Author: Sam Kuhn and Ada Acker

Economy-wide breakdown:

- The U.S. labor market has shrugged off the worst predictions of the immediate tariff impacts as employment growth averaged 150,000 per month over the last three months. Yet, when you look under the hood, warning signs emerge: healthcare and leisure & hospitality own the bulk of job growth while all other major sectors are either flat or have contracted.

- The unemployment rate fell slightly to 4.1% in June, but due to an unfavorable reason: the labor force has begun to contract. In May, 625,000 workers left the labor force. Then the labor force contracted again by 130,000 in June. The shift in U.S. immigration policy has started to materialize throughout the job market, potentially signaling renewed labor shortages.

- On the trade front, a new major trade deadline has been announced: come August 1st, a new set of reciprocal tariffs will be enforced unless a deal with that country has been struck. Policy uncertainty remains elevated, which is souring the mood of consumers and businesses. Until clarity is given on the final path of trade, it is likely that volatility will persist in financial markets and risk bleeding into the broader economy.

- On July 4th the One Big Beautiful Bill Act (OBBBA) was signed into law, marking a significant change in fiscal policy: tax cuts for both businesses and households, boosted funding for immigration enforcement and reductions in spending for Medicaid and SNAP. Each one of these provisions can alter the difficulty of recruiting by industry, depending on the type of workforce. TK: Read more from our Chief Economist Andrew Flowers to learn more.

Read our economy-wide breakdown of the latest numbers.

Employment Trends

With recent tariffs and policy shifts, the transportation and warehousing sector has seen both ups and downs. After short bursts of Q1 growth in response to the first round of tariffs, their negative effects on the sector have started to emerge in the second quarter.

The Port of Los Angeles — the busiest container port in the U.S. — reports on the monthly count of containers passing through. This year, May saw the lowest volume of monthly container imports over two years. June, however, saw a large jump in imports—likely due to many importers choosing to import end-of-year goods to get ahead of possible tariff increases later this year. While this increase in imports is good news for supply in the short term, they may slow in following quarters, leading to less demand for workers in some transportation & warehousing subsectors.

Employment growth has also dipped in the second quarter after strong job growth at the beginning of 2025. The sector averaged just under 1,500 new jobs over the course of the quarter, though growth appears to be on the rise going into the third quarter with 7,500 jobs gained in June.

Employment growth across the sector slowed overall. Transit & ground passenger transportation remains higher than other subsectors at 4.3% growth in June, but its overall decline since mid-2024 continued over the course of Q3 Similarly, air transportation has cooled off after seeing a slight increase in the previous quarter, with employment growth resting at 1.7% annually.

Warehousing and storage saw a slight increase over the second quarter; however, job growth remained negative, losing about -0.8% of total employment. Truck transportation, meanwhile, has finally recovered from a dip in early 2024, with employment growth ebbing back into the positives at just under 0.2% in June.

Wage Trends

Wage growth trends remain relatively distinct across the subsectors. Air transportation continued its steady decrease in wage growth since early 2024, going down to -2.9% in June—a value that has not been observed since 2015. On the other hand, transit & ground passenger transportation wage growth jumped back into positive range with a 1.7% wage increase.

Warehousing & storage remained strong over the quarter, rising slightly to a 3.4% increase in wage growth. Similarly, truck transportation also remained stable over the quarter, coming in at just under 3.9% annual growth.

Openings and Turnover Trends

Job openings in the sector have been on the decline for the past two years, and that trend continued this quarter. After a slight increase at the beginning of the year, job openings constricted again, now sitting at just over 3.3%.

With the labor market movement continuing to slow, the hiring rate continues to decline, settling at 3.8%. Quits remained stable at 2.2%, similar to pre-COVID levels, while layoffs & discharges remained low with a slight decrease down to 1.6% this quarter.

Recruitment Marketing Trends

The term “long” or “ATS apply” refers to the conventional application process, requiring applicants to manually submit their tailored application documents and personal details through the company’s website or an applicant tracking system (ATS). In many cases, applicants are required to create a company-specific account.

On the other hand, “easy apply” refers to a swift application process on a job board, often conducted through a smartphone. With a single click, essential information like the resume is transmitted directly to the company. Due to the simplicity of this application method, easy-apply metrics are not directly comparable to those of the “long” or ATS apply. The metrics are therefore presented separately.

Long Apply

Recruiting costs continued to trend slightly upwards in Q2 with the costs stalling near the end of the quarter, though they remained relatively low. The median cost-per-click (CPC) rose to $1.15, while the median cost-per-application (CPA) remained steady with a minimal decrease to $11.93 in June. Apply rates continued to rise in the sector, reaching 9.59% in quarter two.

Easy Apply

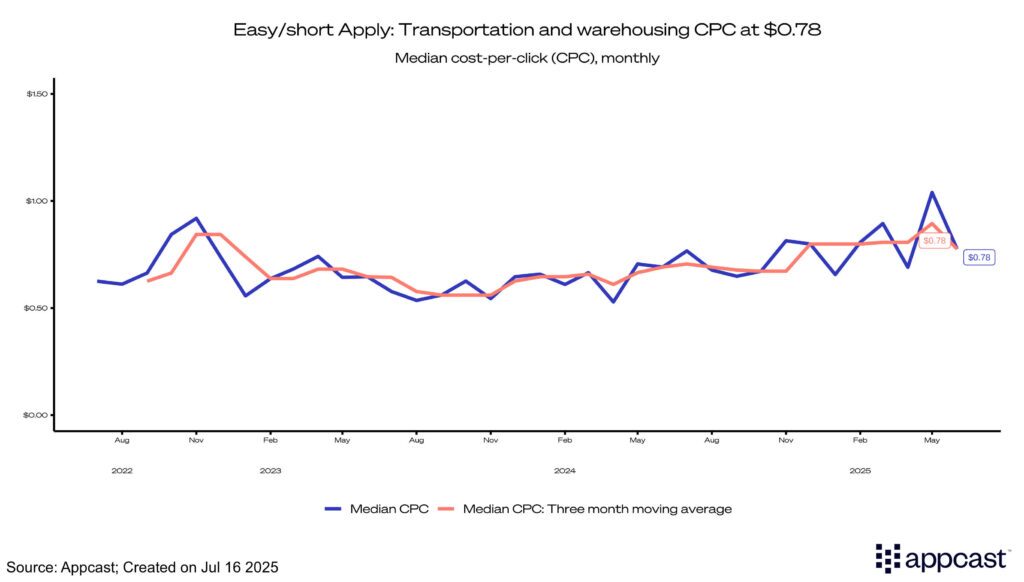

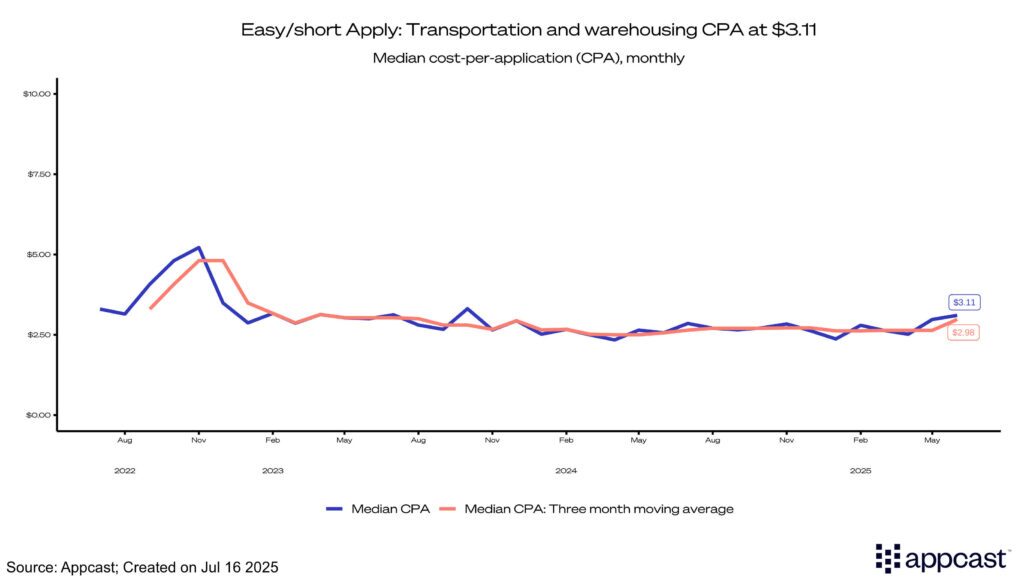

Recruiting costs for easy apply methods remain lower compared to traditional recruitment methods. The Median CPC came in at $0.78 at the end of the quarter after seeing quite a bit of volatility this quarter. CPAs, on the other hand, saw a steady increase over the quarter, reaching $3.11 in June. Apply rates for easy apply methods saw a more significant decline, dropping over 5% this quarter to 24%.

Recruitment Marketing Forecast

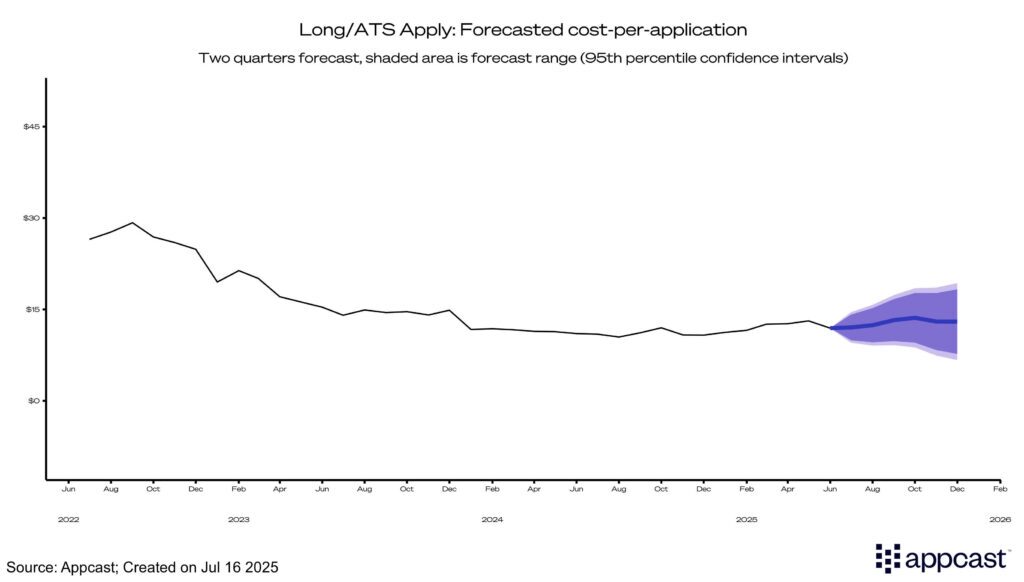

With the future of tariffs still uncertain, the future of the transportation & warehousing sector is similarly unclear. However, based on historical data, our forecast predicts that recruiting costs will remain stable for the rest of the year, with CPAs staying in the $11 to $15 range.

What does this mean for Transportation and Warehousing?

The transportation and warehousing sector was able to remain relatively stable, if slightly deflated, throughout the first wave of tariffs. However, with new tariff policies set to be enacted on August 1st, there is still uncertainty about the effects they will have on hiring in the sector. With the supply of foreign goods in the U.S. constricting and inflation rising, job growth across the sector will likely stall. Recruiters should expect to see similar, if slightly elevated costs and slowing job growth through the second half of 2025.

Forecasting Methodology

Cost-per-application (CPA) is forecasted two quarters ahead using the previous two years’ worth of one-month moving average data. A combination of ARIMA, exponential smoothing, and seasonal naïve models are used to create an ensemble forecast. The forecast provides both the 95th percentile confidence intervals, indicating the likelihood that each value will be within the CPA range provided.