Less than two weeks after Rachel Reeves announced the Autumn Budget that is set to put the U.K. economy on a different path, data points towards a substantial labor market slowdown as hiring freezes. Even as GDP growth has outperformed expectations this year, job growth has come to a standstill. And the decision to increase employers’ national insurance contribution (NI) together with yet another big hike in the minimum wage will weigh on companies’ hiring decisions throughout next year. The labor market data should worry both the Labour government and the Bank of England (BoE). It is becoming evident that monetary policy is weighing heavily on economic activity. While interest rates need to fall, stubborn wage growth remains a thorn in the side of monetary policy makers.

Unemployment rises amidst stagnant job growth

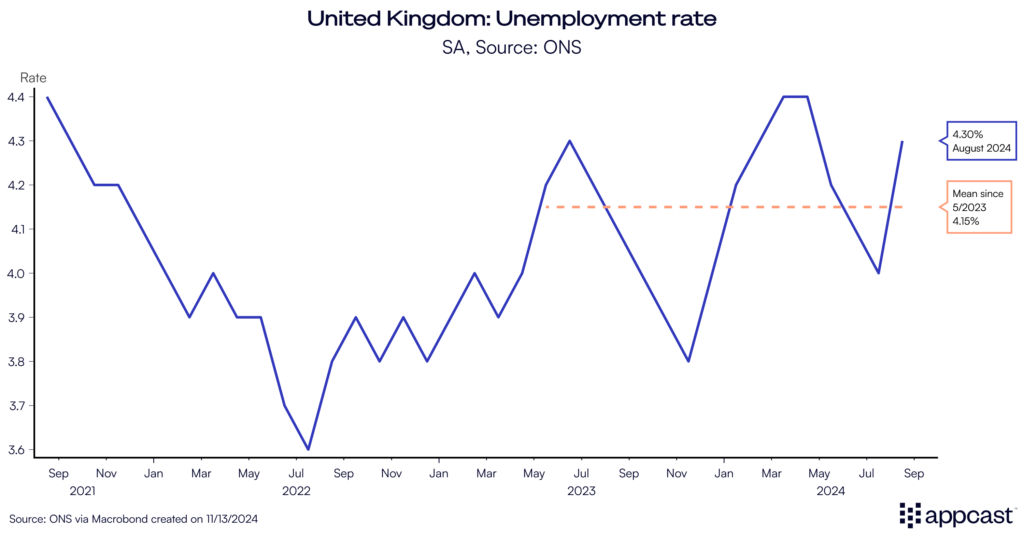

The unemployment rate unexpectedly increased to 4.3% for the period of July to September (it previously stood at 4%). However, the extremely low response rate to the household survey, which measures the unemployment rate, means that we cannot have great confidence in the data. The volatility—the ups and downs since the summer of 2023—are most likely a byproduct of data inaccuracy. The actual unemployment rate could be either slightly higher or lower than recorded—there is no way to know for sure, but there is no doubt that unemployment has increased since 2022 when the labor market was extremely tight.

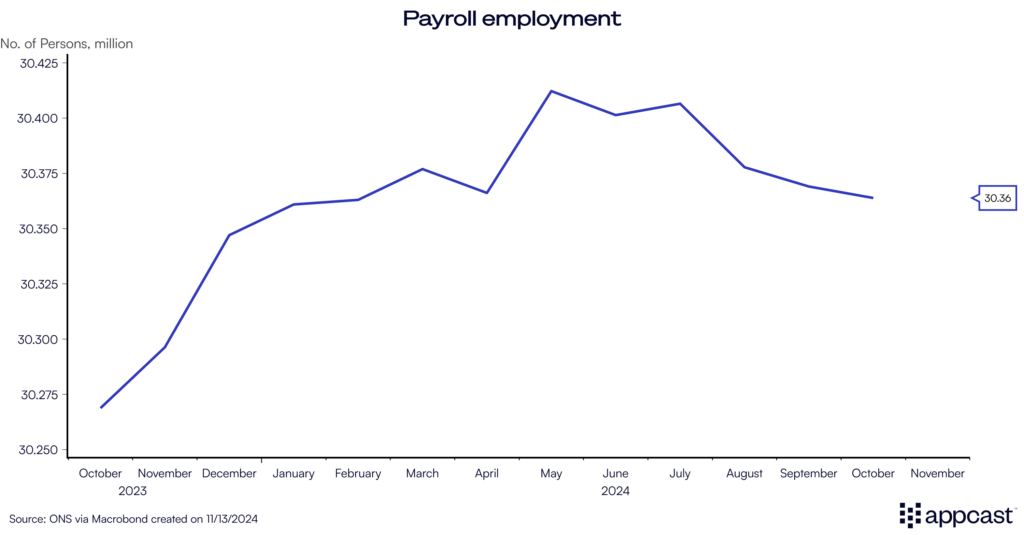

Payroll employment is based on actual tax data submitted to the HMRC (the Treasury). Even as the data is subject to revisions, we should put more trust into the payroll jobs numbers than the employment figures based on the household survey (note that there is a difference between the two data series: the former only measures payroll employment whereas the household survey includes self-employment).

Payroll employment has decreased since May and is now just a tad higher than in January. Basically, the U.K. has seen no job growth since the beginning of this year even as GDP growth has been positive.

Vacancies and worker churn are hitting new lows

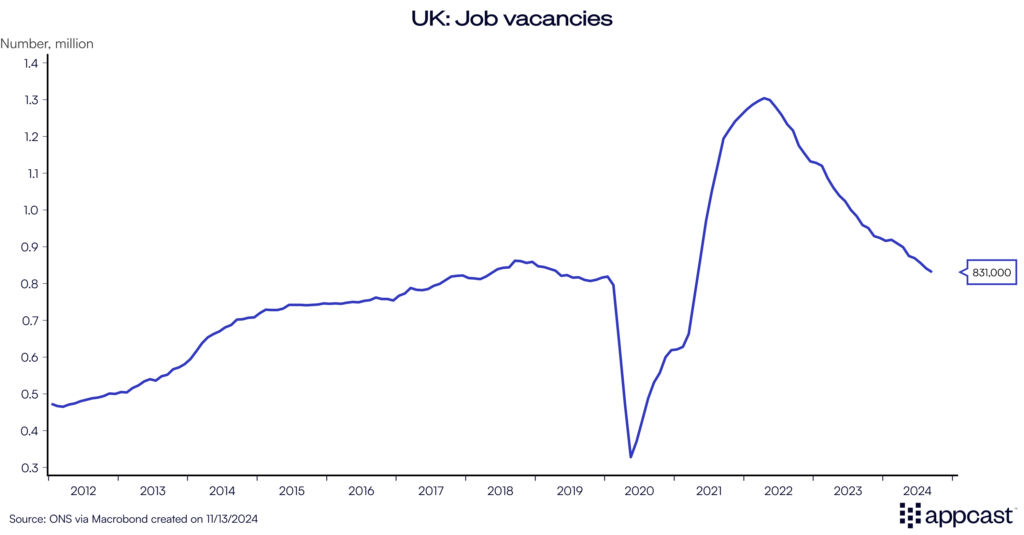

Vacancies continued their two-year long decline. From a peak of more than 1.3 million in early 2022, they have now fallen to just over 830,000. While this is still slightly higher than just before the pandemic, the number of workers in the labor market has grown since then. Actual vacancy rates across industries have completely normalized and we are now clearly heading into a much weaker labor market.

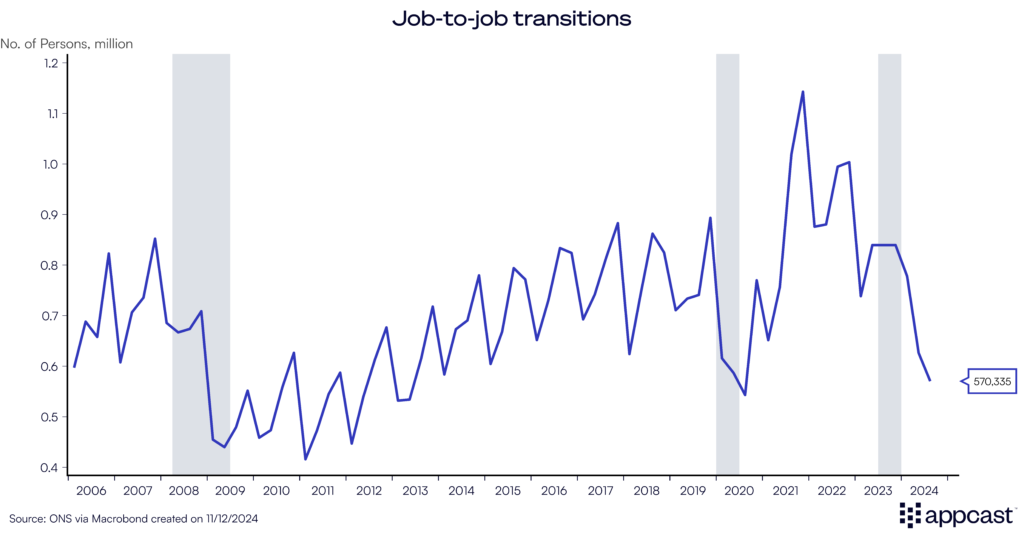

This is even more clear when looking at worker churn. Job-to-job switches have completely plummeted in Q3, and we are now nearing levels not seen outside of recessions. While the U.K. is still a more or less full employment economy, job flows are now indicating a labor market freeze. The option to leave a current company to find employment elsewhere has clearly deteriorated. Workers are very much aware that this is not a great labor market as job resignations have hit their lowest level since 2012.

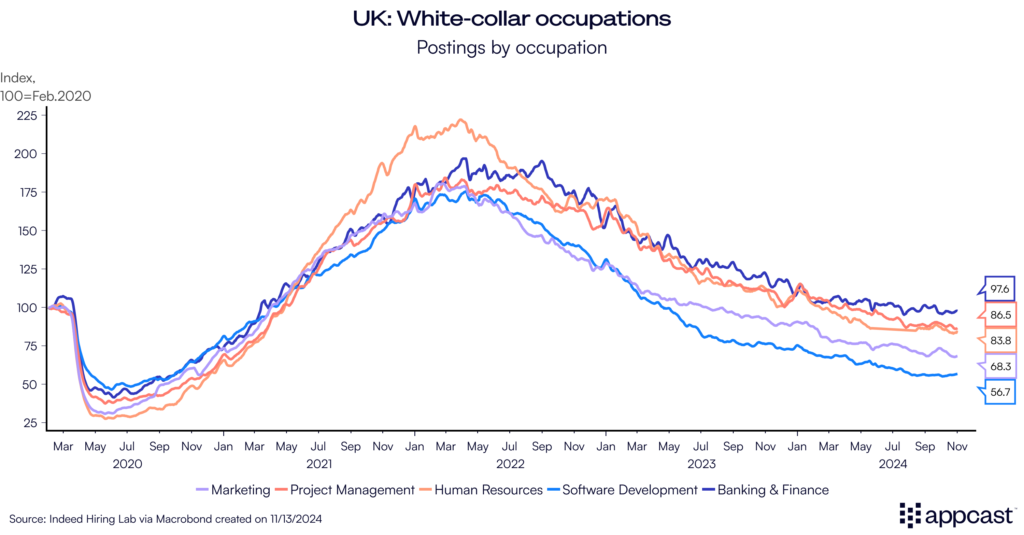

White-collar workers are especially feeling the pinch. Indeed job postings show that the number of vacancies for roles in software development, marketing, project management, and banking and finance have declined for more than two years and are now well-below pre-pandemic levels.

Wage growth continues to be sticky

One piece of good news for workers is that nominal wage growth continues to be elevated even as inflation has fallen back to target this year. Average wage growth reported by the ONS runs at above 4%, and closer to 5% including bonuses. Median pay growth of payroll employees is closer to 6%. Real wages are therefore finally growing again, currently at a rate of more than 2%, which will support household consumption and the economy at large.

For the BoE, elevated wage growth continues to be a problem as they fear inflationary pressures. However, the labor market has sufficiently weakened for now. Monetary policy makers will continue to cut interest rates next year as they do not want to derail the labor market completely.

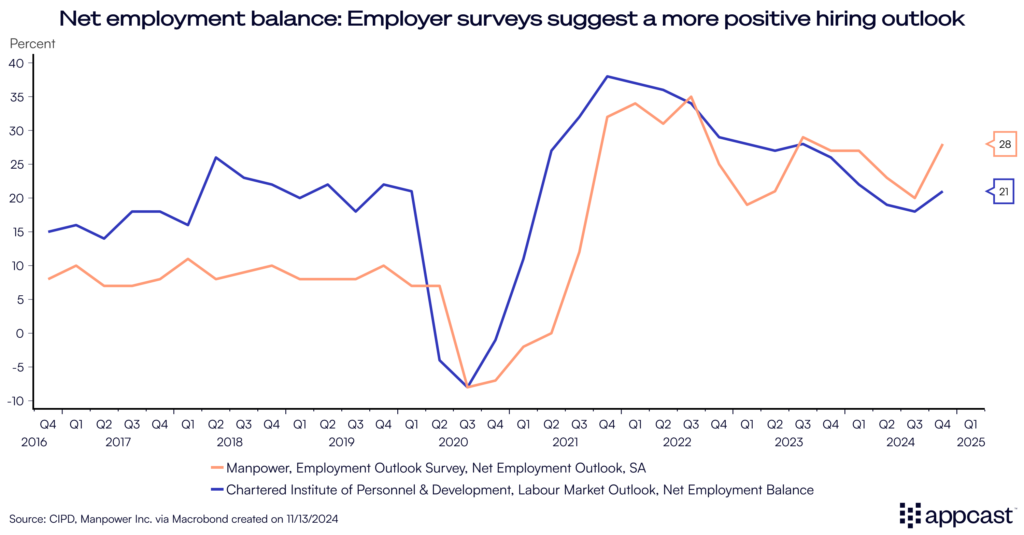

But employer surveys give hope of recruitment picking up

Two different surveys give hope though that the current recruitment drought might be coming to an end. Economic forecasts suggest that the U.K. economy will grow faster next year, which obviously would be a positive for the labor market. The employment outlook surveys from Manpower and the Chartered Institute of Personnel and Development asks employers about recruitment and redundancy intentions. Both suggest a more positive hiring outlook for the last quarter of this year. Hopefully, the trend will carry on into 2025.

What does that mean for recruiters?

Even with a low unemployment rate, the U.K. labor market has come to a standstill. There has been very little job growth and worker churn is in recessionary territory. Many companies have reduced or even frozen hiring for now. Compared to two years ago, recruitment difficulties have eased substantially.

If you are currently hiring, you will likely receive a higher number of applicants at a lower cost (the cost-per-application has decreased as the labor market has cooled).

But challenges remain. While it will be easier for now to find white-collar workers, blue-collar workers are still in relatively short supply due to Brexit. Furthermore, long-run demographics are still pointing towards a more challenging outlook in the near future. And surveys suggest that the economy and labor market might pick up again next year. The current environment with many applicants per open vacancy is a result of cyclical macroeconomic factors, including monetary policy, that are weighing on the labor market. Once these headwinds disappear, recruitment difficulties will pick up again.