Deflation may soon be the main concern in the Eurozone. Yes, you read that right!

Less than three years after inflation peaked at over 10% in October 2022, the Eurozone is now facing deflationary risks. The economy has slowed dramatically, and inflation just fell below target. More concerning, the labor market is deteriorating. Job growth is stalling, and wage growth is expected to come down sharply. With geopolitical risks being extremely elevated and the U.S. trade war weighing on economic activity, the European Central Bank (ECB) may be inclined to lower interest rates this week (with more rate cuts to come later this year), otherwise risk an economic and labor market slowdown that will weigh on job creation and wage growth.

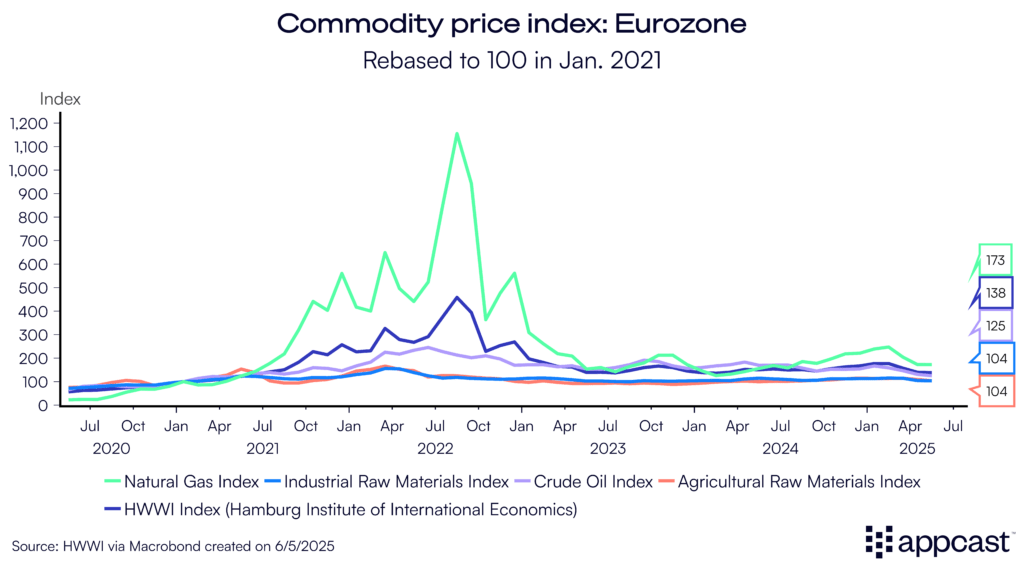

The commodity price shock is over

One big driver of the Eurozone’s inflation problem was the massive surge in commodity prices back in 2022. While the hot labor market and economic stimulus coming out of the pandemic also contributed, there is no doubt that European economies suffered tremendously from the commodity price shock that followed Russia’s invasion of Ukraine.

Natural gas prices almost increased fivefold, oil prices doubled, and food prices surged by more than 50% between January 2021 and mid-2022. But over the last two years, commodity prices have normalized and are basically back to early 2021-levels (natural gas prices are still somewhat elevated as Europe continues to reduce its dependency on Russia).

As commodities prices continued to decline over the last year, they have contributed to falling inflation in the Eurozone.

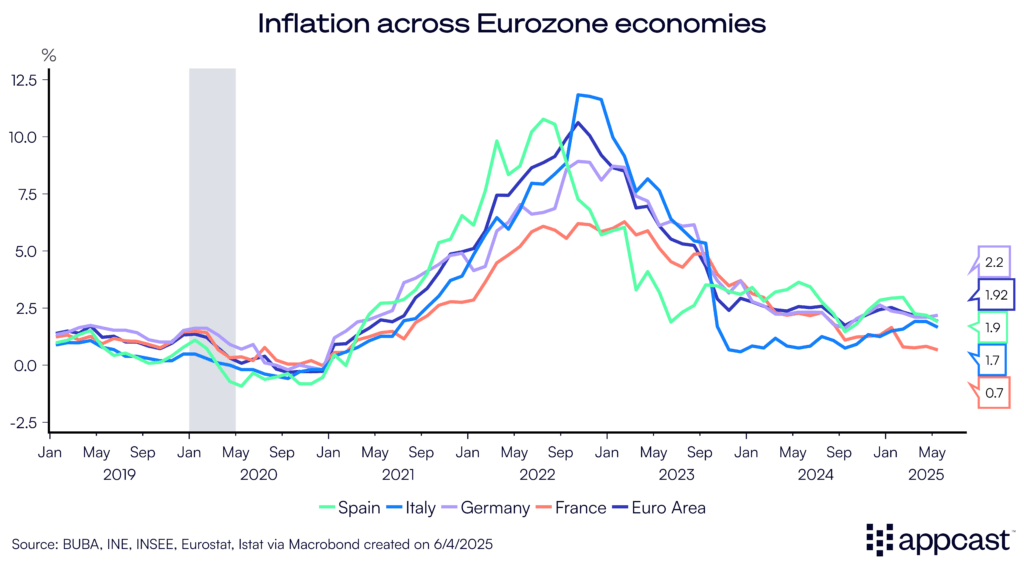

Inflation is back at target

With the economy and labor market slowing and commodity prices falling further, inflation rates are close to or below 2% in most large Eurozone economies. The Eurozone’s inflation rate just dipped to 1.9% in May. After several years of overshooting, the ECB is finally hitting its inflation target again. With global economic risks skewed to the downside, monetary policy makers now need to be careful to not let the Eurozone slide into a low-pressure economy with too little inflation and wage growth due to a lack of demand.

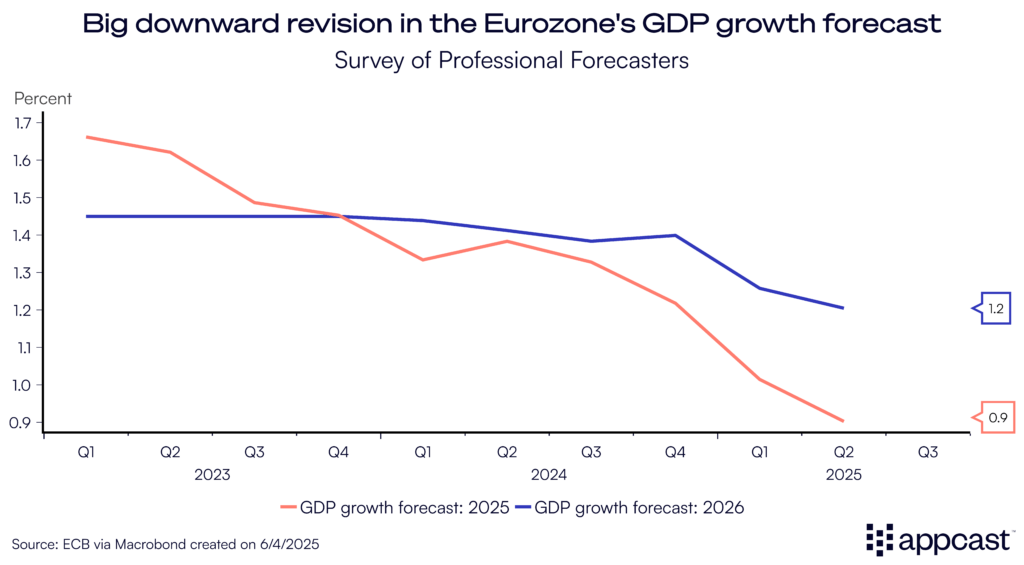

Economic growth is slowing dramatically

There are certainly signs that monetary policy needs to ease now following the rapid surge in interest rates that happened post-COVID. While the ECB already reduced its benchmark rate from 4.5% in early 2024 to 2.5% more recently, more rate cuts are certainly appropriate, given the extent of the economic slowdown the Eurozone economy is currently facing.

The GDP growth forecast for 2025 has been revised down significantly since the middle of last year, from about 1.4% to just 0.9%. Similarly, the growth projection for 2026 has declined from about 1.4% to 1.2% over the same time. The Eurozone economy is thus facing an economic slowdown this year while global economic uncertainty has risen to an all-time high, mostly a result of U.S. trade policy.

Given how dependent many large Eurozone economies are on U.S. trade, a further deterioration of the economic situation should not be ruled out.

Wage growth has normalized

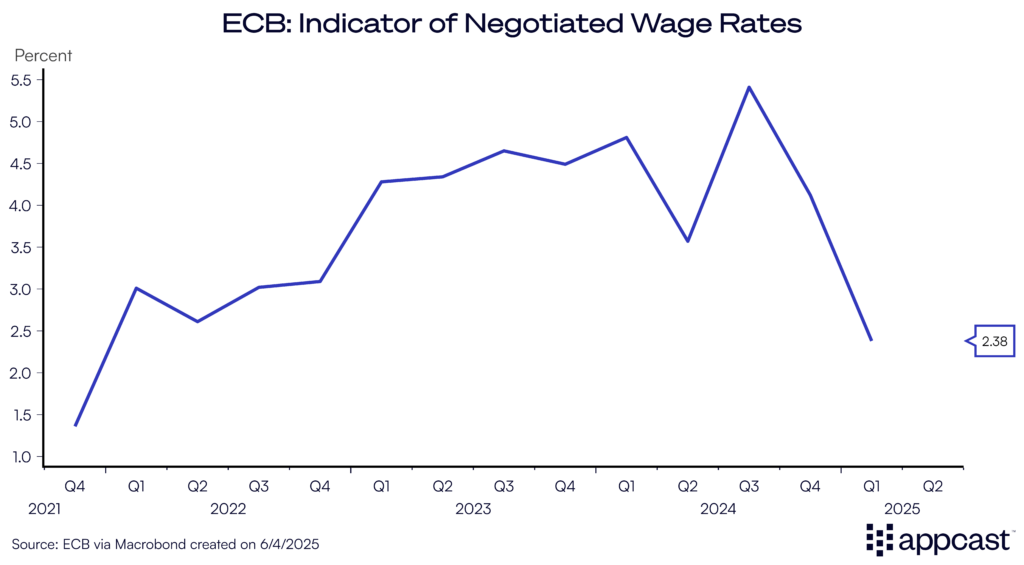

One key objection to quicker rate cuts from the ECB last year was historically elevated wage growth throughout 2023 and 2024, which has been adding to inflationary pressures.

Though the ECB has been cutting rates, it has been a slow and deliberate process. A key objective to quicker rate cuts was historically elevated wage growth in 2023 and 2024 that added to inflationary pressures.

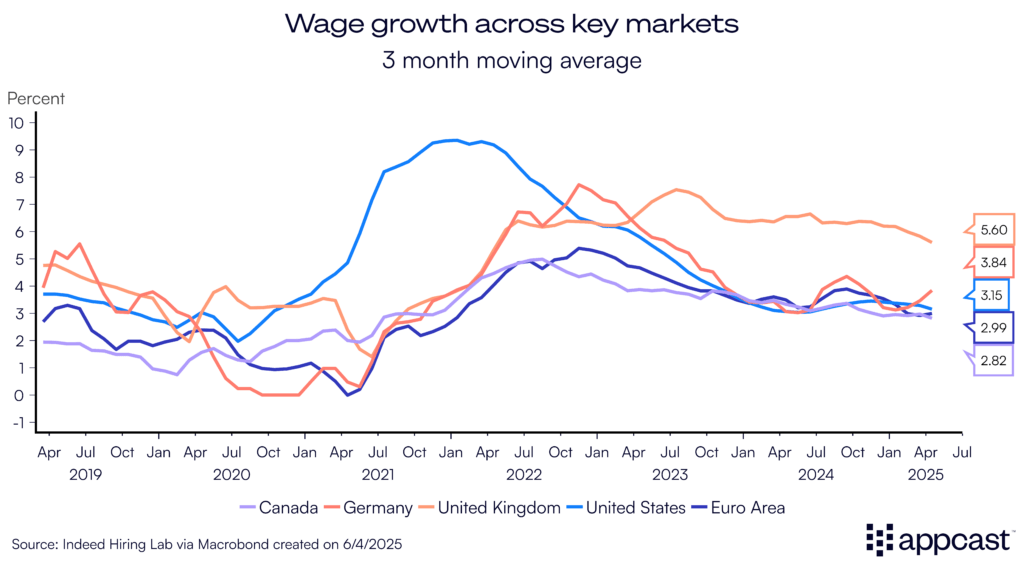

However, the most recent data points show that wage growth across Eurozone economies is now normalizing at a rapid pace. Advertised wage growth on job postings for the Eurozone has declined to about 3%, with Italy and France seeing even smaller gains (below 2%).

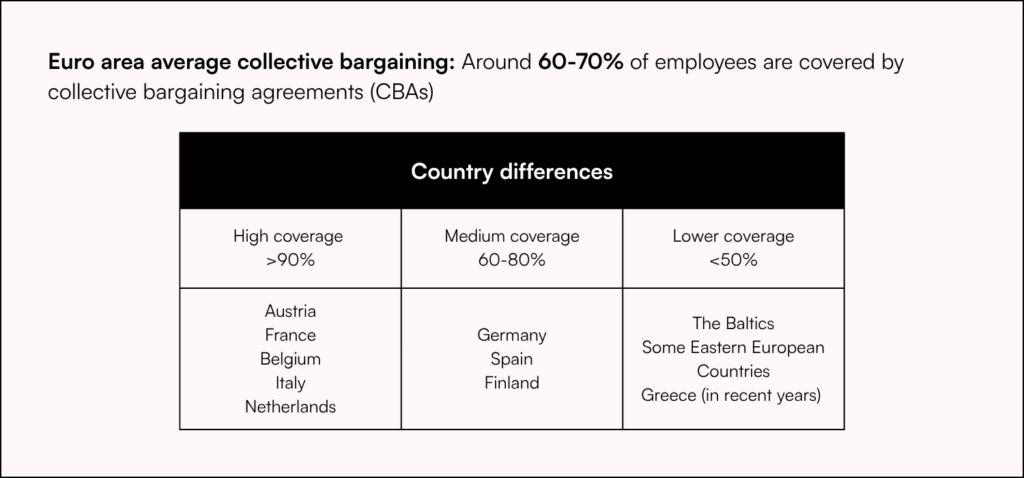

While there are some stark differences across countries, approximately 60 to 70% of all Eurozone employees are subject to collective bargaining agreements. Tracking these collective bargaining agreements can therefore give you an early indication of future wage growth.

The ECB’s measure of negotiated wage rates does precisely that. It currently indicates that Eurozone wages are slowing down substantially this year, following several years of elevated wage pressure. Both advertised wages across job boards and negotiated wages based on collective bargaining are therefore pointing towards a significantly weaker labor market with lower wage pressure.

The labor market is stalling

While Eurozone employment numbers are still holding up, most of the job growth right now is geographically concentrated in Southern Europe. Economies like Spain, Italy, Croatia, and Greece have recently contributed to growing employment numbers while many Northern European economies like Germany and Austria are seeing stagnation or even minor job losses.

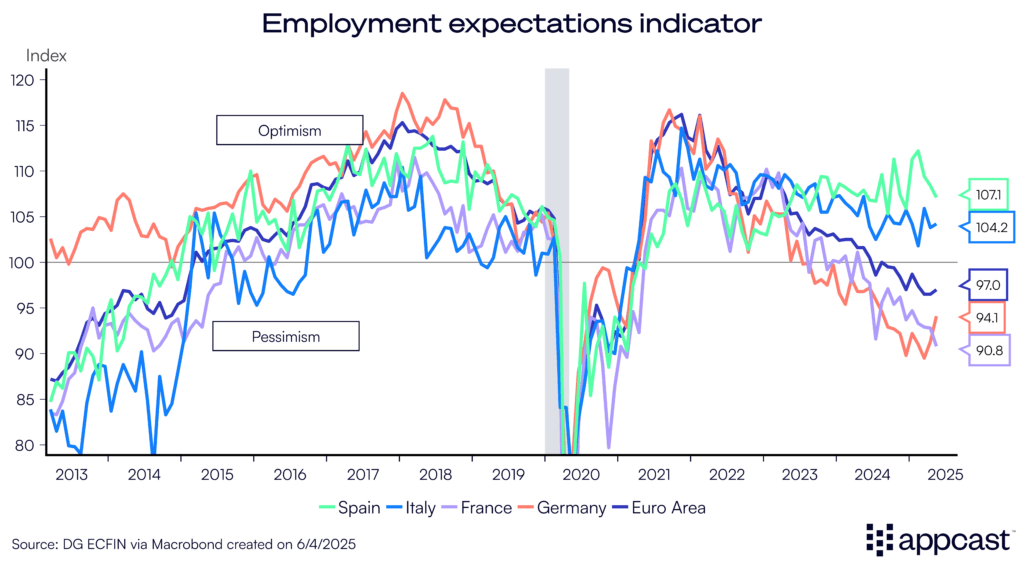

The employment expectation indicator is a survey-based measure that asks managers about their expectation for employment changes in the near future. Any reading below 100 points towards caution and pessimism in terms of job growth. While managers in Italy and Spain feel optimistic about employment growth, Germany, France, and the Eurozone have seen a clear and rapid deterioration over the last year.

All of this points towards a rapidly weakening labor market with potential job losses ahead. Combine that with below-target inflation and falling wage growth, the ECB should ease monetary policy substantially this year or risk a weakening economy with a side of deflation ahead.

What does that mean for recruiters?

The labor market has weakened across the Eurozone, meaning that recruitment has gotten easier for companies that are still hiring. The pressure on compensation growth has eased as well, which should be welcome news for employers. However, the decline in economic activity and the rise in global uncertainty are clearly weighing on the Eurozone economy, meaning that many employers have reduced hiring needs. The ECB will most likely cut interest rates this week as inflation has finally dipped just below target, but further cuts this year remain necessary to prop up economic activity.

There are also large geographic disparities within the Eurozone. Some Southern European labor markets like Spain and Croatia remain very hot whereas Northern Europe continues to struggle. Nevertheless, the prospect of further rate cuts combined with the massive German stimulus and higher European defense spending in the pipelines probably mean that European labor market will soon pick up again. Given adverse demographics in Europe, we will probably soon speak of labor shortages again. Recruiters would do well to take advantage of this employer-favorable market before competition picks up again.