This is part three of a four-part series focused on the healthcare labor market, and the major trends shaping its future. You can find the first part here and the second part here.

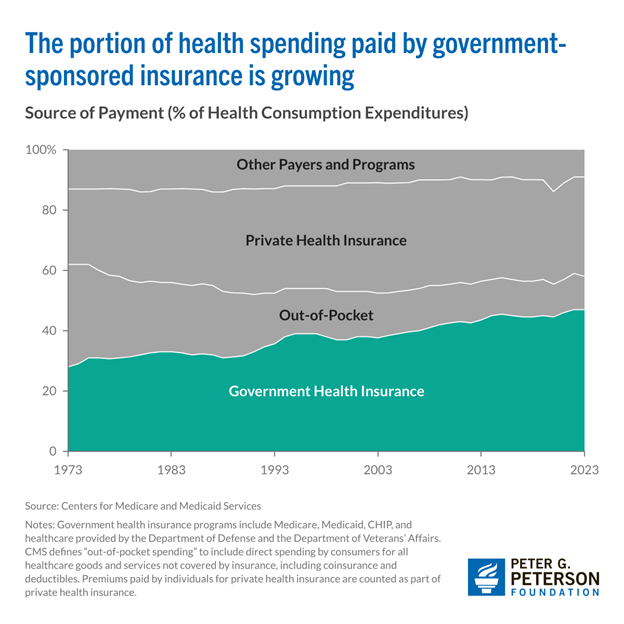

Government-funded healthcare is quickly becoming the dominant force in U.S. health spending. In 2023, Medicare and Medicaid together accounted for nearly half of all healthcare expenditures—$2.1 trillion, or 47% of the total. That’s the highest share on record, and by the end of the decade, government spending on healthcare is projected to reach $3.8 trillion, covering more than half of all healthcare costs. That growing role of government in healthcare has dramatically expanded access, but regulatory expectations have added volatility for healthcare employers. Shifts in policy can translate to stark changes—and policy is shifting fast.

Healthcare’s budgetary pressures

Rising healthcare costs are putting pressure not just on the federal budget, but on the sustainability of key programs like Medicare. To manage growing debt obligations, lawmakers are eying cost-cutting measures—including a recent 2.8% reduction to the physician fee schedule. This cut, which took effect on January 1st, 2025, lowered average Medicare payments to physicians and clinicians by nearly 3%.

While a fix was proposed in the latest continuing resolution, it didn’t make it into the final bill. Medical associations have warned that continued reimbursement cuts could push more providers to opt out of Medicare altogether, jeopardizing access for the millions of Americans who rely on the program.

Physician reimbursement isn’t the only healthcare budget line under pressure. Proposed federal cuts to Medicaid total $880 billion over the next decade—funds that represent a substantial share of state budgets. Without that support, states may be forced to make painful trade-offs, including potential reductions to education and other public services.

California, New York, and Texas stand to lose the most, facing a combined $29 billion in cuts this year alone. The ripple effects on state economies could be severe. According to an analysis by the Commonwealth Fund, these three states alone could see more than 135,000 direct healthcare jobs disappear.

And the impact doesn’t stop there. When hospitals and clinics cut staff, it reduces demand across industries—from transportation to food services to retail. In total, the proposed Medicaid reductions could result in nearly 900,000 lost jobs nationwide.

This dynamic plays out through what economists call an “induced effect.” When healthcare providers lose funding, they may be forced to cut jobs. Those laid-off workers, now with less income, spend less on goods and services—from housing to cars to groceries. The result: reduced demand across the broader economy, amplifying the initial shock and slowing job growth beyond just the healthcare sector.

The problem with pharma

Another major shift in healthcare policy came with the Inflation Reduction Act (IRA) of 2022, which required Medicare to negotiate prices for certain high-cost prescription drugs. Before this change, Medicare spent more than $120 billion annually on pharmaceuticals. Analysts estimate the new policy could have saved $6 billion in its first year alone and the Congressional Budget Office projects nearly $100 billion in savings over the next decade.

The motivation is clear: U.S. drug prices are significantly higher than in peer countries. Take Jardiance, a common medication for type 2 diabetes. A 30-day supply costs around $204 in the U.S., compared to just over $50 in other high-income countries. In Japan, it’s available for as little as $35.

Medicare’s new drug price negotiation powers started small—with just ten medications—but the list is expected to grow. Future additions could include high-impact drugs like Ozempic and Wegovy, which hold promise for millions of Americans with chronic conditions. For low-income households, expanded access could be transformative and may even boost long-run economic productivity by improving public health outcomes.

But U.S. drug prices remain stubbornly high, largely due to a fragmented system where private insurers and pharmacy benefit managers negotiate prices at multiple stages. In contrast, peer countries often rely on centralized negotiations and broader use of generics, which fosters price competition and lowers costs for consumers.

Existing healthcare law, and the path ahead

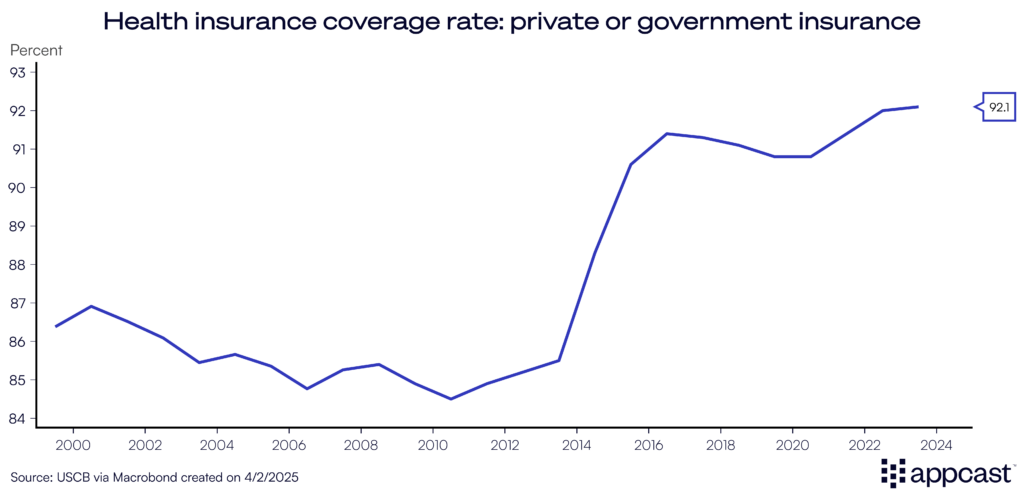

The largest and most impactful regulatory change this century was the passage of the Affordable Care Act (ACA), which sought to reduce the uninsured rate and reduce out-of-pocket expenses.

The first objective, raising the insurance rate, was a clear success. 92% of Americans now have either private or government insurance. More people have access to life-saving care, which further fuels demand for healthcare services.

When it comes to reducing out-of-pocket expenses, results under the ACA have been mixed. Cost-sharing reductions helped lower deductibles and copays for lower-income enrollees, using a sliding income scale. But healthcare costs overall continue to climb in the U.S.—and that trend shows little sign of slowing.

Still, the ACA remains broadly popular. As of the latest polling, 59% of U.S. adults hold a favorable view of the law—a figure that rose sharply during the pandemic, when coverage protections became more visible.

But challenges lie ahead. Key subsidies introduced under the Inflation Reduction Act are set to expire at the end of the year, which could drive up monthly premiums for millions. Meanwhile, Medicaid disenrollments are underway, resulting in the disenrollment of millions—a shift that could push the uninsured rate upward, reversing gains the ACA helped achieve.

What does this mean for recruiters?

The growing role of government in healthcare—through Medicare, Medicaid, and the ACA—has significantly expanded access, but it also adds volatility for healthcare employers. Regulatory changes, cost pressures, and shifts in reimbursement models can all impact hiring demand, staffing levels, and wage expectations, particularly for physicians, nurses, and other frontline clinicians. For recruiters, understanding the policy landscape is more than academic, it’s critical to forecasting demand and sourcing talent in a sector that’s evolving rapidly.

Just as the policy environment reshapes the economics of care, so too does the rise of automation. In the last section, we’ll learn how robots and artificial intelligence are creative solutions to solving hard problems, and what that means for the future of hiring.