This is part two of a four-part series focused on the healthcare industry and the major trends shaping its future. You can find the first part here.

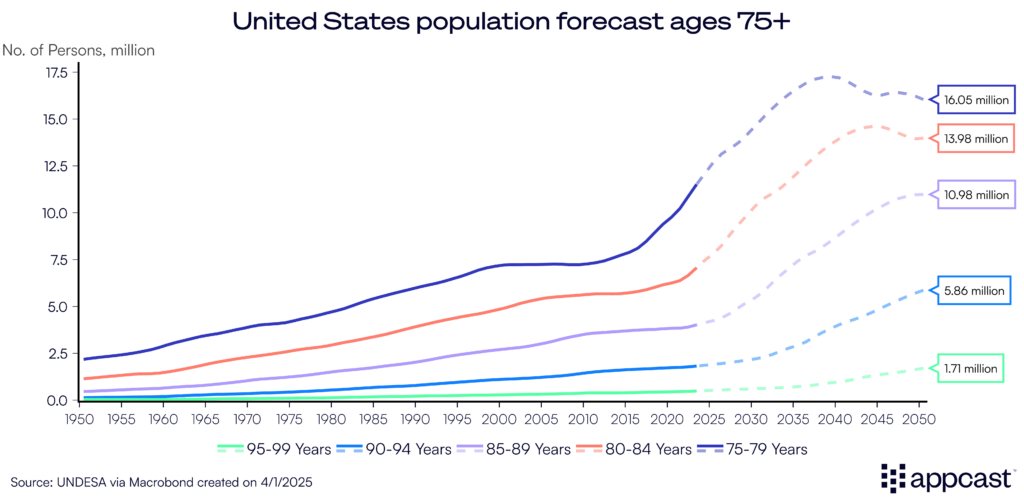

The U.S. is in the midst of a historic demographic shift that will undoubtedly transform the healthcare industry. Welcome to the “Silver Tsunami,” in which more than 11,000 Americans turn 65 every day. By 2050, that number is expected to rise by nearly 50%, with older adults making up 23% of the total population—up from 17% today.

Even more striking: the number of Americans living past 100 is projected to quadruple.

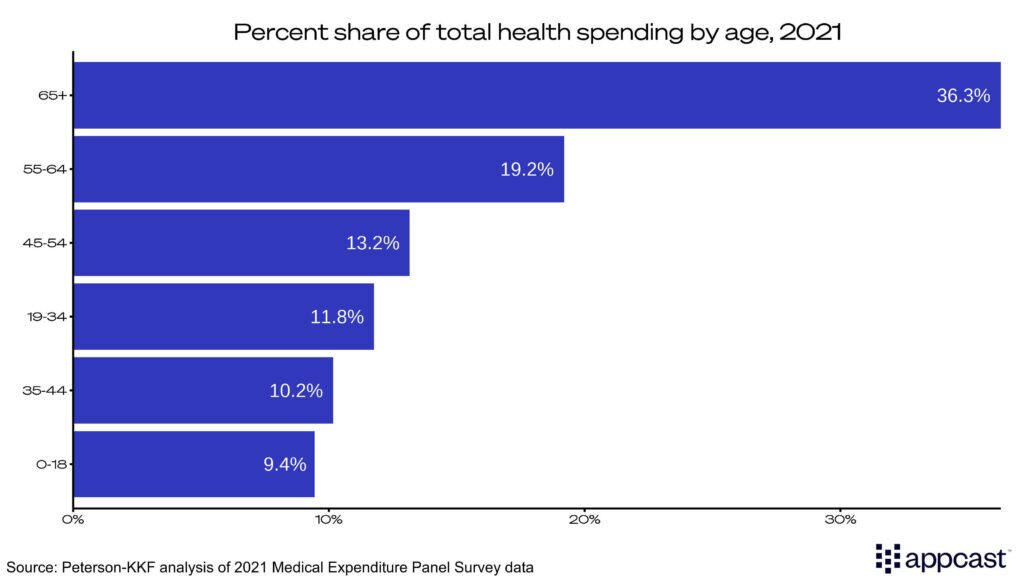

An aging population doesn’t just reshape demographics—it reshapes demand. Americans over 55 already account for half of all health spending. Those 65 and older make up 36% alone.

That translates directly into more utilization: more doctor visits, more specialized at-home care, more emergency procedures. And with it, more hiring demand across the entire healthcare system.

Healthcare’s labor crunch

As healthcare consumption rises, so does the need for talent, placing further pressure on an already stretched labor market.

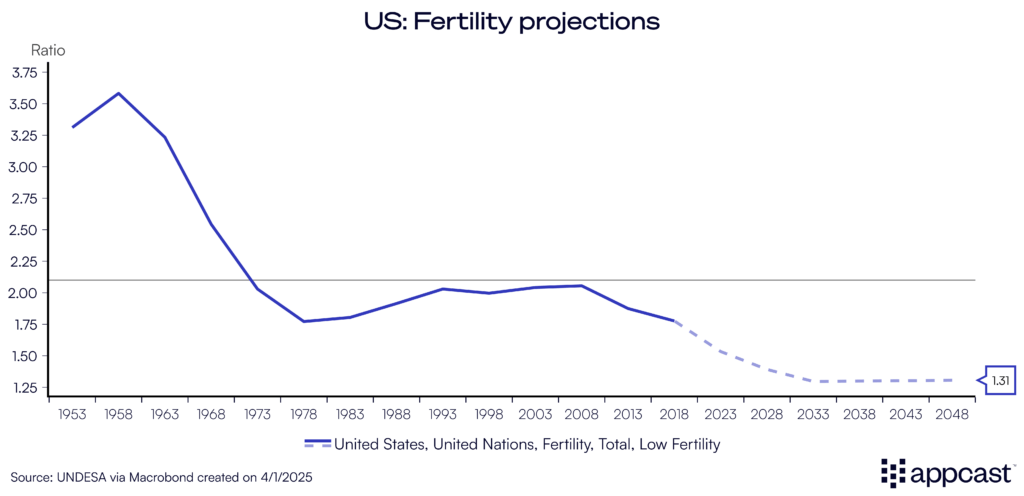

The U.S. population isn’t just aging—it’s aging without replacement. The national fertility rate has fallen to a record low, well below the replacement level of 2.1 births per woman. Annual births are projected to decline from around 3.6 million today to closer to 3.3 million by 2050.

The Congressional Budget Office published its annual report on the demographic outlook until the middle of the century, revealing that it expects the population to grow just 0.1% annually from 2036 and beyond.

This sets up a long-term labor market challenge: rising demand for healthcare services on one end and a shrinking pipeline of future healthcare workers on the other.

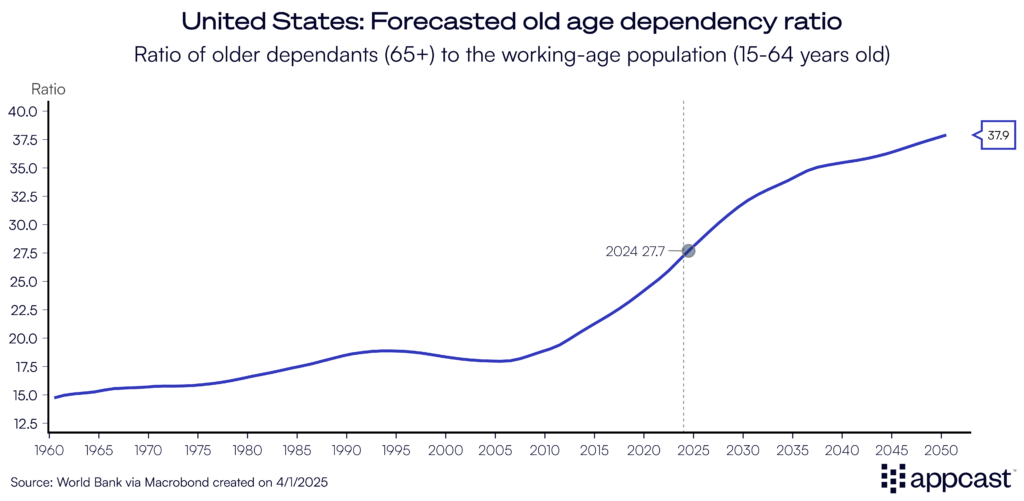

The aging population is pushing up what’s known as the old age dependency ratio: the number of people aged 65 and older compared to those of working age. Today, there are about 28 retirees for every 100 workers. By the middle of the century, that number is expected to climb to 38.

We’ve already seen the long-term effects in countries like Japan, where there is one retiree for every two working-age adults. Japan’s situation is more extreme—the population has declined for 15 straight years—but it serves as a useful case study. From automation to immigration reform and efforts to bring older adults back into the workforce, Japan offers insight into creative ways to respond to demographic pressures. In the final article of this series, we’ll detail what the U.S. can learn from those strategies.

The healthcare spending surge isn’t going away

Between the aging population driving up demand and a shrinking working-age population drying up labor supply, it is clear healthcare will take up an even bigger share of the economy in the years ahead.

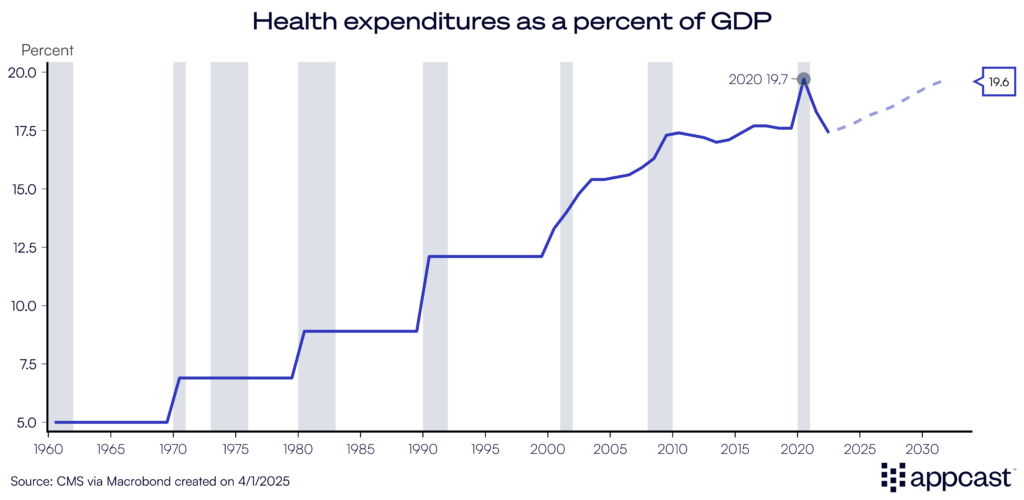

According to the Centers for Medicare & Medicaid Services, one in every five dollars spent in the U.S. economy will go to healthcare by 2030. Historically, that share was just one in ten in the 1990s, and closer to five percent in the 1960s and 70s.

While the aging population is a major driver of rising healthcare demand, it doesn’t tell the whole story. Part of the recent surge in spending, especially in 2023 and 2024, came from a rebound in delayed care. During the height of the pandemic, many Americans postponed elective procedures, leading to a catch-up effect that temporarily boosted healthcare utilization.

Another key factor is the growing role of public insurance programs. Medicare and Medicaid now account for a significant and rising share of total health spending. As enrollment in these programs expands, particularly with the aging of the Baby Boomer generation, the government’s share of healthcare costs will continue to climb, bringing with it complex policy and funding challenges.

In the next article, I will detail how changes in Medicare and Medicaid funding are directly impacting the recruiting funnel of healthcare workers.