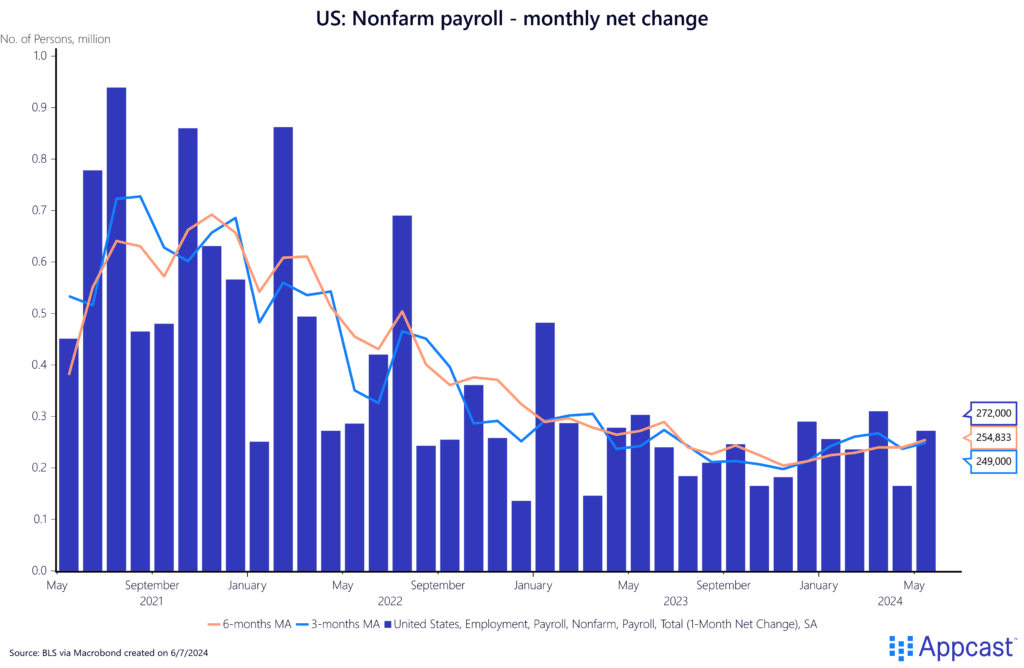

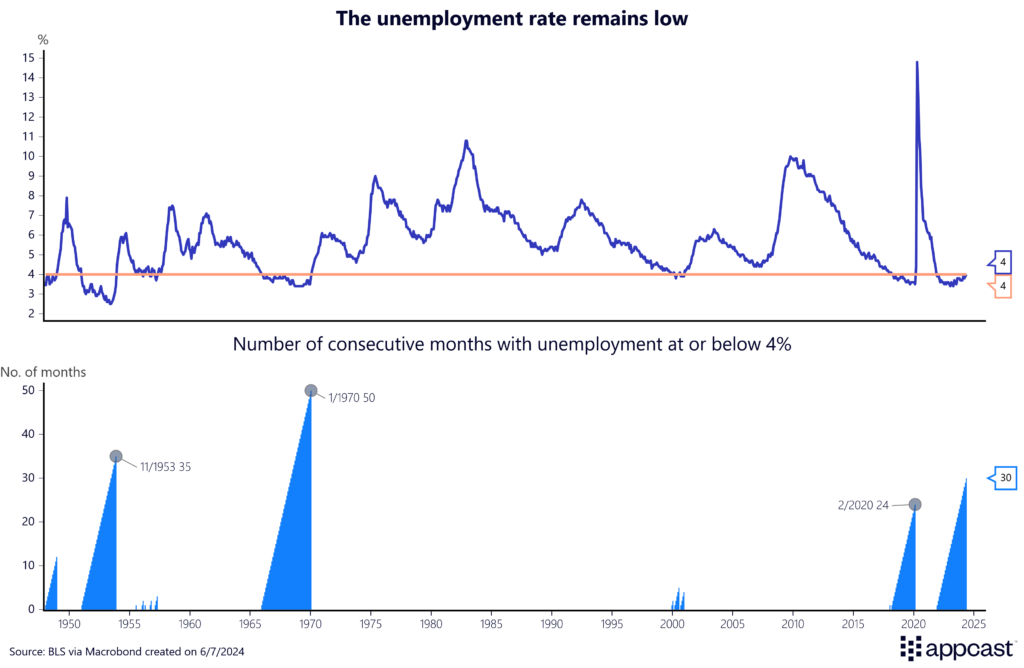

After a weaker jobs report in April, May’s data completely reversed the trend. The U.S. economy added 272,000 new jobs last month, far above market expectations of 150,000. The unemployment rate rose slightly to 4.0%, but this still marks the 30th month in a row of the unemployment rate being at or below 4%. If this trend continues throughout the summer into the fall, this record will exceed the 35-month record set during the economic boom of the Eisenhower administration. Overall, the gap between supply and demand is gradually normalizing, as openings and hiring slow while more job seekers reenter the workforce.

Labor force participation trends

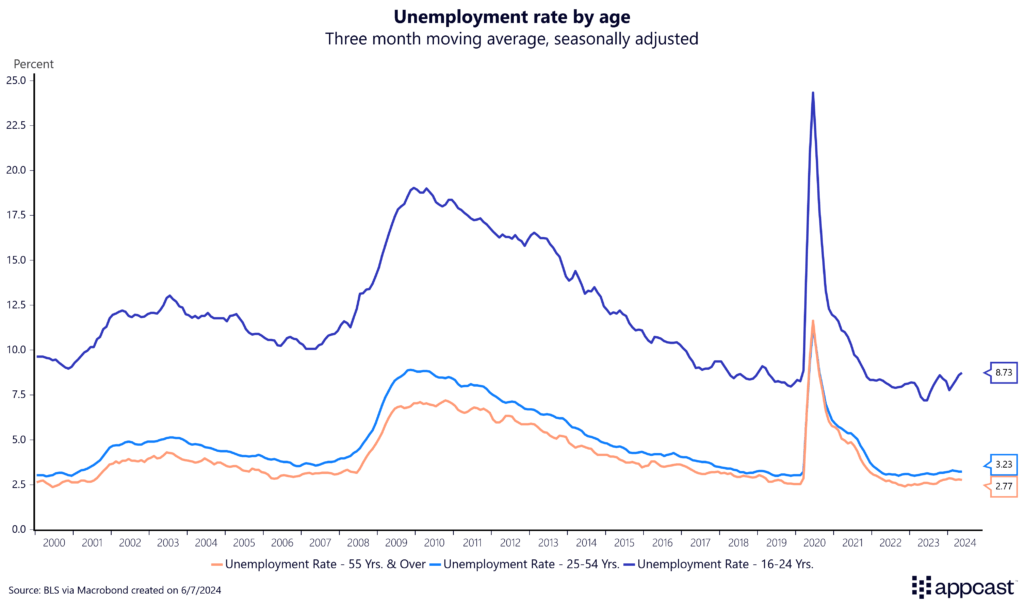

We recently wrote about what kind of labor market awaits Gen Z graduates, which pointed to a softer hiring environment than compared to previous generations. This slower hiring environment is potentially discouraging young Gen Z grads looking to enter the workforce – as their unemployment rate (16-24 years old) is more than double the prime age labor force (25-54) and those 55+! Data from Revelio Labs suggest fewer job openings for entry level roles in 2024 – which means more competition.

What might explain this trend? Rising interest rates have ballooned the costs associated with hiring – prompting employers to reassess their recruitment strategies. Rather than invest in younger, less-tenured employees, employers are shifting their hiring towards more seasoned professionals.

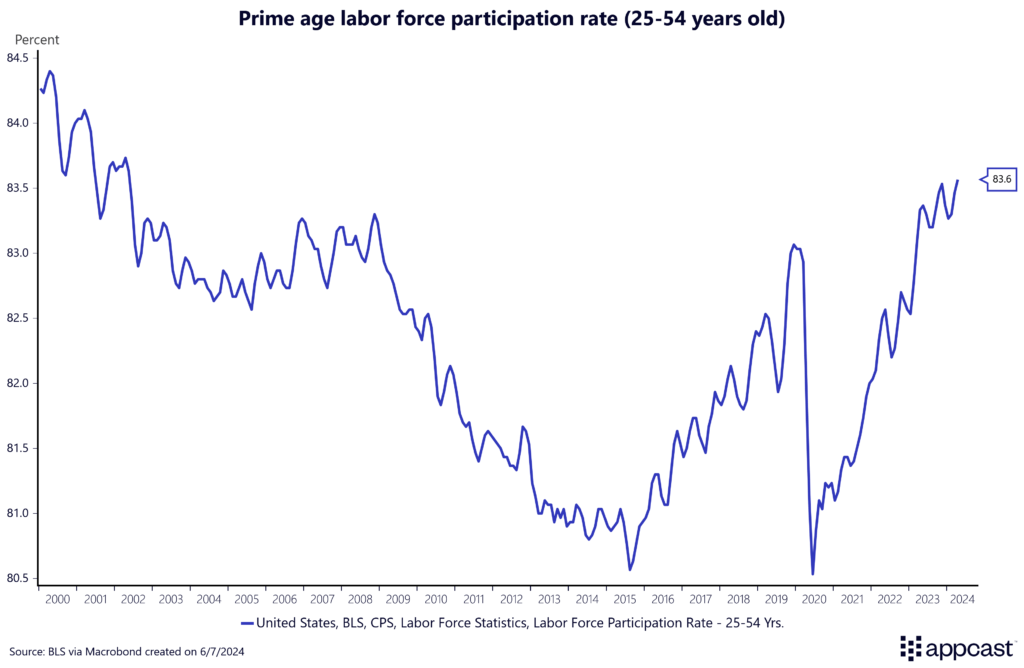

This is also evident in the prime-age labor force participation rate, which hit a recent high of 83.6%. The gap between supply and demand continues to cool, as job openings have slowly unwound, and workers continue to return to the workforce.

Sectoral trends

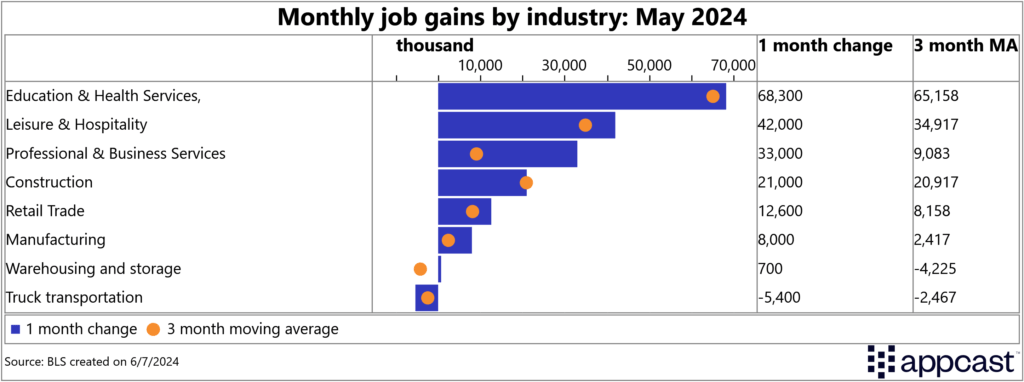

Employment gains were broad-based this month, with healthcare continuing to be the powerhouse of the labor market, adding 68,000 new jobs. Leisure and hospitality also continued to trend upward, adding 42,000 new jobs. Professional and business services, which has experienced subdued growth in the past several months, had a surprising rebound with 33,000 new jobs.

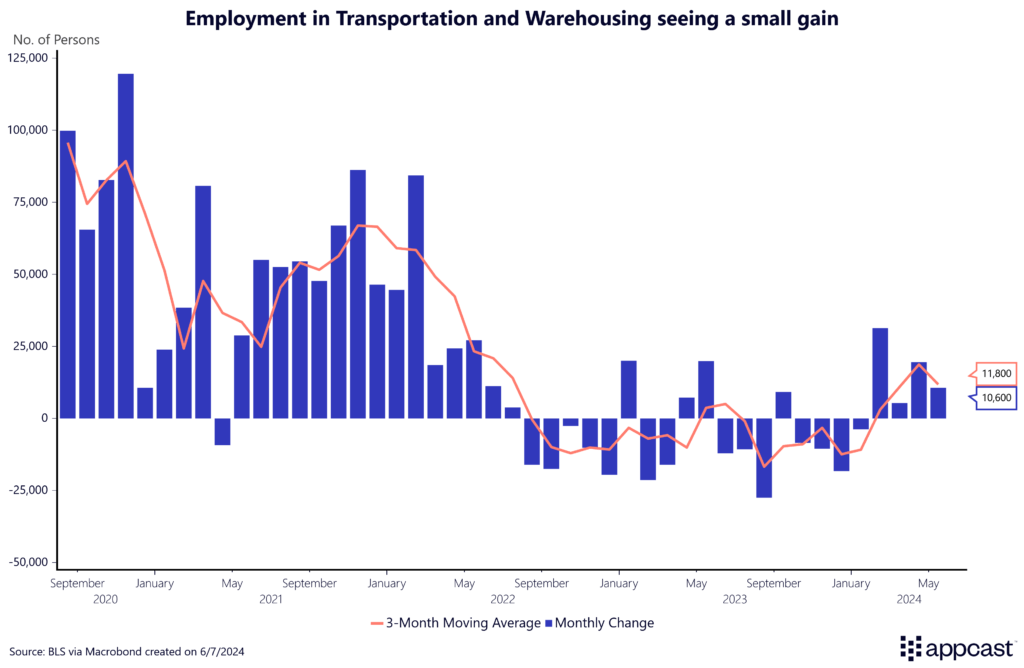

The transportation and warehousing industry, which has faced considerable challenges over the past two years, may be experiencing a turnaround. After enduring four consecutive months of job losses last fall, the sector has seen a notable recovery since the beginning of the year. Over the past three months, it has gained 11,800 jobs. While this uptick does not approach the explosive growth seen during the pandemic, it represents a significant and encouraging shift for an industry looking to stabilize and rebuild.

Wage growth trends and inflation worries

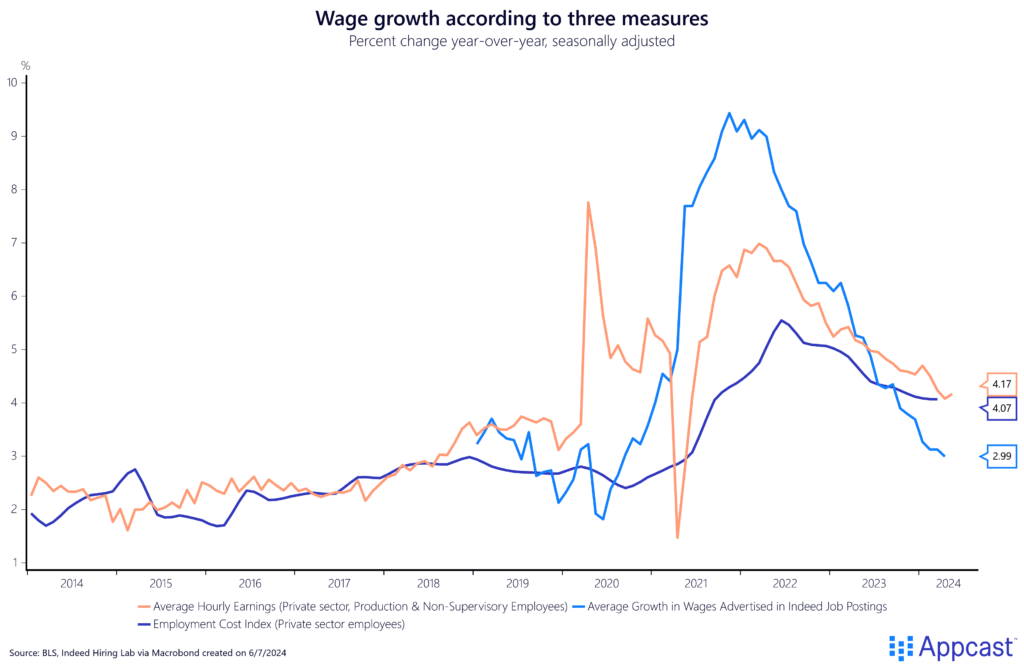

The first half of the year witnessed a shift from the previously cooling inflation, delaying discussions on rate cuts to later in the fall. Despite persistent inflation, wage growth has moderated over the past several months. In May, average hourly earnings increased by 4.1% year-over-year, slightly up from April. Although this is just one data point, it is crucial to monitor, as it could potentially alert the Federal Reserve to the risk of a wage-price spiral, where rising inflation leads to accelerating wage growth.

What does this mean for recruiters?

Recruiters are experiencing vastly different labor markets depending on where they are hiring. In this shifting market, it’s more important than ever to invest in actions that will bring about quality candidates. More and more, workers are sticking with their existing jobs – meaning it is easier to source candidates from the sidelines rather than poaching from other companies. This may mean approaching those less-experienced college graduates and Gen Z workers or restructuring expectations on the type of employee your role can attract.