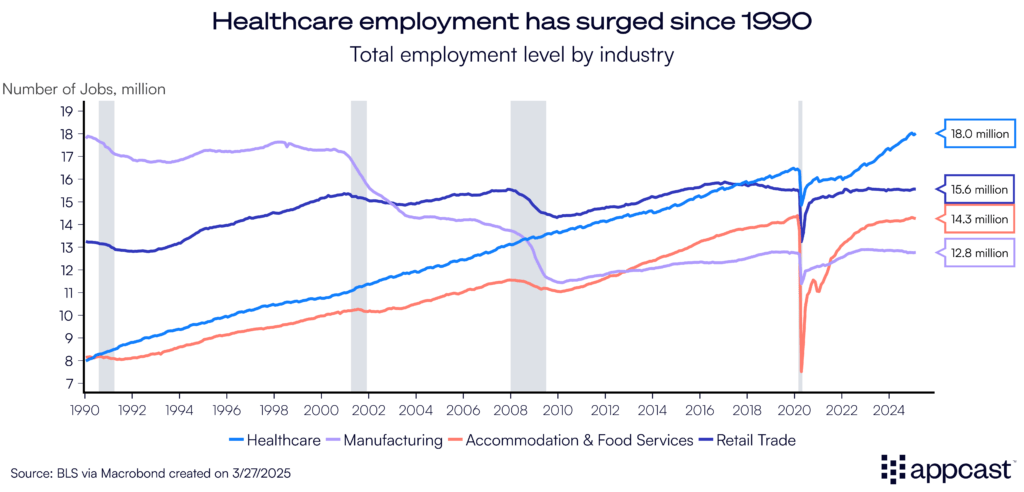

Healthcare is the defining labor market story of the 21st century. No industry has added more jobs, reshaped more communities, or become more essential to the economy. Now the largest sector by employment in the U.S., healthcare has added over 10 million jobs since 1990—outpacing every other industry.

This historic growth has driven wage gains across the income distribution, with healthcare workers seeing some of the strongest earnings increases of any occupation. A recent National Bureau of Economic Research (NBER) working paper highlights this trend: “Real wages have grown faster for healthcare (clinical and overall) than non-health workers across the entire distribution except the top 1%.” Or, in other words, wages for healthcare workers have risen the fastest across all workers (outside of the wealthiest Americans).

In this article, we’ll learn about the current state of the healthcare labor market. In following pieces, we will explore the three key factors shaping its future: Retirees, Regulations and Robots.

Current state of healthcare labor market

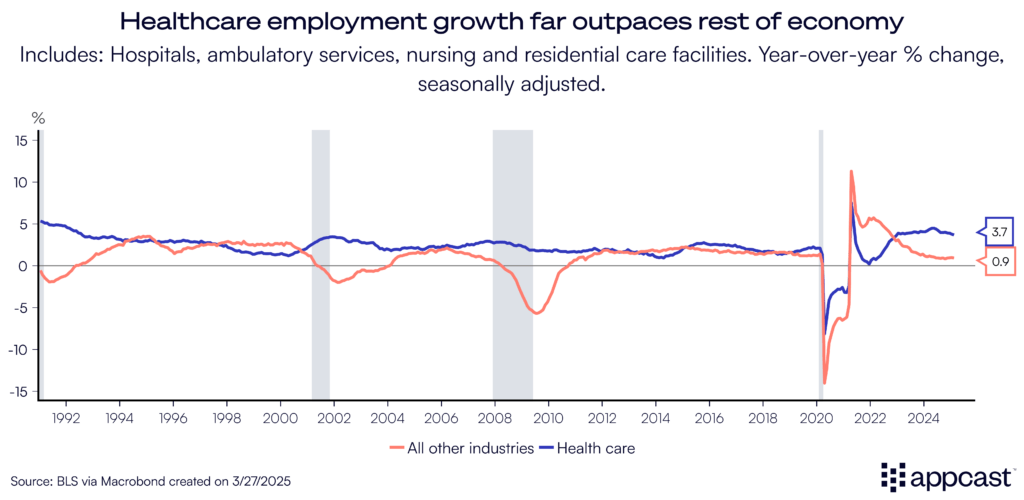

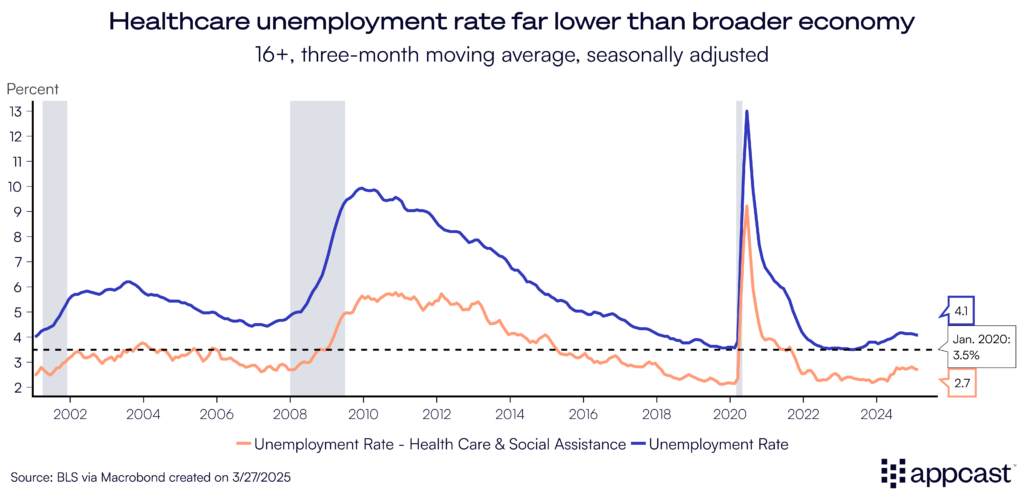

Economists call the healthcare labor market “acyclical” because it defies the business cycle—growing even during recessions. In both the 2001 and 2008 downturns, healthcare hiring didn’t just hold steady, it accelerated. As layoffs swept through other industries, displaced workers sought stability in healthcare, gaining new skills to transition into roles that continued to expand.

This dynamic is especially relevant in 2025. In a recent webinar, Appcast’s Chief Economist, Andrew Flowers, discussed the possibility of an economic slowdown or recession driven by policy shifts under the new administration. While weaker hiring demand could ripple across most industries, healthcare is likely to remain a rare bright spot—continuing to add jobs even as others pull back.

The gap between healthcare and the rest of the economy is staggering. While overall employment growth has slowed to below 1%, healthcare continues to expand at nearly 4% annually, a pace no other industry can match.

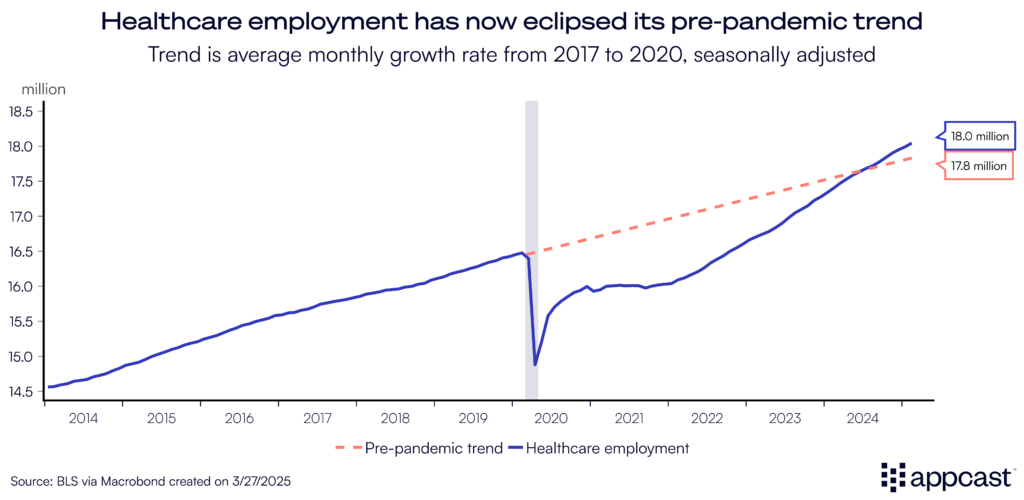

Not only is healthcare outpacing the rest of the economy, but it’s also now expanding faster than it would have if the COVID-19 pandemic had never happened. The industry lost more than 1.6 million workers in just two months due to burnout, childcare challenges, and illness, leading to years of acute labor shortages. But by last summer, healthcare had fully recovered its pandemic-era job losses and is now growing at a rate exceeding its pre-pandemic average.

One major driver of accelerated healthcare employment is the rising demand for mental health services. The World Health Organization reported a 25% increase in global rates of anxiety and depression since the onset of the pandemic, driven by social isolation, financial stress, and widespread burnout. In the U.S., this surge in demand has collided with an already strained mental health system, triggering rapid hiring. Since 2020, employment in mental health practitioner roles has exploded by over 136,000—more than doubling in just four years.

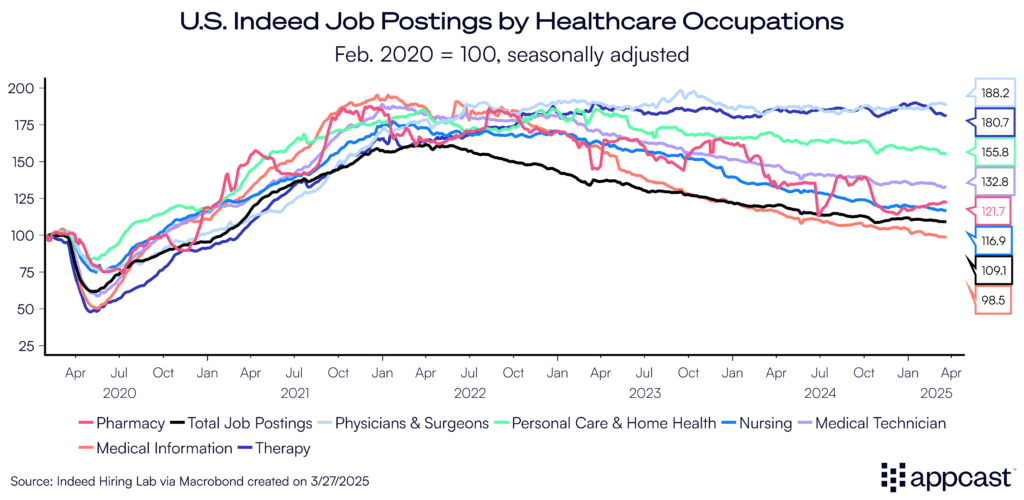

Demand for healthcare workers remains strong, but not all roles are growing at the same pace. The most consistent hiring needs are for physicians and therapists, with job postings for these positions up nearly 90% since the start of the pandemic, according to Indeed’s Job Postings Index. And unlike other roles, demand has not slowed down.

Midlevel occupations like nursing (+19%) and technician roles (+35%) are still in high demand, but the urgency isn’t as extreme as it was during the peak of the pandemic in 2020 and 2021. Postings for home healthcare workers, a critical occupation in caring for our elderly, are also up nearly 56%. While competition for talent remains fierce, the hiring market has started to slowly rebalance.

The other half of the story: who’s filling healthcare jobs?

Hiring demand is only part of the equation, as a job posting means little without workers to fill it. Two major demographic forces have shaped the rise of the healthcare workforce: the increasing participation of women in the labor market and a surge in international immigration to address critical shortages.

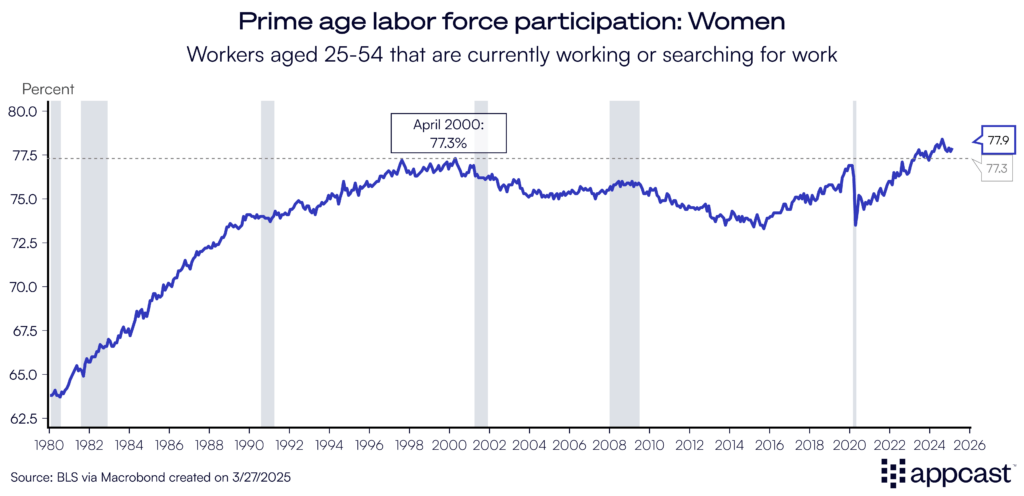

The rise of women in the workforce has been a driving force behind healthcare’s growth. Prime-age labor force participation for women is now near an all-time high, surpassing its previous record set in April 2000.

This resurgence comes after a steep drop during the pandemic, when thousands of women were forced to leave the labor market due to caregiving responsibilities and economic disruptions. But the labor market has now regained those workers and then some, bolstering the female-dependent healthcare workforce.

For more than 40 years, women have made up 76% of the healthcare workforce. Now, even healthcare occupations that were once male dominated have also become more gender diverse.

Take physicians, for example: in 1980, just 13.3% of doctors were women. Today, that figure has climbed to nearly 40%. As women’s labor force participation has surged, healthcare has absorbed much of that growth, further cementing its role as a leading employer of female workers.

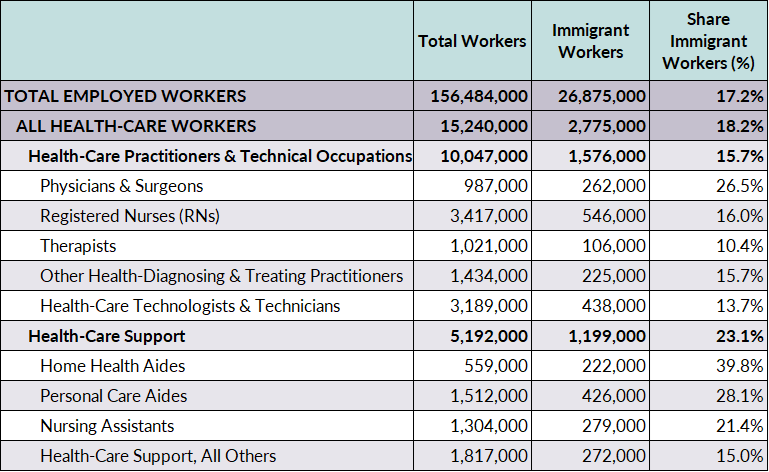

The healthcare workforce is also becoming more diverse by country of origin. According to the Association of American Medical Colleges (AAMC) one in five doctors practicing in the U.S. today were born and educated abroad. That’s over 200,000 physicians contributing to patient care through international migration.

This trend extends far beyond doctors. Data from the Migration Policy Institute shows just how critical immigrant workers are across the healthcare sector. 16% of registered nurses are immigrants. For home health aides, that number jumps to nearly 40%.

Source: Migration Policy Institute

Compared to the broader immigrant population, foreign-born healthcare workers are more likely to be fluent in English, hold U.S. citizenship, and have health insurance, all key indicators of workforce stability and integration. For employers facing ongoing shortages, especially in caregiving roles, immigrant labor continues to be a vital source of talent.

Despite a substantial boost in supply of talent from women and immigrant workers, the healthcare labor market remains exceptionally tight. The unemployment rate for healthcare occupations is 1.4 percentage points lower than the overall economy, which itself is already near historic lows in joblessness.

The takeaway is clear: demand still far outpaces supply

With an aging population and rising demand for medical services, the U.S. will need to grow its domestic healthcare workforce while also tapping into global talent pipelines. From hospitals to home care, the need for skilled professionals is only increasing.

Healthcare remains resilient even in downturns. Competition for talent is fierce, and employers are feeling the pressure. Meeting future demand will require broad investment—in training, education, and immigration pathways—across all levels of the healthcare system.

So, what’s driving this labor market transformation? Stay tuned next week for the second part in our four-part series on the major trends shaping the healthcare labor market.

Interested in learning more about hiring in the healthcare industry? Appcast recently hosted a webinar, The State of Hiring in Healthcare: Key Benchmarks and Strategies, featuring myself and Caitlan Wrona, Senior Director of Strategy at Appcast, that breaks down the current state of hiring.