“What do you do if you’re driving in the fog?” Fed Chair Jay Powell asked rhetorically last week. “You slow down.” The economic fog over the economy — and the job market in particular — is multifaceted:

- The ongoing government shutdown officially became the longest-ever, with SNAP benefits for 42 million Americans in limbo and flight traffic cut by 10% at 40 major airports.

- Future Fed rate cuts are in doubt, after last week’s reduction, as inflation remains stubborn and the government’s data blackout obscures economic trends.

- Last week’s China-US trade detente was a welcome reprieve; and then this week’s Supreme Court oral arguments in a case over the limits of Presidential powers to levy tariffs foreshadowed potential for further ratcheting down.

- Stock prices hit all-time highs last week, led by record-setting valuations for tech giants — but investors are raising suspicions about financial “cockroaches” in the private credit and auto lending markets, or if we’re in an AI-fueled bubble.

- A wave of company layoffs (Amazon, UPS, Target, among others) has triggered concerns that AI is automating work or at least suppressing hiring.

Will the multifaceted fog lead to a labor market crash? That depends on whether employers resort to layoffs. What limited and imperfect data we do have in hand suggests a continual labor market slowdown, but not the bottom falling out.

Still Slowing, Not Crashing

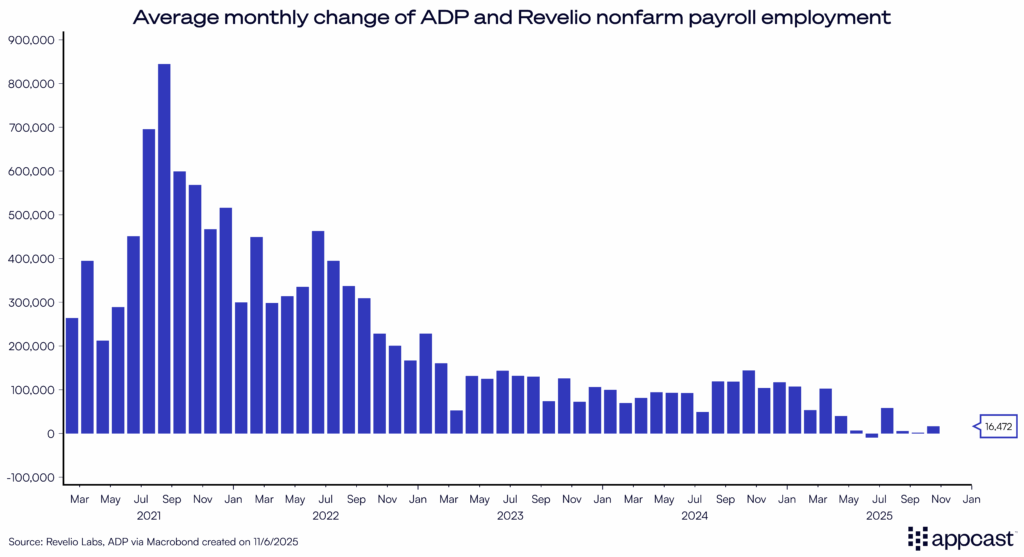

First, employment growth bounced back in October, according to an average of two private sector estimates that seek to mimic the government’s monthly jobs report. From ADP, payroll employment rose by 42,000, after a drop in September. Revelio showed the opposite: gains in September, then 9,100 jobs lost in October. Averaging the two, employment grew just over 16,000 last month.

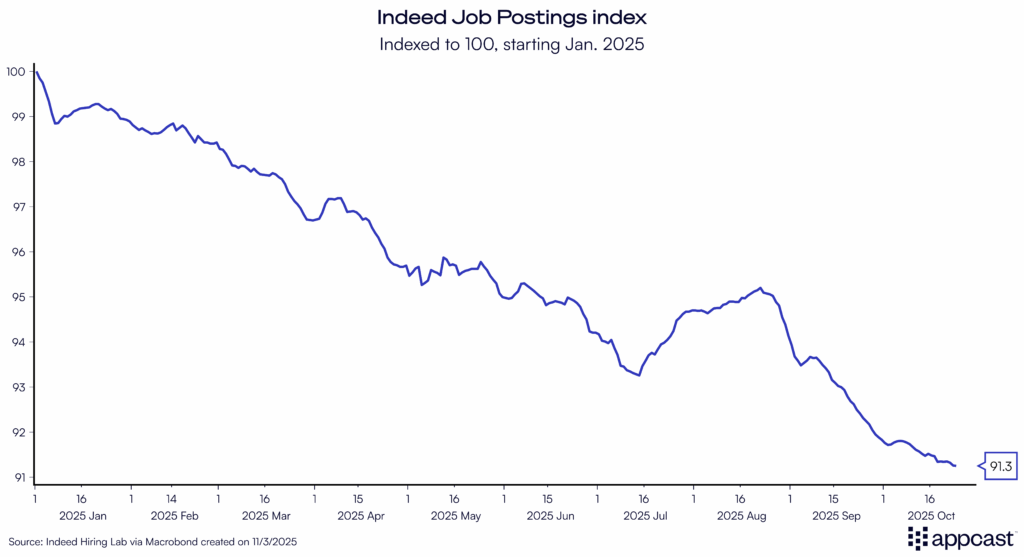

Indeed job postings continue to decline, now down almost 9% since the start of the year. This steady reduction in labor demand is consistent with the last data point released from the Bureau of Labor Statistics (BLS) before the government shutdown took effect — which showed hiring rates falling to the lowest level since the pandemic and, excluding that brief and abrupt period of reduced hiring, the lowest level since January 2011.

So, the lackluster employment estimates from ADP/Revelio, combined with continual declines in Indeed job postings, seems to suggest a bend-but-not-break labor market. Ditto from trends in unemployment insurance claims (aggregated at the state level), which show no major warning signs, according to new indicator of labor market stress from the San Francisco Fed.

However, this relatively sanguine view has been challenged over the past few weeks by layoff announcements — like the ones from Amazon and Target last week. These announcements grabbed headlines and spooked job seekers and workers alike (see data from Challenger, Gray & Christmas). Yet this happened in early 2023, mind you — when bad vibes about jobs were disproportionate to the underlying data. This time around we don’t have the BLS data to guide us on whether these announcements are representative or not. They weren’t in 2023, when despite the surge of tech layoffs in the press, the overall layoff and unemployment rates barely budged.

To extend this analogy: If economists are the proverbial drivers through all this fog, our headlights are broken (the headlights being the gold-standard government data that usually guides economists during periods of tumult); they’re missing in action because of the government shutdown.

So, for the past few weeks we’re left to rely on this imperfect private sector data to make sense of how the economy is holding up. And that data has been conflicting. This conflict has triggered a fog warning for the job market, according to Jay Powell’s comments. So the Fed, and economists, are slowing down. No wonder the Fed is divided — it’s not clear what’s happening. It’s foggy.

What does this mean for recruiters?

The economic fog shouldn’t be confused with an imminent recession. Of all the data points covered above, trust the estimates of employment and job postings more than the layoff announcements, because they’re more representative of the entire economy and rigorously created. It seems the labor market just keeps on keeping on. Recruiters shouldn’t expect a mass flood of candidates due to layoffs, or a sudden easing of competition because of foggy uncertainty. Hold the line; expect a continuation of current trends, rather than an abrupt break in a new (more dire) direction.