The job market is holding up, but it’s shaped like a dumbbell: concentrated strength in healthcare, and concentrated weakness in government. The headline figures show +64k jobs added in November and -105k jobs lost in October. But those don’t tell the true story.

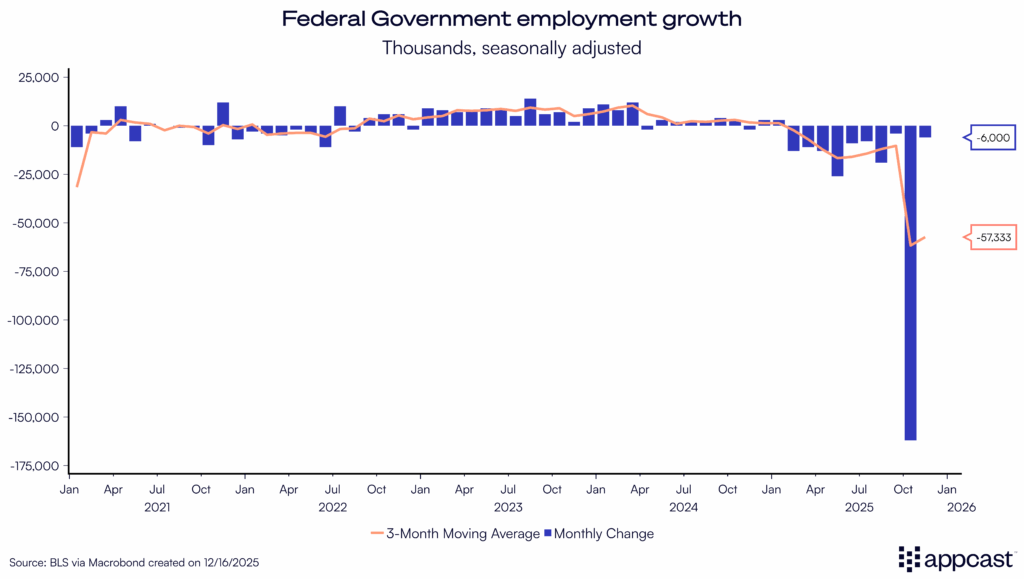

Remember the Department of Government Efficiency (DOGE) and its “fork in the road” email earlier this year? Well, the hundreds of thousands of federal employees who accepted the offer of deferred resignation finally appeared in the jobs data as federal payrolls shrunk by 162k in October alone, and then by 6k more in November.

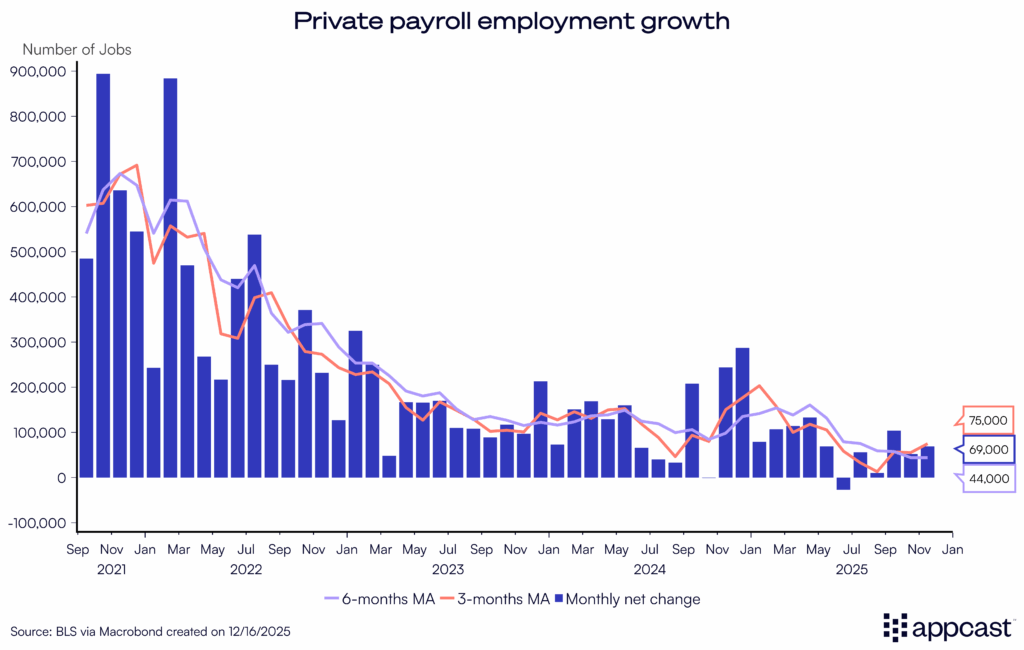

Yes, these government job losses are real, but they mask the underlying trend. Private payrolls growth has increased to 75k on a 3-month basis through November, up from near zero in August. So the DOGE effect, which may be a one-off, makes the overall job market look weaker than it truly is. That said, there may be forthcoming benchmark revisions that lower all the monthly job growth figures since May of this year.

Given the initial financial market reaction, this doesn’t look like a rapidly weakening labor market set to force the Fed’s hand into more rate cuts in 2026. Rather, it seems like the job market — abstracting from the one-off DOGE effects — is doing OK. And with inflation firmly above target due to tariffs, the Fed is in a bind next year — perhaps giving ammunition to the hawks who want to hold off on further rate cuts. Hence the modestly down stock market this morning.

Beyond healthcare and (maybe) A.I., not much growth

That said, some consternation is warranted. Much of the labor market’s strength is in healthcare. More than much — all of it, actually. On average, healthcare is adding 42k jobs per month in the three months through November, far above private-sector pace.

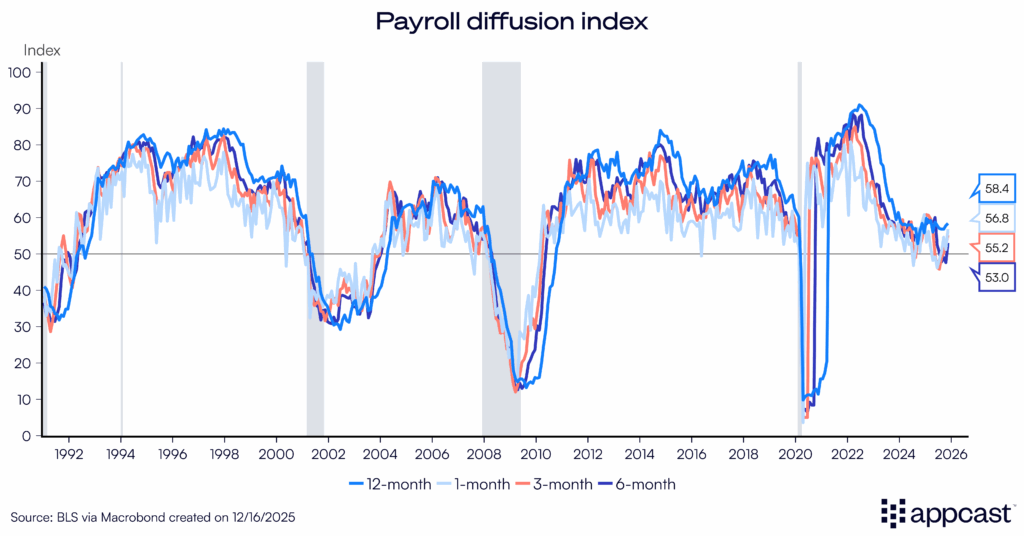

The diffusion index — a measure of the breadth of job gains or losses — was at 56.8 in November, a healthy sign that most industries were adding to payrolls. But those gains are awfully modest, for the most part.

Besides healthcare, the other big gainer is construction — adding 28k jobs in November, on the heels of a similarly strong month in September. Perhaps the data center boom is behind this? Recruitonomics will dig in to confirm in the coming weeks. An initial look under the hood shows that a majority of construction job growth is concentrated in non-residential specialty contractors, so the A.I. hypothesis is plausible. At this moment, it seems healthcare and A.I. may be all we’ve got — and that may be enough to continue carrying the labor market.

Tariff effects are showing fairly clearly in this report. Transportation and warehousing lost 18k jobs last month; manufacturing lost 5k and has steadily weakened since the spring. As Mike Konczal said, “since Liberation Day, health care and private education account for 107% of all private job creation.”

Rising unemployment rate may come with an asterisk

It’s worth mentioning that the unemployment rate ticked up to 4.6%, the highest level in more than four years. The force driving this higher is an increase in the labor force of people searching for work — which is a good thing, considering concerns about dwindling supply of workers due to immigration restrictions. That said, this trend is now creeping into yellow warning light territory — a definite sign of weakness, but not alarm-worthy. The October unemployment rate figures are forever lost to history, as the household survey wasn’t conducted during the government shutdown. These figures come with a major asterisk, because the truncated window to collect data means these numbers are questionable.

Like the unemployment rate rising, there are other worrisome trends in this report. For example, the number of people working part-time for economic reasons spiked in November (meaning more people want more hours or a full-time job). However, that figure may be a product of the DOGE cuts, per Guy Berger.

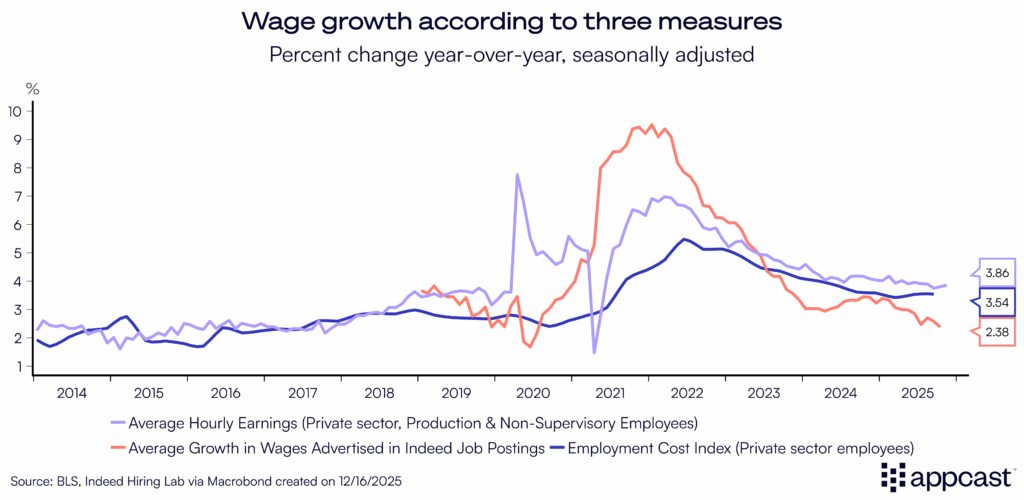

Finally, wage growth (like inflation) remains firm. Average hourly earnings are nearly 4% year-over-year, in nominal terms. This is, predictably, above 2019 levels. Now, real earnings (after adjusting for inflation) are a bit lower than that period. And advertised wages, according to Indeed data, show steady weakening. This confirms what we know from other data: the gap in wage growth between job-stayers and job-switchers has disappeared.

What does this mean for recruiters?

If you’re hiring for talent in healthcare or related to A.I., it’s competitive. For every other industry, there’s not much hiring. The cuts to the federal government workforce added to a pool of talented, mostly white-collar workers to attract. For the overall economy, this report puts the Fed in a bind: the job market doesn’t look to be collapsing, and inflation may remain comfortably above the Fed’s 2% target. So further rate cuts in 2026 are an open question, no matter who President Trump nominates as the next Fed Chair.