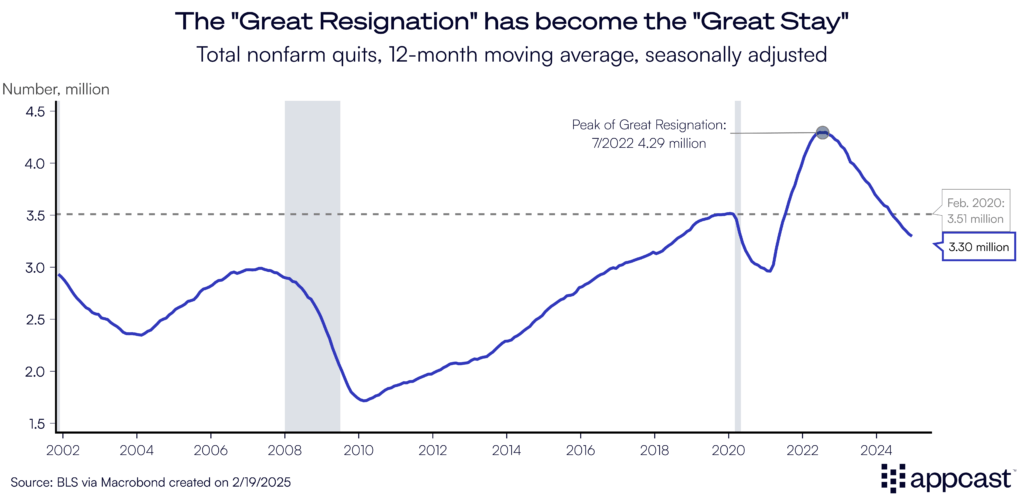

Less hiring, less firing, and less quitting. The dynamism of the U.S. labor market—how often workers switch jobs in pursuit of better opportunities—has slowed sharply over the past two years. In the summer of 2022, a record 4.3 million workers quit their jobs each month. Now, just 3.3 million workers quit in late 2024 – which is nearly 200,000 fewer workers quitting compared to before the pandemic. If the labor market is a game of musical chairs, the music has certainly stopped. Workers who once moved quickly to claim a better seat now seem content to stay put.

Source: DALL-E

The Great Stay’s impact

Most hiring in the U.S. comes from churn—workers leaving jobs and being replaced. When turnover slows, so does hiring. Yet, despite fewer job switches and a gradual decline in hiring, the labor market continues to expand.

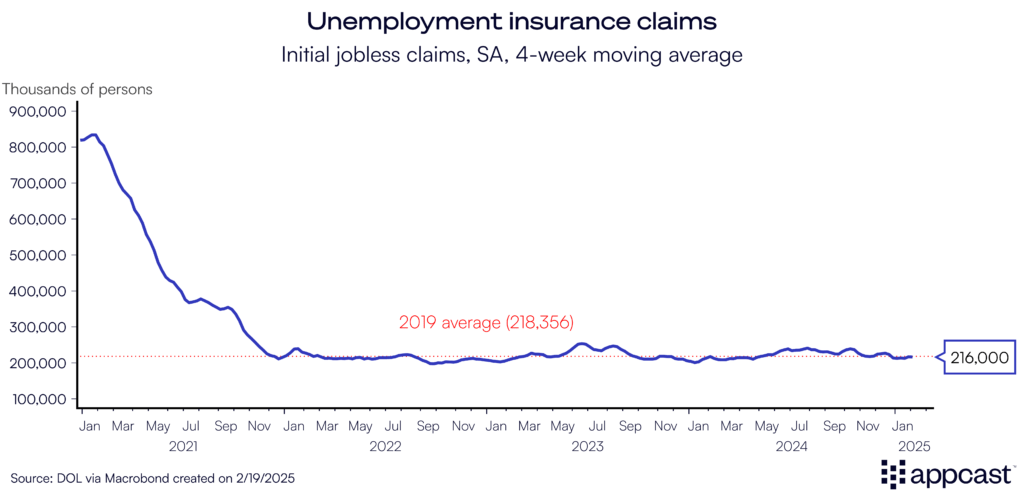

How can that be? Layoffs remain mostly subdued, outside of a few sectors like technology and professional & business services. A high frequency indicator of the health of the labor market and proxy for layoffs—weekly unemployment insurance claims—remains right at its pre-pandemic average.

Since total employment is simply hires minus separations (quits, layoffs and retirements), the stability in layoffs has acted as a buffer, preventing an outright decline in job growth. In other words, while fewer people are changing jobs, those who have them are holding on to them—keeping overall employment levels steady.

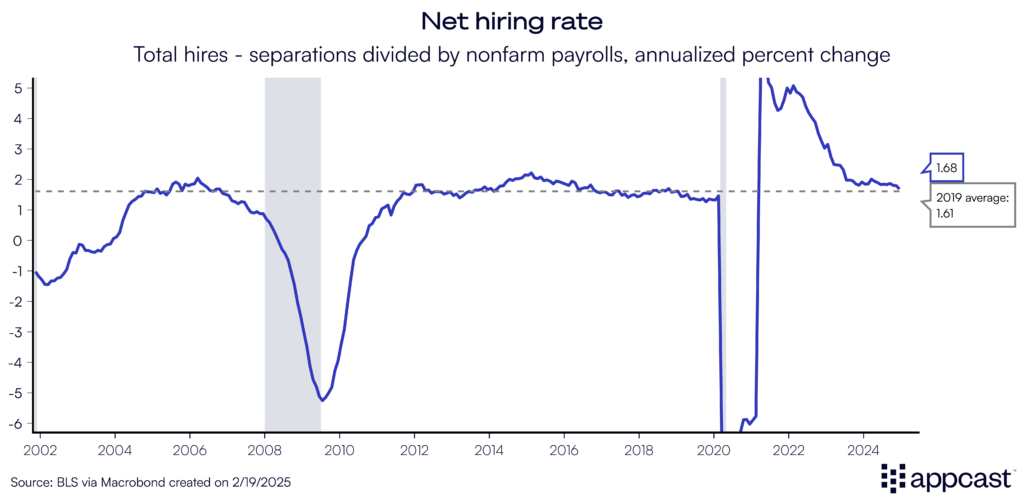

The easiest way to understand this decline in dynamism is through the net hiring rate—the difference between hires and total separations, divided by nonfarm payrolls. This data point captures whether the labor market is expanding or contracting. Currently growing at 1.7% annual rate, the net hiring rate is hovering just above its 2019 average, a healthy labor market that is growing at a steady pace. But that growth is slowing and could dip below its 2019 average sometime this year.

Healthcare Heats Up, Tech Cools Down

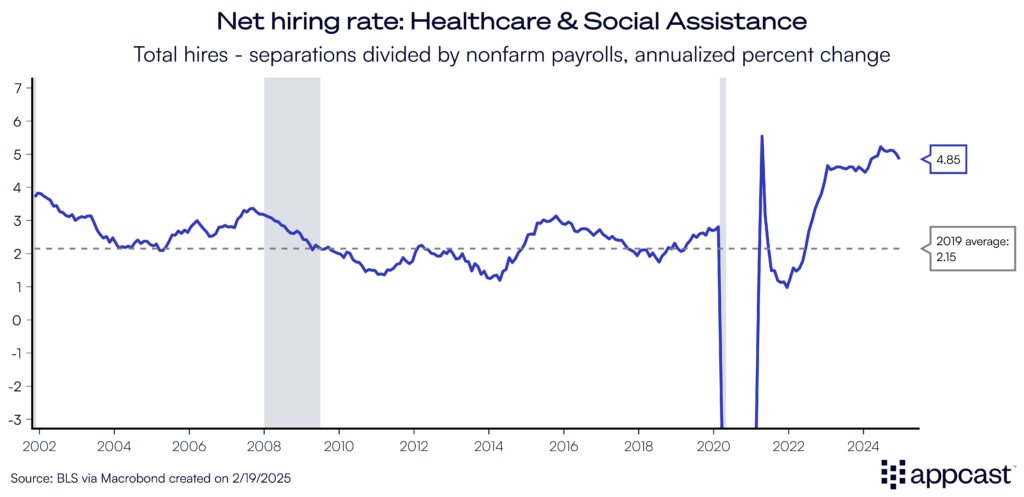

While job-switching has slowed across the economy as a whole, the story is, of course, vastly different depending on the industry. Let’s start with the positive outlier: Healthcare.

Healthcare employment is growing at an annual rate of nearly 5%, continuing the fastest and longest period of sustained growth this century! No industry added more jobs in 2024 than healthcare, as demand for workers surged to meet the needs of an aging population. And this trend isn’t slowing down. With demographic shifts driving long-term demand, the need for skilled healthcare professionals will only increase in the coming decades.

In many industries, the music has stopped. But in healthcare, the hiring beat goes on.

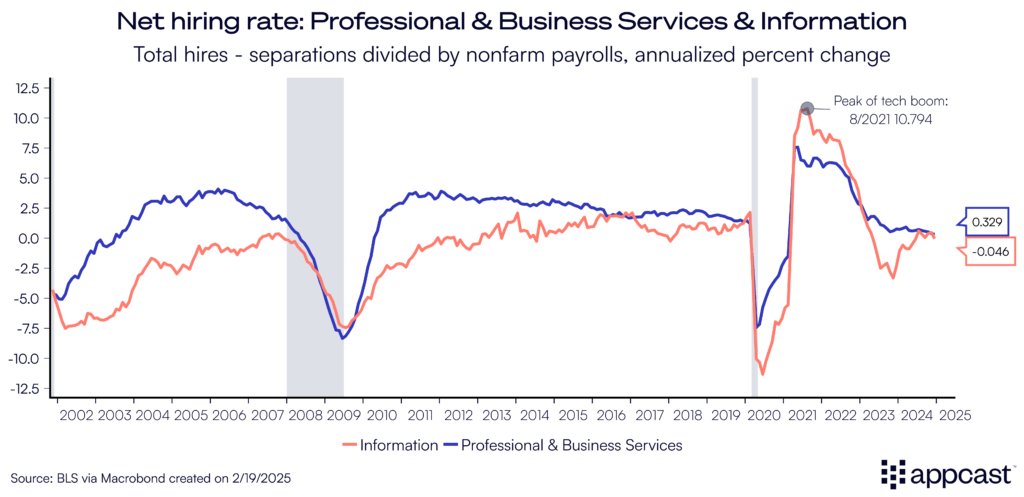

Not all industries are feeling the same rhythm of the labor market. The sharpest slowdown has come in “sitting down” jobs—marketing, software engineering, and data science—where net hiring rates are hovering near contraction.

Take the Information sector, which includes many tech jobs. In 2021, it grew at an astonishing 11% annually, fueled by the pandemic-era boom in consumer tech and companies’ mad dash to keep up with surging demand for goods and digital services. That momentum has vanished. Central banks hiking interest rates to slow inflation weakened the business outlook, and a shift in focus from growth to efficiency resulted in far fewer hires.

2025: A Turning Point for the Labor Market Dynamism?

The key question for 2025: Will workers regain the confidence to quit? Job-switching fuels hiring, creates opportunities, and injects dynamism into the labor market. Without that churn, employment growth risks stagnation, leaving the labor market idling rather than expanding.

Glassdoor’s Employee Confidence Index, which tracks workers’ sentiment about their employer’s business outlook, has been slipping. Some of that decline may reflect uncertainty surrounding the macroeconomic environment and policy shifts under the new administration. But another factor looms large: job satisfaction is down. Declining job satisfaction could be a leading indicator for rising quits.

Last year may have marked the bottom for labor market churn, but 2025 could bring a broader rebound, with increased quits fueling a fresh wave of hiring activity thanks to decreased satisfaction. Otherwise, the labor market’s game of musical chairs will remain paused, with workers stubbornly seated.