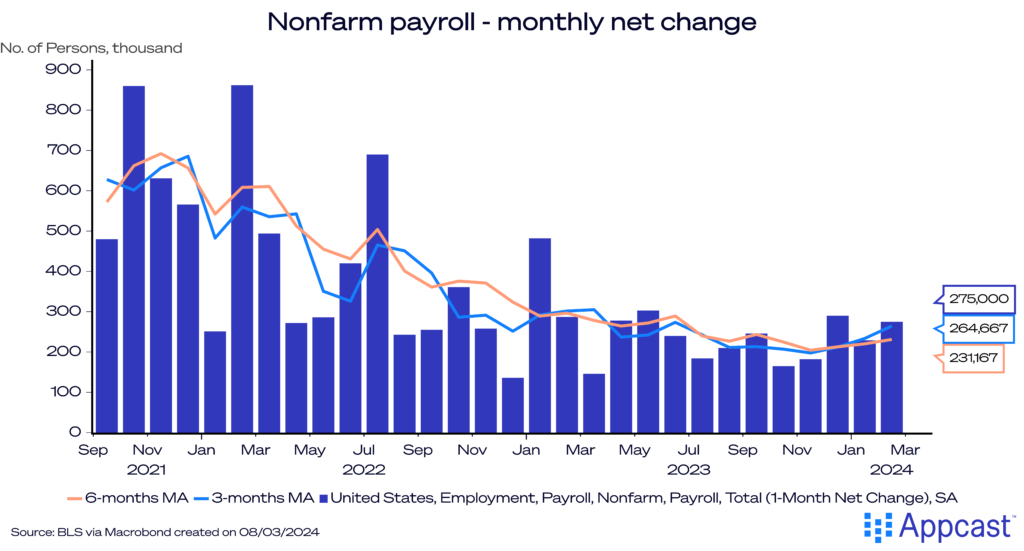

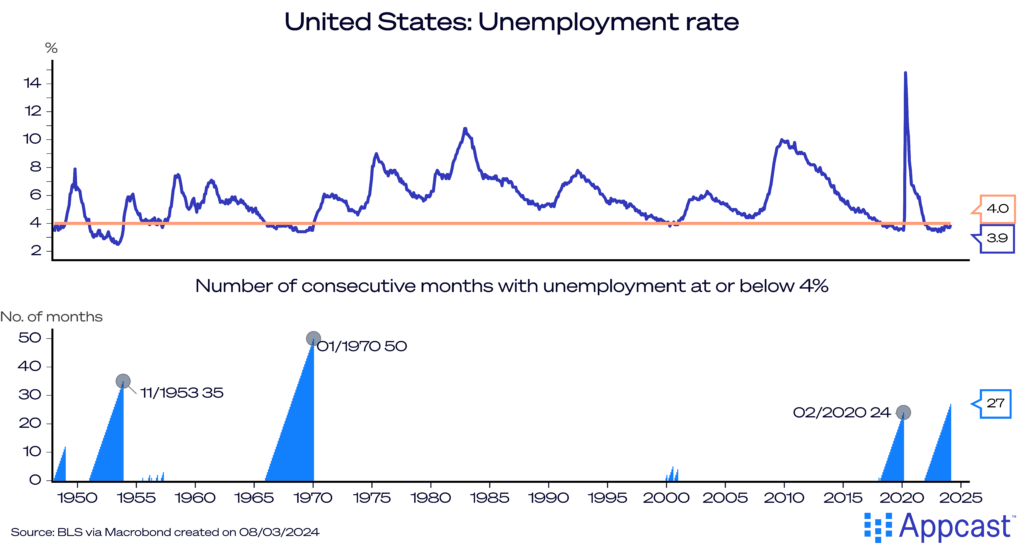

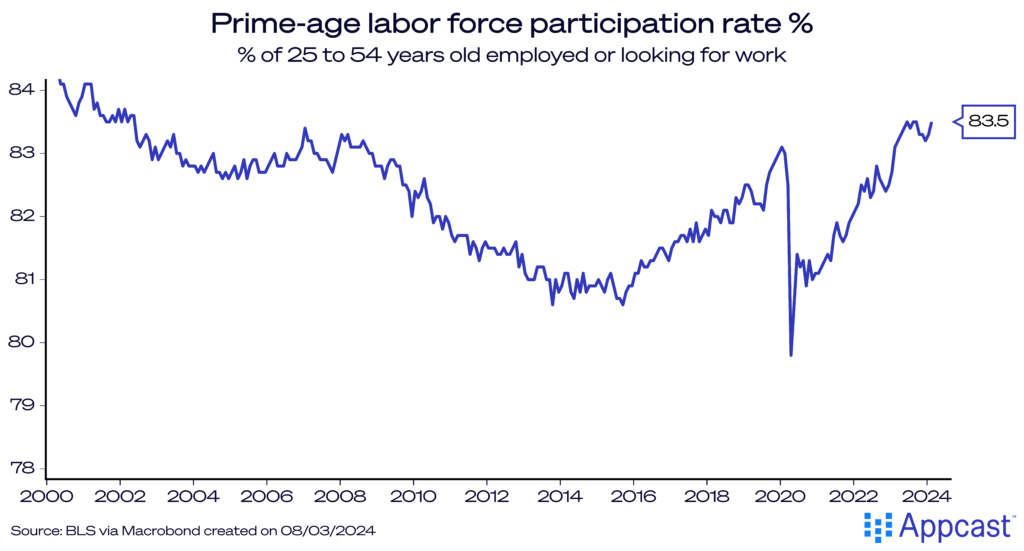

The U.S. labor market continues to defy gravity: with 275,000 net new jobs in February (beating expectations once again) job growth doesn’t appear to be “landing” at all. In recent months, trends have re-accelerated. However, the unemployment rate did increase to 3.9%, the highest level in two years. Yet that even masks strength, as the prime-age labor force is participating at the highest level in two decades. There is little need for worry: This resilient labor market remains strong.

Flying-high

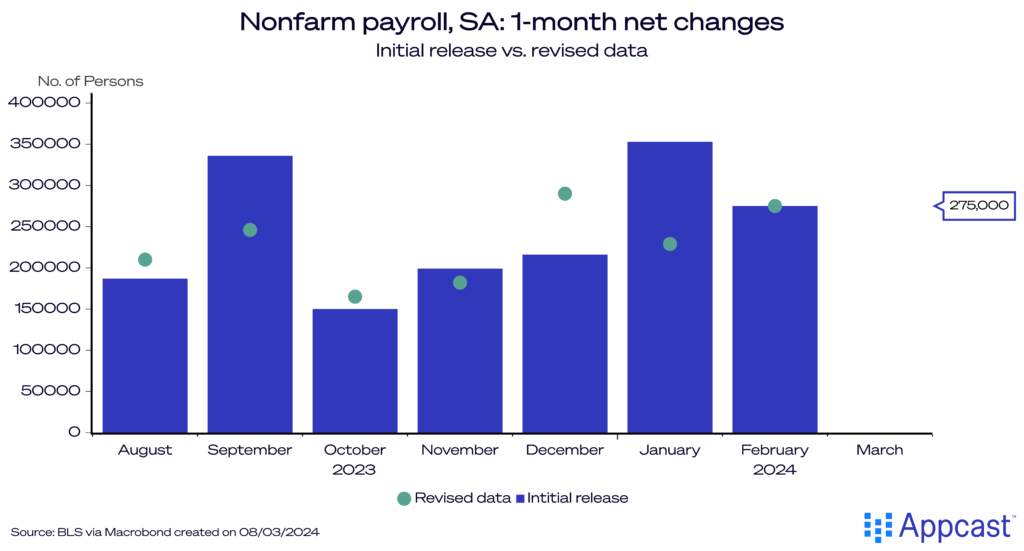

Yet again, job growth blew past expectations. And yet again, there were downward revisions to job growth figures from previous months. So, take the headline growth number from February’s report with a grain of salt: If recent history is a guide, it may get revised back down to the 200,000 or so that forecasters had expected.

Normally, downward revisions are a sign to worry, but we may be moving to a strange world in which the original, initial numbers are far outpacing expectations, but the downward revisions return those to more anticipated terrain. Perhaps the large variations are a symptom of falling response rates, which has been a trend over the past few years.

While the unemployment rate rose two-tenths, it remains historically low at 3.9%. This historically low unemployment rate adds another month to the impressive run of 4%-or-below unemployment, a testament to the enduring nature of this strong labor market.

Diving into demographics: for most working groups, including men, white workers, Black workers, and Hispanic workers, unemployment rates were unchanged in February. However, unemployment has risen slightly for adult women, albeit the rate remains historically low.

Prime-age labor force participation rose strongly, to 83.5% – the highest point in over 20 years. Layoffs remain low, so an important driver of the higher unemployment rate is the expanding workforce – good news for recruiters.

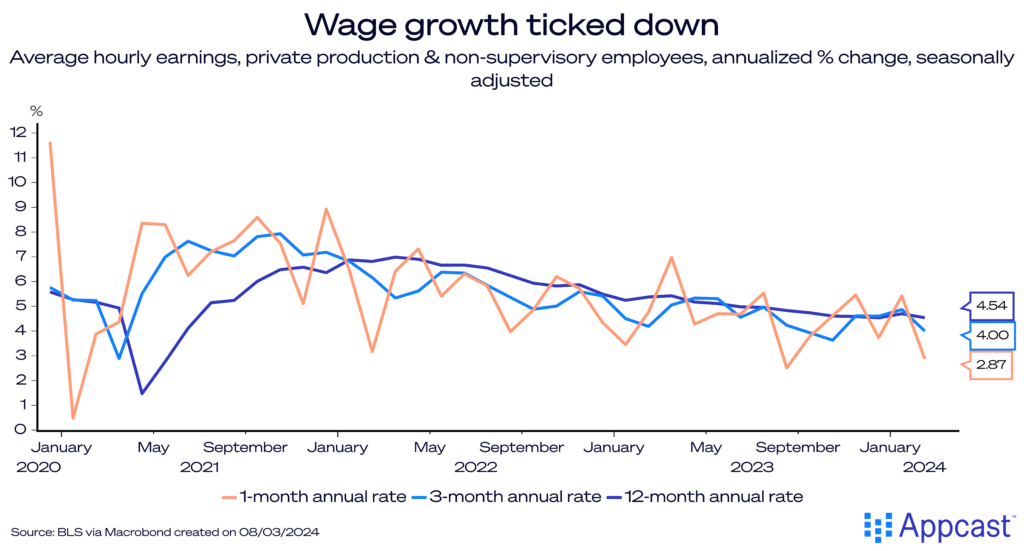

Wage growth trends seem clear for a soft landing. Average hourly earnings cooled considerably for non-supervisory workers, after a few “hot” months recently, rising at a 2.9% annual rate in February. Over the last three months, earnings are up 4% (compared to the 6% or so growth rate from a year prior).

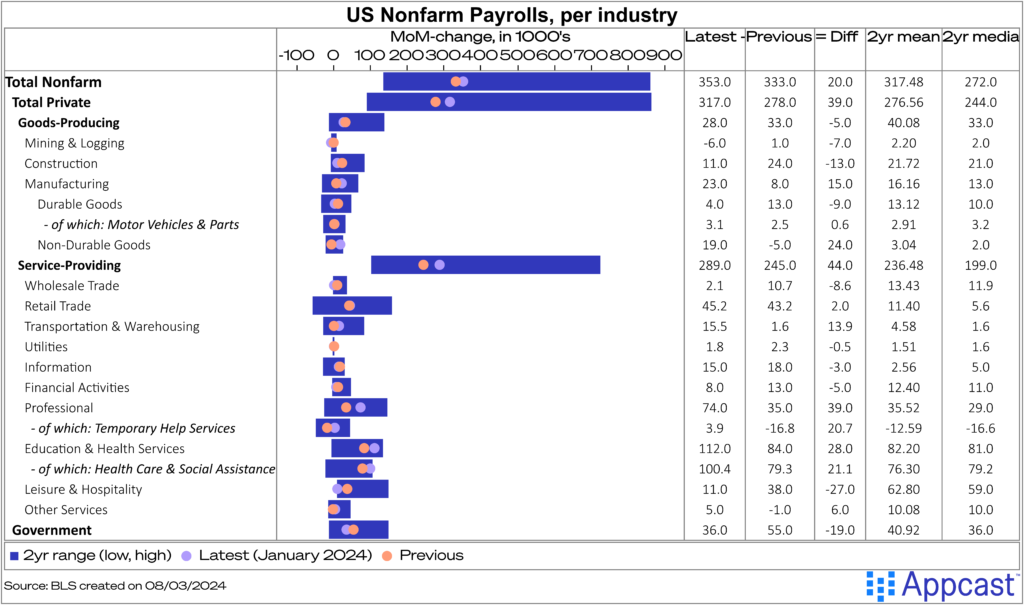

Industries are tracking as expected

Industry job gains were broad-based and behaved as expected. Construction and government payrolls were surprisingly strong in February, too, adding 23,000 and 52,000 net new jobs, respectively.

Other notable sectors include leisure and hospitality, which added 64,000 net jobs after a slow winter. Professional and business services, information, and financial services all had rather slow months, indicative of the sitting-down slowdown we’ve discussed recently.

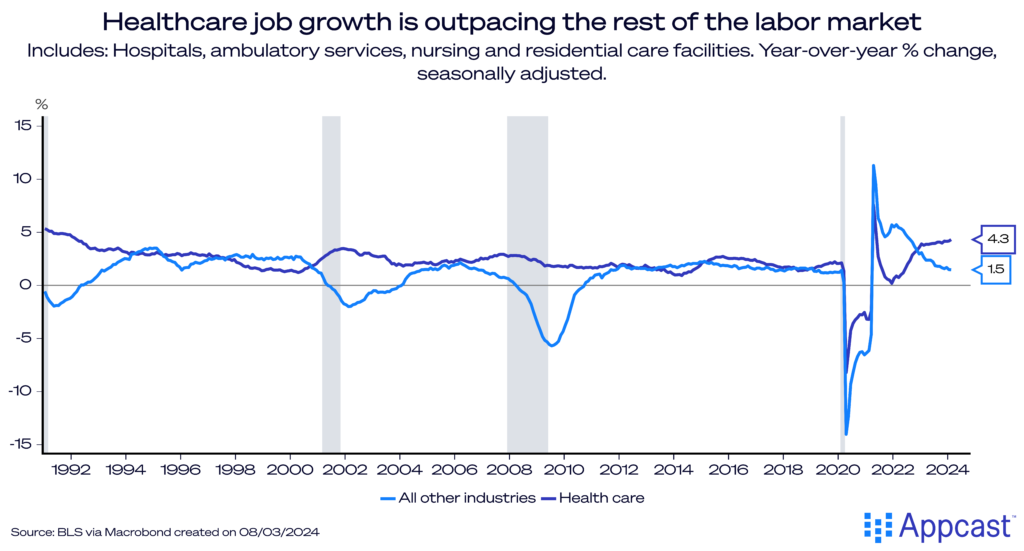

Healthcare continues to power job growth: the sector is up 4.3% from a year ago, while the rest of the labor force has expanded by just 1.5%. Demand in this sector has been particularly strong, as the population ages and healthcare needs expand, but “standing-up” jobs on the whole have been particularly in-demand.

What does this mean for recruiters?

Recruiters should feel confident in another month of strong gains, though those hiring in healthcare, construction, or other “standing-up” jobs might feel more of the jobs day love than recruiters in “sitting-down” industries.

As the labor market continues to fly high, it reminds us at Recruitonomics of a gravity-defying albatross: Perhaps the “no landing” is the new “soft landing”?