Maybe the U.S. job market’s hot streak isn’t slowing down after all. Yet again, the jobs report beat expectations in May. A net total of 339,000 jobs were added, easily above expectations for 190,000. The unemployment rate rose to 3.7%, up from a half-century low of 3.4%. Upward revisions to March and April nearly totaled 100,000. Average hourly earnings remained elevated at just under 5%. Industry job gains were broad-based, with professional and business services, healthcare, and government sectors leading the way. Overall, this jobs report indicated that the perceived slowdown in hiring is happening more gradually than expected, if at all.

FullER employment?

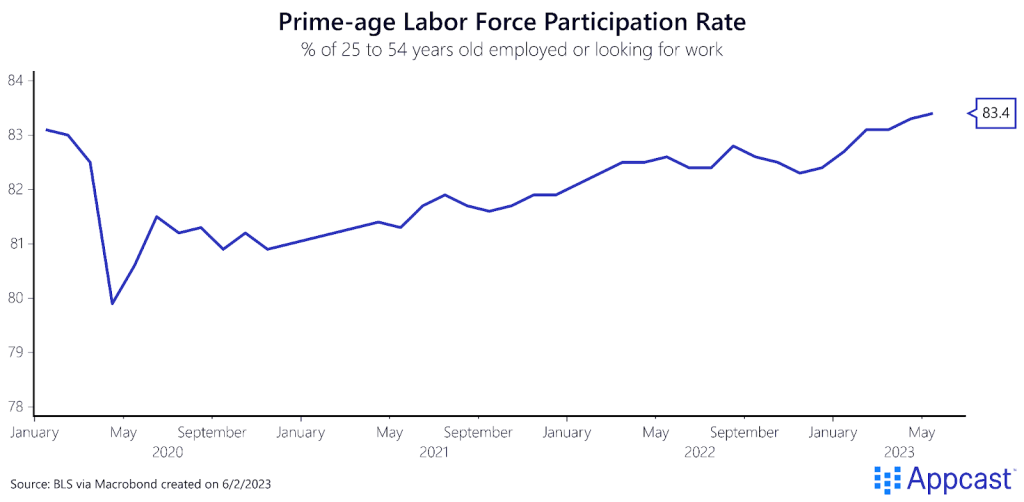

There’s still room to run in the expanding workforce! Prime-age labor force participation increased yet again, to 83.4%. This series has eclipsed its pre-pandemic levels. Compared to other advanced economies, the U.S. labor force participation rate lags. The continued growth and the evidence from other economies suggest there’s still room to grow labor supply, perhaps to fuller employment!

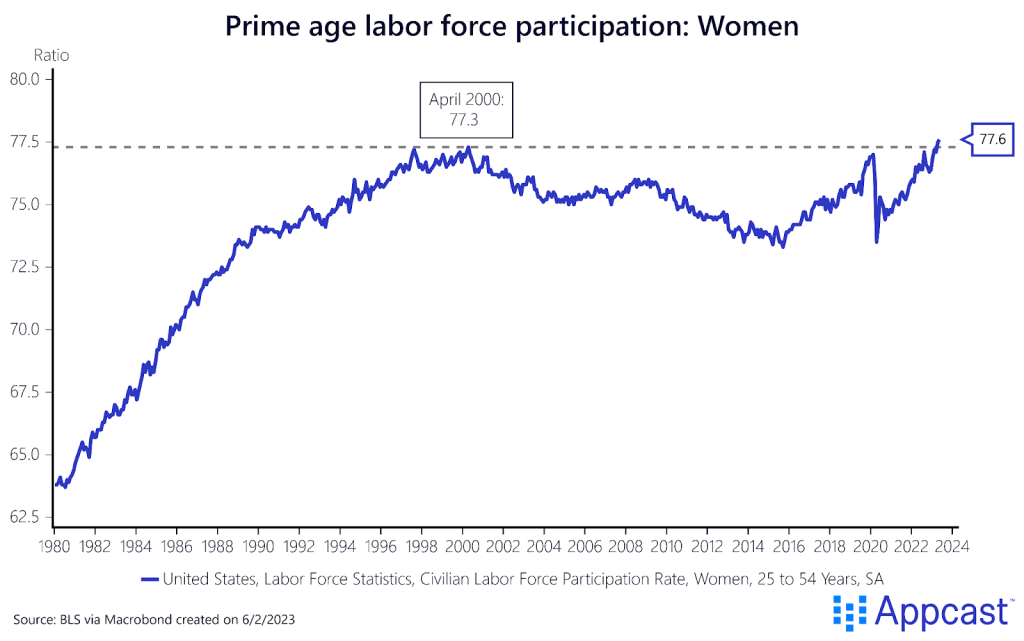

Another piece of good news on the labor supply front: the prime-age female labor force participation rate hit an all time high – 77.6%! During the pandemic, female workers bore the brunt of shuttered schools, closed restaurants, and more. Now, that participation has completely recovered and then some.

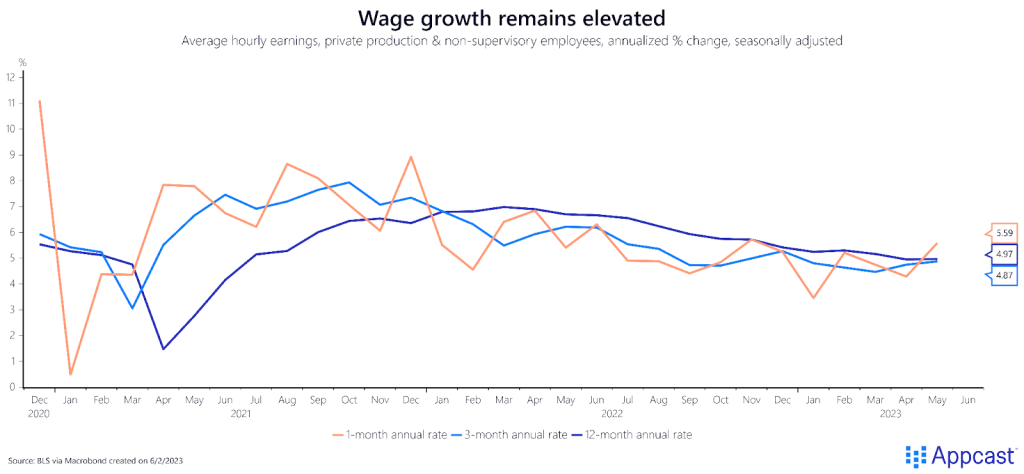

Wage growth holding steady

Average hourly earnings, not adjusted for inflation, were relatively unchanged at 4.9% (3-month annualized rate) in May for private sector non-managers. This series can be noisy and plagued by compositional issues. Most other indicators, like the employment cost index or the Atlanta Fed wage growth tracker, show wage growth remains elevated. This level of growth will continue to aggravate the Federal Reserve as it attempts to slow inflation.

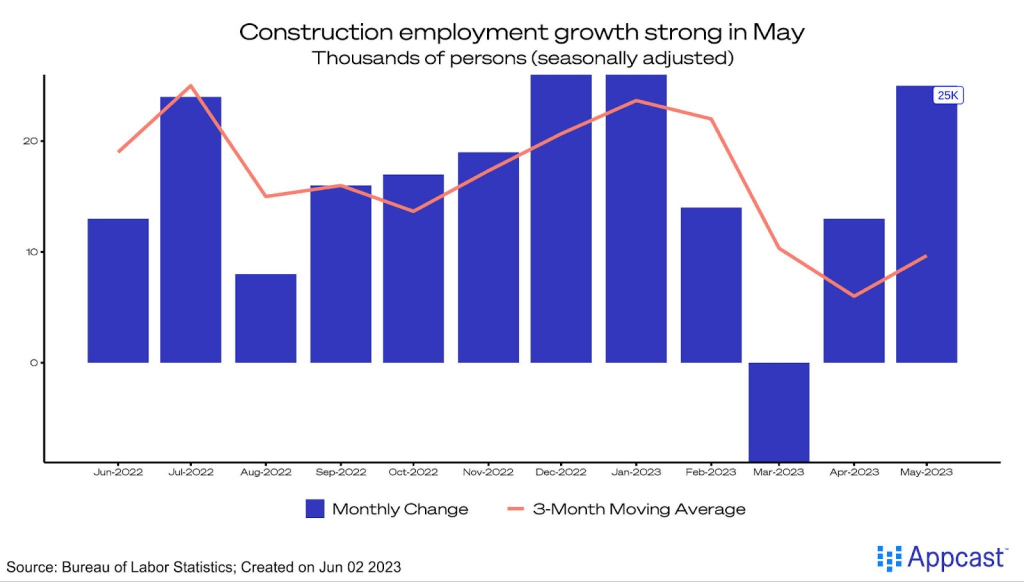

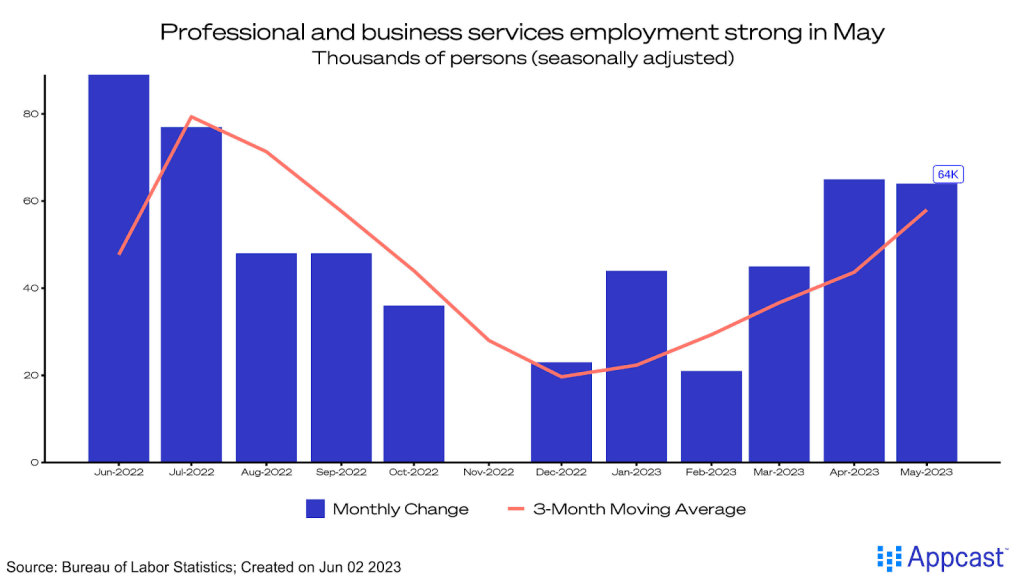

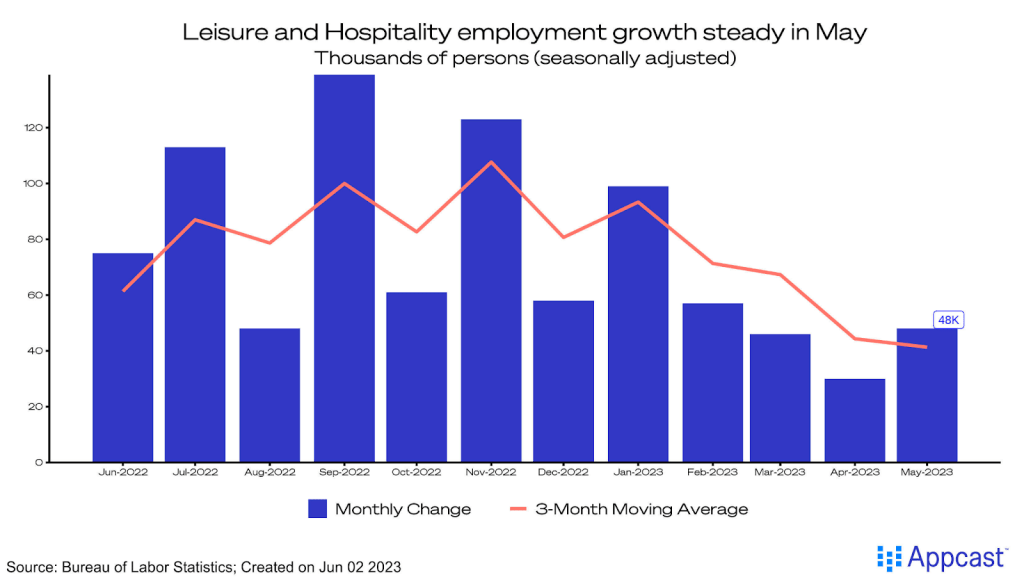

Gains broad-based across industries

Across industries, job growth remains strong. The construction sector is heating up: it gained an impressive 25,000 jobs in May. Despite the slowdown in the housing market, construction jobs gains are holding up well.

Professional and business services, which towards the end of last year slowed enough to suggest an imminent “white collar recession,” has completely rebounded, gaining 64,000 jobs last month.

The leisure and hospitality sector, which has been a powerhouse in post-pandemic growth, seems to be moderating: The sector added 48,000 jobs in May. This is, of course, still strong growth, just slower than the pace seen recently from the sector.

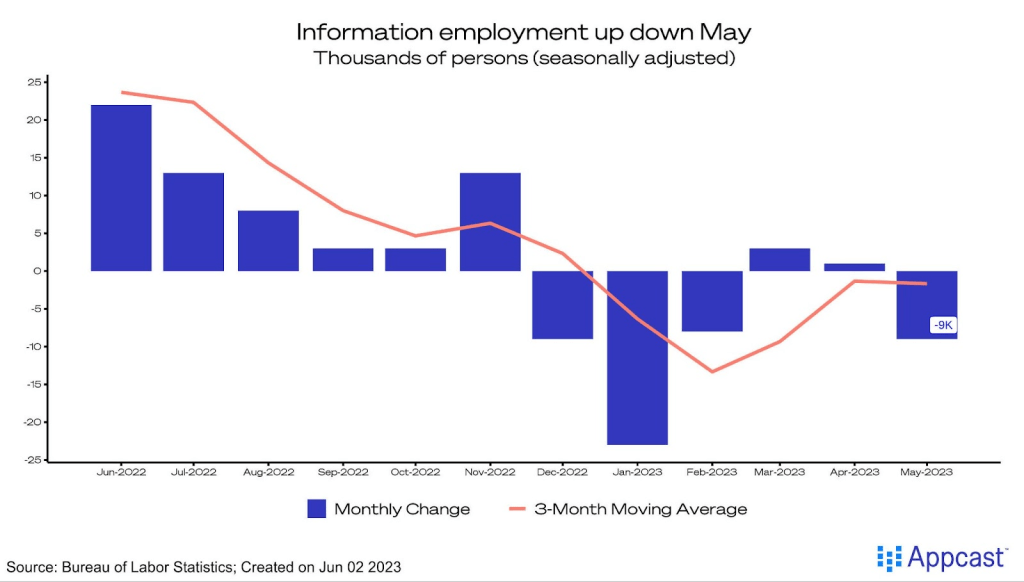

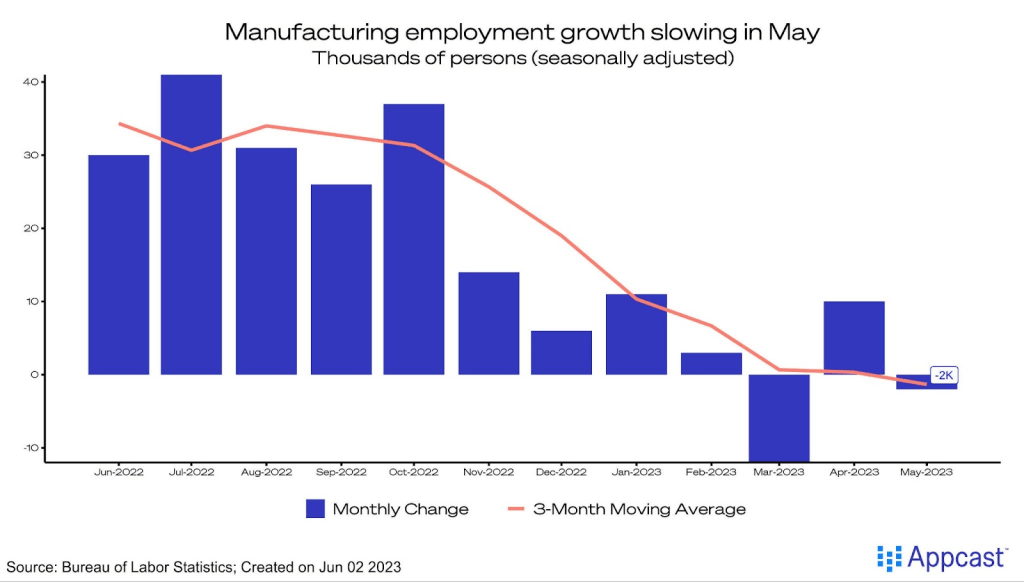

Two laggards last month were information and manufacturing, which lost 9,000 and 2,000 jobs, respectively. The information sector, which is the closest the BLS comes to a tech industry, has suffered in recent months, so this modest decrease was no surprise. Manufacturing, on the other hand, has seen an influx in federal investment in hopes to help reshore key manufacturing industries.

Conclusion

The U.S. labor market refuses to slow. The weaker gains in April suggested that hiring might be slowing, but April’s showers just gave way to blooming May flowers. The gains in May once again trumped expectations. And there’s still room to grow: Demand for labor still far outpaces the supply. The strength of the jobs market has survived high inflation, rising interest rates, and general economic uncertainty.