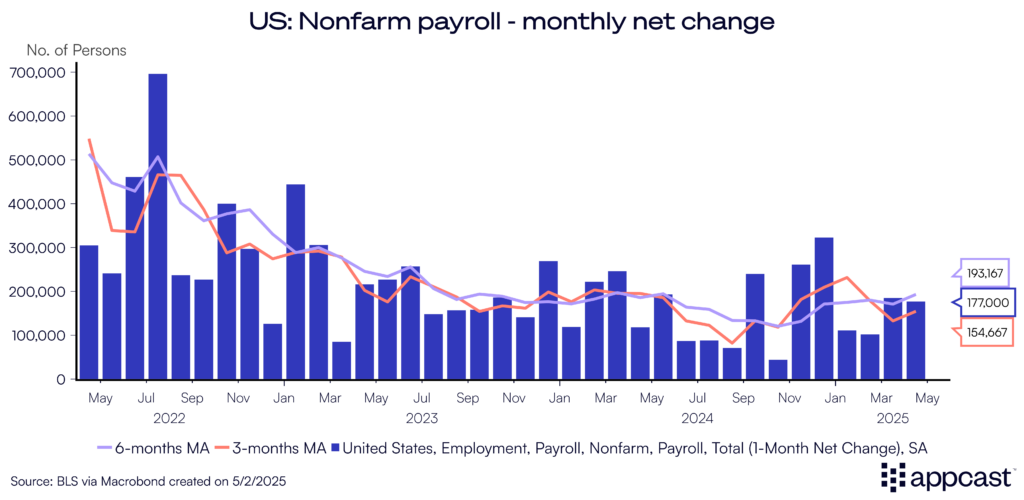

The U.S. labor market continues to show resilience. The U.S. added 177,000 new jobs in April while the unemployment rate stayed fixed at 4.2%. So far, the job market has shrugged off the April 2nd tariff announcements and subsequent whipsawing of financial markets.

The key question we are faced with now is: is this the last “before” report? Before, as in the last jobs report data before the impacts of sweeping tariffs.

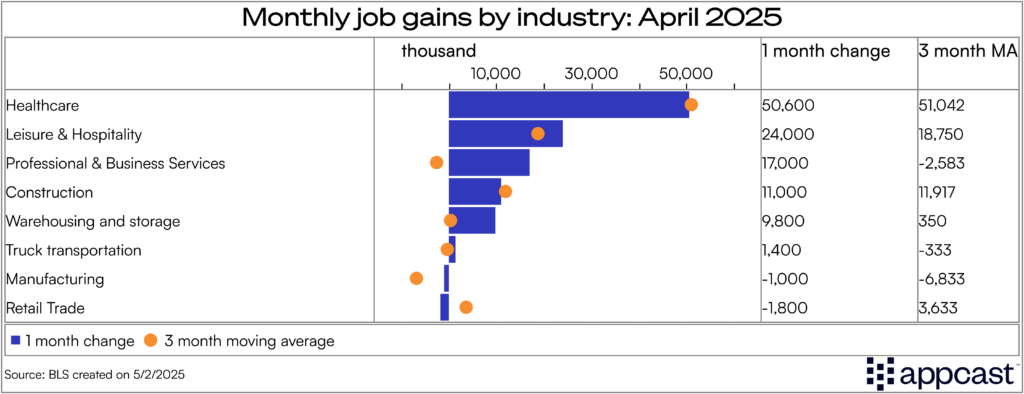

In the short term, the tariff impacts have provided a positive boost to hiring in transportation and warehousing. The sector added 29,000 new jobs, a strong reversal from several continuous months of job losses in 2022 and 2023. Both consumers and businesses have been front-loading the purchases of foreign goods, which has strongly boosted hiring demand across many parts of the supply chain.

For example, local freight trucking, an industry that has been contracting for more than a year now, added 2,300 jobs. Air transportation added 2,900. Warehousing & storage overall, 9,800 jobs— the strongest month of job growth in more than two years.

Outside of the supply chain & logistics industries, hiring demand was solid across the board. Healthcare continues to chug along, adding 50,600 new jobs. Despite some warning signs about cooling international and domestic travel, leisure and hospitality added 24,000 jobs.

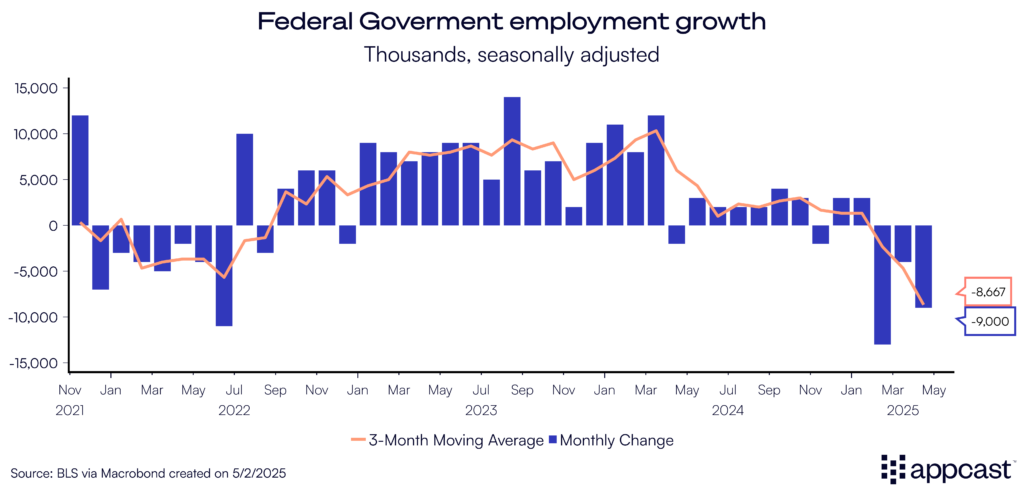

One area of weakness we’ve highlighted before has been the decline in federal government employment, as the sector lost another 9,000 jobs in April. The longer-term strategy to reduce the federal workforce on behalf of the Department of Government Efficiency (DOGE) continues to play out as thousands of workers have been asked to take severance.

Pre-tariffs in the greater economy

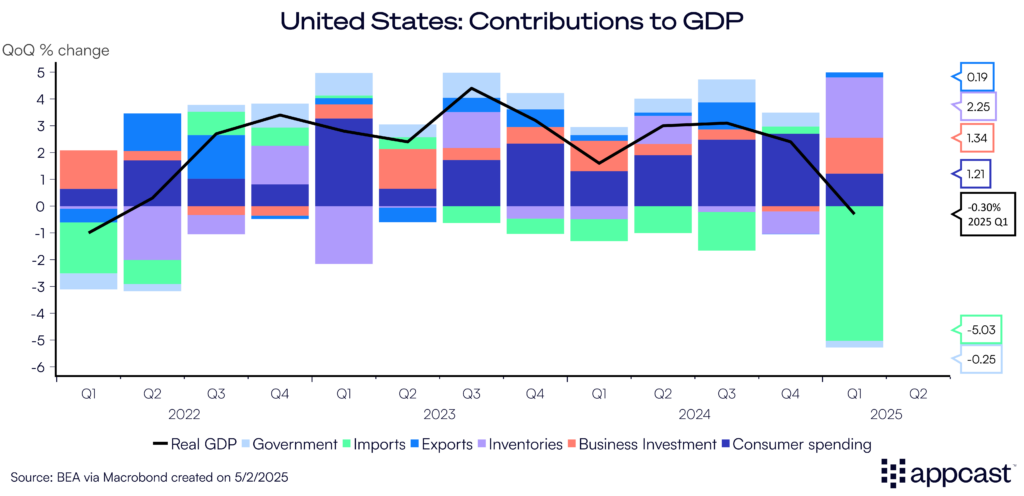

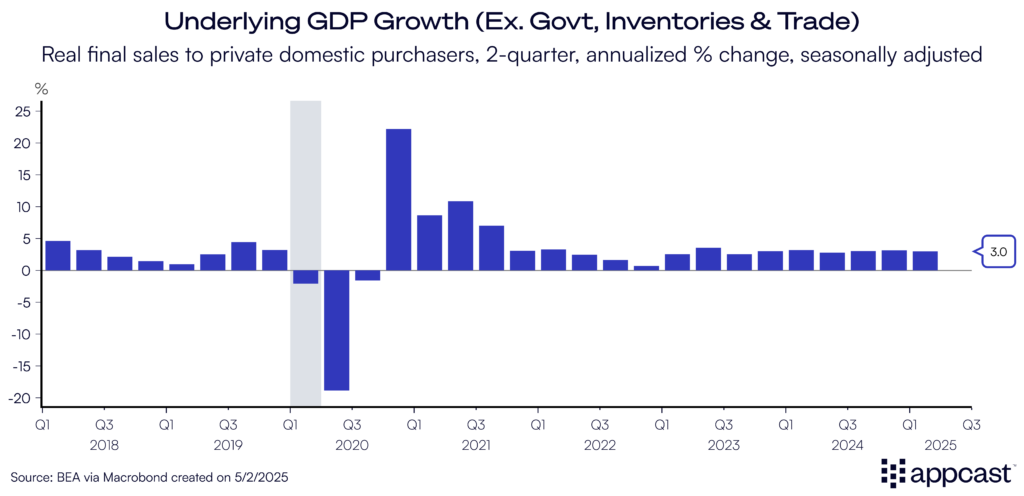

The other main piece of economic news this week was the release of first quarter gross domestic product (GDP). This week’s GDP figure showed the U.S. economy contracted for the first time since the first quarter of 2022, declining -0.3%.

This decline was driven primarily by a surge in foreign goods imports, increasing 51% at a seasonally adjusted annualized rate. Imports subtract away from the arithmetic of GDP to avoid double counting, as the imports could count towards consumption or investment. Total imports overall subtracted five percentage points from overall GDP growth, the most in more than three years.

Stripping away the impact of trade data and just focusing on consumer spending and business investment was surprisingly strong, growing at 3% annually.

Now, the question is how will the economy fair going forward given a dip in business and consumer sentiment?

“Soft” vs “Hard” data

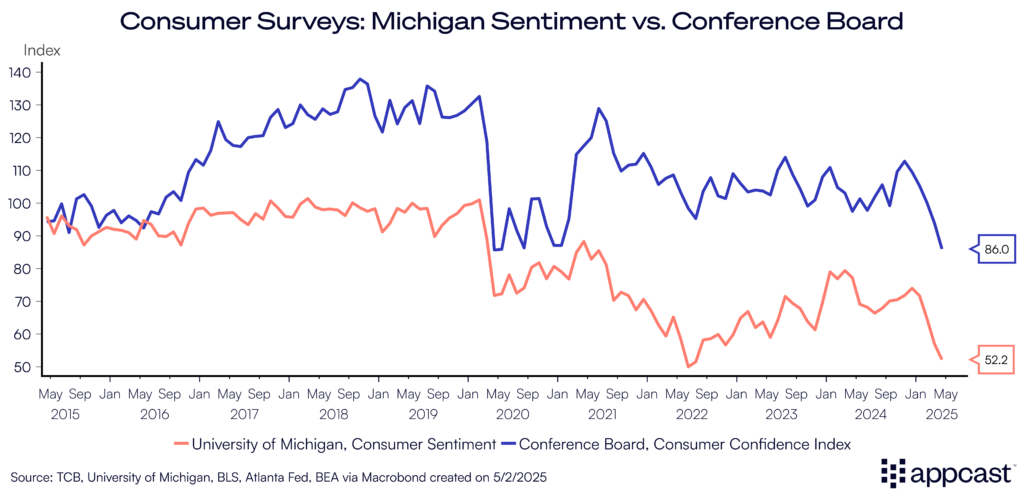

Employment growth or GDP are what economists refer to as “hard” data – tangible data points that reflect the true reality of the situation. Both areas seem mostly fine (stripping out trade volatility from GDP). “Soft” data—or how people feel about the economy—has weakened substantially since February.

For example, University of Michigan’s Consumer Sentiment survey is at a two-year low. Likewise, the Conference Board’s version of the survey also reflects a more pessimistic consumer.

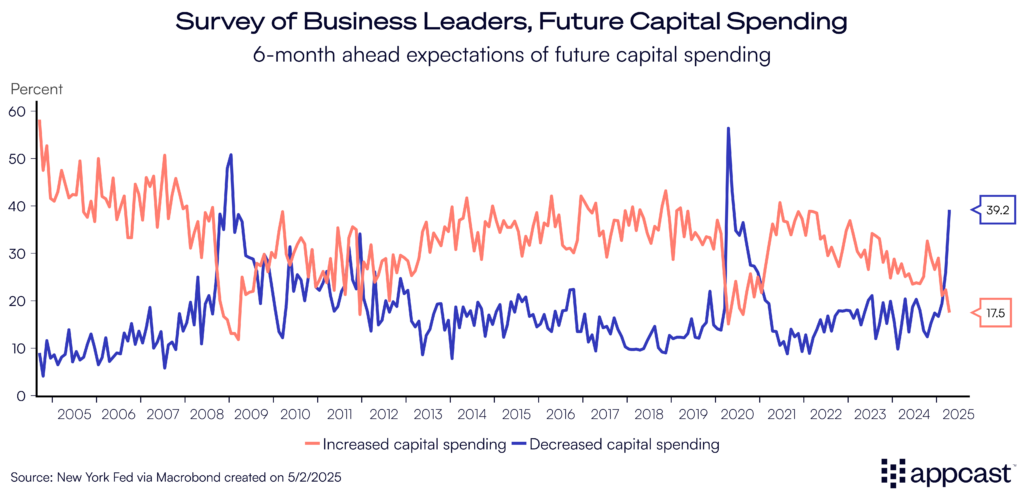

On the business side, the New York Federal Reserve’s Survey of Business Leaders also shows a worrisome trend. Future 6-month ahead expectations of capital spending have declined rapidly.

In 2024, most respondents indicated they were going to invest further in their businesses to grow. Now, that has completely flipped on its head: 39% of respondents indicated their businesses will pull back on investment, while just 17.5% said they will invest further.

Where does that leave us? Right at this moment, we still have a mostly healthy labor market and underlying GDP growth while consumer and business sentiment has dipped. Second quarter GDP growth may look substantially different from the picture at the beginning of the year as international trade dwindles and supply chains must readjust.

What does this mean for recruiters?

For recruiters, this jobs report indicates that hiring demand across the economy was mostly stable in April. Those working in transportation, warehousing or logistics may have experienced a recent spike in competition as hiring picked up in the first quarter. Yet, the soft data highlighted shows a worrying sign—businesses and households may begin to change their purchasing and investment habits.