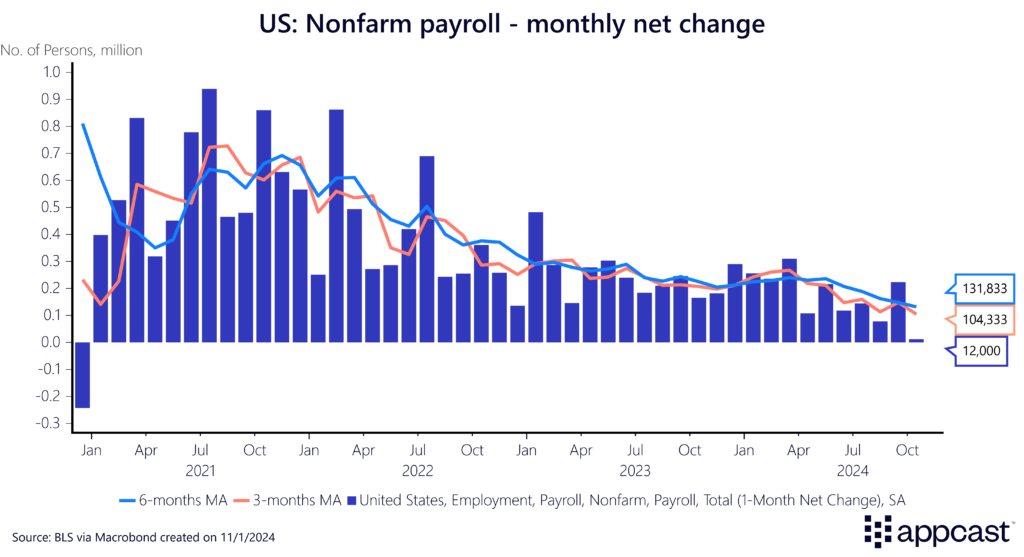

With the U.S. election just four days away, the October jobs report could have major implications for both voters and businesses. The U.S. economy added just 12,000 new jobs in October – but this is with a major asterisk as this data was significantly distorted by storms and strikes. This is the lowest month of job growth since December 2020.

Hurricane Milton made landfall during the survey reference week (when the data is collected) which resulted in much lower response rates than normal. On top of the impact of devastating weather events – there are major strikes within the aerospace industry that reduced manufacturing employment by a significant margin.

Industry insights:

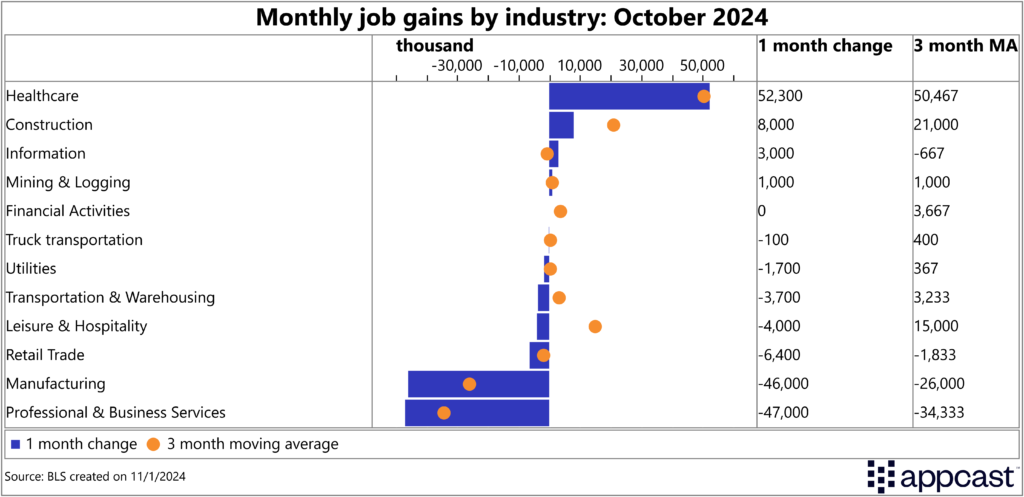

Healthcare once again led job growth, adding 52,300 positions in October, highlighting a continued trend of concentrated employment gains in this sector. Outside of healthcare, construction and information sectors added a modest combined total of 11,000 jobs. Most other industries saw little change or slight declines, including transportation and warehousing, retail trade, and leisure & hospitality.

Manufacturing and professional & business services posted notable declines, with manufacturing affected largely by recent strike activity.

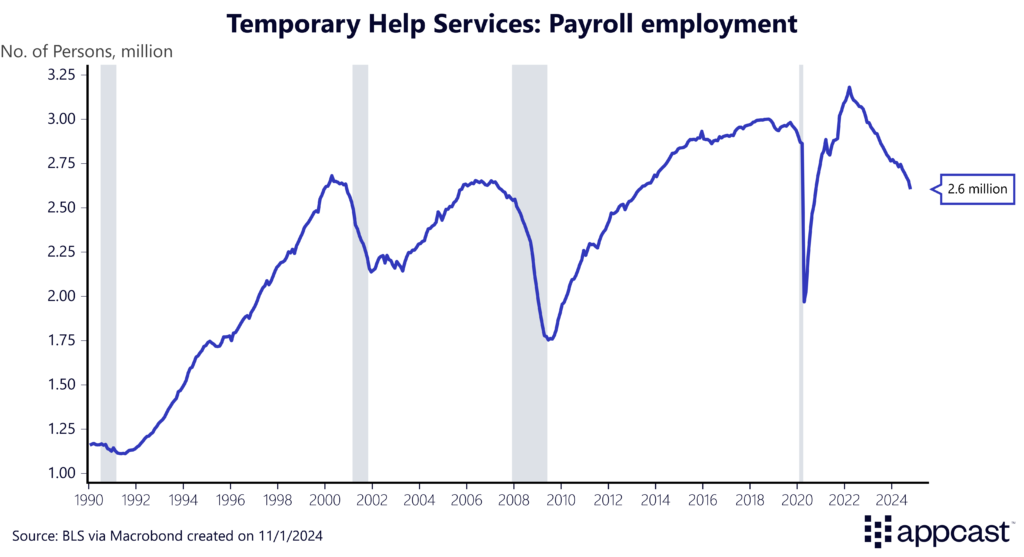

However, professional and business services saw a sharper drop of 47,000 jobs, driven by a significant decrease of 49,000 in temporary help services, signaling deeper underlying challenges in the sector.

Temp help services, which is comprised mostly of the staffing industry, experienced a major boom in 2021 and 2022. Employers had thousands of unfilled job postings and needed the extra help to continue to operate their businesses. As those positions were filled and hiring demand cooled, the staffing industry has undergone a serious correction.

Since its peak in March 2022, the sector has shed nearly 580,000 jobs, returning to employment levels witnessed in 2012 and 2013 during the recovery from the Great Recession. This contraction happening in the staffing industry reflects the broader story of the job market weakening as businesses have less excess demand and need to hire.

Wage growth:

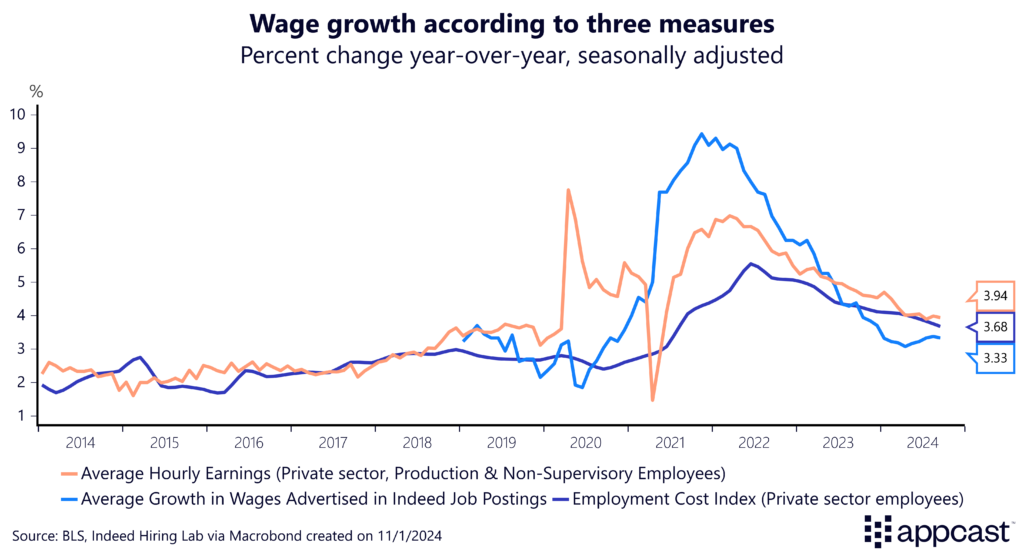

Average hourly earnings rose by 0.4% this month, pushing the annual growth rate above 4%. Although the employment report shows elevated wage growth, the more detailed Employment Cost Index suggests earnings are cooling, now at 3.7%. Overall, wage growth appears to be stabilizing around 3.5-4%, well below the peaks seen in 2021.

Storms and strikes:

Two things are happening at once: job growth is weakening, yes, but this October’s report has been distorted by storms and strikes. The BLS added a note to this release that Hurricane Milton struck during the reference period that resulted in much lower initial response rates than normal. The issue is quantifying the impact this has on overall job growth – the BLS does not isolate the effects disruptive events like hurricanes have on their data.

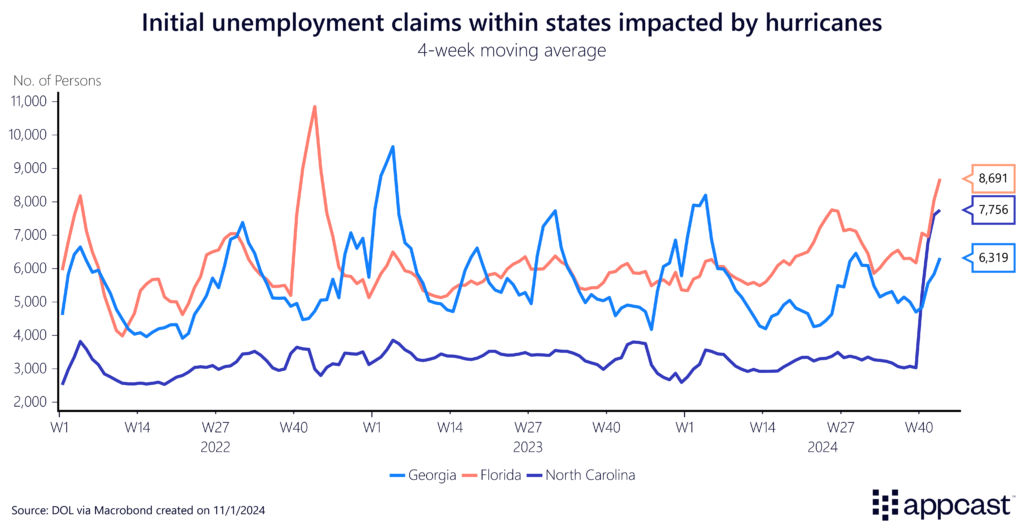

One potential avenue to assess this impact was a recent spike in initial unemployment insurance claims by state: Georgia, Florida, and North Carolina all had significant growth in claims outside of normal ranges due to the recent weather events. Although it’s not possible to discern the entire impact hurricanes are having on this report, it is surely distorting the overall picture.

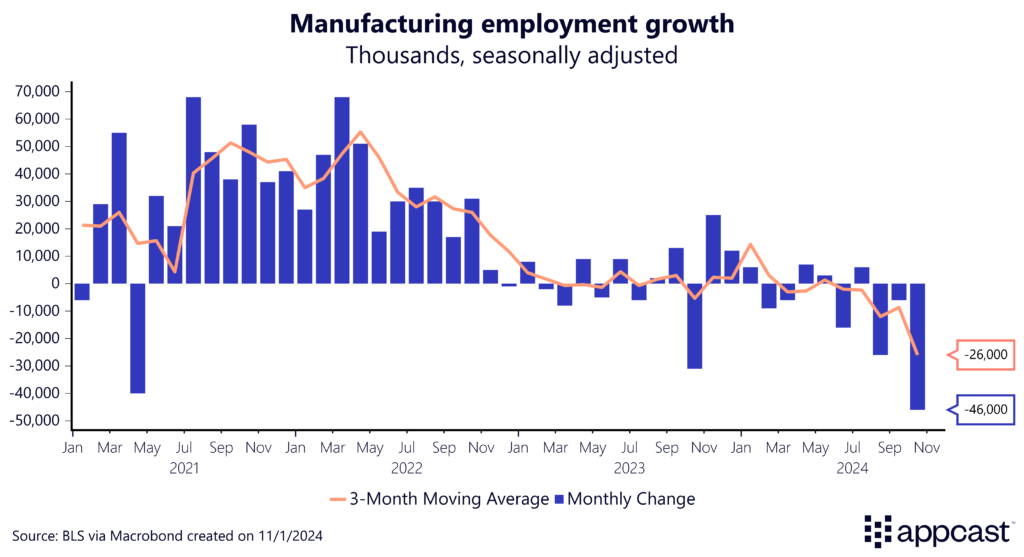

Likewise, these storms are making this report harder to interpret, along with the recent strikes at Boeing and Textron. Manufacturing employment growth suffered a severe contraction this month, dipping by 46,000. This is the single biggest drop since the pandemic-impacted April 2020.

While the strikes are likely to end soon and the immediate impact will dissipate, the story remains the same for manufacturing: employment growth has been weak throughout 2024 as the industry has been suffering under the weight of elevated interest costs from the Federal Reserve.

What does this mean for recruiters?

This jobs report carries a significant caveat: the recorded employment swings last month were notably affected by storms and strikes. Yet, setting aside these temporary distortions, it’s clear that the labor market is gradually cooling. For recruiters in industries like staffing or manufacturing, this slowdown may be more noticeable compared to those in healthcare or construction, which still show growth. Across sectors, hiring demand has fallen sharply from its 2022 peak. As we look toward the new year, the post-election landscape and anticipated rate cuts could make 2025 a more optimistic hiring environment.