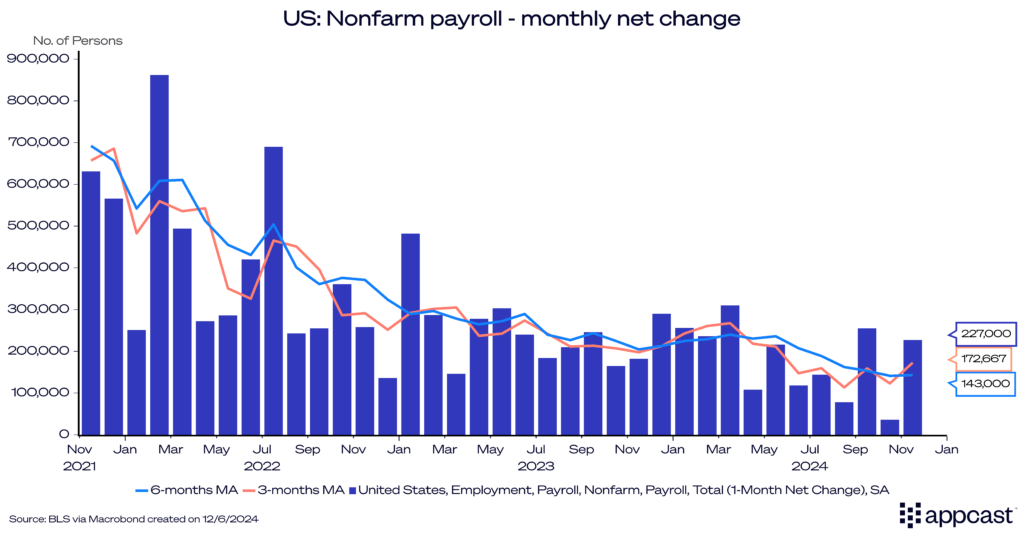

The U.S. economy continued to add payroll jobs at a very healthy pace last month. The data that was released today was actually quite boring, showing that about 227k jobs were created in November, which was basically in line with expectations from Wall Street analysts. This steady report proves the rather dismal October jobs report was therefore due to the disruptions of two hurricanes and the Boeing strikes; a blip rather than the new normal.

Though October turned out to be a blip, that doesn’t mean there’s nothing to worry about in the labor market. There are subtle signs of weakening in the household survey, which directly surveys workers compared to the establishment survey of businesses. The unemployment rate rose slightly, to 4.2%. More concerning, under the hood, the prime-age employment-to-population ratio has declined sharply over the last three months, from 80.9% to 0.4%. While down just half a percentage point, this is a weakening equivalent to what happened over 6 months in 2023. Unemployment is up year-over-year, while still being at a low level historically. The absolute level of joblessness is low, but the trend is concerning.

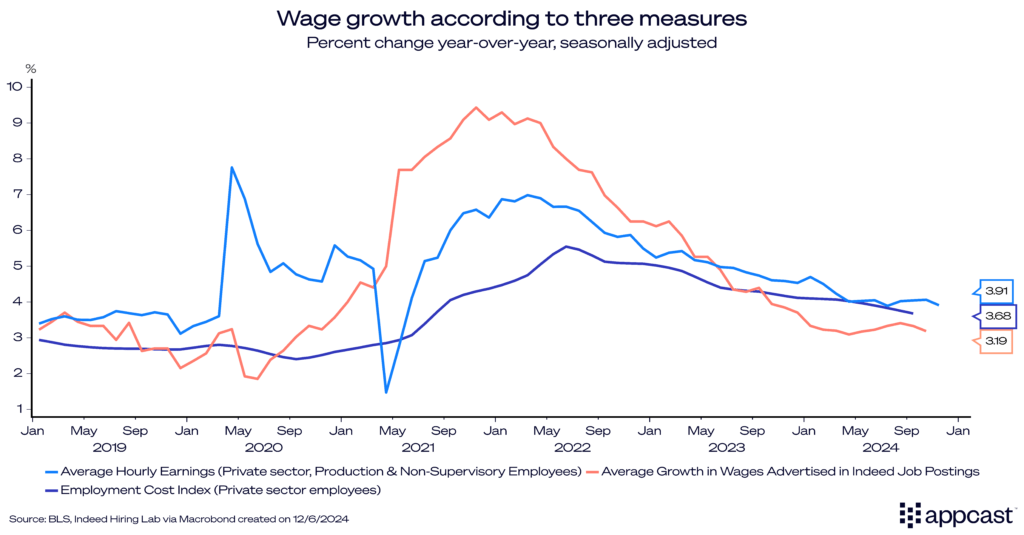

Wage growth steady

Average hourly earnings growth is steady and up by about 3.9% year-on-year. Given the recent surge in productivity gains that the U.S. economy has experienced, nominal wage growth close to 4% should not be inconsistent with the Fed’s inflation target of 2%. By that metric, normalization of wage growth has been achieved. The U.S. economy is therefore on good measure to achieve the soft-landing that the Fed has been aiming for since the inflationary surge.

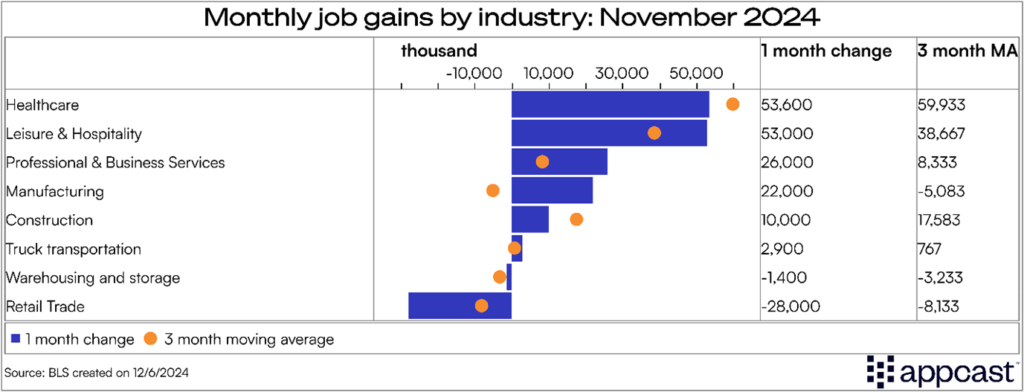

Industry shifts

Industry gains were surprisingly broad-based; even in past strong reports, there have been clear winners and losers. In November, though, many sectors added jobs, even those who had underperformed in other months. Professional and business services, for example, added 26k jobs in November after losses throughout the summer. The manufacturing sector added 22k after shedding throughout the summer. A notable underperformer was retail, which posted losses during the holiday shopping season.

The hiring outlook is a bit cloudy

Before today’s pretty decent but also somewhat boring jobs report, the Bureau of Labor Statistics released its JOLTS data (Job Openings and Labor Turnover Survey) earlier this week.

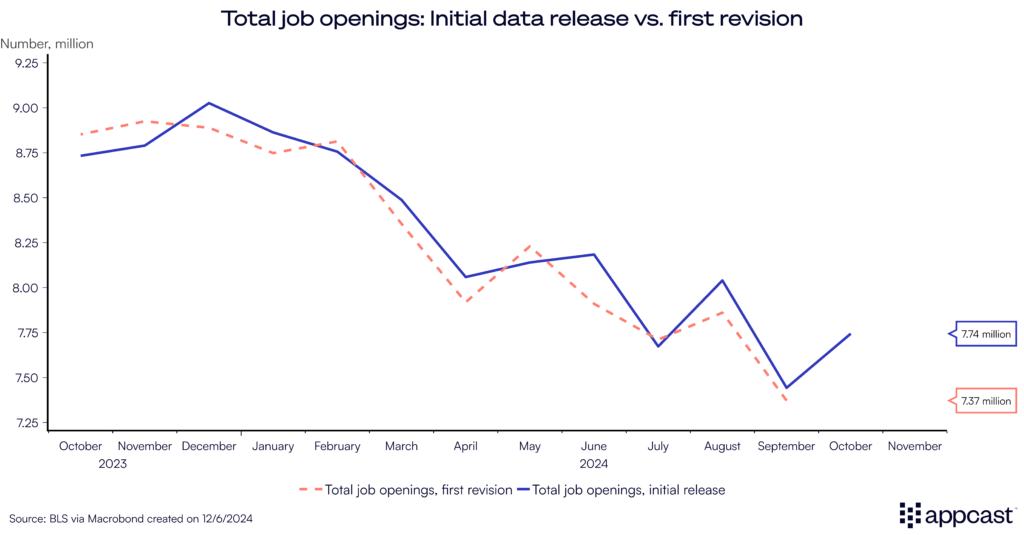

JOLTS publishes key information about the number of vacancies in the economy as well as hiring data and worker churn (quits, layoffs and discharges). While total job openings saw a significant increase from September to October, a word of caution is in order. The JOLTS data is somewhat volatile and has seen several spikes followed by subsequent declines over the last year. Furthermore, most data revisions since late 2023 have been negative, and the October data will probably not be an exception. Generally speaking, job openings seem to continue their long-run downward trend from their post-pandemic peak for now.

The JOLTS report also showed that, total hires stood at 5.31 million in October, therefore exceeding total separations of 5.26 million by only a small margin. One needs to keep in mind though that the JOLTS data lags the payroll employment data by one month. And as we noted in our previous report, October job growth was inhibited by two severe hurricanes and the Boeing strike. Nevertheless, the hiring outlook has been weakening since early 2022, a trend that for now seems unabated.

Conclusion

This month’s strong job gain was to some extent a result of last month’s weakness. Generally speaking, employment growth is continuing on a downward trend. This is rather unsurprising as the job boom coming out of the pandemic is basically over. Long-run demographics suggest that trend growth for the U.S. labor market might be closer to 100,000, which is where we are heading now. With wage growth being down to 4% while unemployment remains historically low, the Fed has pretty much achieved its soft-landing. The hiring outlook, of course, remains somewhat cloudy as vacancies also continue to decline. Additionally, we still don’t know what policies the Trump administration will actually implement and how they will affect the labor market. Stay tuned for a 2025 that will probably be less boring!