Author: Sam Kuhn and Ada Acker

Economy-wide breakdown:

- The U.S. labor market has shrugged off the worst predictions of the immediate tariff impacts as employment growth averaged 150,000 per month over a three-month average. Yet, when you look under the hood, warning signs emerge: healthcare and leisure & hospitality own the bulk of job growth while all other major sectors are either flat or have contracted.

- The unemployment rate fell slightly to 4.1% in June, but due to an unfavorable reason: the labor force has begun to contract. In May, 625,000 workers left the labor force. Then the labor force contracted again by 130,000 in June. The shift in U.S. immigration policy has started to materialize throughout the job market, potentially signaling renewed labor shortages.

- On the trade front, a new major trade deadline has been announced: come August 1st, a new set of reciprocal tariffs will be enforced unless a deal with that country has been struck. Policy uncertainty remains elevated, which is souring the mood of consumers and businesses. Until clarity is given on the final path of trade, it is likely that volatility will persist in financial markets, risking bleeding into the broader economy.

- On July 4th, the One Big Beautiful Bill Act (OBBBA) was signed into law marking a significant change in fiscal policy: tax cuts for both businesses and households, boosted funding for immigration enforcement, and reductions in spending for Medicaid and SNAP. Each one of these provisions can alter the difficulty of recruiting by industry, depending on the type of workforce. TK: Read more from our Chief Economist Andrew Flowers to learn more.

Read our economy-wide breakdown of the latest numbers.

Employment Trends

Through the first half of the year, healthcare remains the powerhouse sector of the economy. It has gained the lion’s share of employment in the past six months, with little sign of slowing down. The net hiring rate, or the total difference between hires and separations remains elevated near 4%. Simply put, healthcare employment is growing at 4% excess of quitting or attrition, which has always been a big factor on retaining workers. This is higher than most sectors of the economy.

Excluding a drop in April, employment growth in healthcare has been gaining a steady 30 to 40 thousand jobs per month. This is in line with historical growth patterns and is likely to persist through the end of the year.

Perhaps one concerning trend emerging is the slowdown in hiring ambulatory services. During the peak of the pandemic, this sector grew from 10 to 15%, which has now slowed to just 0.4%.

Likewise, home healthcare growth has leveled off to 3.5% after reaching nearly 10% several months ago. Hospital and residential care facilities continue to grow at a steady pace of 3.5%.

Wage Trends

Wage growth patterns began to diverge by healthcare subsector in the first quarter, and this trend persisted through the second quarter. Particularly, wages for hospital workers have accelerated rapidly, reaching nearly 2.3%. However, wages for ambulance services workers have collapsed down to just 0.1%, effectively a rounding error.

Home health and care facility workers are enjoying more stable wage growth patterns, both above 1% and are likely to continue on that trend through the end of the year.

Openings and turnover trends

Both hiring patterns and turnover have recently stabilized in healthcare after a trend of declines. The hiring rate remains above 3%, while turnover rose above 2% recently, potentially indicative of an upswing in quitting activity.

Recruitment Marketing Trends

The term “long” or “ATS apply” refers to the conventional application process, requiring applicants to manually submit their tailored application documents and personal details through the company’s website or an applicant tracking system (ATS). In many cases, applicants are required to create a company-specific account.

On the other hand, “easy apply” refers to a swift application process on a job board, often conducted through a smartphone. With a single click, essential information like the resume is transmitted directly to the company. Due to the simplicity of this application method, easy-apply metrics are not directly comparable to those of the “long” or “ATS apply” The metrics are therefore presented separately.

Long Apply

While recruitment costs have declined across much of the labor market, healthcare has bucked the trend. In the second quarter of the year, hiring costs for healthcare roles accelerated, driven by persistently high demand and limited supply.

Cost-per-click (CPC) for healthcare job ads rose to $1.66, an all-time high, while cost-per-application (CPA) climbed past $41, the highest level in over two years. This surge is being fueled by unrelenting demand for critical roles such as mental health workers, behavior analysts, and home health aides.

The underlying dynamics are clear: labor supply remains extraordinarily tight. The unemployment rate for healthcare occupations sits below 3% and click-to-apply conversion rates remain stubbornly low at under 4%. These conditions are creating an environment where employers must spend more to attract fewer qualified applicants, driving recruitment costs higher even as other sectors see relief.

Easy Apply

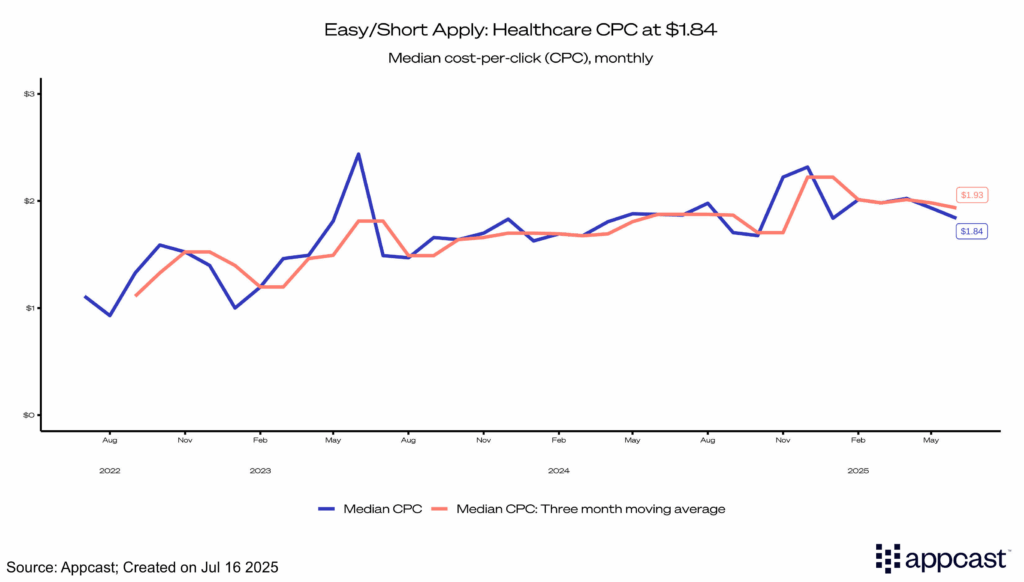

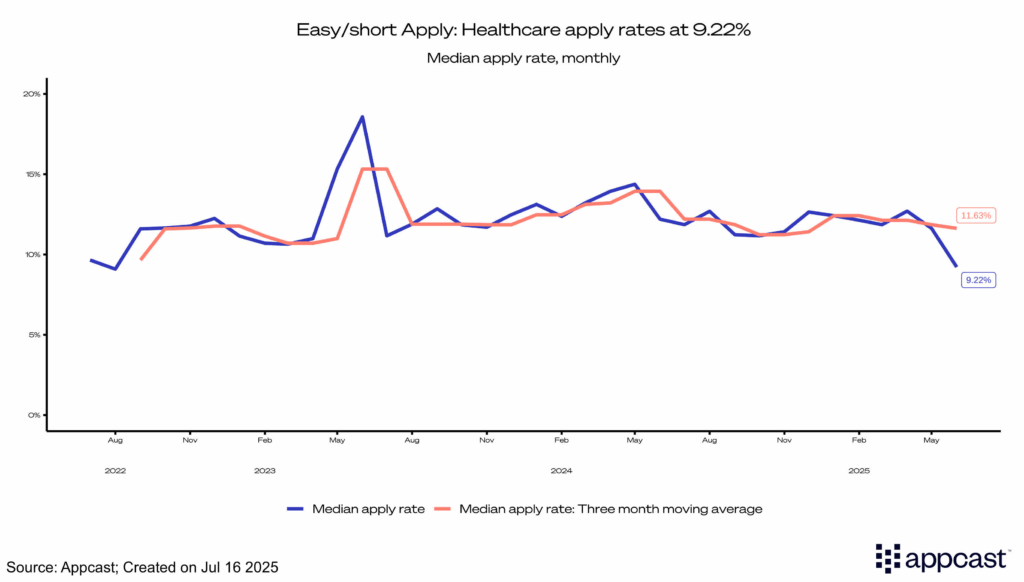

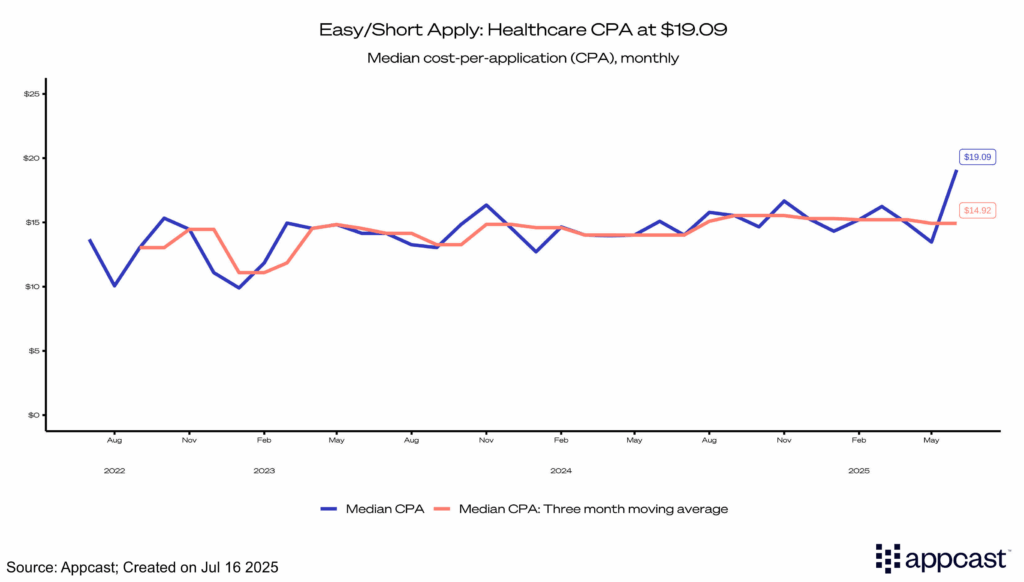

Even short- or easy-apply jobs long considered the lower-cost option in recruitment saw costs climb in the second quarter. Cost-per-click (CPC) nearly touched $2, while cost-per-application (CPA) rose by four dollars to an all-time high of $19.

The driver behind these increases is a familiar one: declining conversion rates. Apply rates for short-apply jobs slipped another percentage point in Q2, falling from 12% to 9%. As fewer job seekers move from click to application, the cost of generating each apply rises, tightening recruitment budgets even in channels that were once considered more efficient.

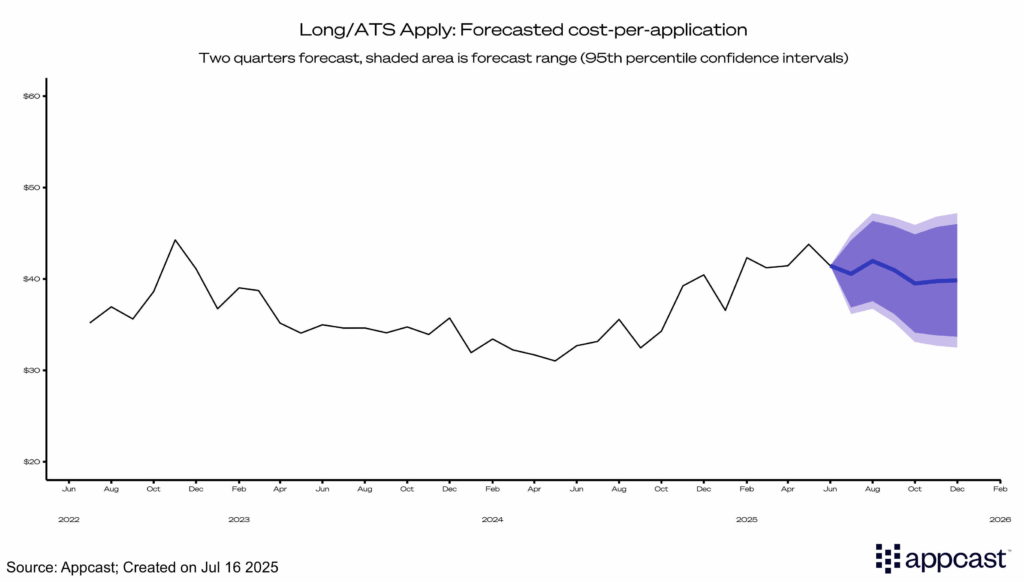

Recruiting Marketing Forecasts

Using Appcast’s weekly historical cost-per-application (CPA) data, Recruitonomics has developed a two-quarter forecast for median CPA in the healthcare sector. The outlook points to rising costs, with CPAs expected to return to levels last seen in 2022.

This projected increase reflects a persistently competitive hiring environment. With demand for healthcare talent remaining high and labor supply still constrained, employers will likely continue to face elevated costs to attract applicants in the months ahead.

What does this mean for healthcare?

Hiring demand in healthcare continues to remain robust as it’s the largest driver of job growth across the U.S. economy. Through the first half of the year, employment growth was steady, with no serious sign of a cooling pattern. The latter half of the year is likely to follow a similar pattern.

Yet, major policy change is underway which could affect healthcare recruitment. On July 4th, the One Big Beautiful Bill Act was signed into law, which contains previsions that will reduce Federal spending on Medicaid, up to 15% of the total. The Congressional Budget Office predicts this could increase the number of uninsured by 11.8 million, the largest increase in the uninsurance rate this century.

These cuts will shift both providers and patients on how to approach their care needs and ultimately hiring patterns for healthcare providers with a large share of Medicaid recipients, particularly hospitals.

However, the reductions will take several years to work their way through the system, ramping up in late 2026 into 2027. In the short term, they’re unlikely to significantly impact recruiting, but will surely as time goes on.

Forecasting Methodology

Cost-per-application (CPA) is forecasted two quarters ahead using the previous two years’ worth of one-month moving average data. A combination of ARIMA, exponential smoothing, and seasonal naïve models are used to create an ensemble forecast. The forecast provides both the 95th percentile confidence intervals, indicating the likelihood that each value will be within the CPA range provided. Economy-wide breakdown