The recruitment landscape has undergone a transformation during the past two years. The process of bringing a workforce back up to par from devastating employment losses proved a difficult task – especially as the labor market overheated. As the market begins to cool, the memory of a painful restructuring and continued recruitment challenges are tempting employers to hoard labor.

Labor hoarding is the act of retaining employees and minimizing layoffs amid an economic downturn. Employers are incurring the short-term costs of a larger-than-necessary workforce, so as to avoid the long-term costs of hiring new employees when the economy rebounds.

Rebuilding the workforce post-pandemic was a long and arduous process. Recruitment costs increased. Job seekers and workers held the power in negotiations, spurring fast wage gains. To attract job seekers, recruiters had to restructure their job ads and rethink salary offers.

Engaging in another round of large layoffs today may doom employers to a repeat of recent recruitment challenges at the next turn of the business cycle.

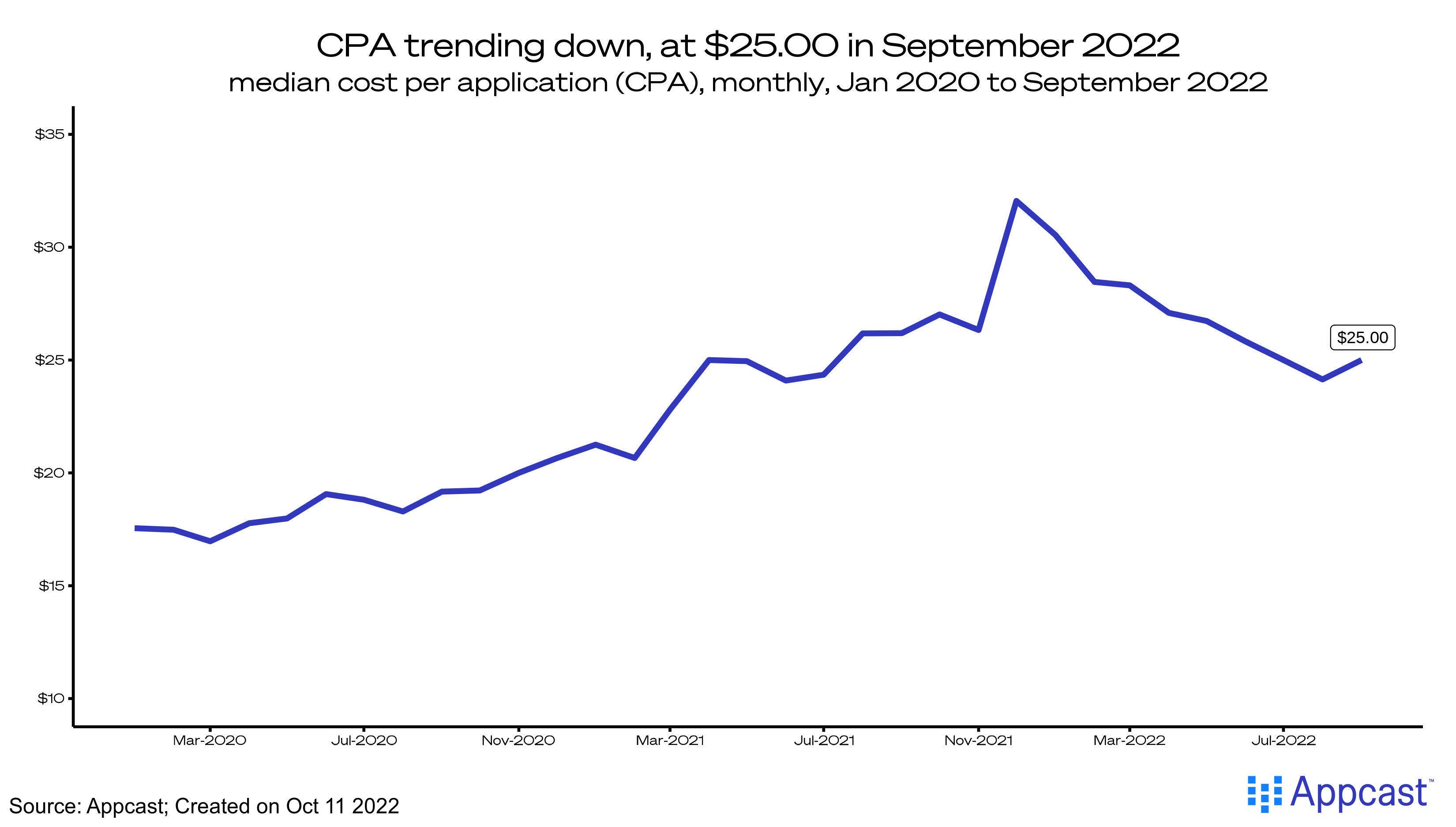

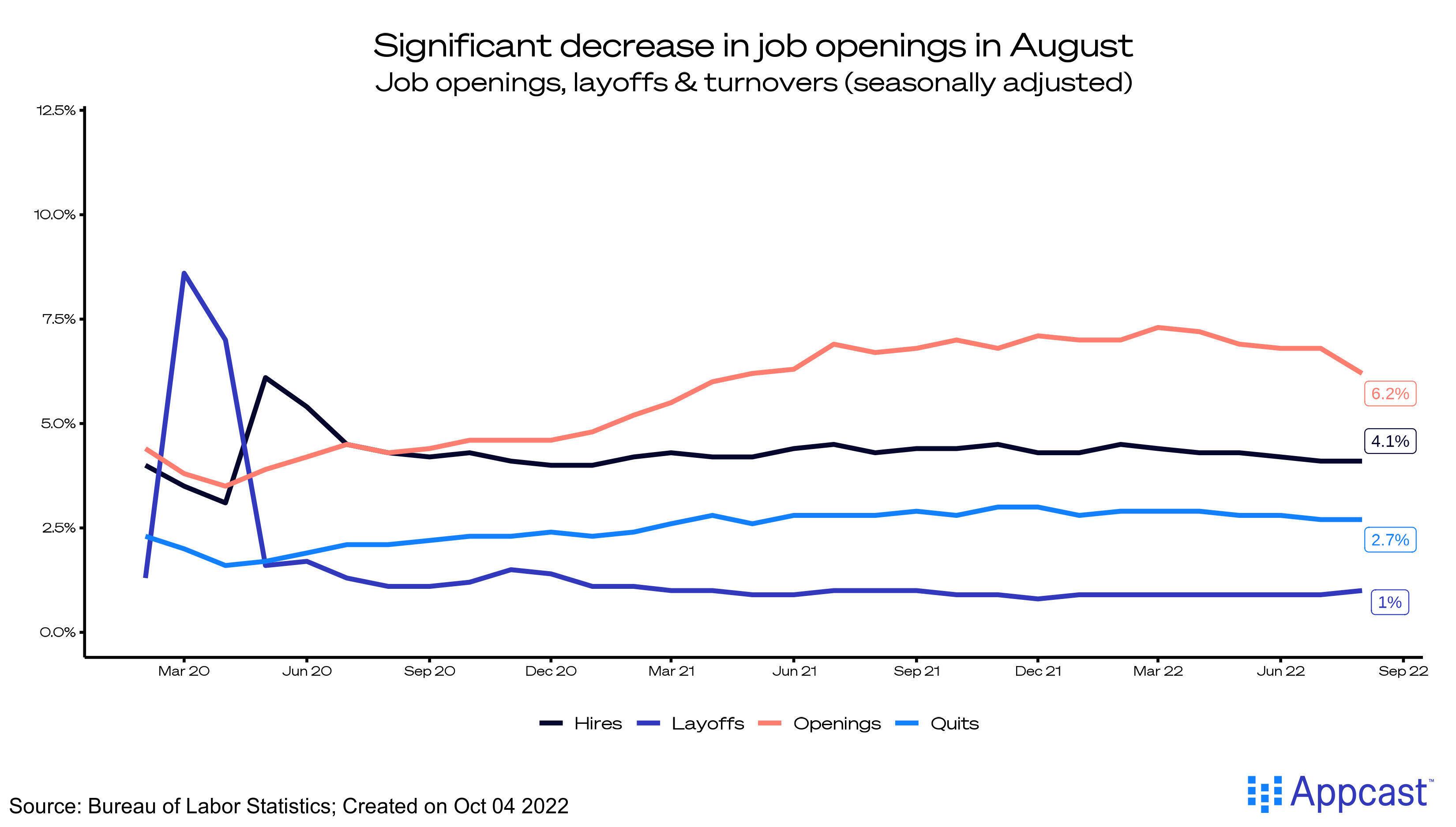

Recruitment competition is in the very beginning stages of cooling. August’s sizable decrease in job openings was encouraging, yes, but the labor market still has over 10 million unfilled positions. Similarly, while the median cost-per-application (CPA) is at $25.00 as of September 2022 – an improvement from the highs of late 2021 – it’s still elevated compared to the pre-pandemic cost.

So far, employers seem haunted by the recruitment challenges of the past year. Even high inflation and strengthening odds of an upcoming recession haven’t materially increased layoffs (as of August). The more up-to-date initial unemployment insurance claims data (a proxy for layoffs) also suggest fewer fires.

September’s employment data showed one sector engaging in this labor hoarding trend: construction. Despite turbulence in the housing market, the sector continued to add jobs in September, and layoffs remained low in August. Economic uncertainty has yet to spur layoffs in the sector.

Employers are choosing the path of labor hoarding both to avoid another round of layoffs and because labor demand is still high. Hiring and openings will slow before employers consider beginning a round of layoffs as employers attempt to push off the chance of another frustrating restructuring period.