Checking in on the consumer

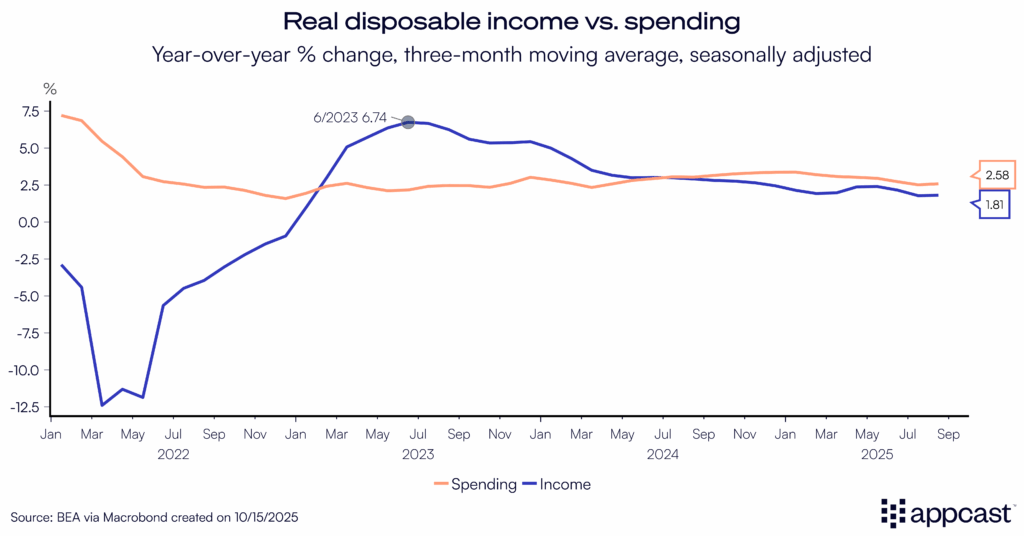

2025’s seasonal hiring rush will look different from recent years. Over the past five years, steady income gains have fueled strong demand for retail, warehousing, and transportation workers. Rising wages kept consumer spending growing at about a 2.5% annual pace from 2022. That strength is now starting to fade.

As we move into the final quarter of 2025, December’s retail spending may come in softer than in recent years. Mastercard’s annual holiday spending report suggests inflation from tariffs will drive a larger share of sales growth this season, rather than stronger consumer demand. With importers facing higher costs and shoppers growing more price-sensitive, discount retailers are likely to come out ahead.

Adding to the challenge, spending is becoming increasingly concentrated among high earners. Analysis of Federal Reserve household balance sheet data shows the top 10% of earners now account for nearly half of all consumer spending, the highest share on record. For the bottom 80%, spending has barely outpaced inflation, suggesting a fragile consumer landscape heading into the holiday season.

For hiring, that points to a quieter seasonal rush. Retailers and logistics firms may post fewer openings, easing competition for applicants. Cost-per-application could trend lower, while application rates rise modestly as job seekers chase stable, short-term work.

Labor market trends: low hiring, low firing

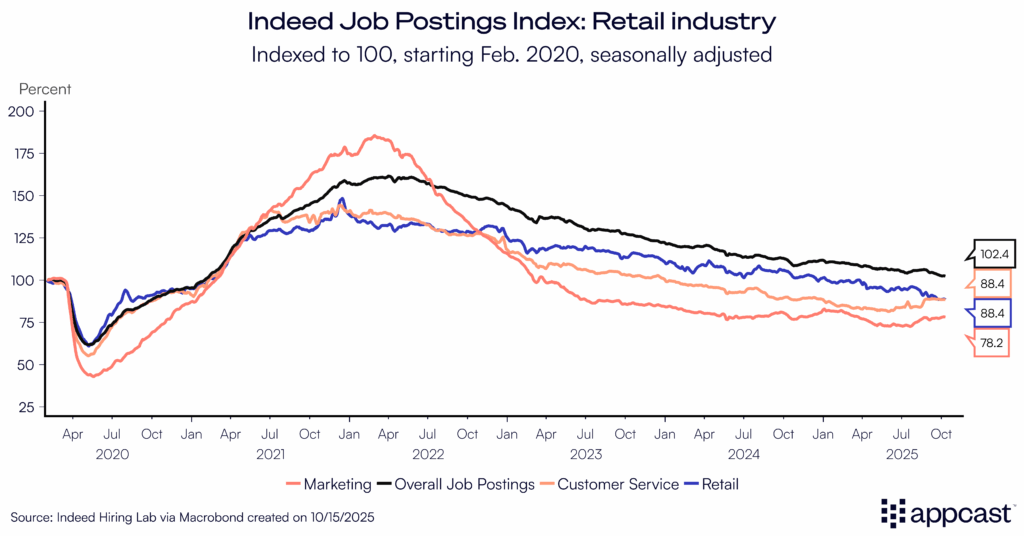

Across the broader labor market, retail job postings have been trending lower for two years. Openings in retail on Indeed are down about 13% from 2020, with similar declines in customer service roles. Marketing postings — another critical means by which consumers become aware of products to buy — have fallen even further, down nearly 22%.

The decline in hiring demand doesn’t just speak to a more cautious consumer, but also to the longer-term secular trend of e-commerce growth being hyper accelerated by AI. Consumers now armed with autonomous agents that can work on their behalf and find the best deals are likely to devote more of their wallet to online spending, putting even more pressure on in-person shopping.

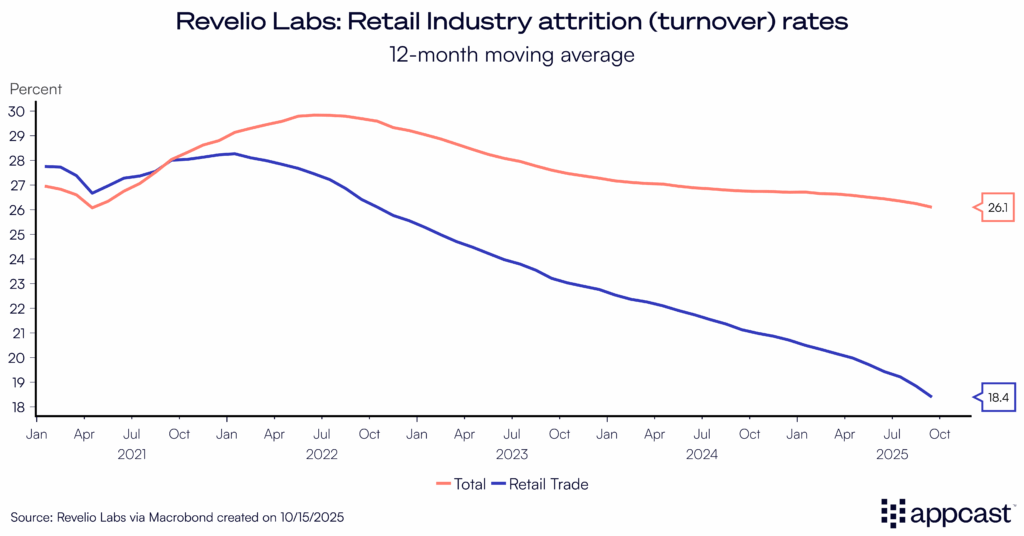

It’s not just that recruiting intensity has eased; churn in the labor market has also slowed sharply. New data from Revelio Labs shows economy-wide annual turnover hovering around 26%, but in retail it’s closer to 18%. In practical terms, for every 100 retail workers hired at the start of the year, only 18 will have left by year’s end. Compared to the Job Openings and Labor Turnover Survey (JOLTS) from the BLS, the Retail industry has a monthly quits rate of 2.6% on a similar downward trend as Revelio.

Lower turnover means fewer replacement hires, and since much of total hiring demand stems from backfilling open roles, this shift has taken real weight out of the labor market. Retailers that once faced constant churn are now operating with more stable workforces, easing recruiting pressure but also contribute to a more cautious, slow-to-hire and slow-to- fire labor market.

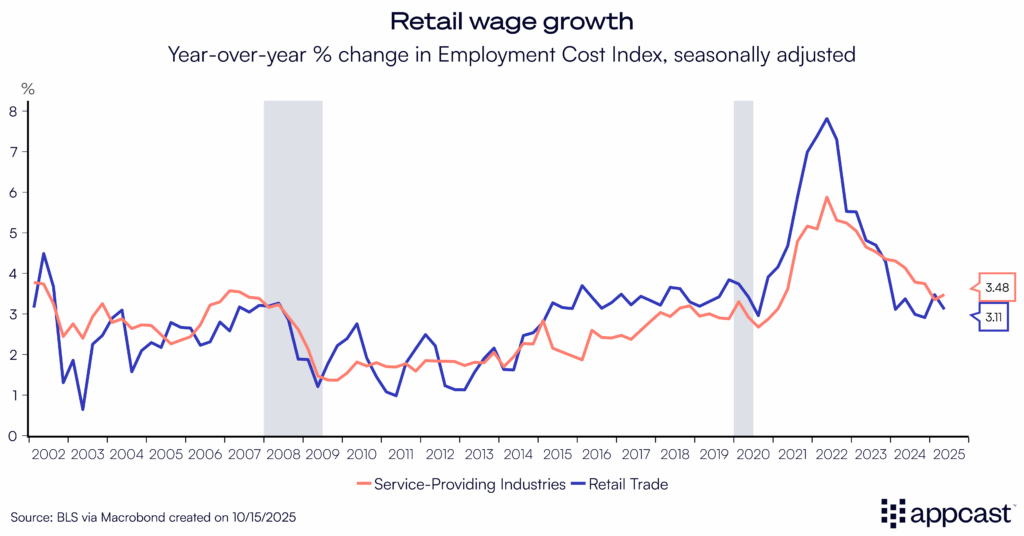

In this new labor market, where both hiring demand and worker turnover have eased, wage growth in retail has cooled noticeably. In the aftermath of the pandemic, retailers scrambled to rehire laid-off staff, pushing wage growth to a record 8% in 2021. Consumers also had flush pocketbooks following significant fiscal stimulus on behalf of the government, driving significant sales growth.

More than three years later, those pressures have faded. Retail wages are now rising at roughly 3%, on-pace with the mid-2010s. For employers, that means less competition on pay and fewer incentives like signing or hiring bonuses. This winter, retailers entering the seasonal hiring period are likely to find a more balanced market where wage growth and recruiting costs are both subdued.

Recruiting cost trends ease

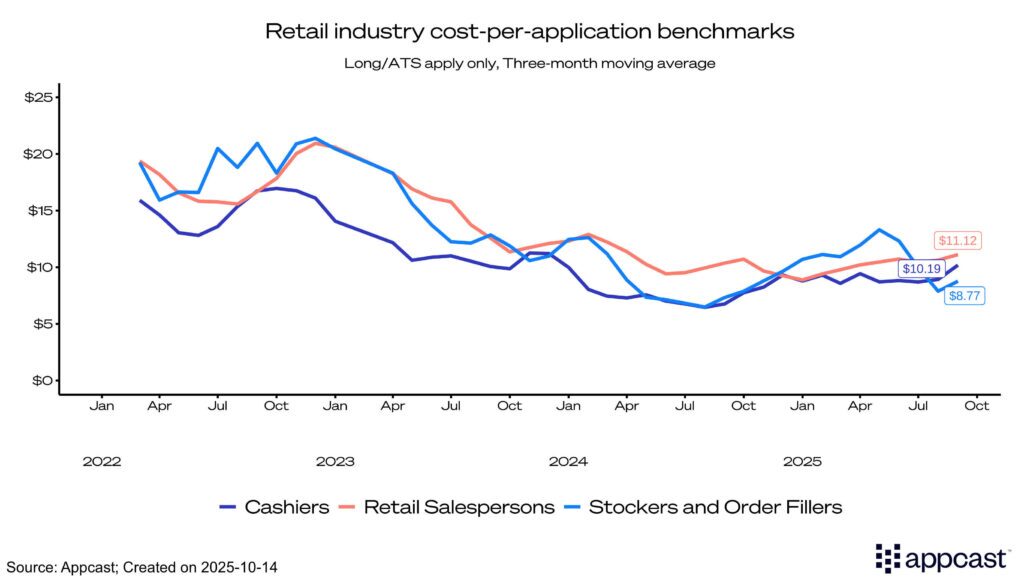

Appcast’s recruiting cost data for the retail industry shows a clear cooling trend. Cost-per-application (CPA) for both stocker and salesperson roles peaked above $20 in late 2023 but has since fallen by nearly half. The decline reflects broader labor market easing: lower hiring demand, reduced turnover, and more stable wage growth.

Seasonal cost patterns still hold as CPAs typically rise through late winter as demand for workers briefly spikes. The 2023 cycle saw sharp upward pressure on costs, while 2024 was far more moderate. For 2025, the outlook points to a similar or slightly softer trend: steady demand, contained costs, and a seasonal rise that’s likely mild by historical standards.

What does this mean for recruiters?

For recruiters, the 2025 seasonal hiring period will likely be calmer and more cost-efficient than in recent years. With slower consumer spending, fewer job openings, and lower worker turnover, hiring demand has cooled across the retail industry. Wage growth has normalized, reducing the need for bonuses or aggressive pay competition, and recruiting costs have followed suit, with CPAs at nearly half of 2023’s peak. While seasonal fluctuations will persist, the overall environment could lead to lower costs and less competition for talent heading into the holidays.