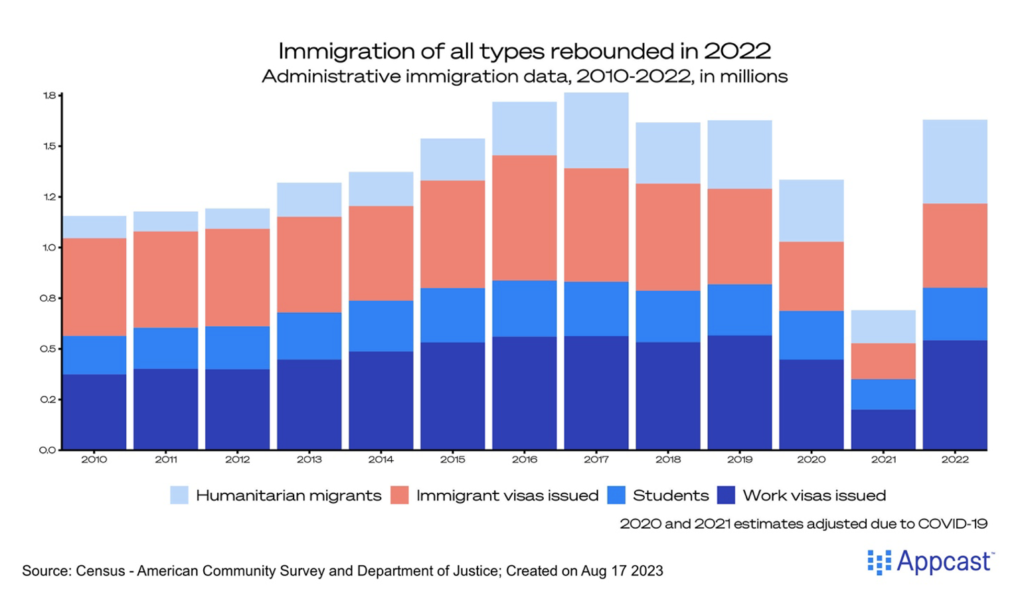

A mere 376,000 people were let in from 2020 to 2021, the lowest in many years. Then this trend completely reversed in 2022. Travel restrictions subsided and net immigration returned to the pre-pandemic norm of around a million people a year.

Perhaps the most significant change was the strong return of work visas – 543,000 were issued in 2022. The number of job openings in the U.S. is still elevated, and these work visas are an important part of growing the economy by plugging the gaps in the labor market.

An Aging Population

In industries with particularly acute recruiting dilemmas, immigrant workers serve an even more vital role. A Brookings Insititute study found that an increase in the share of the foreign-born labor force decreased the likelihood of the elderly living in an institution, compared to aging in place. Based on their model, an average 65-year-old in 2000 would have been 10% less likely to live in an assisted care facility if immigration levels remained at their 1980 levels. The U.S. population is gradually aging and the demand for healthcare workers is set to surge.

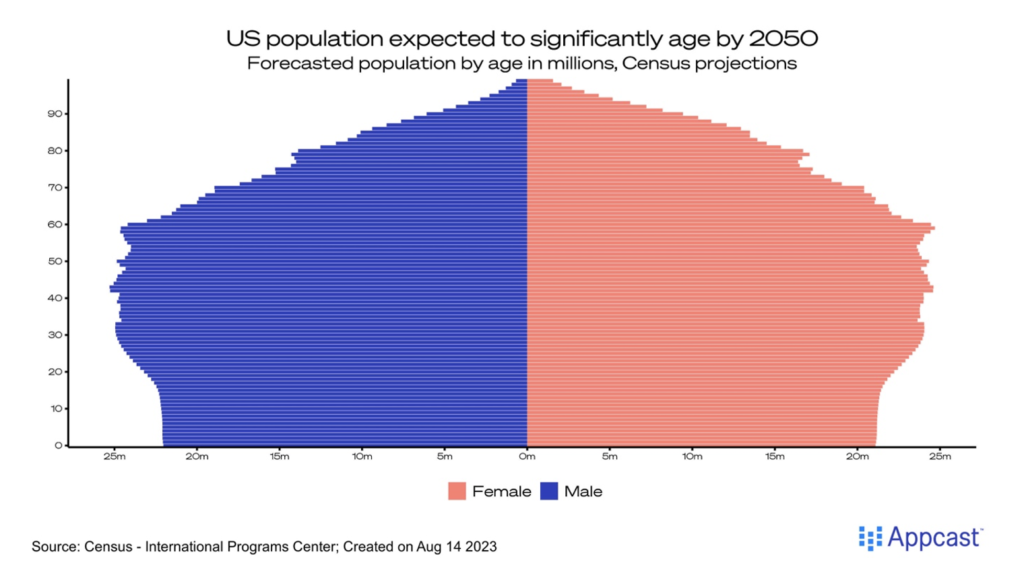

New estimates from the Census show the median age in the U.S. hit a record-high of 38.9 years old. During the post-war boom of the 50s and 60s, the average age was significantly lower, a period of substantial GDP and wage growth. Future estimates put the median at 43.1 years old by 2050, proving the crucial need for an infusion of younger workers to bolster the prime-age workforce and provide critical care to our seniors.

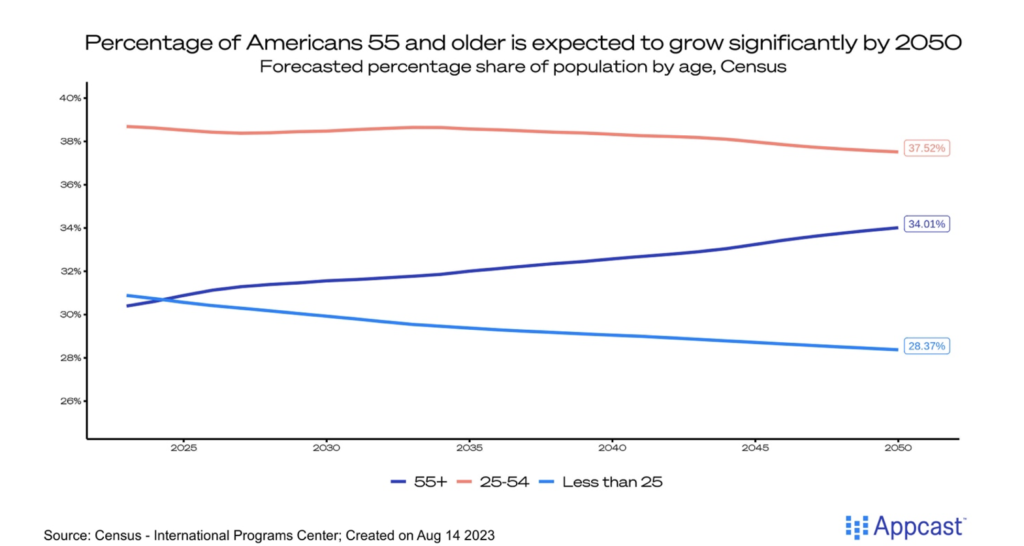

The share of the population currently 55 and older is just over 30% and is expected to rise to 34% by 2050. Not only will there be a declining share of the eligible prime-age working population – the share of the younger population is expected to drop as well. Students and younger workers are the future of the labor market and their proportion of the population is projected to decline from almost 31% down to 28%!

These demographic challenges only highlight how important both working and student visas are to support the growth of the economy. Without these workers, many vacancies critical to the health of our elderly population could go unfilled.

The Costly Gaps

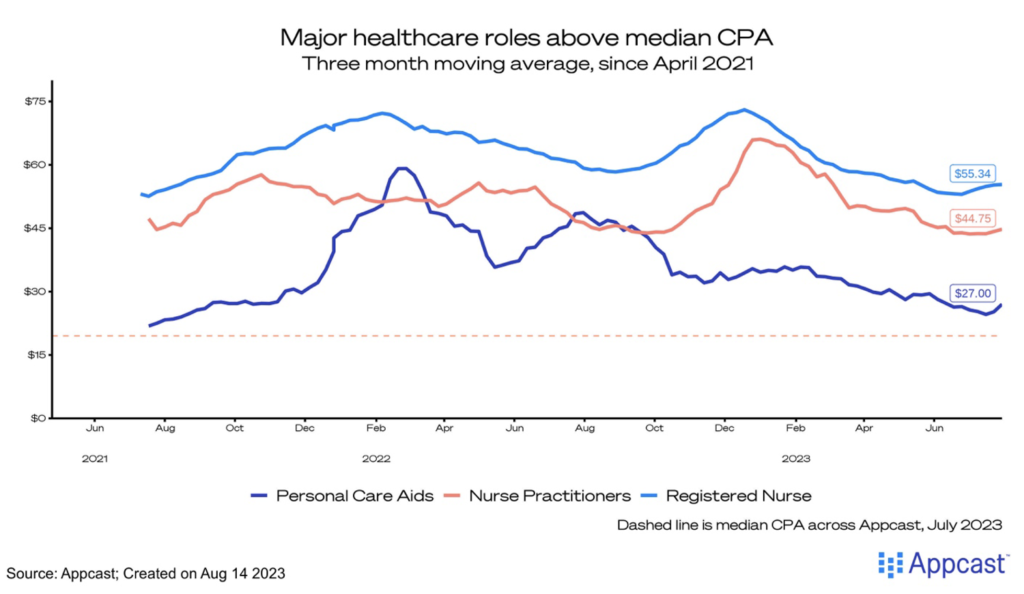

The empirical work done in academic research also materializes in Appcast data on recruiting costs. The cost-per-application (CPA) for healthcare workers has been notoriously high, particularly for nurses and personal care aides. Despite a broad softening in the labor market over the past six months, these roles are still hard to fill.

Personal Care Aids have a median CPA at $27 in July, more than 40% higher than the median CPA across all roles within Appcast . For nursing roles, it is even more competitive – both Nurse Practitioners and Registered Nurses have CPA’s far above the median, at $44.75 and $27.00, respectively.

The healthcare sector is not the only industry plagued by high recruiting costs – similar trends are happening in the skilled trades. CPAs for plumbers, electricians, and maintenance workers were also substantially higher than the median. These recruiting challenges further show how essential immigration will be to alleviating the pressure on the demand for workers.

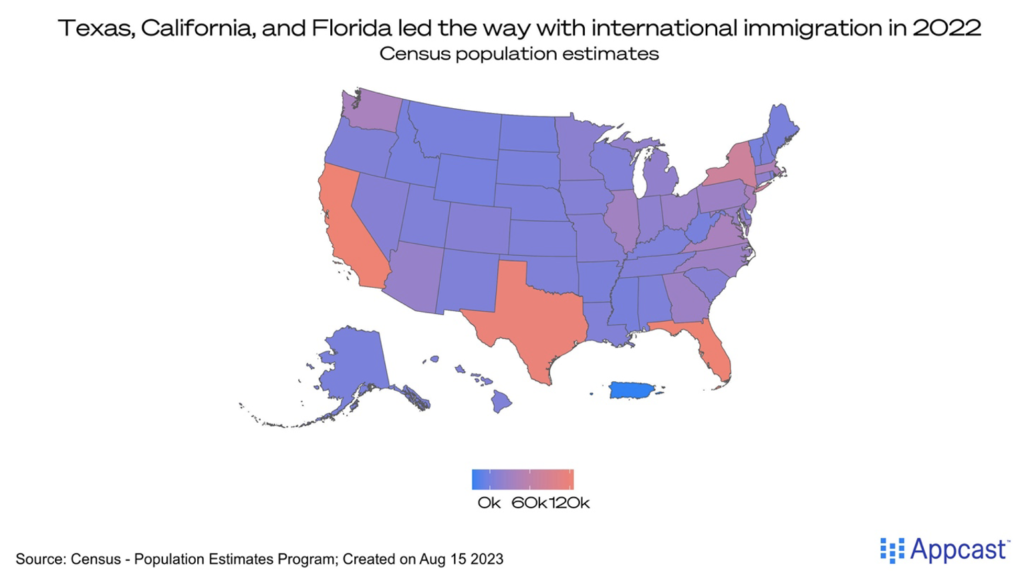

When 2022’s immigration data is broken down by state – an interesting pattern appears. Most states had international immigration growth but Florida, California, and Texas led the way with a combined 368,000 new residents. These states also had a significant GDP boost in 2022, with Texas far above with an annual growth rate of nearly 15%! Booming economies fuel the demand for labor and the substantial boost in immigration surely helped.

What does this mean for recruiters?

The evolving immigration landscape, demographic shifts, and recruitment challenges underscore the need for longer-term thinking. Embracing immigration as a solution to labor shortages, particularly in critical sectors, can contribute significantly to addressing unfilled vacancies in the face of an aging population.