This shift in policy may result in an increase in the uninsured population and could result in job losses to direct healthcare providers and their surrounding communities.

The goal of this article is to understand how these reductions may impact the healthcare labor market and broader U.S. population.

Current state of healthcare labor market

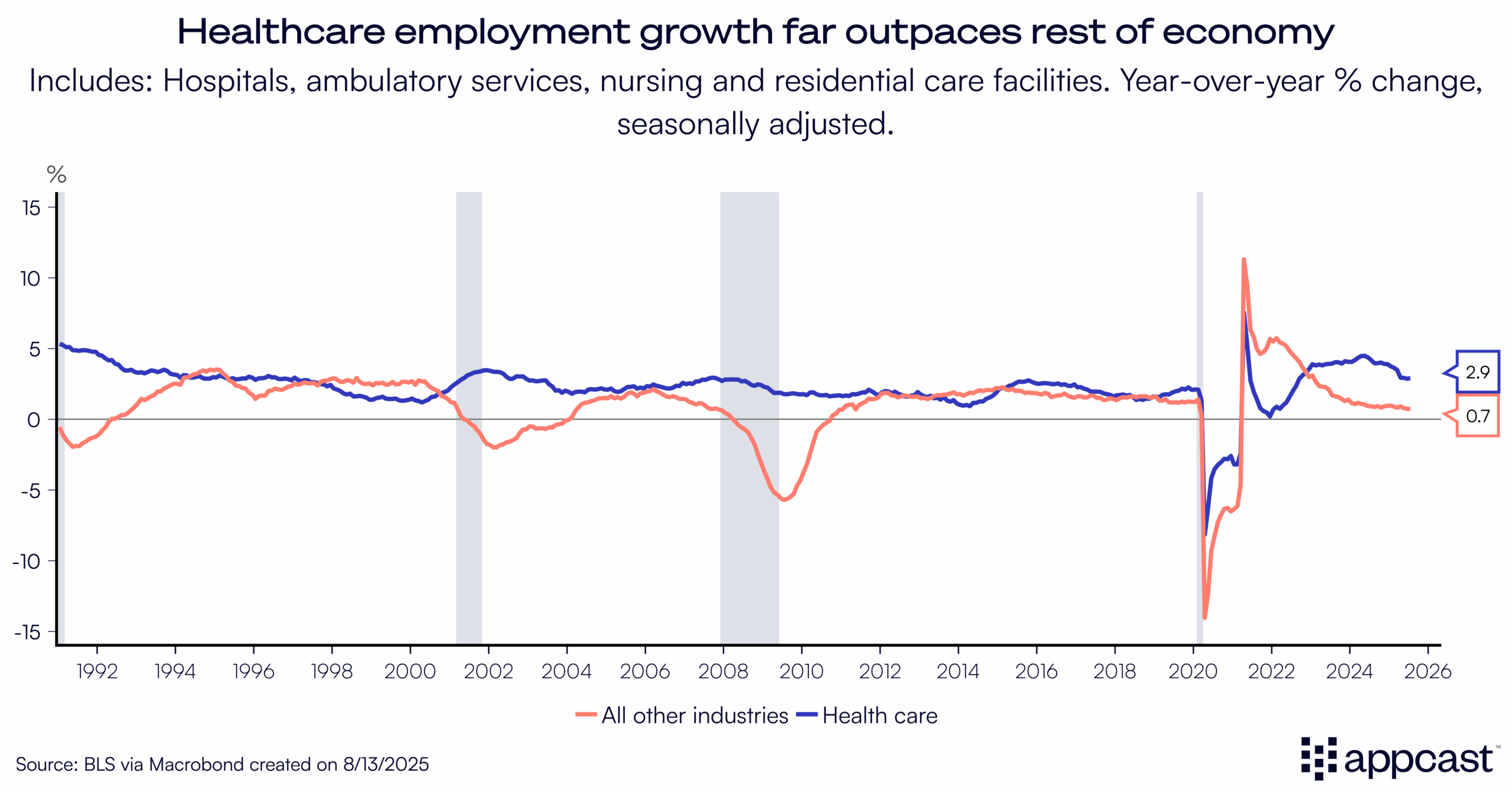

The healthcare labor market continues to exceed expectations as it’s growing at nearly 3% annually—while the rest of the economy has slowed to a post-pandemic low of just 0.7%.

Following the release of the latest jobs report on August 1st we learned that the vast majority of hiring demand is concentrated in just healthcare now. In fact, if you remove healthcare & social assistance from the overall monthly employment growth figure of 73,000 jobs the labor market would have contracted by 300 jobs.

Many factors are at play contributing to overall hiring demand in healthcare, but there are two simple patterns to understand: first, that the U.S. population is aging, which is increasing healthcare service needs; and second, that the uninsured population has steadily dropped over the past 15 years, leading to more people with access to healthcare.

The second factor, a decrease in the uninsured population, has been evident over the past ten years ever since key provisions of the Affordable Care Act (ACA) were enacted in 2014. For much of the 2000s, nearly 15% of the U.S. population did not have any form of healthcare. Just under 10% had Medicaid as their primary insurance in 2000.

Medicaid coverage has rapidly expanded since then, now insuring more than one in five Americans. Medicare has risen modestly to 19%, as well. This in turn has halved the uninsured rate to below 8%.

The Details on Medicaid Reductions

Under OB3, future Medicaid funding will be shaped by four key provisions that together account for the roughly $1 trillion in projected cuts:

- Work requirements – $326 billion. New eligibility rules will require many enrollees to meet work or community engagement criteria to maintain coverage.

- Eligibility redeterminations – $63 billion. States will increase the frequency and rigor of eligibility checks needed for people to stay continuously enrolled.

- Reduction in provider taxes – $191 billion. Limits on how much states can tax hospitals and other providers will reduce a key source of state Medicaid revenue.

- Eliminating the Medicaid expansion match rate – $149 billion. The federal government will scale back the enhanced match rate for ACA expansion populations, shifting more of the cost burden to states.

The first two provisions determine who gets on or stays on Medicaid, while the latter two change how states finance their programs, either by constraining provider tax revenue or by reducing federal cost-sharing.

Not only is it crucial to understand how these reductions are impacting enrollees and state programs, but also how long they will take to come into effect. According to the Congressional Budget Office (CBO), a vast majority of the total reduction will not be realized until 2030 and beyond.

The 2025–2027 reductions total just over $63 billion. The cuts ramp up after the midterm elections and accelerate following the next presidential election. Given that timing, the labor market effects likely won’t be felt for several years.

Impacts will vary widely by state as well, depending on whether the state expanded Medicaid under the ACA. Florida did not expand, so it faces a relatively modest cut: about 5% of its baseline spending. By contrast, Oregon faces a 19% reduction, California 17%, and New York 16%. States with larger gaps will need new revenue to keep enrollment steady or they’ll be forced to reduce coverage.

Impacts on labor supply and demand

How will these reductions affect the healthcare labor market?

Starting with labor supply, a goal of Medicaid work requirements is to boost employment by requiring enrollees to complete 80 hours per month of work or volunteering. Arkansas implemented this in 2018, giving us a real-world test case.

Research from the Urban Institute compared prime-age adults (ages 30–49) in Arkansas with a similar group elsewhere. After the policy took effect, the uninsured rate in Arkansas rose, especially among households with limited internet access who struggled to log in to the state portal and verify work status. It didn’t lift employment, either. Most prime-age Medicaid recipients were already working, in school, or faced health limitations that kept them out of the labor force.

On the demand side, research from the Commonwealth Fund points to sizable job losses if Medicaid and SNAP are reduced together. Their estimates translate into roughly 500,000 fewer direct healthcare jobs, with broader spillovers pushing total losses to more than 1.2 million jobs across local economies.

The direct result to healthcare providers stems from reduced funding. In response to fewer funds, providers may reduce staff or cut wages. This results in what is know as an “induced effect”: more than 20 million Americans work in Healthcare & Social Assistance, so a reduction in staff could slow consumer spending and result in a broader economic slowdown.

Why it matters: fewer insured patients and lower provider revenue mean tighter budgets, reduced hiring, and potential layoffs, not just in hospitals and clinics, but in the surrounding ecosystem of local businesses that depend on healthcare dollars.

What does this mean for recruiters?

Medicaid cuts are coming but their impact will roll out slowly and unevenly. Don’t expect a near-term flood of candidates—the reductions are backloaded, so hiring competition is unlikely to ease for several years. Geography matters, too: ACA expansion states are likely to feel a sharper squeeze.

Over the longer run, plan for tighter hiring budgets and tougher approval thresholds as the uninsured share edges higher and uncompensated care costs rise.