Author: Sam Kuhn

Economy-wide breakdown

- At the start of 2025, the labor market looks solid. It grew at a steady rate, averaging 180,000 new jobs a month over a three-month average. Wage growth continues to moderate, trending towards 3.5% as inflationary wage pressures recede and the unemployment rate remains near a historical low of 4.2%.

- Under the hood, though, there are some issues. For one, hiring is very healthcare heavy. In March, 40% of private employment growth was concentrated in healthcare and private education. Outside of healthcare, most industries are experiencing uneven growth grappling with elevated interest rates and heightened uncertainty about trade policy.

- On April 2nd— or “Liberation Day”— President Trump issued a sweeping increase of tariffs that will bring the average U.S. tariff rate to the highest point in more than a century. It includes a 10% across-the-board tariff, affecting all foreign goods imports. The impending fallout from retaliatory tariffs from U.S. trading partners across Europe and Asia will radically shift employment growth in goods-oriented industries like retail, transportation and manufacturing as consumer good prices rise in response to tariffs. Compromises may be reached, and tariffs levels could be lowered.

- In March, Appcast’s Chief Economist Andrew Flowers presented our outlook on the economy in the face of sweeping policy changes. Our base case is a slowdown in economic growth due to immigration and trade policy changes, but not a recession. However, over the past three months consumers’ expectations of inflation have risen rapidly while sentiment around the business environment has deteriorated – a serious warning sign about the future health of the economy. This environment is highly dynamic, and by the time you read this it may be out of date.

Read our economy-wide breakdown of the latest numbers.

Employment Trends

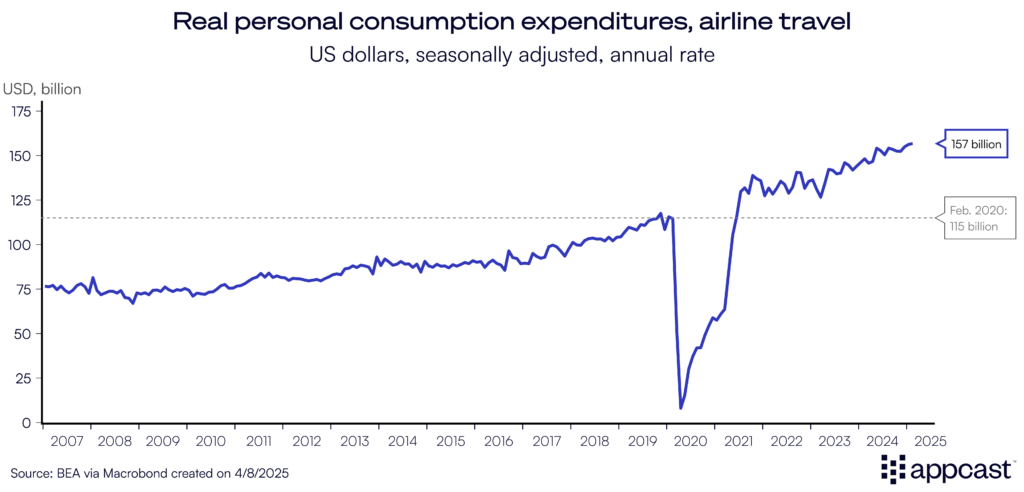

Even amid persistent economic uncertainty, the American consumer remains a pillar of strength. One high-frequency indicator of consumer sentiment—daily TSA travel throughput—continues to show resilience. Air travel tends to falter during downturns, yet early-year data suggests that Americans are still taking to the skies, whether for business or leisure.

Still, warning signs are beginning to surface. In its most recent earnings report, Delta Airlines withheld forward guidance, a move that often signals reduced confidence in future demand. The airline also announced it would hold off on expanding routes in the back half of the year. Economists view this as a pullback in capital expenditures, which, if echoed across sectors, could eventually weigh on the broader economy. But for now, it’s a signal, not a certainty.

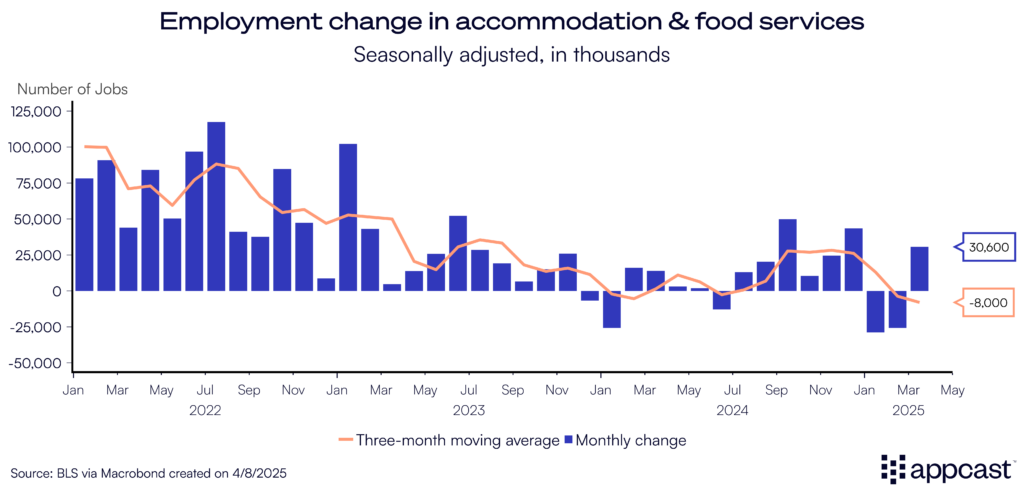

After a solid finish to 2024, with 21,500 jobs added in Q4, the accommodation and food services sector has stumbled out of the gate in 2025. Over the first three months of the year, the industry shed an average of 8,000 jobs per month, signaling a potential shift in momentum.

This sector has long been a barometer of post-pandemic labor market normalization. Following the hiring frenzy of the Great Resignation, job growth has gradually decelerated. Yet demand for in-person services—and strong wage gains at the lower end of the income distribution—helped sustain hiring through much of last year. The recent slowdown, however, suggests that even consumer-facing industries are beginning to feel the weight of a more cautious macroeconomic environment.

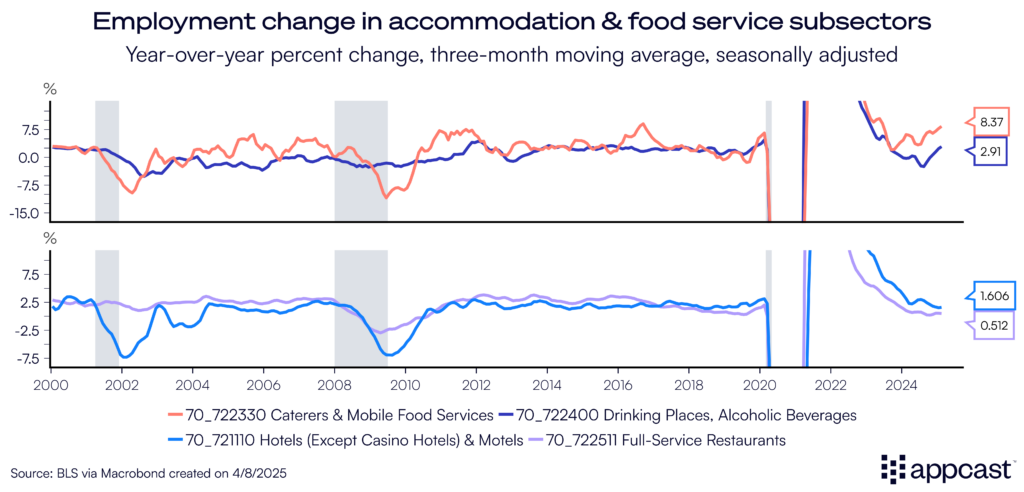

Job growth within accommodation and food services remains uneven across subsectors. Employment at caterers and mobile food services rose 8.3% over the past year, maintaining the fastest pace in the sector, although momentum has slowed since earlier highs. Hotels and motels growth has stalled, slowing to 1.6% over the year.

Alcoholic beverage establishments saw a 3% increase in employment, rebounding from a mid-year dip. Full-service restaurants, on the other hand, experienced only a slight pickup in Q1, with annual growth of just 0.5%. This suggests that hiring in one of the core industry categories remains sluggish despite broader stability.

Wage Trends

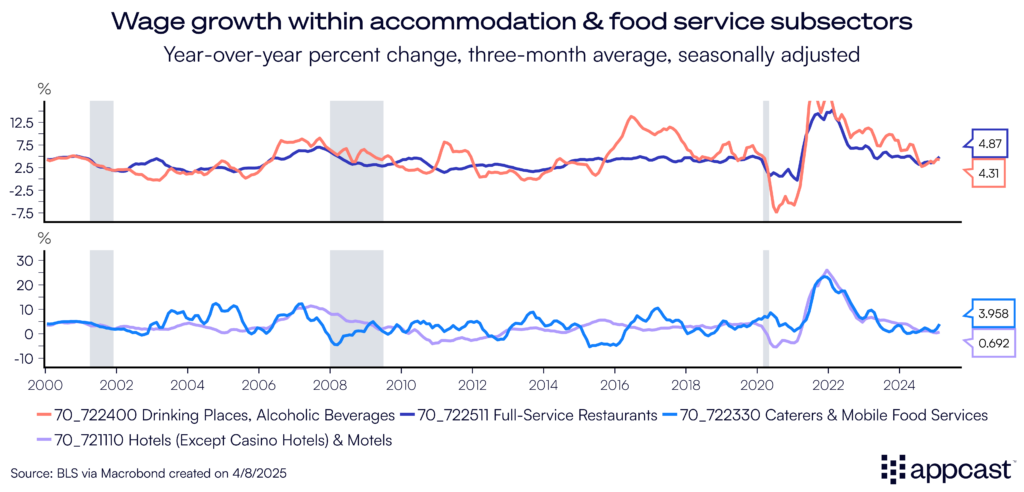

On the wage front, only alcoholic beverage drinking places can be seen to have recovered at all in Q4—though not nearly enough to offset precipitous declines in the first half of 2024. While wage growth also fell off for full-service restaurants and hotels & motels, they remained stagnant in Q4, and wages for caterers & mobile food services declined enough in Q4 to offset their gains earlier in the year. Among these subsectors, only full-service restaurants can boast wage growth consistent with pre-pandemic levels.

Openings and Turnover Trends

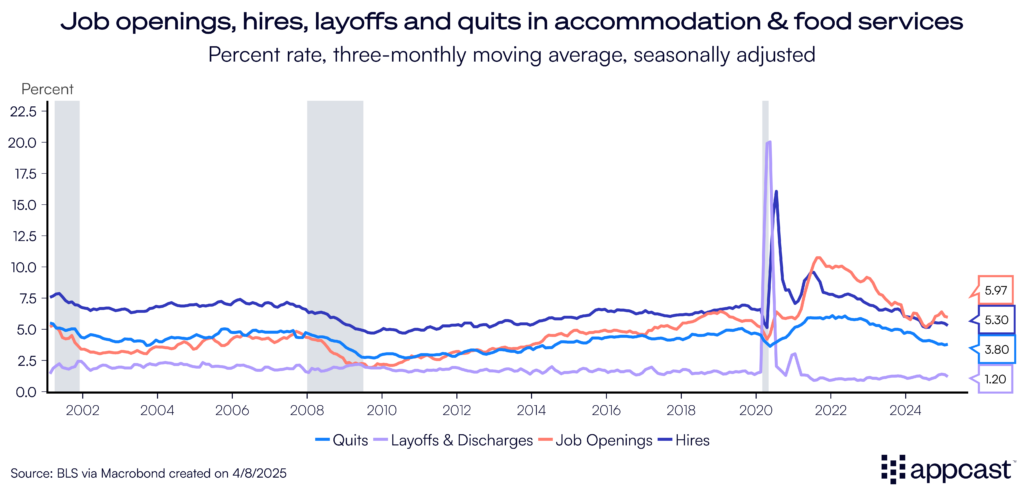

Overall job openings ticked down slightly in the first quarter to below 6% as demand softened. Hiring patterns continue to slowly decline as the hiring rate declined to 5.3%, a near pandemic low. Hiring patterns are being pushed down, as overall attrition—or voluntary quits—reached a post-pandemic low of 3.8%. Layoffs remain subdued at 1.2%.

Recruitment Marketing Trends

In the following section we will refer to two distinct application methods:

A “long” or “ATS apply” is typically a manual application process in which jobseekers must submit individually tailored documents and details through a company’s applicant tracking system (ATS), often using a company-specific account.

A “quick” or “easy apply,” by contrast, typically only requires a single click to transfer essential information to that company and can be much more easily completed with a smartphone.

Because the volume and quality vary so dramatically between application methods, Appcast presents these metrics separately.

Appcast’s sectoral distinctions differ slightly from those of the Bureau of Labor Statistics. Namely, the accommodation subsector will be referred to as “travel and tourism” in this section that details key recruitment metrics.

Long Apply

Recent trends in longer-form applications reveal a growing divergence between food service and travel & tourism. Hiring conditions appear to be loosening in food service, while becoming more competitive in travel-related sectors. Cost-per-click rose to $1.05 in food service, breaking from the largely flat trajectory seen throughout 2024. Meanwhile, CPC in travel and tourism edged down to $0.99, signaling a potential easing of competition in a sector that had seen rising costs for much of last year.

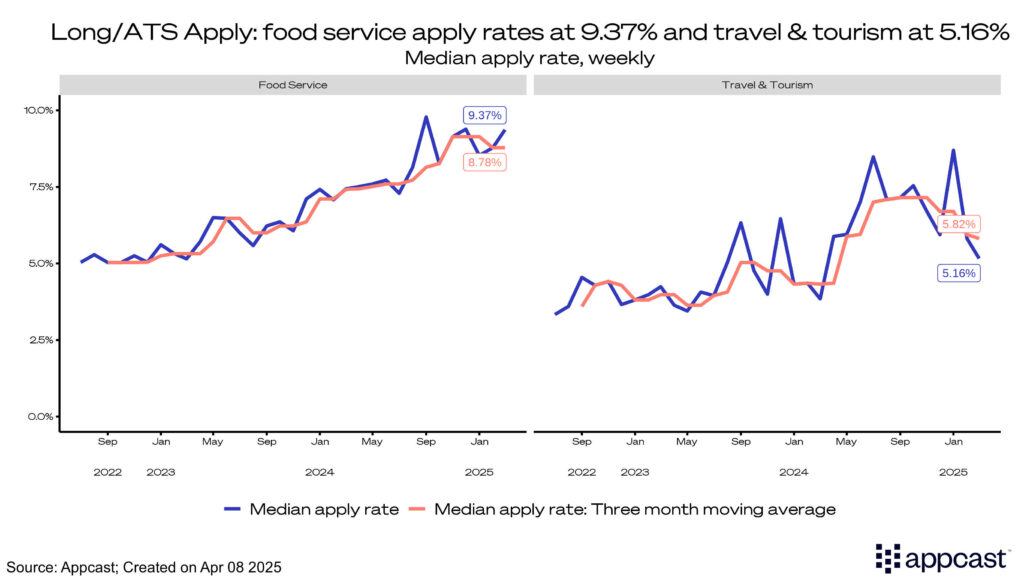

The increase in food service CPCs translated into a slight rise in apply rates (now at 9.4%), while apply rates travel and tourism (now at 5.8%) declined more precipitously.

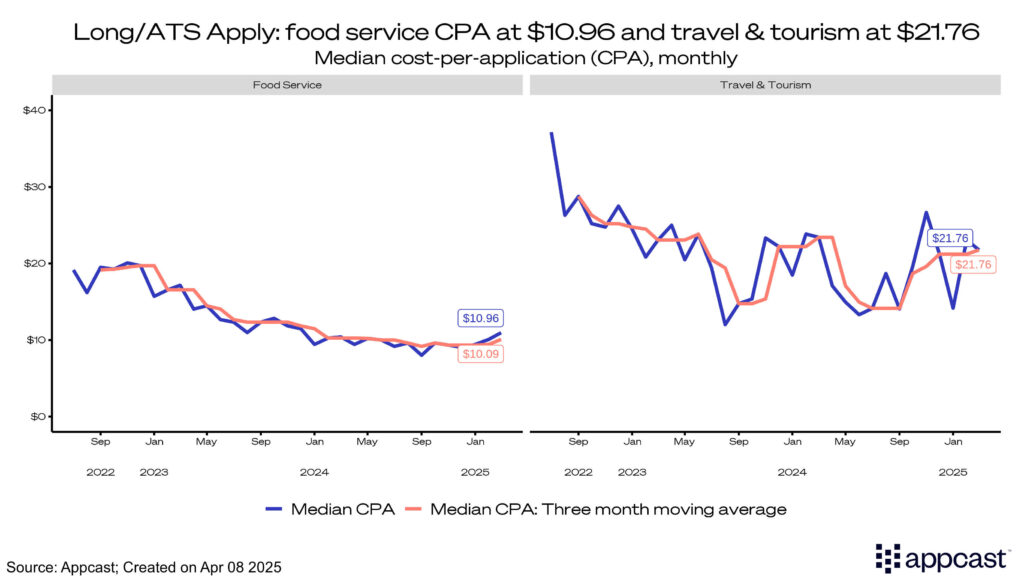

Cost-per-applications for both industries rose modestly to start the year. CPAs for food service rose to nearly $11 after several months of little growth. Travel & tourism CPAs spiked more sharply to $21.76, however these price changes are more volatile and less likely to indicate a longer-term trend.

This is the first quarter in more than a year that we’ve observed both higher costs (rising CPCs and CPAs) combined with lower job seeker interest (apply rates). Taking these two trends together, this may indicate a more competitive recruiting market for the remainder of the year.

Easy Apply

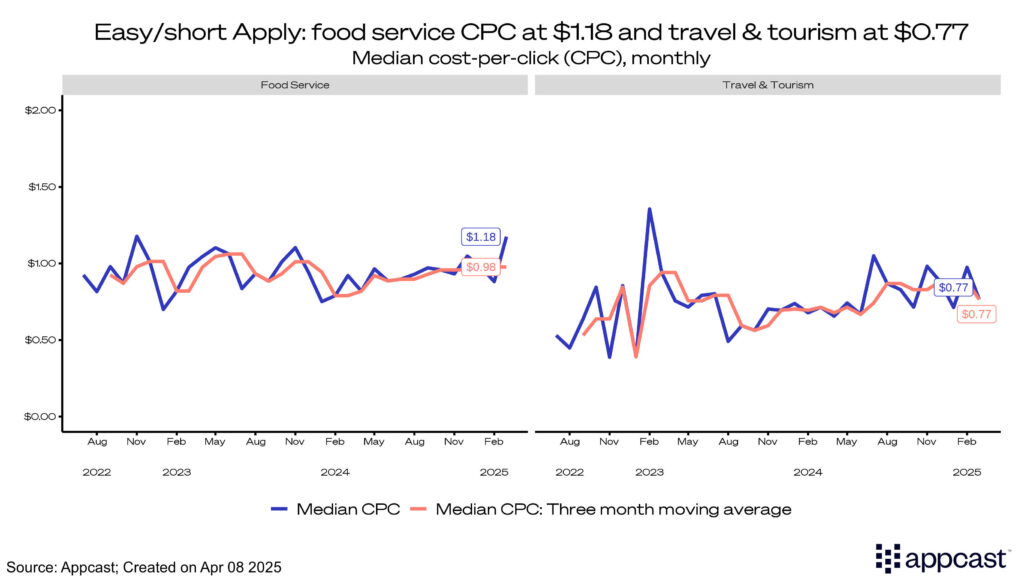

Meanwhile, quick-apply data has been less erratic over the past few months, mostly elongating trends which started earlier this year. Food service cost-per-click, for example, moderated slightly in Q4 (now $1.18), but is more or less following its three-month moving average. Travel & tourism CPCs dropped just a smidge this quarter, down to $0.77.

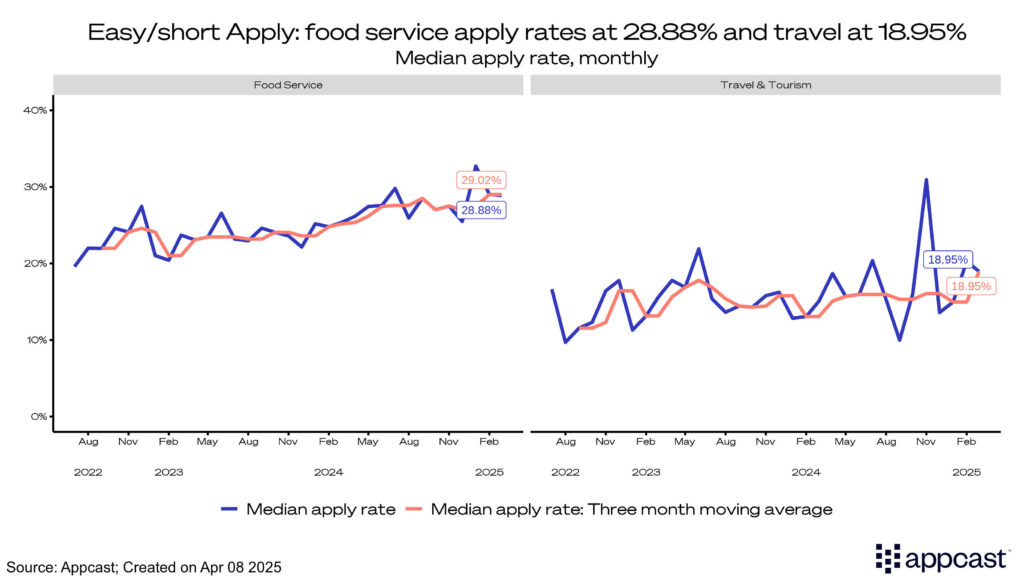

Quick apply rates for food service, meanwhile, increased in the first quarter (now at 28.9%). There was a spike early in the quarter. Quick apply rates for travel and tourism, which can shift rapidly month-to-month, recovered after declining dramatically at the end of Q4 (now at 19%).

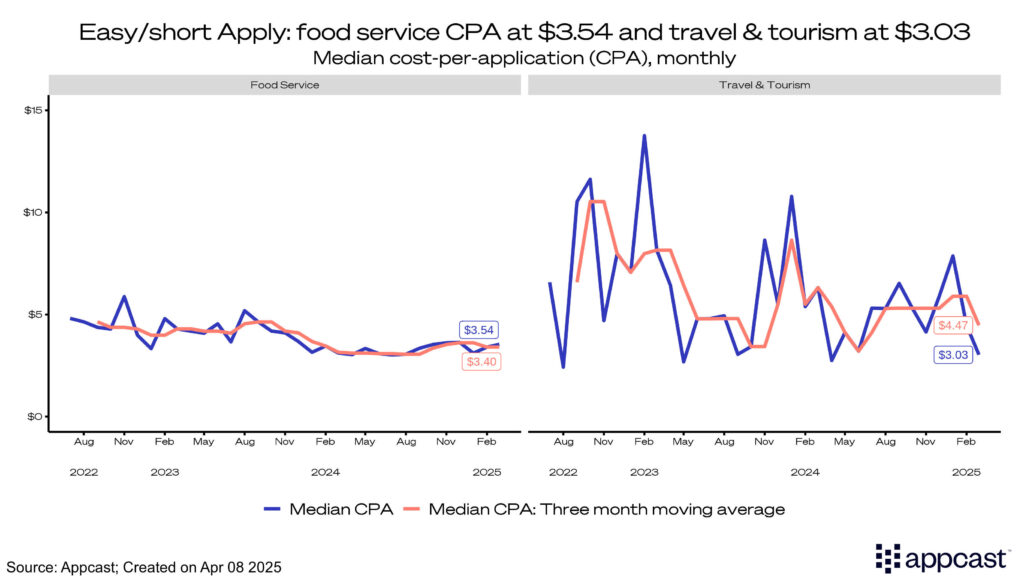

Despite more CPA volatility in travel & tourism (now at $3.03), its three-month moving CPA average has held steady for the past six months. CPAs for food service have not changed much at all the past year, hovering around the $3.50 mark.

Recruitment Marketing Forecast

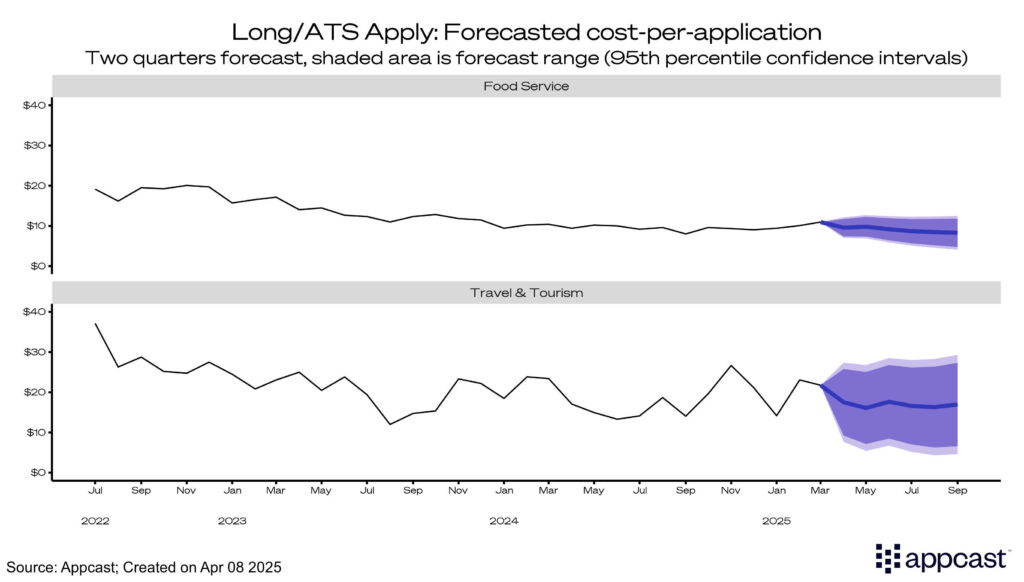

As far as the next six months are concerned, Appcast’s historical CPA data suggests that moderating trends through the first quarter will likely continue. We forecast food service CPAs will stay near the $10 range through the summer, while tourism CPAs may drop 10-15% into the summer months.

What Does This Mean for Accommodation and Food Services?

Overall, Q1 recruitment and labor market data indicate a slightly more competitive environment than Q4. Recruiting costs rose modestly, as did overall job openings in the sector. This has been boosted by a strong consumer that has buoyed the industry through several volatile years. However, warning signs are emerging. Airlines are issuing warnings that domestic airfare is falling. This could be the first sign that consumers are being more mindful with the pocketbooks under heightened economic uncertainty. In the case of receding travel and hospitality demand, the sector could face a tougher summer holiday season.

Forecasting Methodology

Cost-per-application (CPA) is forecasted two quarters ahead using the previous two years’ worth of one-month moving average data. A combination of ARIMA, exponential smoothing, and seasonal naïve models are used to create an ensemble forecast. The forecast provides both the 95th percentile confidence intervals, indicating the likelihood that each value will be within the CPA range provided.